Iowa Memo on Company Relocation including Relocation Pay for Employees

Description

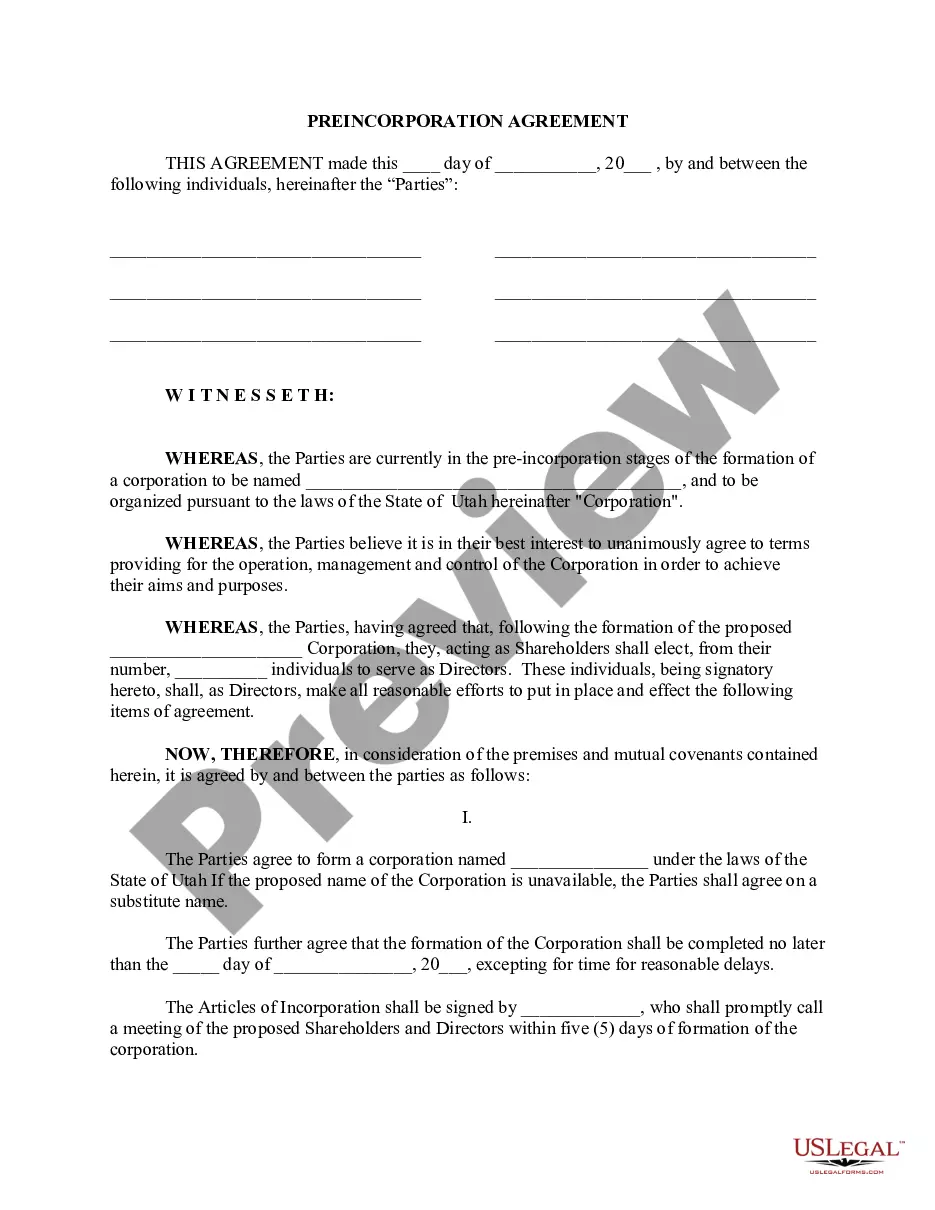

How to fill out Memo On Company Relocation Including Relocation Pay For Employees?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By utilizing the website, you can obtain thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of forms such as the Iowa Memo on Company Relocation, including Relocation Compensation for Employees.

If you currently hold a membership, Log In to download the Iowa Memo on Company Relocation with Relocation Compensation for Employees from the US Legal Forms catalog. The Download option will be visible on every form you view.

If you are satisfied with the form, validate your choice by clicking the Buy now button. Then, select your pricing plan and provide your information to create an account.

Complete the payment. Use your credit card or PayPal account to process the payment. Choose the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded Iowa Memo on Company Relocation including Relocation Compensation for Employees. Every template added to your account has no expiration date and is yours permanently.

Therefore, if you wish to download or print another copy, simply return to the My documents section and click on the form you need. Access the Iowa Memo on Company Relocation including Relocation Compensation for Employees with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these easy instructions.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the form's details.

- Check the form description to confirm you have selected the right document.

- If the form doesn't meet your needs, utilize the Search field at the top of the page to find one that does.

Form popularity

FAQ

Requesting a relocation package involves a few clear steps. First, review your employer's Iowa Memo on Company Relocation including Relocation Pay for Employees to understand what is offered. You should then prepare a detailed request addressed to your HR department, highlighting your specific needs and circumstances. Engaging directly with HR can help you navigate the available options more effectively.

To request a relocation allowance, you should first consult your company's Iowa Memo on Company Relocation including Relocation Pay for Employees. This memo will outline the procedures and requirements necessary for your request. Generally, you will need to submit a formal request to your HR department, including any relevant documentation to support your claim. Ensure to mention your relocation plans clearly to facilitate the process.

Writing a letter of relocation for an employee starts with a clear statement of the move and its purpose. Include key details such as the new location, the timeline, and any benefits associated with the relocation, such as relocation pay. You can refer to the Iowa Memo on Company Relocation including Relocation Pay for Employees to ensure you cover all necessary elements. Remember to be supportive and encourage open communication, so the employee feels valued during this transition.

To effectively use a relocation stipend, first, understand your budget and determine the necessary expenses for your move. This can include travel, moving services, temporary housing, and even utility setup. The Iowa Memo on Company Relocation including Relocation Pay for Employees may outline allowable expenses, so review that document closely. Finally, keep receipts and track your spending to ensure you're using the stipend efficiently and within the guidelines.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

How to write an employee relocation letterInform the employee.Determine the duration of the move.Discuss company coverage.Mention tax differences.Highlight potential bonuses.Reassure your employee.

More often than not, your employer will pay for all relocation expenses directly. This means you won't have to pay out of pocket for services like household goods relocation, foreign moving expenses, and international moving servicesbecause your employer will coordinate them with the moving company in advance.

An average relocation package costs between $21,327-$24,913 for a transferee who is a renter and $61,622-$79,429 for a transferee who is a homeowner. Of course, this number is just an average of what larger corporations are spending on employee relocation the relocation amount can be anywhere from $2,000 - $100,000.

Relocating an employee can be a costly endeavor for companies. The average relocation package costs between $21,327 and $24,913 for renters and between $61,622 and $79,429 for homeowners, according to a 2016 report by Worldwide ERC, a relocation services trade group.

Moving company and insurance coverage Another important component that can be included in a relocation package is a paid moving company to help transport your belongings and adequate insurance coverage to cover the cost of any of your personal items that may become damaged during the moving process.