Iowa Living Trust with Provisions for Disability

Description

How to fill out Living Trust With Provisions For Disability?

Are you presently in a situation where you need documents for either business or personal activities almost every day.

There are numerous legal document templates accessible online, but locating reliable ones is not straightforward.

US Legal Forms offers a vast selection of form templates, such as the Iowa Living Trust with Provisions for Disability, which are designed to comply with federal and state requirements.

Choose a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents menu. You can obtain another copy of the Iowa Living Trust with Provisions for Disability whenever needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Iowa Living Trust with Provisions for Disability template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

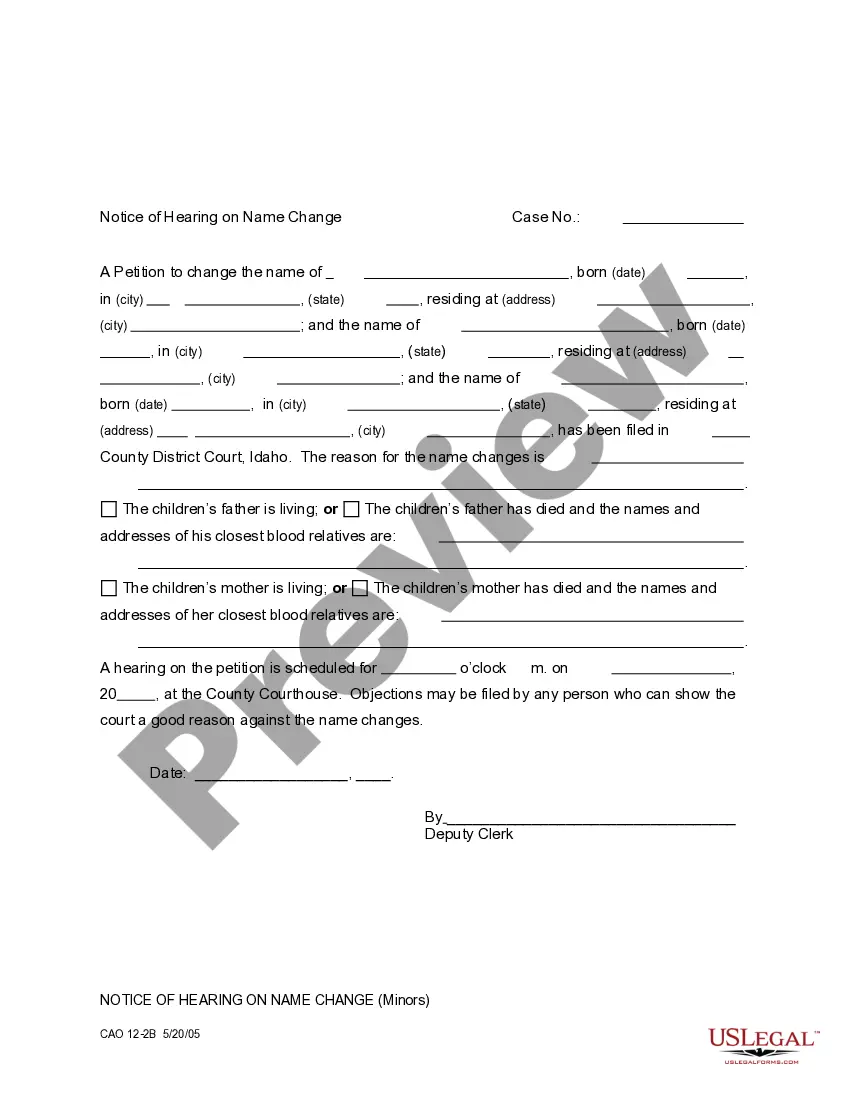

- Use the Preview button to examine the document.

- Read the description to verify that you have selected the correct form.

- If the form does not meet your needs, utilize the Search field to find the form that fits your requirements.

- Once you find the appropriate form, simply click Buy now.

- Select the payment plan you wish, provide the necessary information to create your account, and complete your purchase using PayPal or a Visa or MasterCard.

Form popularity

FAQ

All these elements are important to address and start preparing the trust.Estimate the Funds Required For Special Needs Care. One of the major considerations while setting up a trust us to identify the fund's trust will require.Preparing the Trust Deed.Registering the Trust Deed.

The first $20 of income received each month is not counted. In addition, with respect to earned income, the first $65 each month is not counted, and one-half of the earnings over $65 in any given month is not counted.

SSDI is not a needs-based benefit. If you are on that program for two years, you will also qualify for Medicare. Because SSDI is not needs-based, a special needs trust is not necessary to qualify for it.

The SSDI program does not limit the amount of cash, assets, or resources an applicant owns. An SSDI applicant can own two houses, five cars, and have $1,000,000 in the bank. And the SSDI program doesn't have a limit to the amount of unearned income someone can bring in; for instance, dividends from investments.

A Trust can protect a disabled person who could otherwise be vulnerable to financial abuse or exploitation from others. The Trust offers a means of managing money or other assets for a disabled person, which is invaluable if they are unable to do this themselves.

Requirements for a Special Needs TrustThe trust must be irrevocable.established for the beneficiary by the beneficiary, a parent, grandparent, legal guardian, or a court.created with the assets of a disabled person who is under 65.the State of Iowa must be the residual beneficiary of the trust.

HOW DOES MONEY FROM A TRUST THAT IS NOT MY RESOURCE AFFECT MY SSI BENEFITS? Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.

So the special-needs trust is a type of trust that is used to provide assets and resources to take care of a person with a disability, while the living trust is a will substitute that I might use in place of having a will for my estate plan.

The money simply replaces state-funding benefits and services until their fund drops below the excluded capital level, when they go back on to means-tested benefits. A Vulnerable Beneficiary Trust or Disabled Person's Trust can be a way of ringfencing the windfall so that means-tested benefits are not affected.

Unlike SSI, there are no income or asset limits for SSDI eligibility. Instead, to qualify for SSDI, enrollees must have a sufficient work history (generally, 40 quarters) and meet the strict federal disability rules. SSA uses the same rules to determine disability for both the SSI and the SSDI programs.