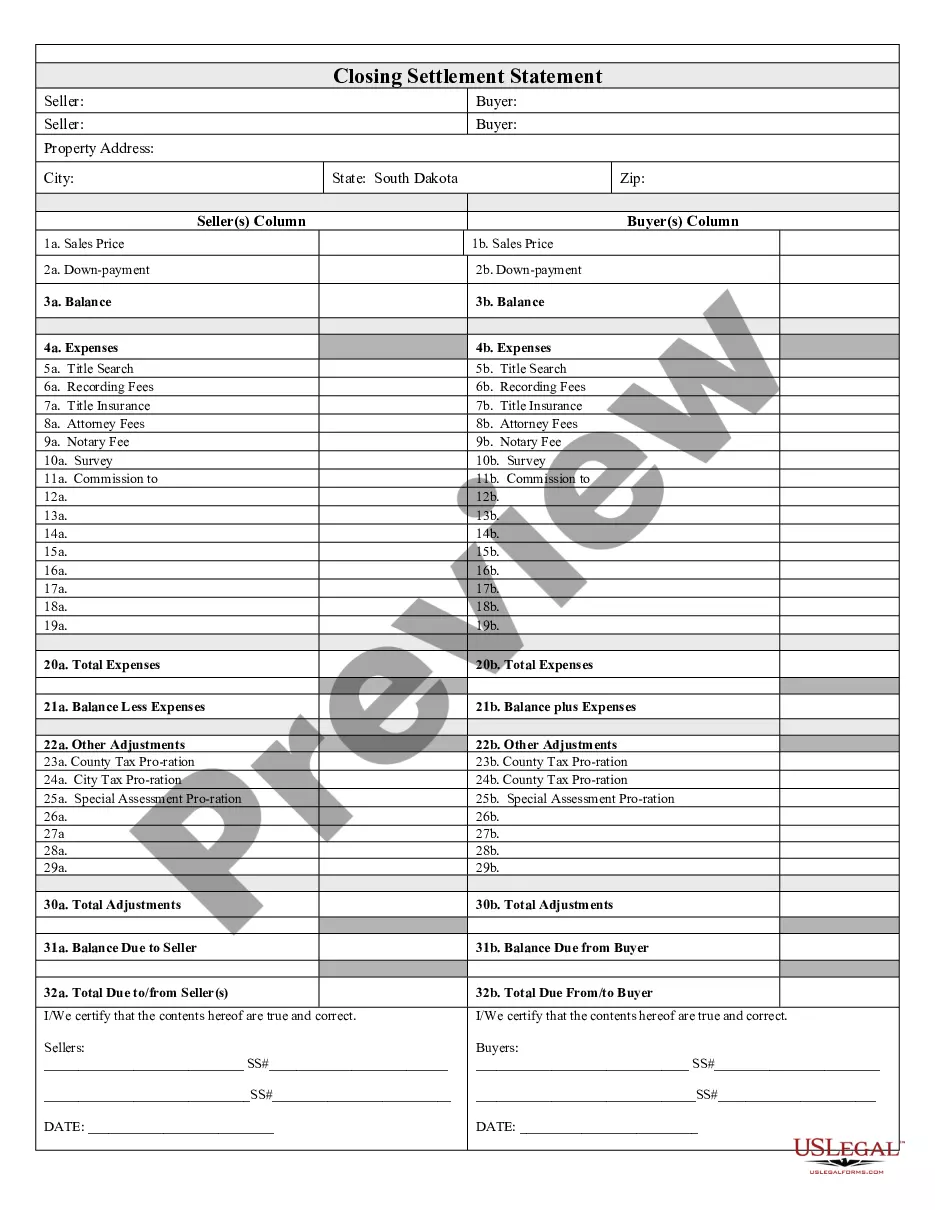

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

South Dakota Closing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Dakota Closing Statement?

Get access to top quality South Dakota Closing Statement forms online with US Legal Forms. Prevent days of lost time looking the internet and dropped money on documents that aren’t updated. US Legal Forms gives you a solution to just that. Get over 85,000 state-specific authorized and tax forms that you could save and complete in clicks in the Forms library.

To get the example, log in to your account and click on Download button. The file is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Check if the South Dakota Closing Statement you’re looking at is appropriate for your state.

- See the form using the Preview option and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish making an account.

- Choose a favored format to save the document (.pdf or .docx).

You can now open up the South Dakota Closing Statement template and fill it out online or print it out and do it by hand. Take into account sending the papers to your legal counsel to make certain all things are completed appropriately. If you make a error, print out and complete application again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing.

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

What is the seller's closing statement, aka settlement statement? The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.

A closing statement is a document that records the details of a financial transaction. A home buyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

To get a copy of your closing statement of your home purchase in 2006, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your Settlement Documents.

If the closing date is missed, at a minimum, the contract is in jeopardy; the worst-case scenario is the contract has expired. The typical action is to extend the closing date, but the sellers might not agree.

In the United States, a seller disclosure statement is a form disclosing the seller's knowledge of the condition of the property. The seller disclosure notice or statement is anecdotal and does not serve as a substitute for any inspections of warranties the purchaser may wish to obtain.

In South Dakota, typical closing costs including origination fees charged by the lender and third-party fees like appraisals, flood certification fees, and the fee charged by the closing attorney. According to a study from Bankrate, closing fees in South Dakota typically average $1,814.