South Carolina Key Employee Stock Option Award Agreement

Description

How to fill out Key Employee Stock Option Award Agreement?

Choosing the right legal document web template can be a have a problem. Needless to say, there are a lot of themes available on the net, but how will you obtain the legal kind you need? Make use of the US Legal Forms site. The support gives 1000s of themes, such as the South Carolina Key Employee Stock Option Award Agreement, that can be used for business and private requirements. All of the types are checked by experts and satisfy federal and state specifications.

Should you be currently registered, log in in your account and click the Obtain key to have the South Carolina Key Employee Stock Option Award Agreement. Make use of account to look throughout the legal types you possess acquired earlier. Visit the My Forms tab of your own account and acquire another version of the document you need.

Should you be a brand new user of US Legal Forms, listed here are straightforward instructions for you to follow:

- Initial, be sure you have chosen the proper kind to your town/area. It is possible to examine the form making use of the Preview key and study the form outline to make sure this is the right one for you.

- When the kind is not going to satisfy your requirements, use the Seach discipline to get the correct kind.

- When you are certain that the form is suitable, go through the Purchase now key to have the kind.

- Choose the prices strategy you need and type in the essential info. Build your account and buy the transaction utilizing your PayPal account or bank card.

- Opt for the data file formatting and download the legal document web template in your gadget.

- Full, revise and print and indicator the obtained South Carolina Key Employee Stock Option Award Agreement.

US Legal Forms may be the greatest collection of legal types in which you can see numerous document themes. Make use of the company to download professionally-produced documents that follow status specifications.

Form popularity

FAQ

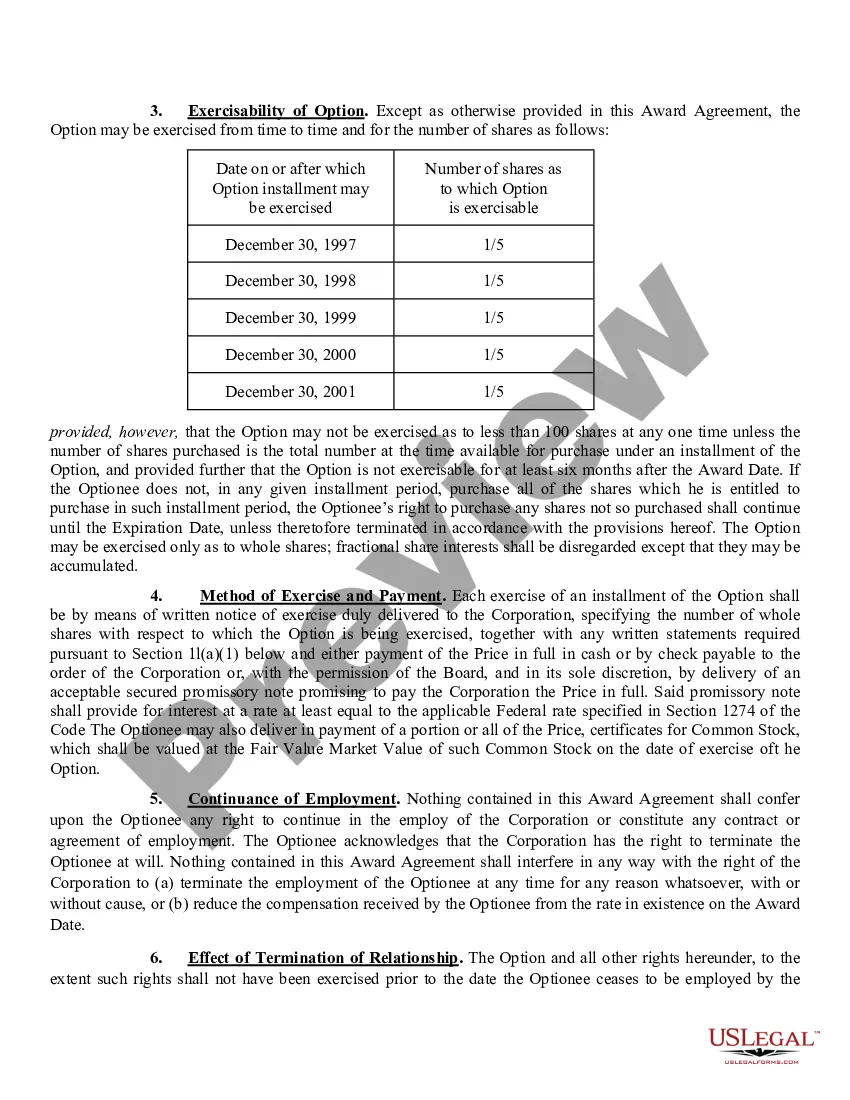

These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

Weighing your options Ultimately, it's best to remember that stock options are just that: Options. They don't compel anyone to do anything, but they can, in some cases, prove extremely valuable and help significantly increase an employee's wealth. If they're fortunate enough to be at a strong, growing company, that is.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

A stock option is a contract between two parties that gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified time period. A seller of the stock option is called an option writer, where the seller is paid a premium from the contract purchased by the buyer.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

Incentive stock options (ISOs), also known as statutory or qualified options, are generally only offered to key employees and top management. They receive preferential tax treatment in many cases, as the IRS treats gains on such options as long-term capital gains.

Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase. Your strike price.

What is a Stock Option Agreement? A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.