Iowa Letter to Shareholders

Description

How to fill out Letter To Shareholders?

Finding the right lawful file web template can be a struggle. Of course, there are a lot of layouts available online, but how can you obtain the lawful develop you need? Use the US Legal Forms web site. The support offers a large number of layouts, for example the Iowa Letter to Shareholders, which can be used for company and personal demands. All of the forms are checked out by professionals and meet federal and state needs.

Should you be already listed, log in to the bank account and click on the Download button to get the Iowa Letter to Shareholders. Make use of your bank account to appear with the lawful forms you may have bought earlier. Go to the My Forms tab of your respective bank account and get an additional duplicate of the file you need.

Should you be a whole new end user of US Legal Forms, listed below are simple instructions that you can adhere to:

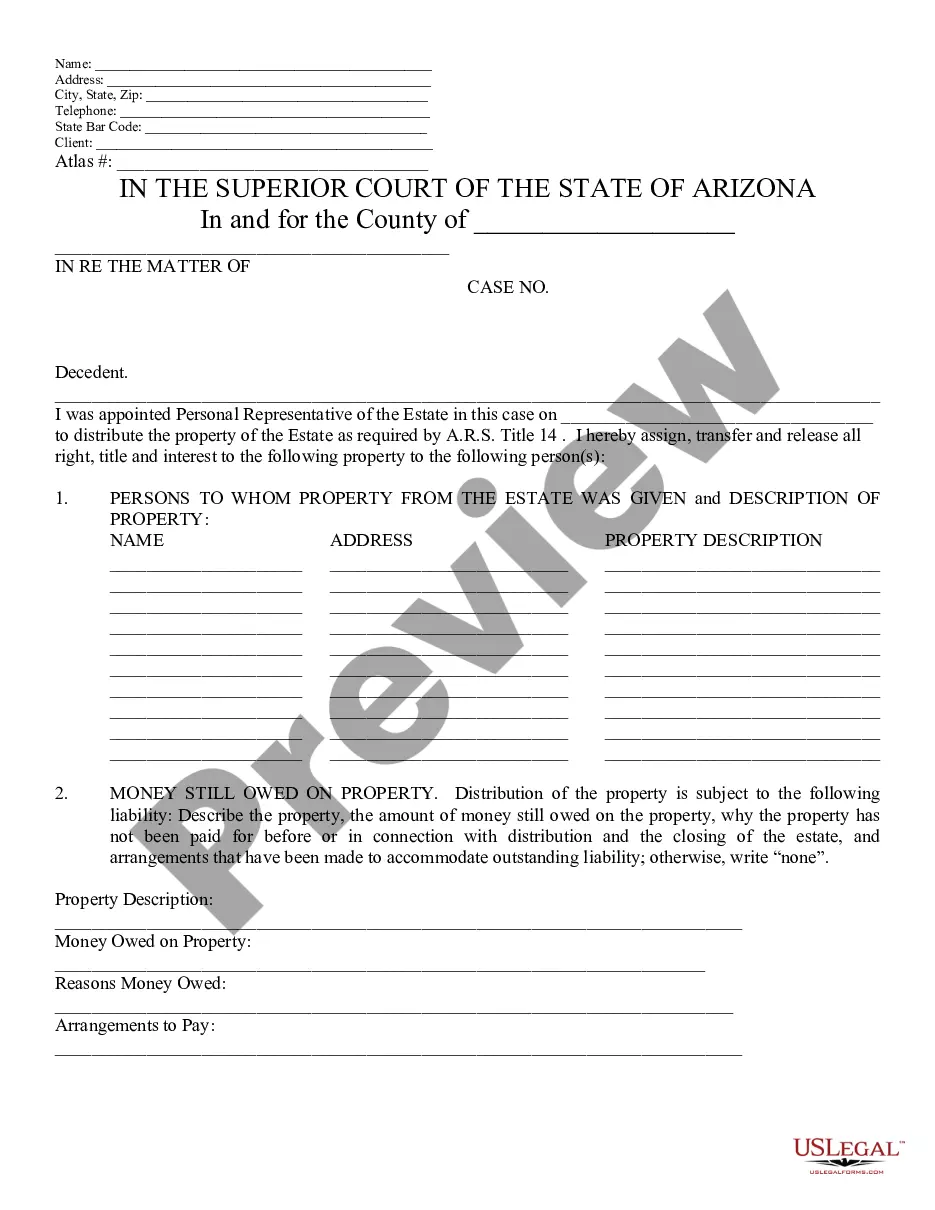

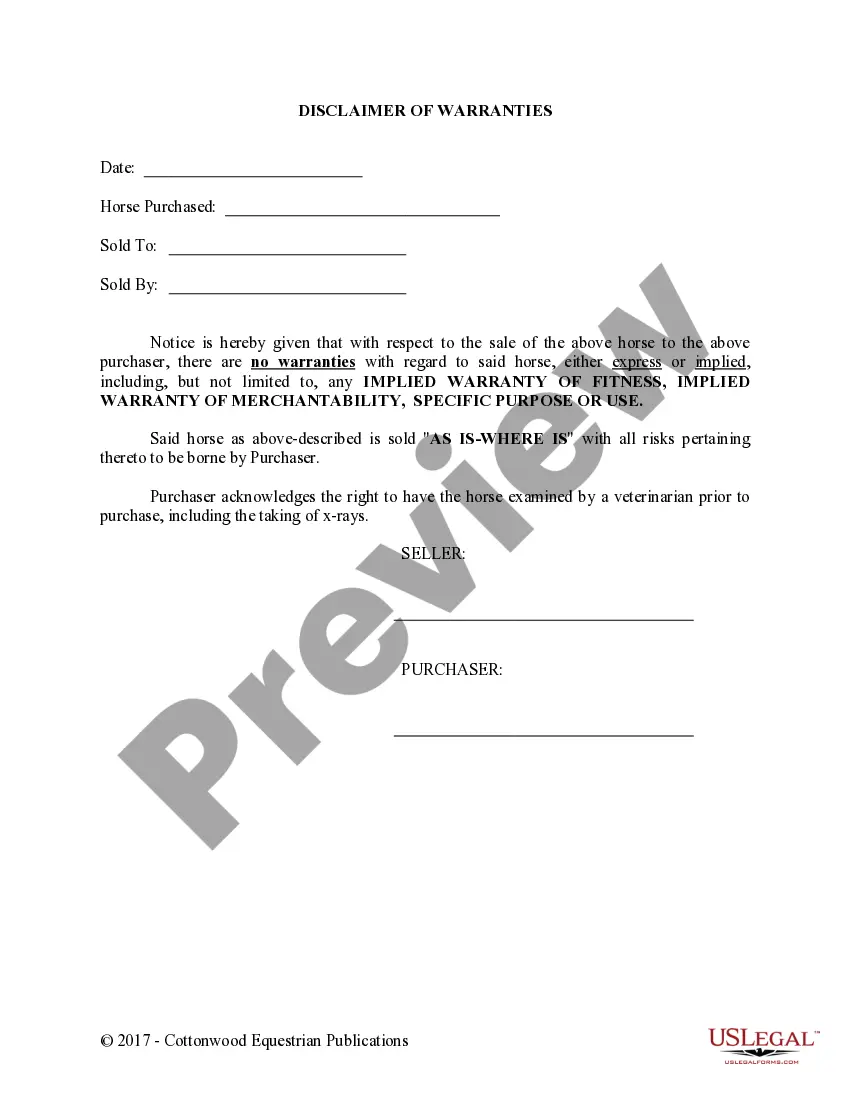

- First, make sure you have selected the appropriate develop for your town/area. It is possible to check out the form making use of the Review button and look at the form description to make sure this is basically the right one for you.

- If the develop fails to meet your requirements, use the Seach area to discover the appropriate develop.

- Once you are sure that the form is suitable, select the Buy now button to get the develop.

- Opt for the costs program you would like and type in the required information and facts. Create your bank account and buy the transaction using your PayPal bank account or Visa or Mastercard.

- Select the data file format and download the lawful file web template to the system.

- Total, revise and print and sign the acquired Iowa Letter to Shareholders.

US Legal Forms is the biggest local library of lawful forms in which you can discover numerous file layouts. Use the service to download skillfully-manufactured paperwork that adhere to express needs.

