Iowa List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

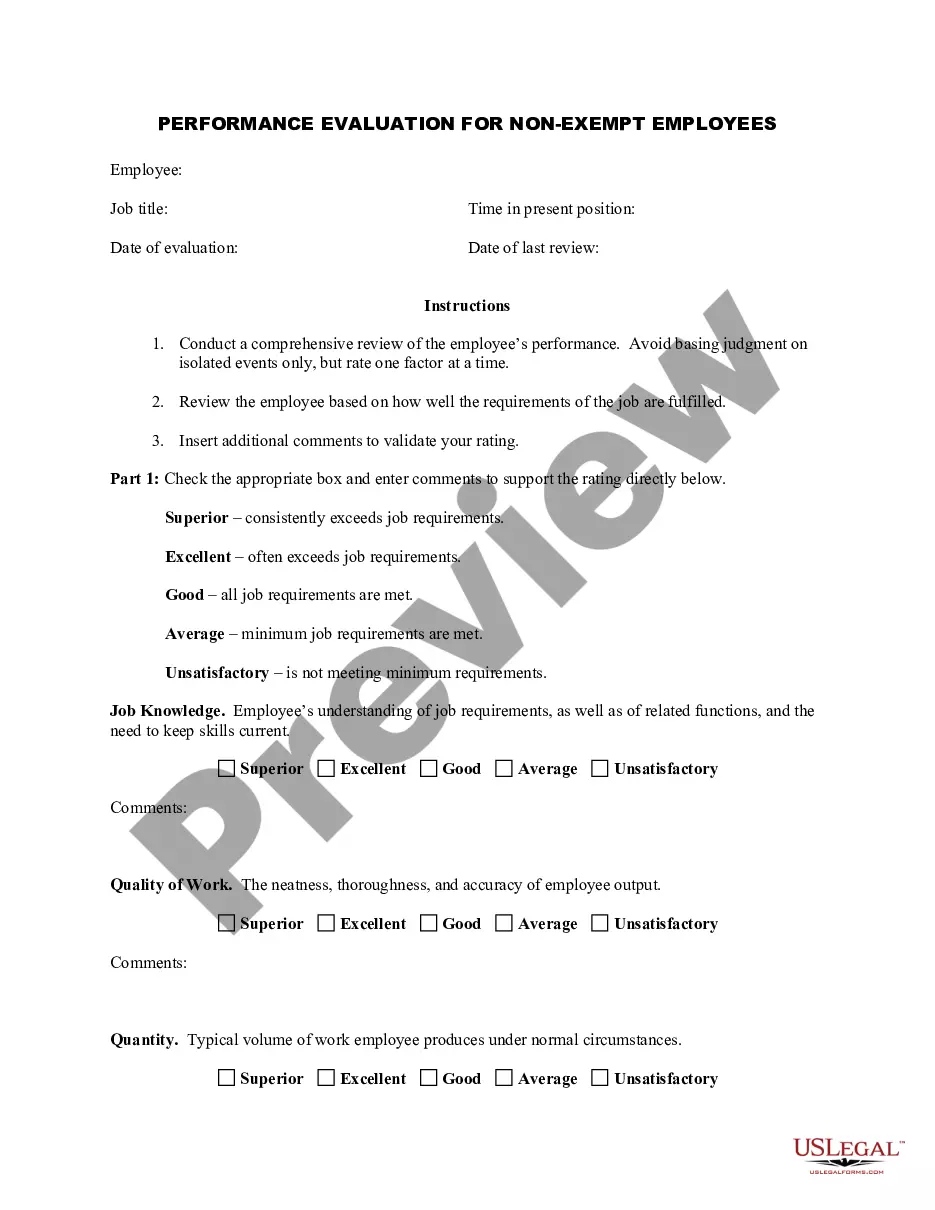

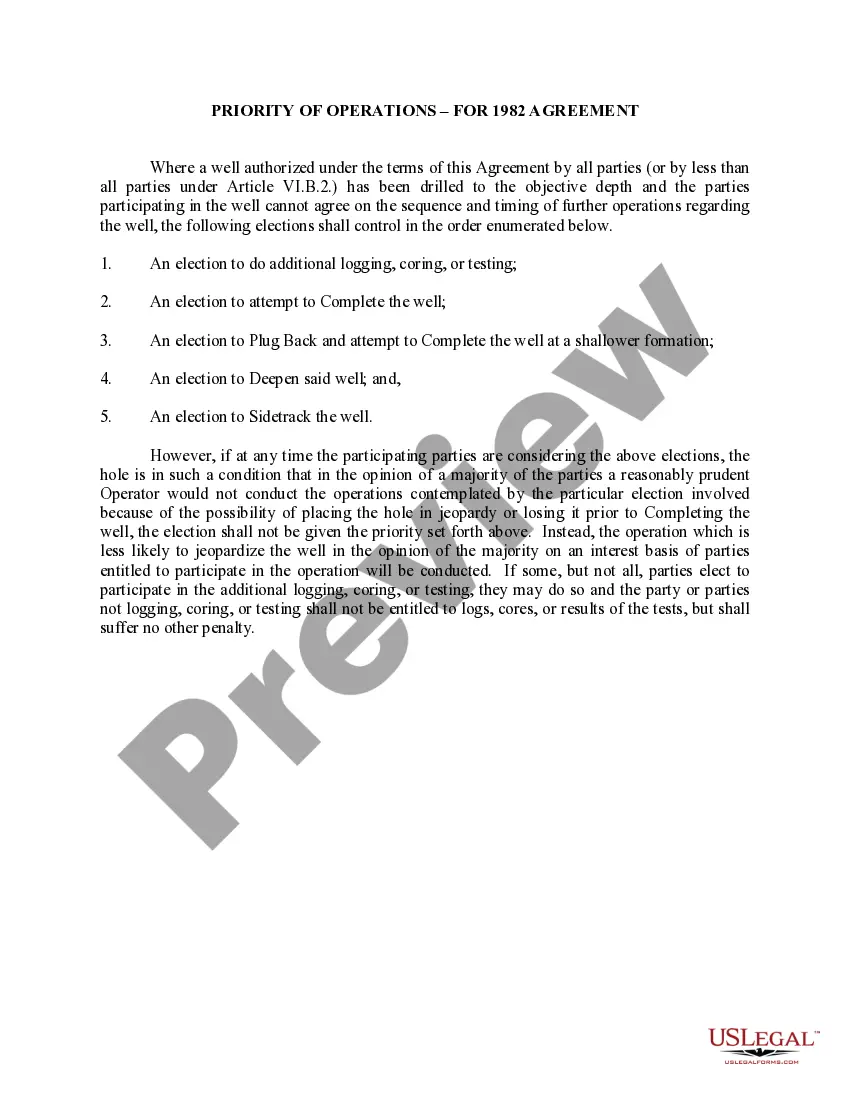

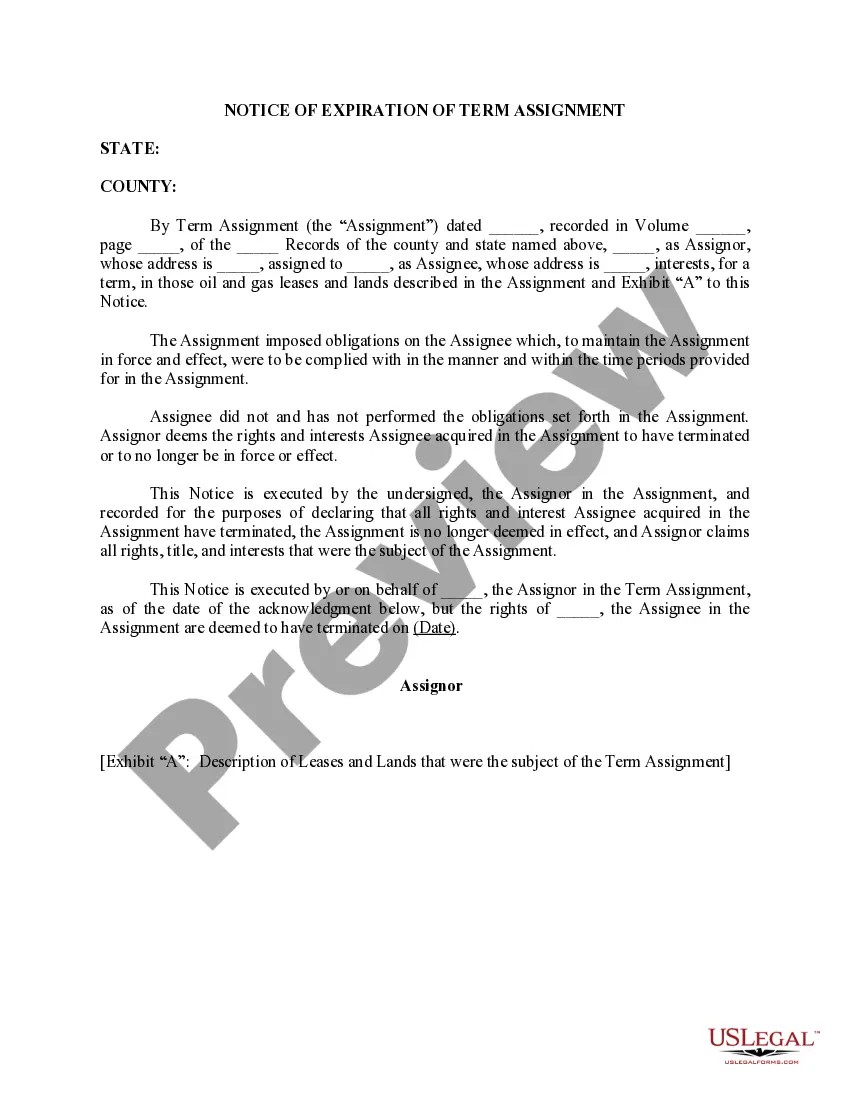

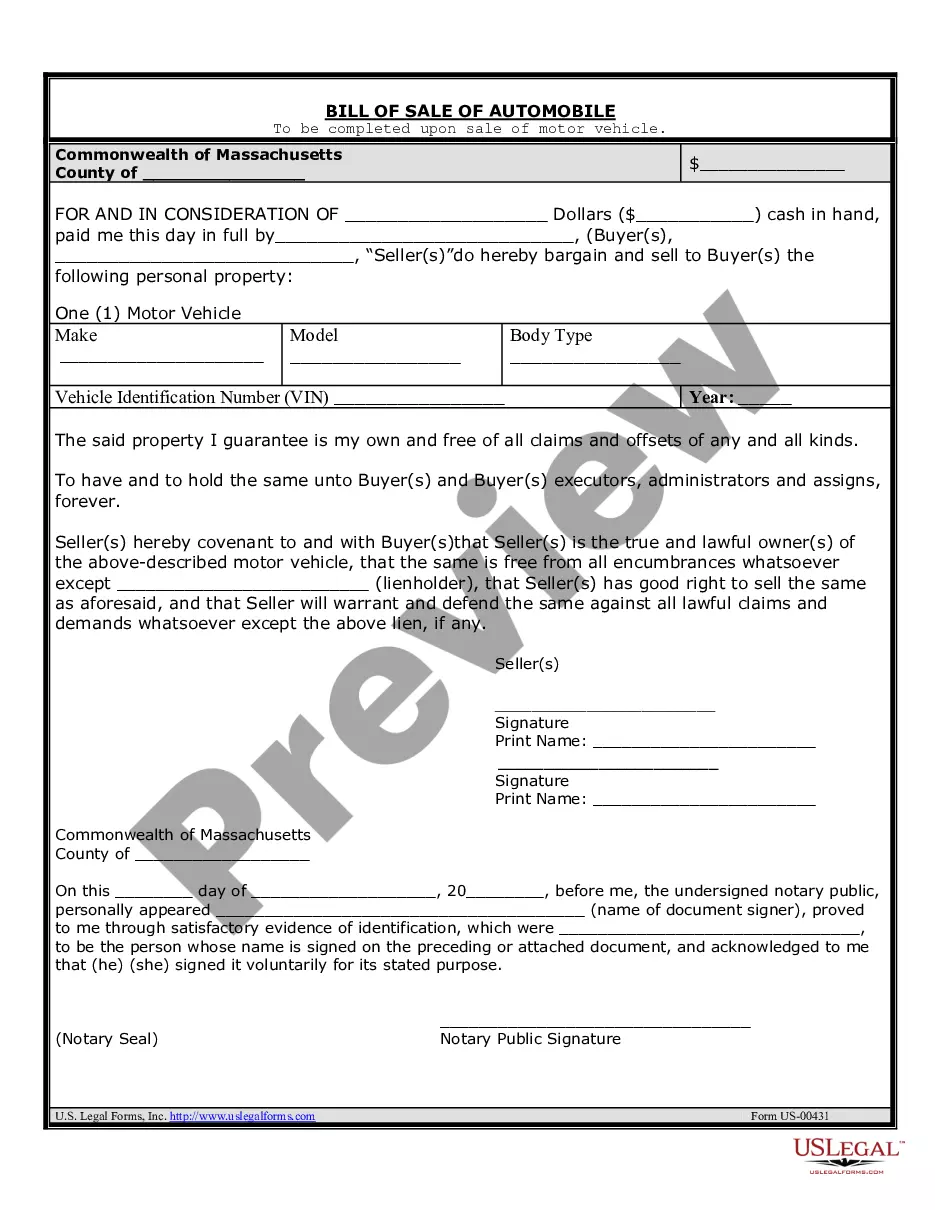

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

US Legal Forms - among the greatest libraries of legal kinds in the United States - gives a variety of legal record web templates you are able to down load or printing. Utilizing the site, you may get a huge number of kinds for business and personal purposes, sorted by groups, states, or key phrases.You can get the latest variations of kinds just like the Iowa List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 in seconds.

If you already possess a registration, log in and down load Iowa List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 through the US Legal Forms library. The Download button will show up on each and every kind you view. You have access to all formerly acquired kinds from the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, allow me to share simple recommendations to get you began:

