Iowa Complex Will - Max. Credit Shelter Marital Trust to Children

Description

How to fill out Complex Will - Max. Credit Shelter Marital Trust To Children?

Are you currently within a place where you require files for possibly business or individual functions just about every day time? There are tons of lawful document layouts available on the net, but discovering kinds you can rely on is not effortless. US Legal Forms provides 1000s of kind layouts, much like the Iowa Complex Will - Max. Credit Shelter Marital Trust to Children, which are composed to meet federal and state requirements.

Should you be already familiar with US Legal Forms site and also have a merchant account, simply log in. Following that, you are able to acquire the Iowa Complex Will - Max. Credit Shelter Marital Trust to Children design.

If you do not provide an bank account and want to begin to use US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is for the correct city/area.

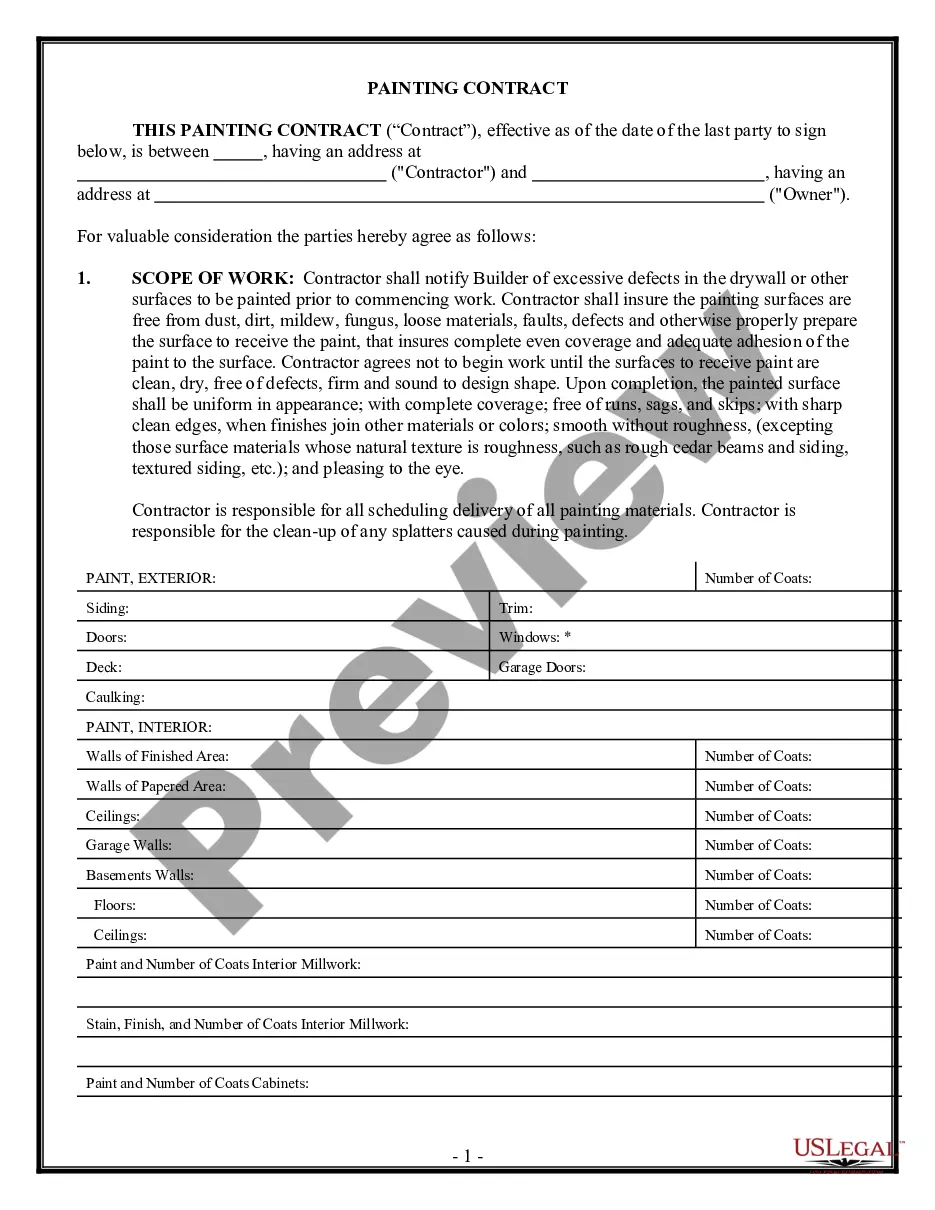

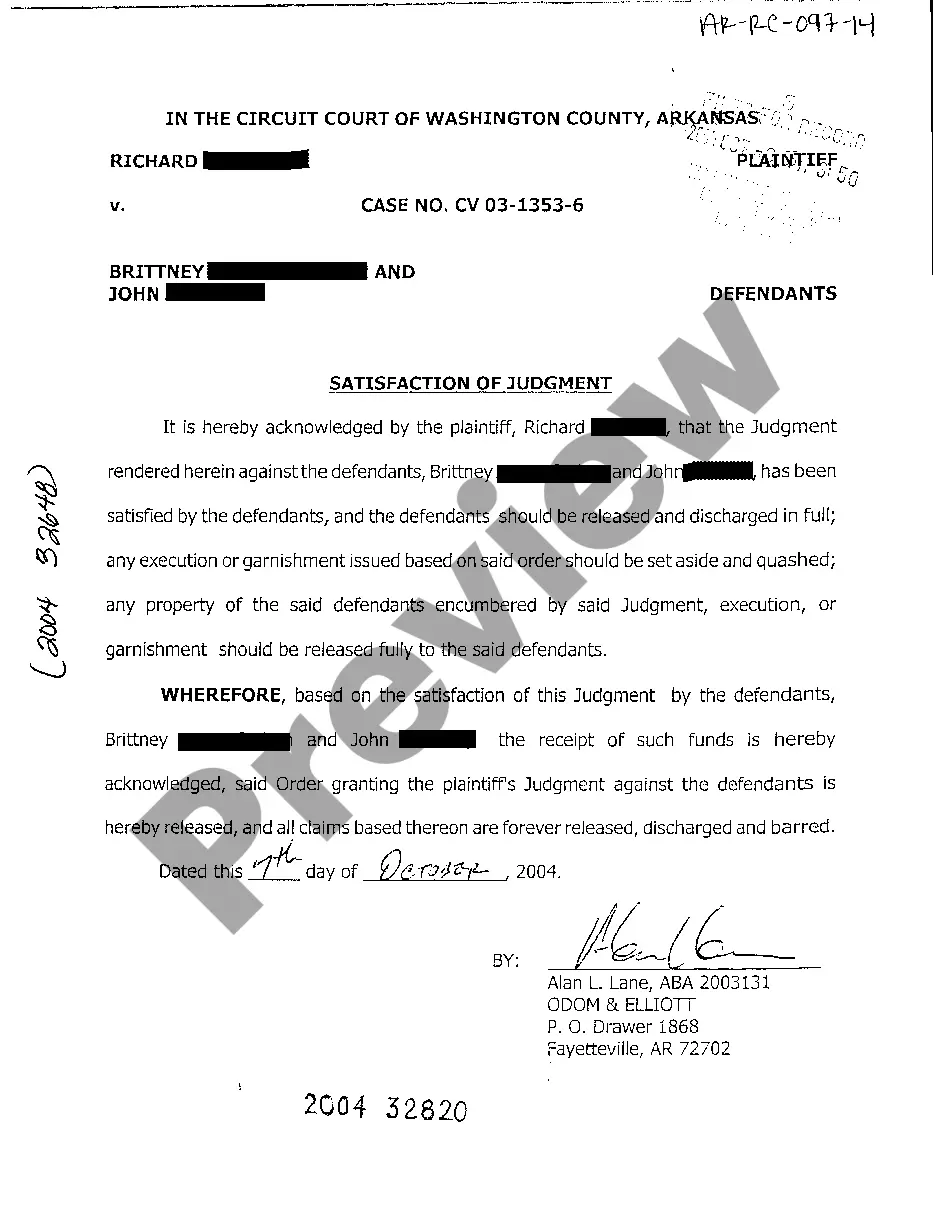

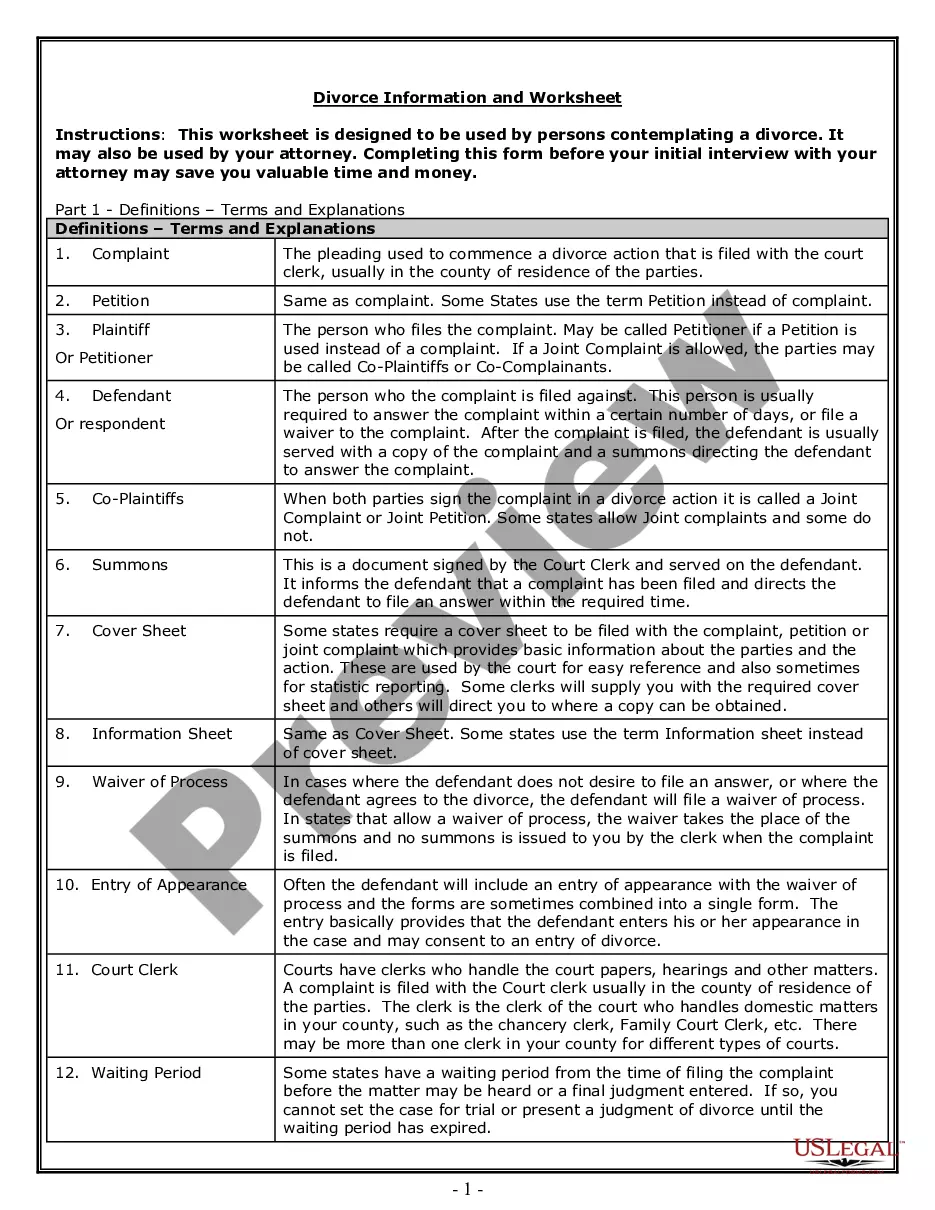

- Utilize the Review key to examine the form.

- Browse the information to actually have selected the correct kind.

- In case the kind is not what you are searching for, use the Lookup industry to find the kind that fits your needs and requirements.

- If you get the correct kind, simply click Get now.

- Choose the costs program you would like, fill in the desired information to generate your account, and buy the transaction making use of your PayPal or bank card.

- Choose a hassle-free document formatting and acquire your backup.

Find all of the document layouts you have purchased in the My Forms menus. You can get a further backup of Iowa Complex Will - Max. Credit Shelter Marital Trust to Children anytime, if required. Just click on the necessary kind to acquire or print the document design.

Use US Legal Forms, the most comprehensive selection of lawful types, to conserve time and steer clear of faults. The assistance provides expertly made lawful document layouts that can be used for an array of functions. Make a merchant account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

When the credit shelter trust is initially funded upon the death of one spouse, the assets that are placed under the trust receive a step-up in basis. This is an important consideration, because any assets held in a CST don't receive a second step-up in basis upon the death of the surviving spouse.

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

CSTs are created upon a married individual's death and funded with that person's entire estate or a portion of it as outlined in the trust agreement. These assets then flow to the surviving spouse.