Iowa Approval for Relocation Expenses and Allowances

Description

How to fill out Approval For Relocation Expenses And Allowances?

Have you ever been in a situation where you require documents for business or specific purposes almost every day.

There are numerous trustworthy document templates accessible online, but finding ones you can rely on is not straightforward.

US Legal Forms offers a vast array of form templates, including the Iowa Approval for Relocation Expenses and Allowances, crafted to meet federal and state standards.

Once you find the correct form, click on Get now.

Choose the payment plan you prefer, enter the required details to create your account, and pay for the order using your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Iowa Approval for Relocation Expenses and Allowances template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and make sure it corresponds to the correct city/state.

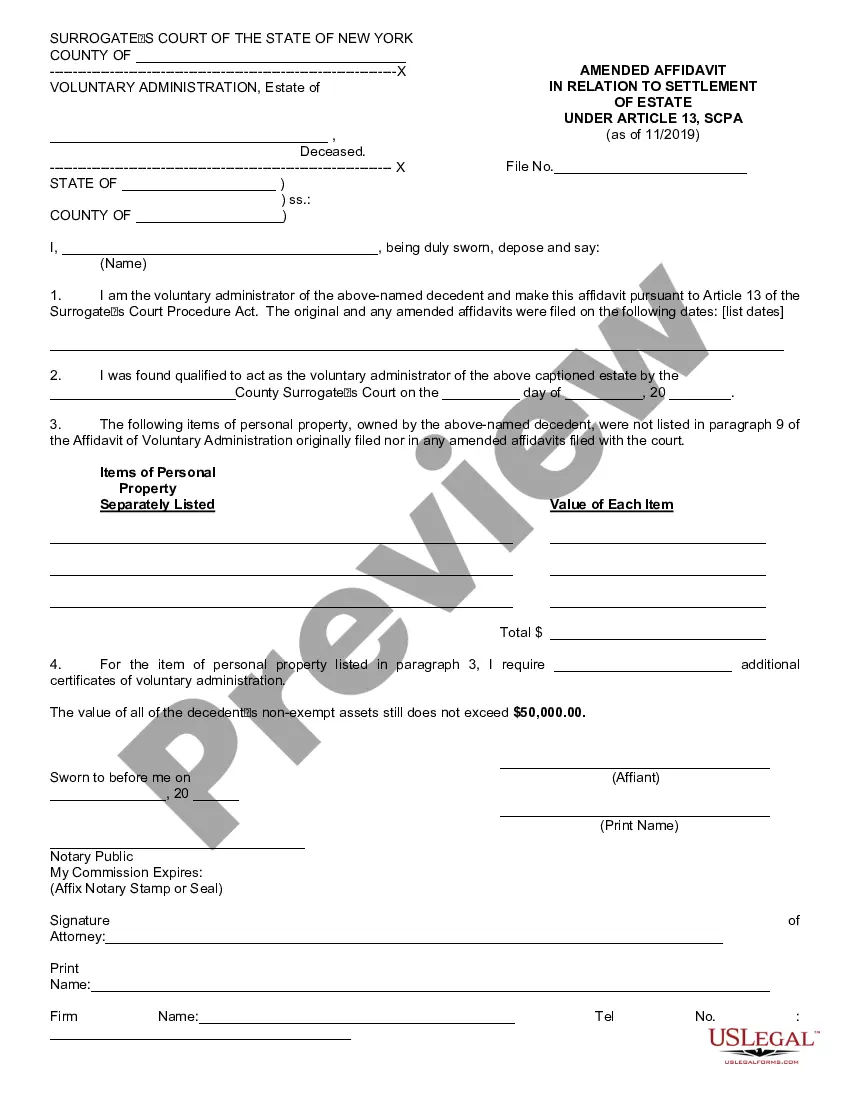

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the right form.

- If the form does not match what you are looking for, use the Search box to find the template that suits your needs and requirements.

Form popularity

FAQ

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

So you can claim the relocation allowance as exempt from tax to the extent of actual specified expenses incurred on your transfer. If the amount paid by the employer is more than the actual specified expenses incurred, the difference shall be taxable as salary income in your hands.

A generous relocation package covers all of your moving needs and expenses and gives you ample time in which to find or build a new home. Of course, the dollar amount of that varies by location because some areas are more expensive to live in and others can be relatively inexpensive to move to.

Relocation packages can range in worth from $2,000 to $100,000. What services and the amount of money you decide to cover is entirely up to you and your company. However, keep in mind that the more you are willing to give, the harder it may be for a candidate to refuse your offer when you negotiate moving expenses!

An average relocation package costs between $21,327-$24,913 for a transferee who is a renter and $61,622-$79,429 for a transferee who is a homeowner. Of course, this number is just an average of what larger corporations are spending on employee relocation the relocation amount can be anywhere from $2,000 - $100,000.

Put the limit in writing with an offer of relocation reimbursement. The offer details the amount of money you will refund, the types of expenses that qualify, and any other stipulations that you want set on the reimbursement. Make sure you and the job candidate both sign the relocation offer.

Debit "Relocation Benefits" or "Moving Expenses" for the same amount. For example, if you issue a $25,000 relocation benefit, credit the accrual account $25,000 and debit the expense account $25,000.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

To qualify, reimbursements or payments must be for work-related moving expenses that would have been deductible by the employee if the employee had directly paid them before Jan. 1, 2018.

Across the nation, the average lump sum that employees receive is $7200. 56 percent of companies offered lump sum relocation assistance for travel expenses. 44 percent said that lump sums were used to cover the entire cost of the relocation.