Iowa FLSA Exempt / Nonexempt Compliance Form

Description

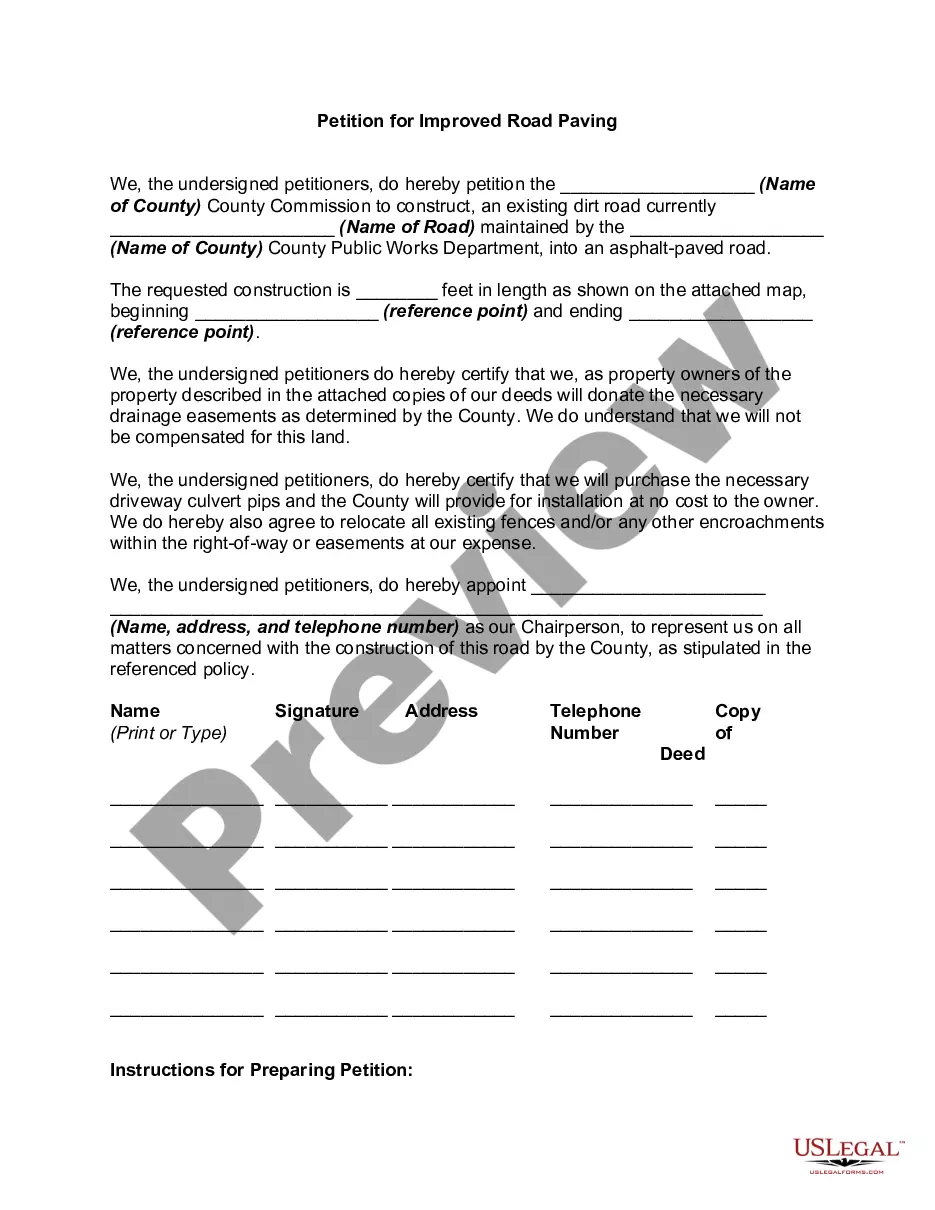

How to fill out FLSA Exempt / Nonexempt Compliance Form?

Finding the correct legal document template can be a challenge.

Clearly, there are numerous templates accessible online, but how do you get the legal form you need.

Utilize the US Legal Forms website. The service provides a vast selection of templates, including the Iowa FLSA Exempt / Nonexempt Compliance Form, for business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate document.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, sign in to your account and click on the Download button to access the Iowa FLSA Exempt / Nonexempt Compliance Form.

- Use your account to search among the legal forms you have previously acquired.

- Go to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines to follow.

- First, ensure you have selected the correct form for your area/county. You can browse the form using the Preview button and review the form description to make sure it is suitable for you.

Form popularity

FAQ

Changing an employee's status from exempt to non-exempt requires a thorough assessment of their job responsibilities. First, verify that the duties align with non-exempt classifications under the FLSA. After confirming this, update payroll practices and inform the employee of the changes. Utilizing the Iowa FLSA Exempt / Nonexempt Compliance Form can streamline this process and ensure compliance.

A. Iowa has no laws mandating breaks for adults. An employer does not have to pay you for a break during which you are completely relieved of your job duties. Your employer can require you to stay on the business premises during your break.

The Iowa Minimum Wage Law is similar to the FLSA's minimum wage provisions, but it applies to some additional employers. The Iowa minimum wage is currently the same as the federal minimum wage, but the amounts are adjusted separately and may not always be the same. Employers in Iowa must pay whichever rate is higher.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Exempt Salaried Employees To be exempt, an employee must be classified as an executive, administrator, professional, salesperson or computer employee. Exempt employees must exercise some independent judgment or decision making in their work and must be paid a minimum salary of $455 a week.

Iowa is similar to several other states in that it does not have specific state overtime laws but instead follows the overtime provisions of the federal Fair Labor Standards Act (FLSA). In other words, employees in Iowa are owed 1.5 times their regular pay rate for all time worked over 40 hours in a week.

Iowa's state code declares, "No person shall be deprived of the right to work at a chosen occupation because of membership, affiliation, withdrawal/expulsion, or refusal to join any labor union."

Iowa has no state law covering overtime, so the FLSA applies in most cases. Under the FLSA, a nonexempt employee must be paid time and a half (1.5 times their regular rate) for every hour worked in excess of 40 hours in a work week.

Many instructors on the college level allow their students to exempt (which means 'not take') the final exam if they have an A average going into the final exam. Many students have trouble finding the information they need on their final assignments in order to be exempted from the final exam.

The FLSA exemption test refers to the status of a job as outlined in the Fair Labor Standards Act. The FLSA determines whether a job is exempt or nonexempt as it relates to overtime obligations.