Iowa Alternative Method

Description

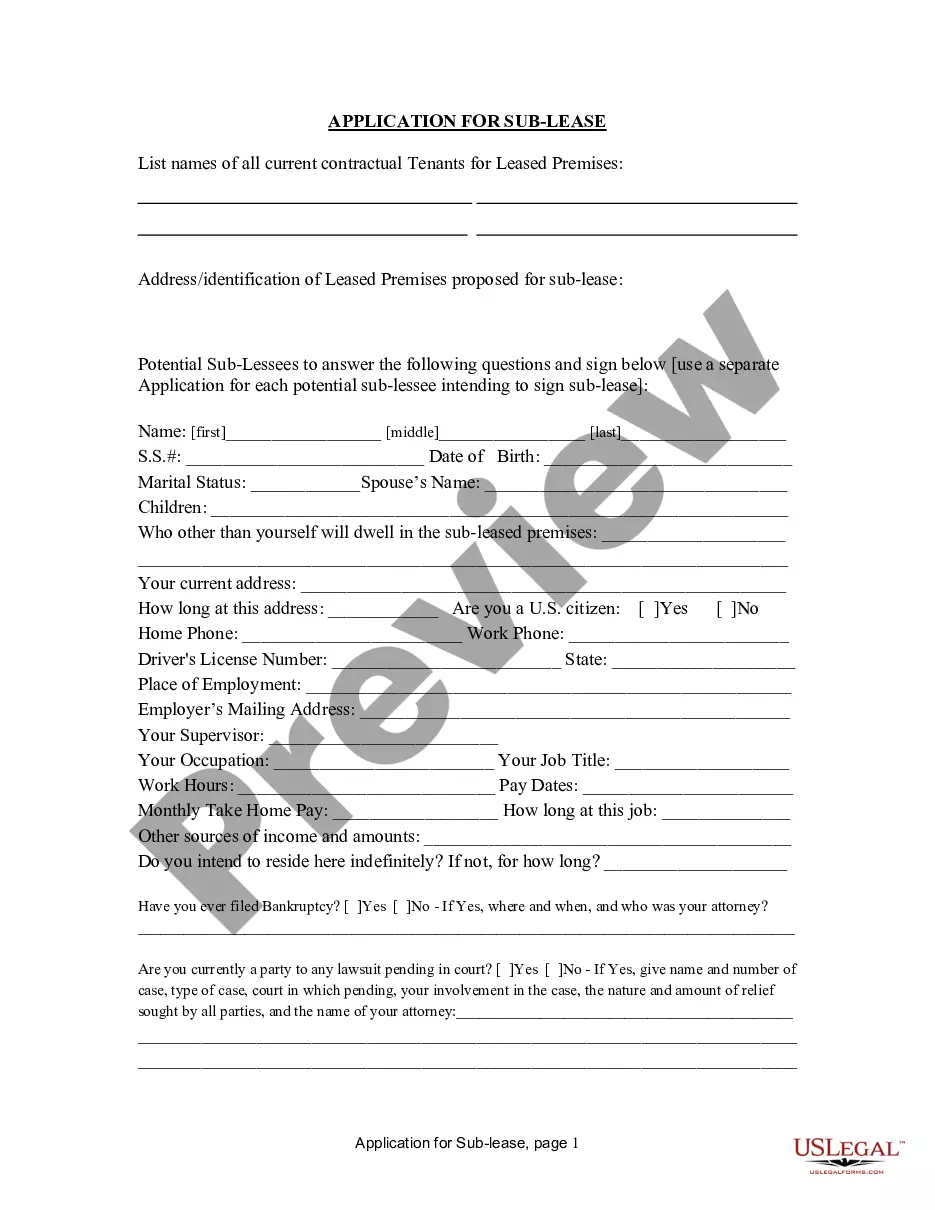

How to fill out Alternative Method?

You can allocate numerous hours online trying to locate the valid document template that meets the federal and state standards you require.

US Legal Forms offers an extensive array of legitimate forms that can be examined by specialists.

It is feasible to download or print the Iowa Alternative Method from the service.

To obtain another version of your form, use the Search field to find the template that suits your needs and specifications.

- If you already possess a US Legal Forms account, you may sign in and click on the Download button.

- Subsequently, you may complete, modify, print, or endorse the Iowa Alternative Method.

- Each legitimate document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, adhere to the straightforward instructions below.

- Initially, ensure that you have selected the correct document template for the area/city of your choice.

- Examine the form description to verify that you have chosen the suitable form.

Form popularity

FAQ

Individual Income Tax Standard Deductions$2,210 for single taxpayers. $2,210 for married taxpayers filing separately. $5,450 for married taxpayers filing jointly.

Standard Deduction$12,550 for single filers. $12,550 for married couples filing separately. $18,800 for heads of households. $25,100 for married couples filing jointly.

Alternative motor vehicle deduction of $2,000 for taxpayers who are eligible for the federal Alternative Motor Vehicle Credit under Internal Revenue Code section 30B and who complete federal form 8910.

Vehicle Registration Fee Deduction and Worksheet. If you itemize deductions, a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2019 may be deducted as personal property tax on your Iowa Schedule A, line 6, and federal form 1040, Schedule A, line 5c.

Long-term gains (e.g., profits from selling a home or other investments) are taxed at the same rate under both systems, but capital gains could put you over the AMT exemption threshold. That could cause the AMT to kick in, which means you may not be able to deduct state income taxes you paid. Exercising stock options.

The Iowa Alternate Tax Computation may benefit some married taxpayers by reducing the amount of tax they owe. If your net income and that of your spouse combined is greater than $13,500, you may owe less Iowa tax by using the Alternate Tax Computation.

Nonresidents and Part-Year Residents: If you have Iowa-source tax preferences or adjustments, you may be subject to Iowa alternative minimum tax. See form IA 6251. Married Separate Filers (including status 4): Each spouse that had tax preference items and adjustments must complete their own IA 6251.

In 2019, the AMT impacted just 0.1 percent of households overall. This includes 0.2 percent of households with income between $200,000 and $500,000, 1.8 percent of those with incomes between $500,000 and $1 million, and 12.5 percent of households with incomes greater than $1 million (table 1).

Adjustments to Income include such items as Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account. Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower.

Alternative Minimum Tax Credit Claims On average, 39 percent of Iowa AMT liability is paid with the corporation income tax and 61 percent is paid with the individual income tax. An AMT is also assessed against banks subject to the Iowa franchise tax.