Washington Letter to Debt Collector - Only Contact Me In Writing

Description

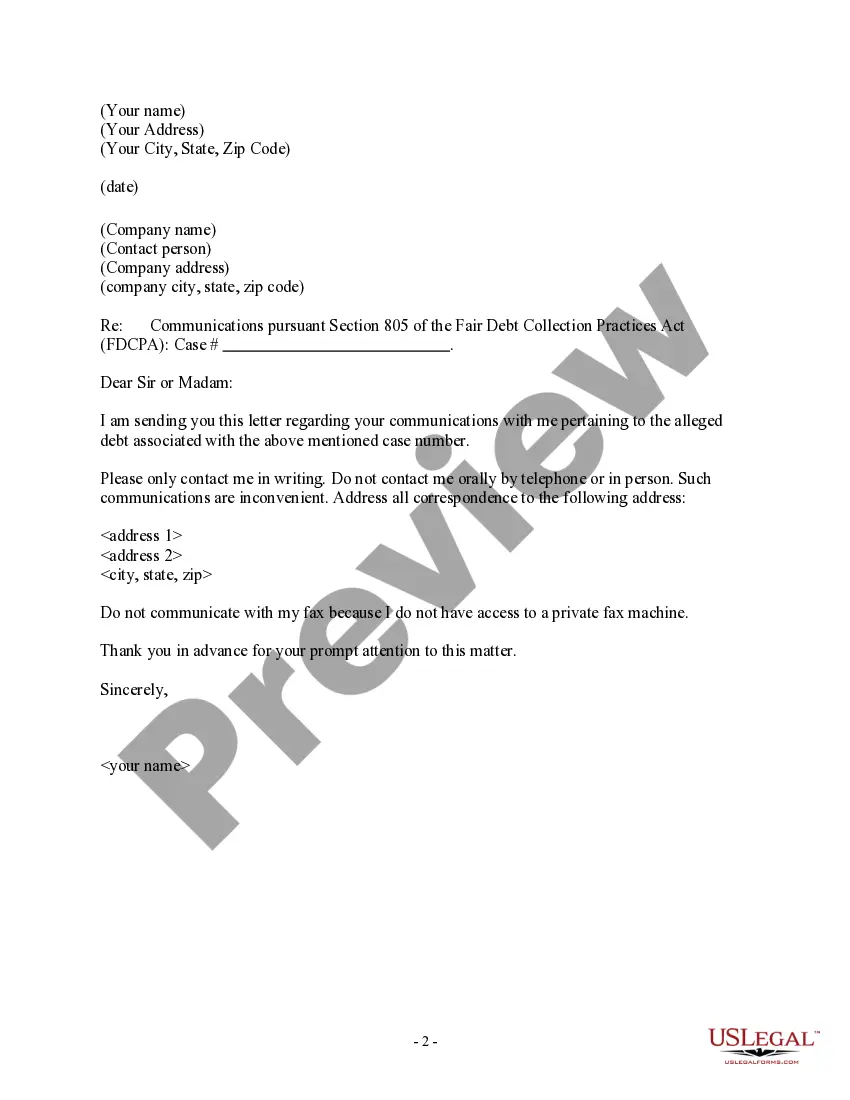

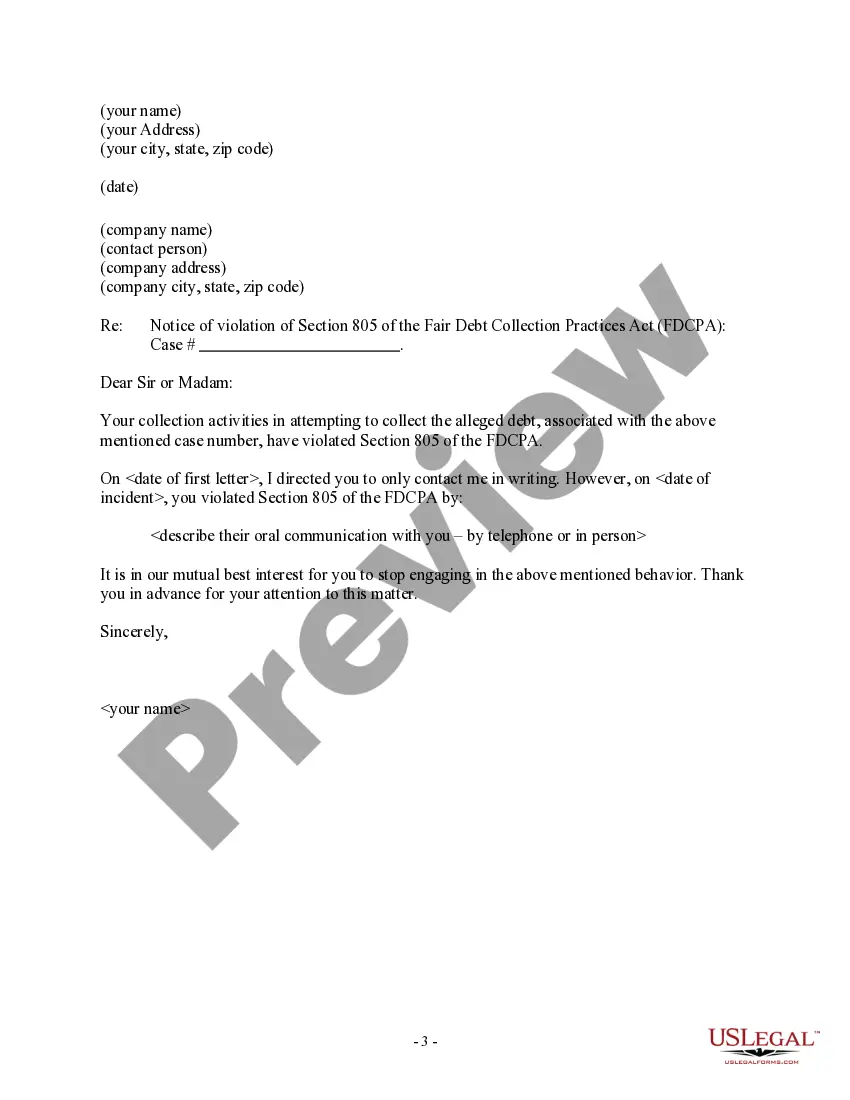

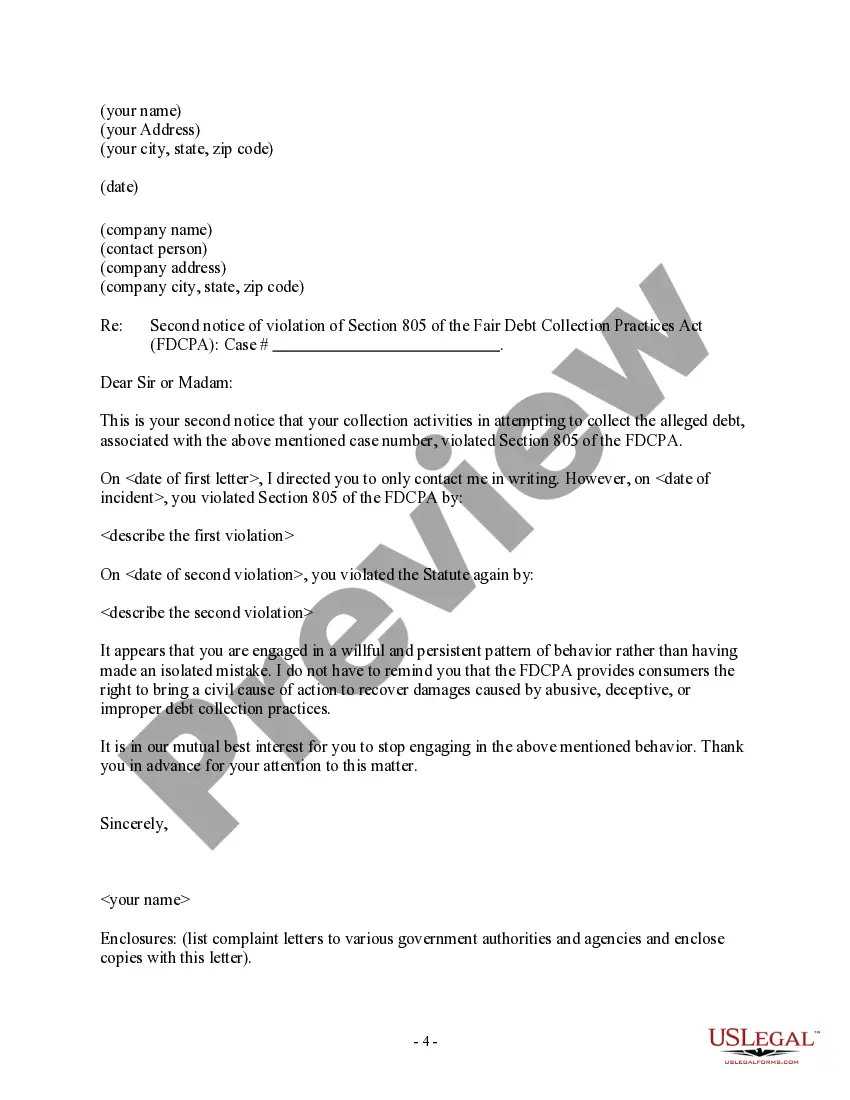

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

US Legal Forms - one of the largest collections of legal documents in the country - provides a variety of legal templates that you can download or print.

By using the website, you can access thousands of forms for professional and personal purposes, categorized by types, states, or keywords.

You can quickly find the latest versions of forms such as the Washington Letter to Debt Collector - Only Contact Me In Writing.

Check the form description to confirm that you've chosen the right form.

If the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- If you already have a subscription, Log In to obtain the Washington Letter to Debt Collector - Only Contact Me In Writing from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the right form for your area/state.

- Review the form's content using the Preview option.

Form popularity

FAQ

In Washington, the statute of limitations on debt collection lawsuits is six years after the date of default or last payment on the debt account. Once a debt is past the statute of limitations, debt collectors can still attempt to collect on these debts, but they cannot file a collection lawsuit.

In Washington, the statute of limitations on debt collection lawsuits is six years after the date of default or last payment on the debt account. Once a debt is past the statute of limitations, debt collectors can still attempt to collect on these debts, but they cannot file a collection lawsuit.

Debt collection agencies may take you to court on behalf of a creditor if they have been unable to contact you in their attempts to recover a debt. Before being threatened by court action, the debt collection agency must have first sent you a warning letter.

What are debt collectors not allowed to do?Contact you at your workplace or via social media.Give you incorrect or misleading information.Contact you outside the hours of 8am-9pm on working days or at all on weekends and holidays.Tell other people such as family about your debt situation.More items...

You have the right not to be contacted at work, and some local and state laws make it illegal for creditors to contact your place of employment if they have reason to know those calls are forbidden.

How much interest can collection agencies charge? Collection agencies can collect 12% interest annually on debts.

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Try not to let all of the calls badgering you from a debt collector get to you. If you need to take a break, you can use this 11 word phrase to stop debt collectors: Please cease and desist all calls and contact with me, immediately. Here is what you should do if you are being contacted by a debt collector.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been