Form popularity

FAQ

States' agencies have computer links with the IRS. Only Nevada does not share residents' data with the IRS. Most state taxing authorities act quickly when they receive IRS information if it means the taxpayer will owe the state more, too. In fact, many states act on IRS-supplied information before the IRS does.

Form 1120-S And the total assets at the end of the tax year are:Use the following IRS center address:$10 million or more or Schedule M-3 is filedDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-0013Any amountDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-00132 more rows ?

Why did the Department send me a letter? We send letters for the following reasons: You have a balance due. We have a question about your tax return.

The state is garnishing your wages or bank accounts. The state is offsetting benefit payments and tax refunds. These are all signs that you may owe money to the state of Iowa. If you owe the state of Iowa for certain kinds of debts, your license may also be suspended.

What is the Phone Number to Find Out the Taxes You Owe? Individual taxpayers may call 1-800-829-1040, Monday through Friday, 7 a.m. to 7 p.m. local time. Taxpayers representing a business may call 1-800-829-4933, Monday through Friday, 7 a.m. to 7 p.m. local time.

On , Governor Reynolds signed House File 352 which creates a voluntary election for a partnership or S corporation to be subject to Iowa income tax at the entity level. This is referred to as the Pass-Through Entity Tax (PTET).

If you owe money to the state, you will receive a notice. Do not ignore this notice. It is important for you to know how much you owe, why you owe it, and what state agency you will be dealing with.

You can check the status of your Iowa state tax refund online at the Iowa Department of Revenue website. The exact amount of your anticipated refund. You may also call 1-800-572-3944 (Iowa only) or 515/281-4966 to check the status.