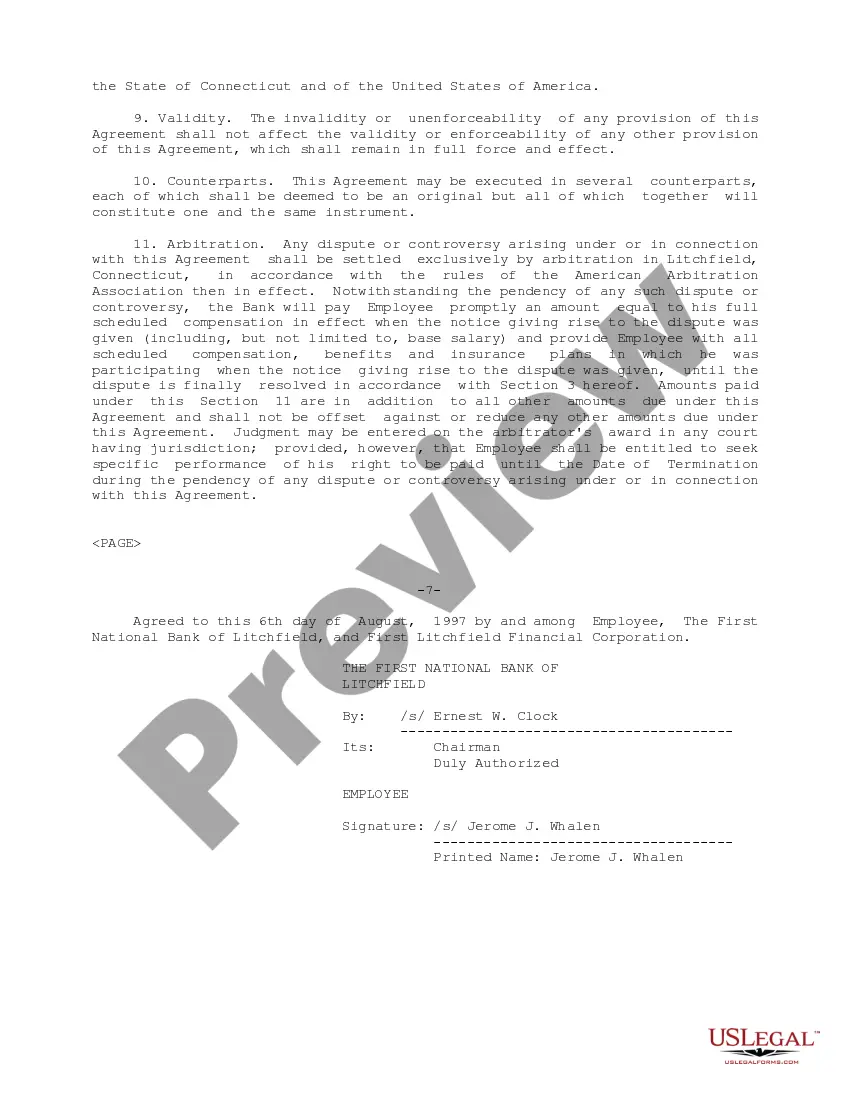

Iowa Executive Change in Control Agreement for The First National Bank of Litchfield

Description

How to fill out Executive Change In Control Agreement For The First National Bank Of Litchfield?

If you want to total, down load, or printing legitimate record templates, use US Legal Forms, the greatest collection of legitimate forms, which can be found on the web. Make use of the site`s basic and convenient lookup to get the paperwork you want. A variety of templates for business and individual uses are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Iowa Executive Change in Control Agreement for The First National Bank of Litchfield in a handful of clicks.

In case you are currently a US Legal Forms customer, log in in your accounts and then click the Down load key to obtain the Iowa Executive Change in Control Agreement for The First National Bank of Litchfield. You may also entry forms you in the past saved from the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape to the right metropolis/nation.

- Step 2. Make use of the Review method to look through the form`s articles. Do not forget to learn the information.

- Step 3. In case you are not satisfied with all the type, make use of the Look for industry on top of the monitor to discover other models of your legitimate type format.

- Step 4. Upon having identified the shape you want, select the Buy now key. Choose the pricing prepare you choose and add your credentials to sign up for an accounts.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Find the file format of your legitimate type and down load it on your own system.

- Step 7. Total, modify and printing or signal the Iowa Executive Change in Control Agreement for The First National Bank of Litchfield.

Each legitimate record format you buy is your own property eternally. You have acces to every type you saved with your acccount. Click on the My Forms segment and select a type to printing or down load once more.

Contend and down load, and printing the Iowa Executive Change in Control Agreement for The First National Bank of Litchfield with US Legal Forms. There are millions of specialist and status-specific forms you can utilize to your business or individual demands.