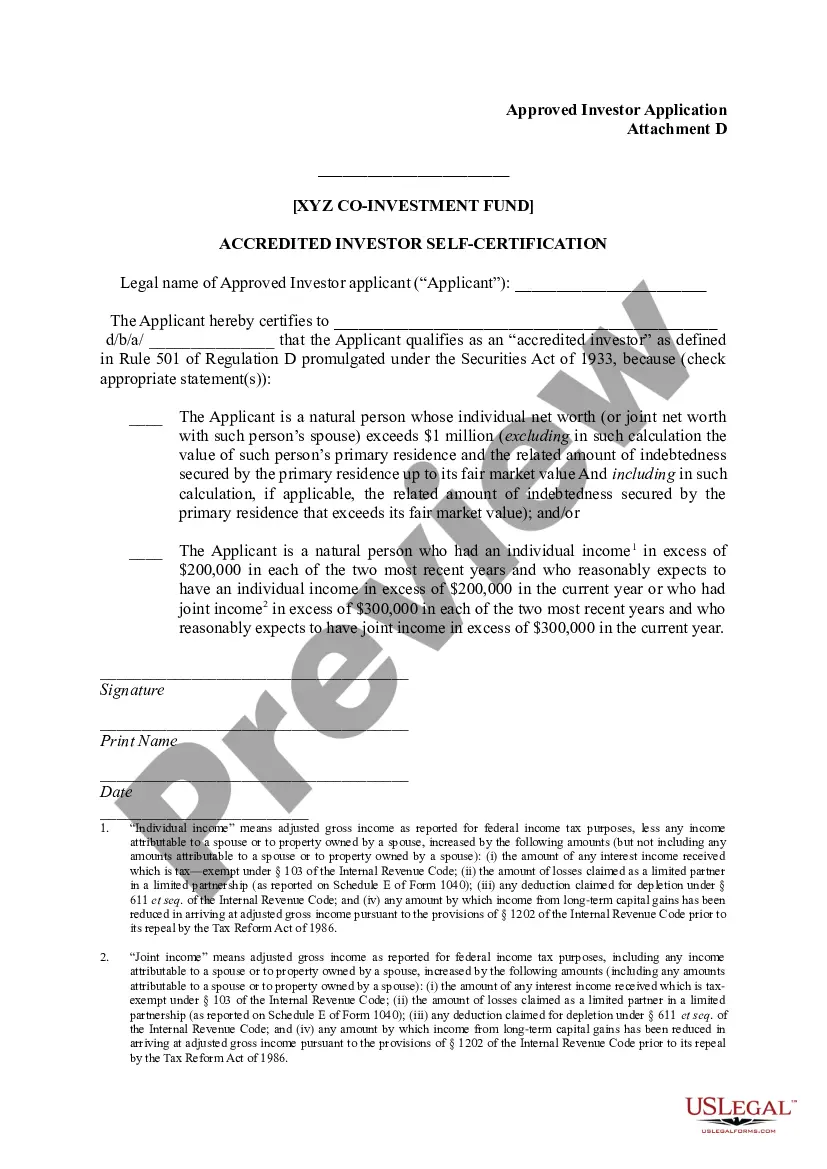

Iowa Accredited Investor Self-Certification Attachment D

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Self-Certification Attachment D?

Discovering the right authorized file web template might be a struggle. Needless to say, there are tons of themes accessible on the Internet, but how will you find the authorized kind you will need? Take advantage of the US Legal Forms website. The service gives thousands of themes, including the Iowa Accredited Investor Self-Certification Attachment D, that you can use for business and private needs. All of the types are checked out by experts and fulfill federal and state requirements.

Should you be presently listed, log in to your profile and click on the Acquire option to find the Iowa Accredited Investor Self-Certification Attachment D. Make use of your profile to check throughout the authorized types you have bought in the past. Visit the My Forms tab of your respective profile and acquire another copy from the file you will need.

Should you be a fresh end user of US Legal Forms, listed below are basic guidelines that you can stick to:

- Initial, be sure you have selected the appropriate kind for your metropolis/region. It is possible to look through the form making use of the Preview option and browse the form information to guarantee this is the right one for you.

- In case the kind fails to fulfill your preferences, take advantage of the Seach discipline to discover the proper kind.

- Once you are positive that the form is acceptable, select the Acquire now option to find the kind.

- Choose the costs strategy you desire and enter in the necessary details. Make your profile and purchase the transaction with your PayPal profile or Visa or Mastercard.

- Select the submit file format and acquire the authorized file web template to your system.

- Comprehensive, change and produce and indicator the received Iowa Accredited Investor Self-Certification Attachment D.

US Legal Forms will be the biggest collection of authorized types for which you can find different file themes. Take advantage of the service to acquire appropriately-created papers that stick to status requirements.

Form popularity

FAQ

Form D, also known as the Notice of Sale of Securities, is required by the SEC for companies selling securities in a Regulation (Reg) D exemption or with Section 4(6) exemption provisions. Form D details basic information or essential facts about the company for investors.

You must publically provide information about the offering and your company including information on the company's name, address, executive officers, directors, and the size of the offering.

Form D is a brief notice that includes the names and addresses of the company's promoters, executive officers and directors, and some details about the offering, but contains little other information about the company. You can access the SEC's EDGAR database to determine whether the company has filed a Form D.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

Form D is a brief notice that includes basic information about the company and the offering, such as the names and addresses of the company's executive officers, the size of the offering and the date of first sale.

Form D requires that companies provide their principal place of business addresses and telephone number. Item 3 ? Related Persons Disclosure. Form D Item 3 requires that Company's disclose ?related persons? to the extent such persons are promoters or are the company's executive officers and directors.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

An accredited investor must have a net worth of $1 million or more, without including the value of their primary residence. To demonstrate this net worth, an investor must provide the securities offer with relevant documents that essentially prove how much money they have in the bank.