Iowa Job Description Format IV

Description

How to fill out Job Description Format IV?

If you want to be thorough, acquire, or print official documentation templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and individual purposes are organized by category and location, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Iowa Job Description Format IV. Every legal document template you obtain is yours indefinitely. You have access to all templates downloaded in your account. Click on the My documents section to choose a form to print or download again. Finalize and retrieve the Iowa Job Description Format IV with US Legal Forms. Thousands of professional and state-specific forms are available for your business or personal requirements.

- Utilize US Legal Forms to locate the Iowa Job Description Format IV in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Iowa Job Description Format IV.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

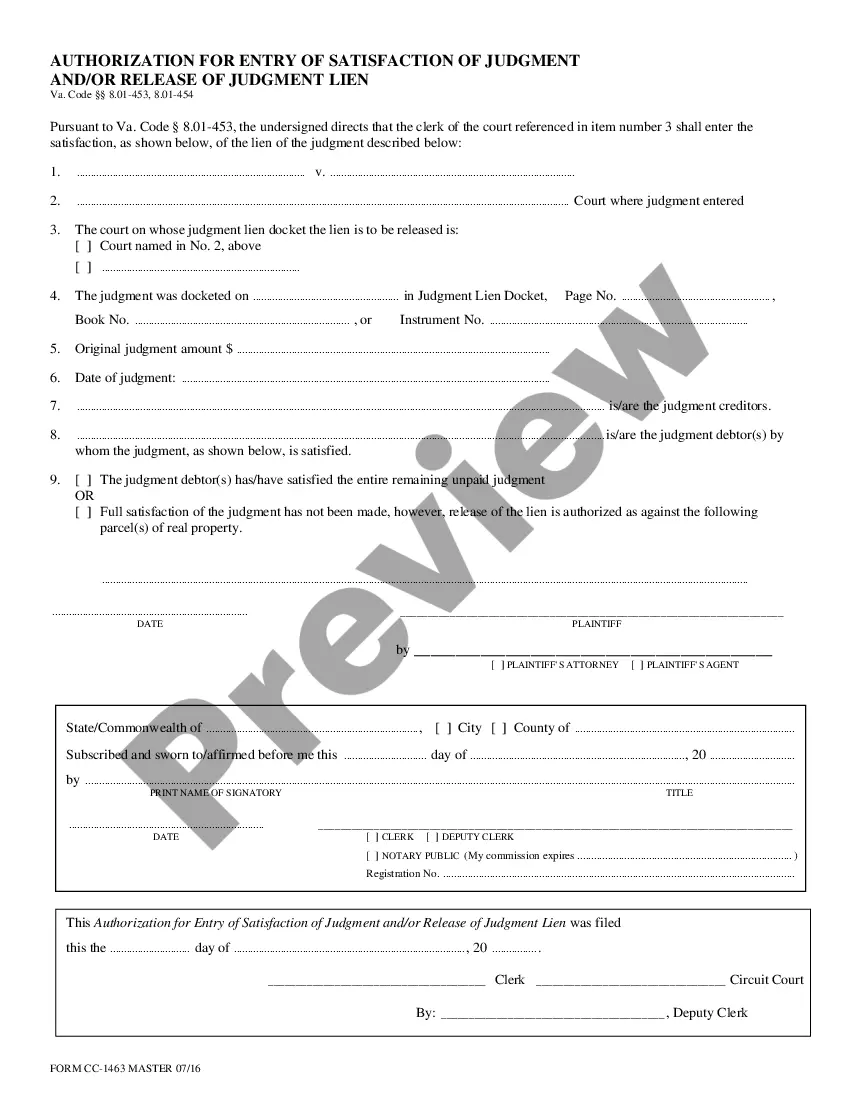

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the template, utilize the Search field at the top of the screen to find other templates in the legal form category.

- Step 4. Once you’ve found the necessary form, click on the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

You'll most likely get a tax refund if you claim no allowances or 1 allowance. If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

Claiming two allowances You are single. Claiming two allowances will get you close to your tax liability but may result in tax due when filing your taxes. You're single and work more than one job. Claim one allowance at each job or two allowances at one job and zero at the other.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

The best format depends entirely on the nature of the job posting itself, but in general, a good job description starts with the job title, a quick description, and then moves on to expected experience/qualifications, required software tools, and daily responsibilities.

FAQs:Use an accurate job title.Write a brief summary paragraph that provides an overview of the job.Define what success looks like in the position after 30 days, the first quarter, and the first year.Write only the job responsibilities that are necessary for this job, not every job.List essential qualifications.More items...

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Personal Allowances: You can claim the following personal allowances: 2022 1 allowance for yourself or 2 allowances if you are unmarried and eligible to claim head of household status, plus 1 allowance if you are 65 or older, and plus 1 allowance if you are blind.

A job description contains the following components: job title, job purpose, job duties and responsibilities, required qualifications, preferred qualifications and working conditions.

How to write your own job descriptionDecide what you want to do.Determine the need for a new position.Create a job title.Describe how the job supports the company's mission.Write a job description.List job duties.List your qualifications and competencies.Present the job to your employer.More items...?