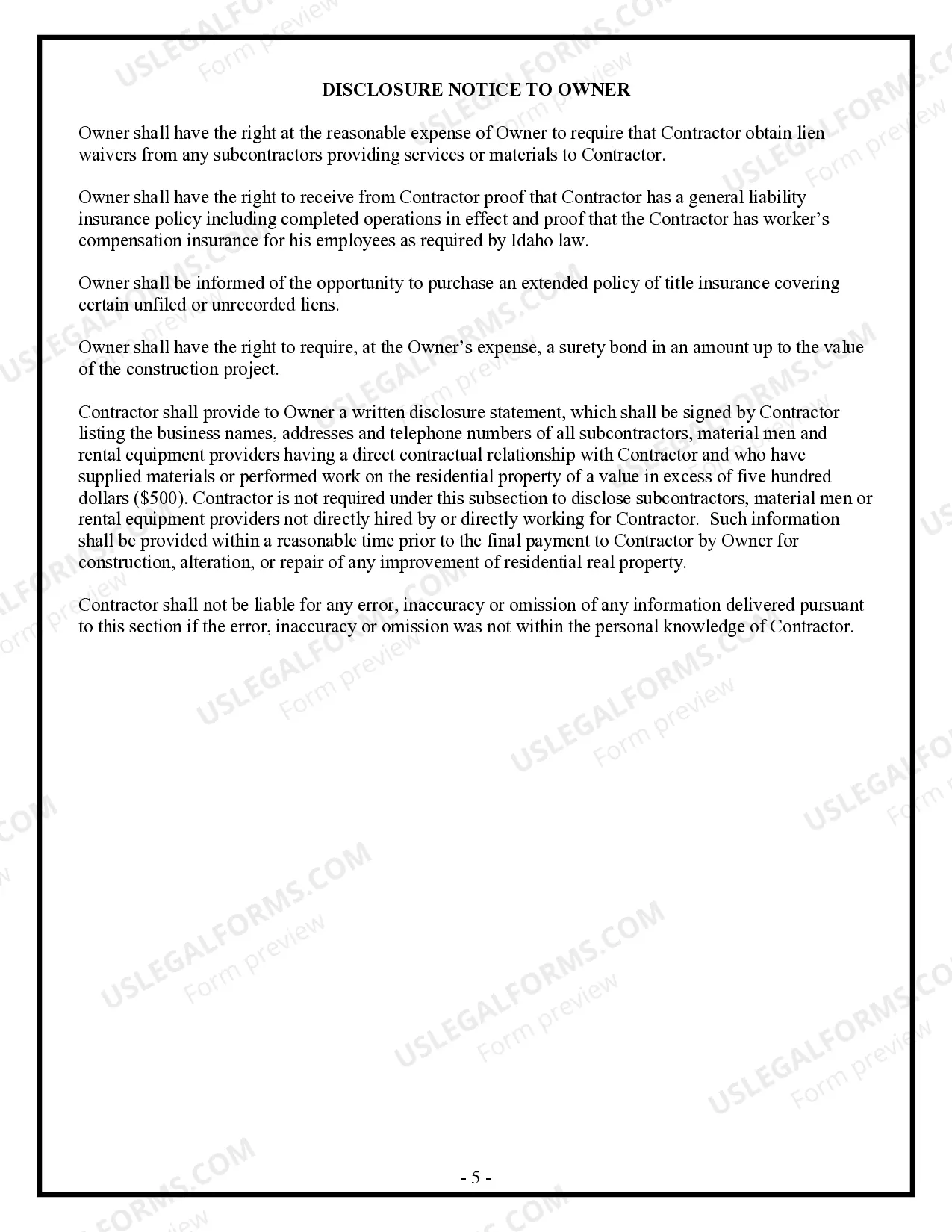

This form is designed for use between Site Work Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Idaho.

Idaho Site Work Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Site Work Contract For Contractor?

Obtain the most extensive collection of sanctioned forms.

US Legal Forms is essentially a platform to locate any state-specific document in just a few clicks, including Idaho Site Work Contract for Contractor examples.

There's no requirement to invest hours searching for a court-admissible sample.

That’s all! You simply need to submit the Idaho Site Work Contract for Contractor template and complete the check-out process. To ensure that everything is correct, contact your local legal adviser for assistance. Register and easily access over 85,000 useful templates.

- Our certified experts guarantee that you receive current samples at all times.

- To take advantage of the document library, select a subscription and register your account.

- If you've already established your account, simply Log In and hit the Download button.

- The Idaho Site Work Contract for Contractor sample will automatically be stored in the My documents section (a section for every form you save on US Legal Forms).

- To set up a new account, follow the straightforward instructions provided below.

- If you're planning to use a state-specific example, ensure you select the correct state.

- If feasible, examine the description to understand all the details of the document.

- Utilize the Preview option if it's available to review the information about the document.

- If everything appears accurate, click Buy Now.

- Immediately after choosing a payment plan, create an account.

- Make a payment using a card or PayPal.

- Download the example to your device by clicking Download.

Form popularity

FAQ

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including: A description of the services provided. Terms and length of the project or service. Payment details (including deposits, retainers, and other billing details)

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Length of Contract. Each client contractor agreement should outline the length of the working relationship. Project Description. Payment Terms. Nondisclosure Terms. Rights and Responsibilities. Termination Clause. Disclaimers.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.