Iowa Complex Will - Income Trust for Spouse

Description

How to fill out Complex Will - Income Trust For Spouse?

Have you been in a placement the place you need documents for sometimes organization or personal purposes almost every working day? There are tons of legitimate file layouts available on the Internet, but getting versions you can trust isn`t effortless. US Legal Forms provides 1000s of develop layouts, like the Iowa Complex Will - Income Trust for Spouse, which can be composed to meet state and federal demands.

Should you be previously familiar with US Legal Forms website and get a merchant account, just log in. After that, you are able to acquire the Iowa Complex Will - Income Trust for Spouse web template.

If you do not have an account and need to begin using US Legal Forms, adopt these measures:

- Get the develop you need and make sure it is for your appropriate town/region.

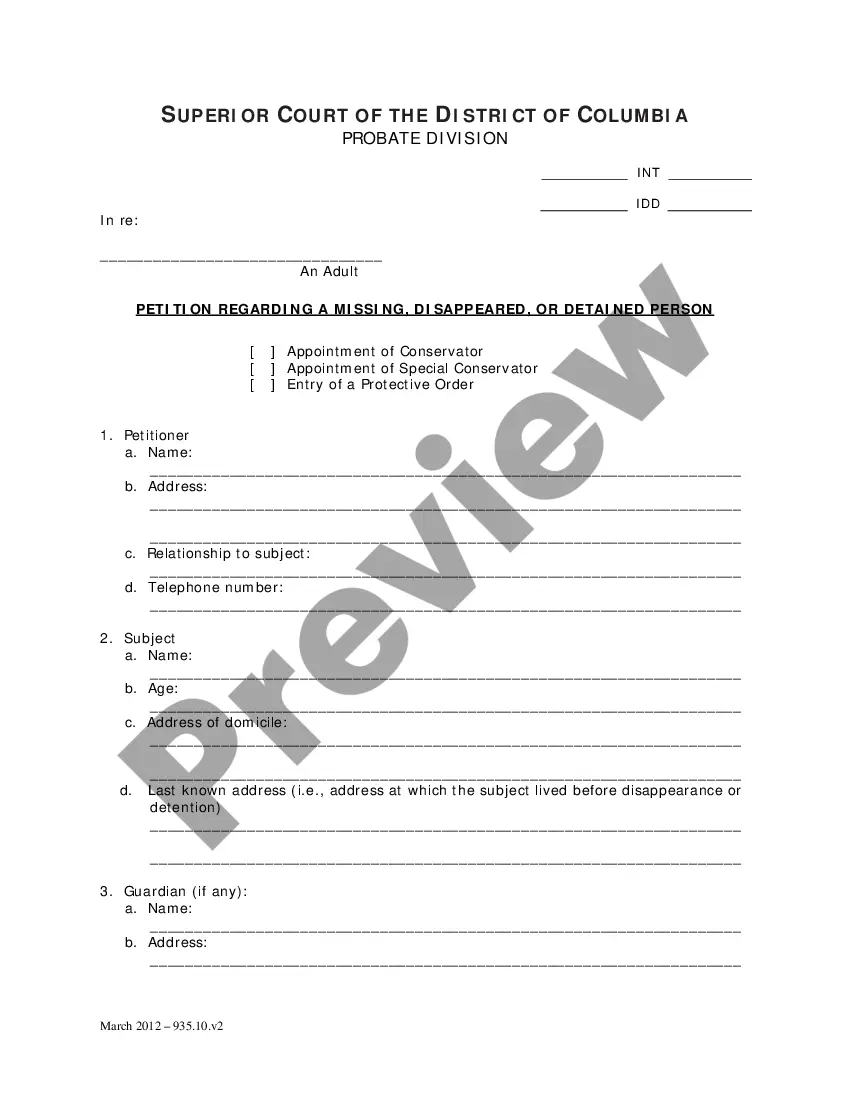

- Make use of the Preview option to examine the form.

- Look at the description to actually have selected the correct develop.

- If the develop isn`t what you are looking for, take advantage of the Lookup area to find the develop that fits your needs and demands.

- If you find the appropriate develop, click Buy now.

- Opt for the prices strategy you would like, fill in the desired info to make your bank account, and buy your order using your PayPal or Visa or Mastercard.

- Choose a handy document formatting and acquire your copy.

Locate each of the file layouts you possess purchased in the My Forms menu. You may get a extra copy of Iowa Complex Will - Income Trust for Spouse any time, if required. Just select the necessary develop to acquire or print the file web template.

Use US Legal Forms, one of the most comprehensive collection of legitimate kinds, to conserve efforts and stay away from errors. The support provides expertly created legitimate file layouts which can be used for an array of purposes. Generate a merchant account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

A Spousal Lifetime Access Trust (SLAT) is an irrevocable trust set up by one spouse for the benefit of the other spouse (and possibly other family members) during your lifetime. A properly structured SLAT will help you avoid federal estate taxes while still providing limited access to the trust assets.

What Type of Assets Go into a Trust? Real Estate. Many people wonder whether it is a good idea to place their house in a trust. ... Financial Accounts. ... Life Insurance. ... Valuable Personal Property. ... Collectible Vehicles. ... Sole Proprietorships. ... Partnerships. ... Limited Liability Companies (LLC).

For instance, putting your bank account in your living trust is one way you ensure to fund the trust. If you leave a trust unfunded, the estate's assets will not pass as easily to your desired beneficiaries. The assets will still have to go through the expensive, time-consuming probate process.

Q: I have been told that I can assign income to a trust and I will not be taxed on that income. Is this true? A: No. Income that is earned by one person cannot be assigned to another for federal income tax purposes.

The trust must keep part of its income rather than giving it all together to the beneficiaries. The beneficiaries must receive part or all of the trust's principal. A portion of the trust's assets must be distributed to charity organizations.

On the other hand, a good rule of thumb is to consider a revocable living trust if your net worth is at least $100,000. Even so, be sure to check your state's ?small estate? laws?which set dollar amounts or caps for a decedent's estate?knowing that anything below these thresholds may allow you to bypass probate.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.