Iowa Self-Employed Paving Services Contract

Description

How to fill out Self-Employed Paving Services Contract?

US Legal Forms - one of the largest repositories of legal documents in the United States - presents a variety of legal template files you can download or create.

By using the site, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Iowa Self-Employed Paving Services Agreement within moments.

If you already have a monthly subscription, Log In and get the Iowa Self-Employed Paving Services Agreement from the US Legal Forms archive. The Download button will show up on every document you view. You can access all previously downloaded forms within the My documents section of your account.

Complete the purchase. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Select the file format and download the document to your device. Edit it. Fill out, modify, print, and sign the downloaded Iowa Self-Employed Paving Services Agreement. Each template you have added to your account has no expiration date and is yours indefinitely. Therefore, to download or create another copy, just go to the My documents section and click on the document you need. Access the Iowa Self-Employed Paving Services Agreement with US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are straightforward instructions to assist you in getting started.

- Make sure you have selected the correct form for the city/state.

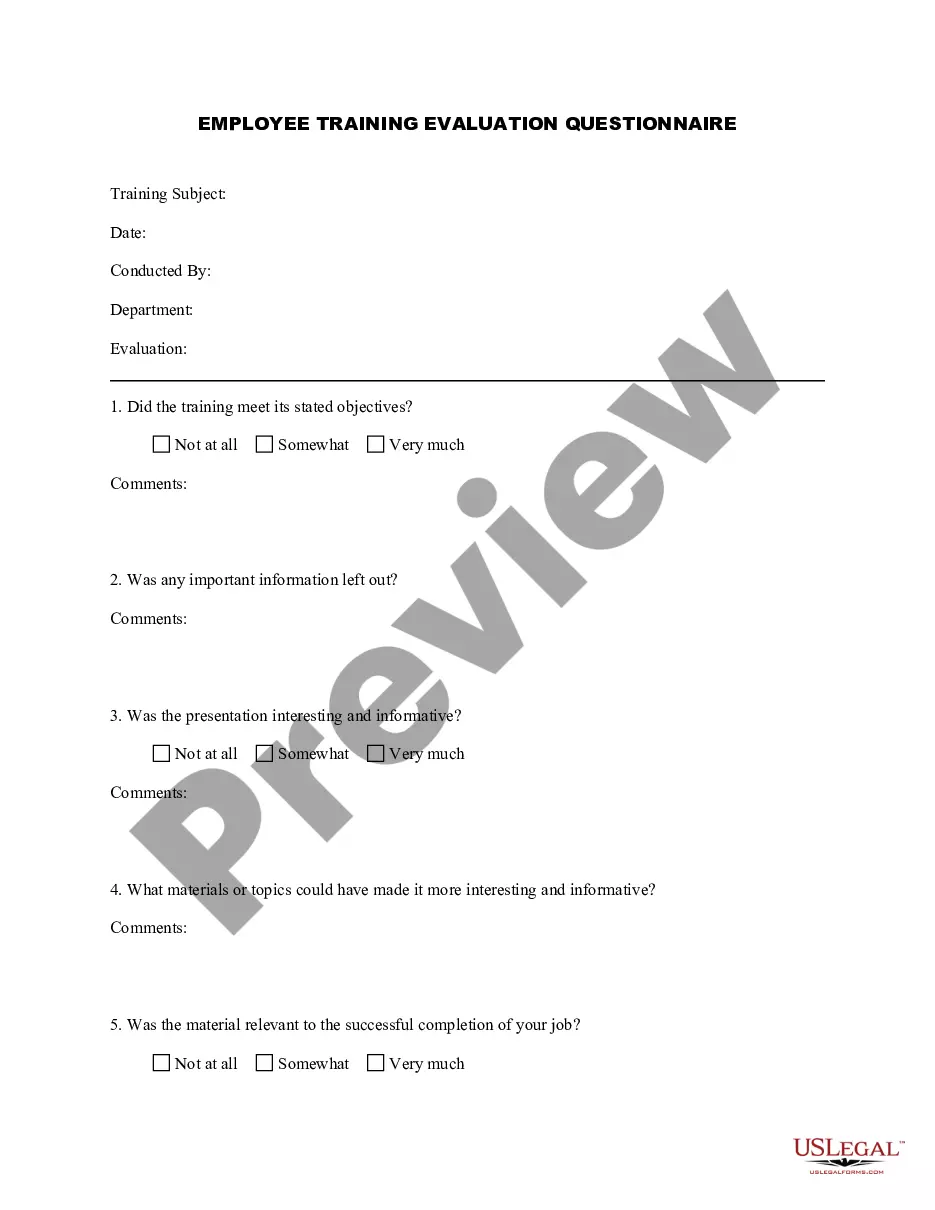

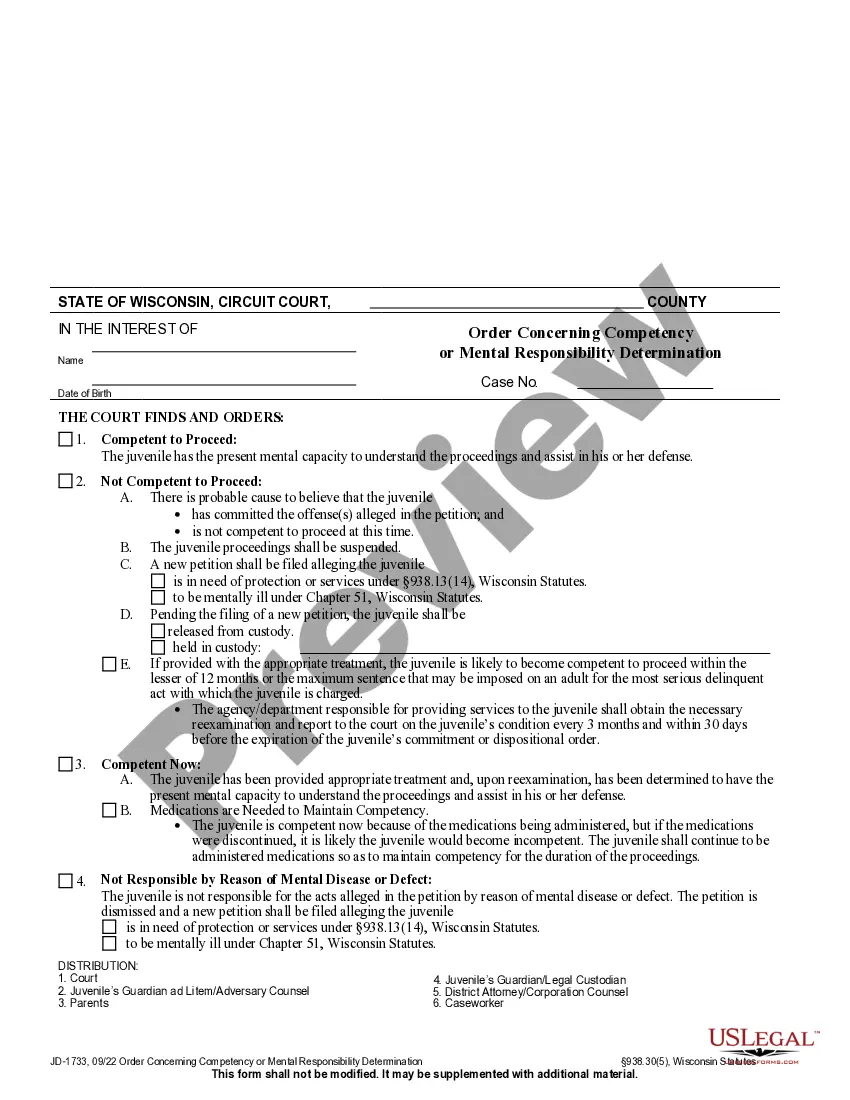

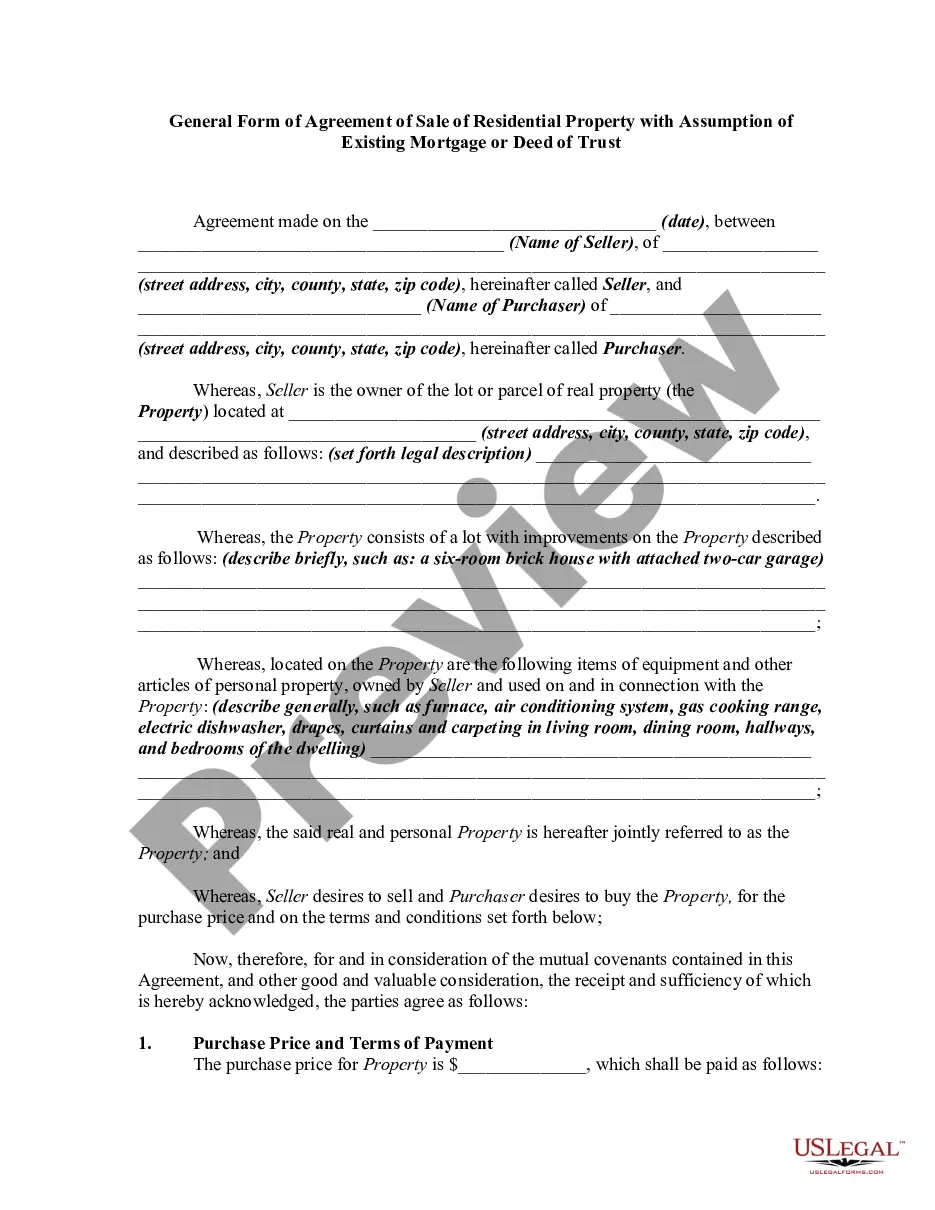

- Click the Preview button to review the form's details.

- Check the form description to ensure you have chosen the right document.

- If the form does not meet your needs, utilize the Search area at the top of the screen to find the one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Buy now button.

- Then, choose your payment plan and provide your information to register for an account.

Form popularity

FAQ

Labor is exempt from sales tax for real property and structures only. Not tangible personal property. You pay tax to the supplier for materials. You do not charge tax to the customer for labor or materials.

Pays tax to the supplier on materials not typically placed in inventory, such as wet concrete. Performing a construction contract - does not collect sales tax from the final customer. Performing a taxable service (repairs) - charges customers sales tax on labor and materials.

Is the Job New Construction, Reconstruction, Alteration, Expansion, or Remodeling? If it is, the labor is exempt from sales tax. This exemption applies to real property and structures only. It does not apply to tangible personal property.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Labor is exempt from sales tax for real property and structures only. Not tangible personal property. You pay tax to the supplier for materials. You do not charge tax to the customer for labor or materials.

Construction. When services are performed on or connected with new construction, reconstruction, alteration, expansion, or remodeling of a building or structure, they are exempt from sales and use tax. Repair services remain taxable.

Repairs of trucks or trailers performed in Iowa are subject to Iowa sales tax whether or not the owner has an ICC exemption number (or M.C. Docket Number). This includes both labor and parts.

However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers. Generally, if you perform taxable labor in California, you must obtain a seller's permit and report and pay tax on your taxable sales.

Sales of tangible personal property in Iowa are subject to sales tax unless exempted by state law. Sales of services are exempt from Iowa sales tax unless taxed by state law. The retailer must add the tax to the price and collect the tax from the purchaser.

Sales of tangible personal property in Iowa are subject to sales tax unless exempted by state law. Sales of services are exempt from Iowa sales tax unless taxed by state law.