- Make sure you have picked out the right kind to your area/region. Go through the Preview button to check the form`s content. Look at the kind outline to ensure that you have chosen the right kind.

- In case the kind does not satisfy your requirements, utilize the Lookup industry towards the top of the display to obtain the one who does.

- In case you are satisfied with the shape, affirm your choice by clicking the Buy now button. Then, select the pricing prepare you prefer and provide your qualifications to sign up to have an profile.

- Procedure the purchase. Use your bank card or PayPal profile to accomplish the purchase.

- Choose the formatting and down load the shape on the gadget.

- Make alterations. Fill up, revise and printing and indication the acquired Iowa List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005.

Every single design you included with your money lacks an expiration time and is also your own eternally. So, in order to down load or printing another duplicate, just go to the My Forms section and click on the kind you need.

Gain access to the Iowa List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 with US Legal Forms, one of the most considerable library of legal record web templates. Use a huge number of skilled and express-certain web templates that meet your small business or personal requirements and requirements.

Form popularity

FAQ

While a priority claim is not secured by collateral, it is however treated with higher priority over other claims by Federal law. A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims.

Among the top 30 unsecured creditors that Yellow owes are some of the industry's most recognized names. This includes railroads such as BNSF and Union Pacific, retail giants like Amazon and Home Depot, and leading equipment suppliers like Goodyear, Michelin, and DTNA (Daimler Trucks North America).

The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units ...

What is a List of Creditors? When you file a voluntary petition under any bankruptcy chapter, you the debtor (or your attorney, if you use one) must prepare a List of Creditors and submit it to the Court. The List of Creditors is essentially a mailing list of creditors to whom you owe money.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

Some assets may have multiple liens placed upon them; in these cases, the first lien has priority over the second lien. Unsecured creditors are divided between preferred and non-preferred, as certain unclaimed creditors like employees and tax agencies are given priority.

It's true that even if a debtor is completely honest in their Chapter 7 bankruptcy filing, their case can still be dismissed for technical reasons. The 1% of Chapter 7 bankruptcy cases that are dismissed are typically due to technicalities.

Unsecured Creditors, like credit card issuers, suppliers, and some cash advance companies (although this is changing), do not hold a lien on its debtor's property to assure payment of the debt if there is a default. The secured creditor holds priority on debt collection from the property on which it holds a lien.