Iowa Form of Anti-Money Laundering Compliance Policy

Description

How to fill out Form Of Anti-Money Laundering Compliance Policy?

Are you in a position where you will need paperwork for both company or individual purposes virtually every working day? There are tons of legitimate file web templates available on the Internet, but locating types you can trust isn`t effortless. US Legal Forms provides thousands of form web templates, like the Iowa Form of Anti-Money Laundering Compliance Policy, that happen to be created to fulfill state and federal needs.

Should you be presently familiar with US Legal Forms website and also have an account, basically log in. After that, you can down load the Iowa Form of Anti-Money Laundering Compliance Policy template.

If you do not offer an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is for that correct area/county.

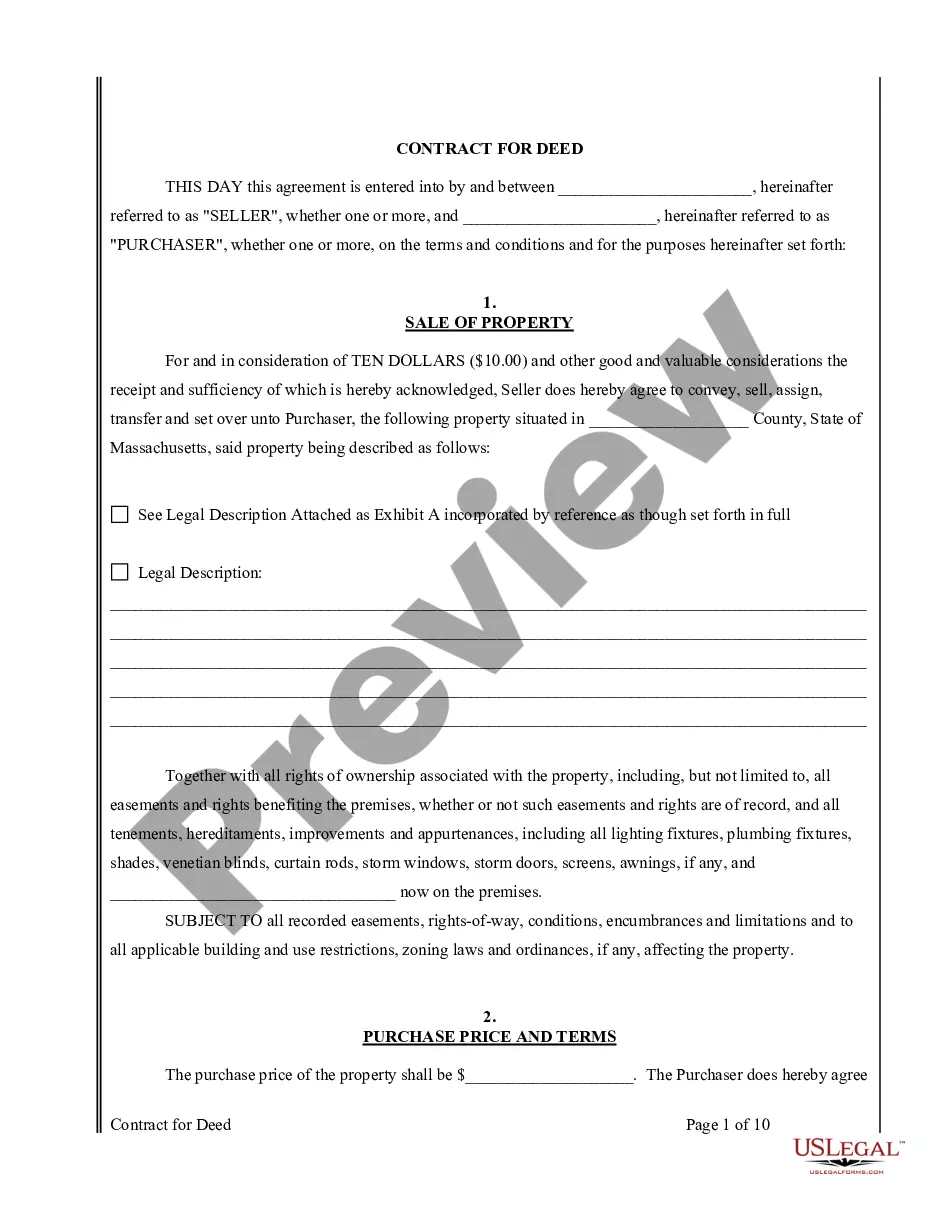

- Utilize the Review key to analyze the form.

- Read the description to ensure that you have selected the appropriate form.

- In the event the form isn`t what you are searching for, use the Look for area to discover the form that meets your needs and needs.

- Once you get the correct form, simply click Get now.

- Select the costs prepare you desire, submit the required details to generate your money, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free document structure and down load your version.

Discover all the file web templates you might have bought in the My Forms menu. You can obtain a extra version of Iowa Form of Anti-Money Laundering Compliance Policy whenever, if needed. Just click on the required form to down load or printing the file template.

Use US Legal Forms, by far the most considerable variety of legitimate forms, to save lots of time as well as prevent mistakes. The services provides skillfully created legitimate file web templates which can be used for an array of purposes. Produce an account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

This guide contains the steps to developing an effective compliance program: Appoint an AML compliance officer (AMLCO)? ... Conduct employee training. ... Perform risk assessment. ... Develop internal policies and procedures. ... Detect suspicious activity and report it. ... Organize independent audits.

Who regulates the process? Steps to creating an AML policy. Step 1: draft an AML policy statement. Step 2: appoint a Money Laundering Reporting Officer (MLRO) Step 3: perform Customer Due Diligence (CDD) Step 4: verifying client identity. Step 5: report to Financial Intelligence Units (FIU)

The five critical components of an AML policy are suspicious transaction reporting, risk assessment, internal policies and practices, AML training, and independent compliance review.

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering (AML) compliance program required by the Bank Secrecy Act (BSA) and its implementing regulations and FINRA Rule 3310.

Firms must comply with the Bank Secrecy Act and its implementing regulations ("AML rules"). The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

Some types of businesses are also legally required to have anti-money laundering procedures in place. You might sometimes see these referred to as anti-money laundering checks, or AML for short.

5 Pillars of a Successful AML Program Designation of a Compliance Officer. The first step is to designate a BSA compliance officer to manage AML operations. ... 2. Development of Internal Controls. ... Establishing a BSA Training Program. ... Independent Audits and Reviews. ... Perform Customer Due Diligence.

The BSA requires each bank to establish a BSA/AML compliance program. By statute, individuals, banks, and other financial institutions are subject to the BSA recordkeeping requirements.