Iowa Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Are you presently in a situation where you require documents for both business or personal motivations nearly daily.

There are numerous lawful document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, including the Iowa Revocable Trust for Asset Protection, designed to comply with state and federal regulations.

Once you find the right form, click Get now.

Choose the pricing plan you prefer, enter your required information to process your payment, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Iowa Revocable Trust for Asset Protection template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Search for the form you need and ensure it is for the appropriate city/state.

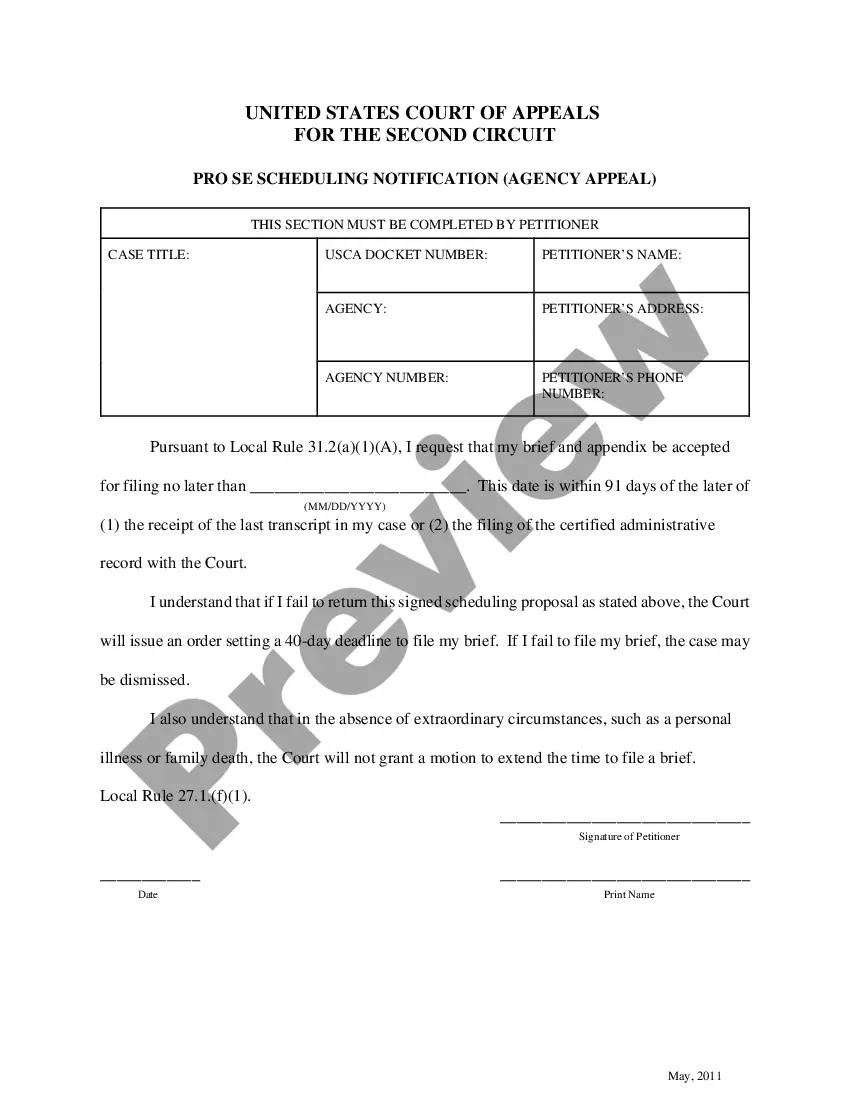

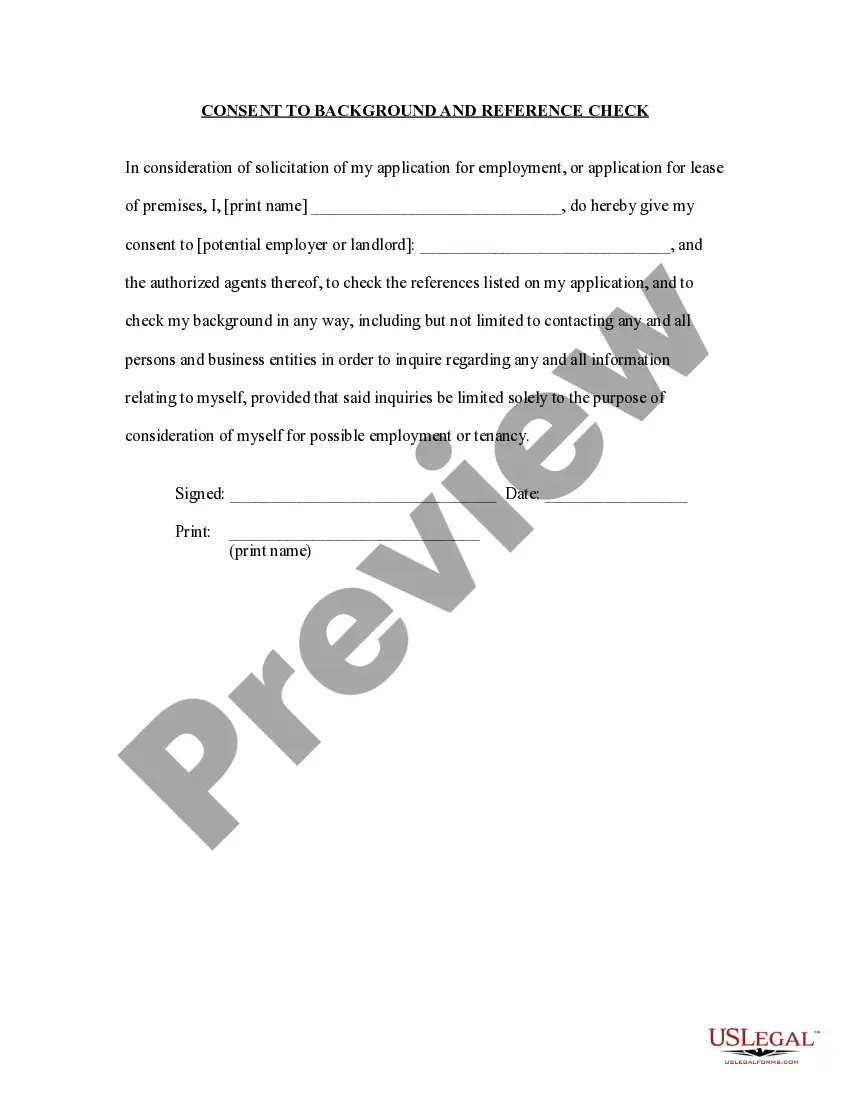

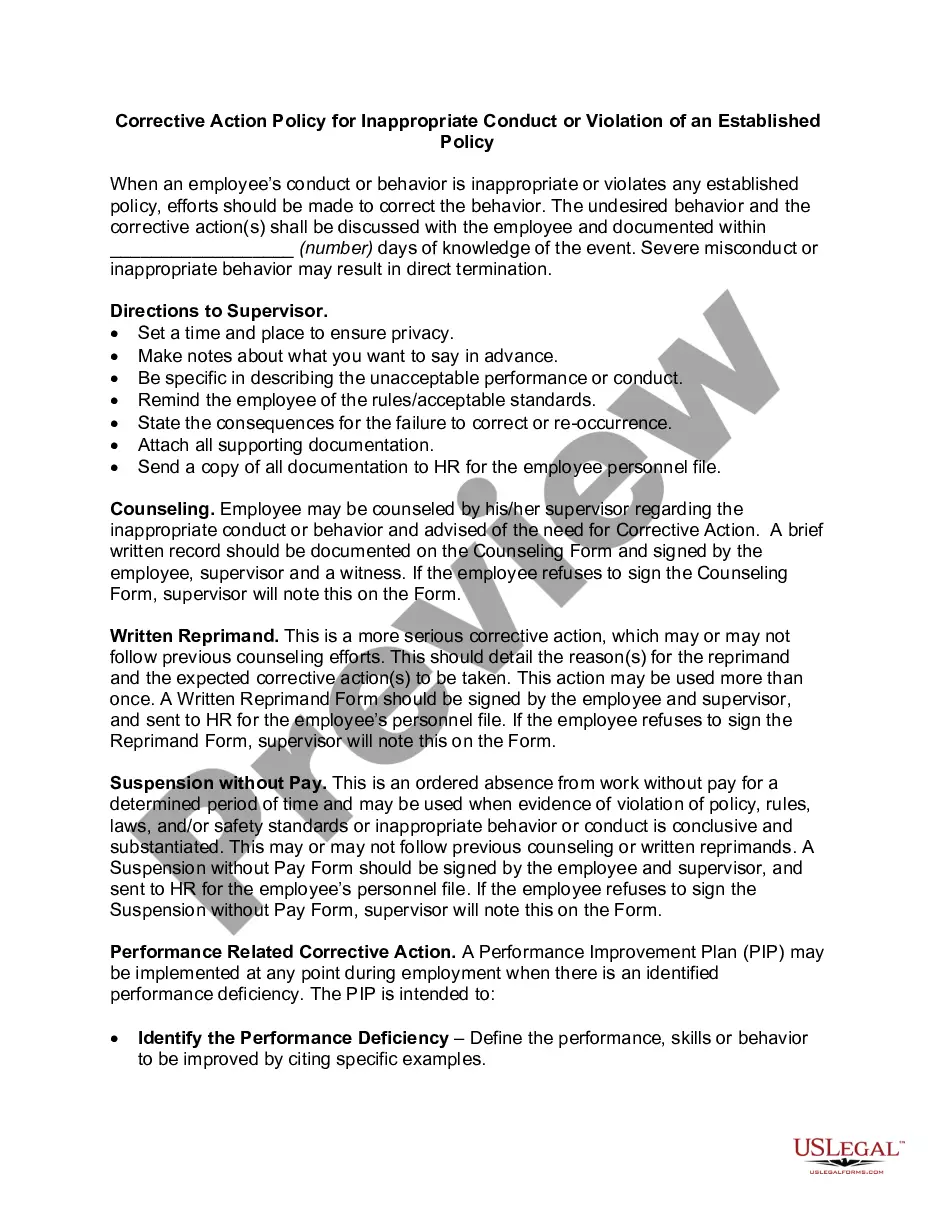

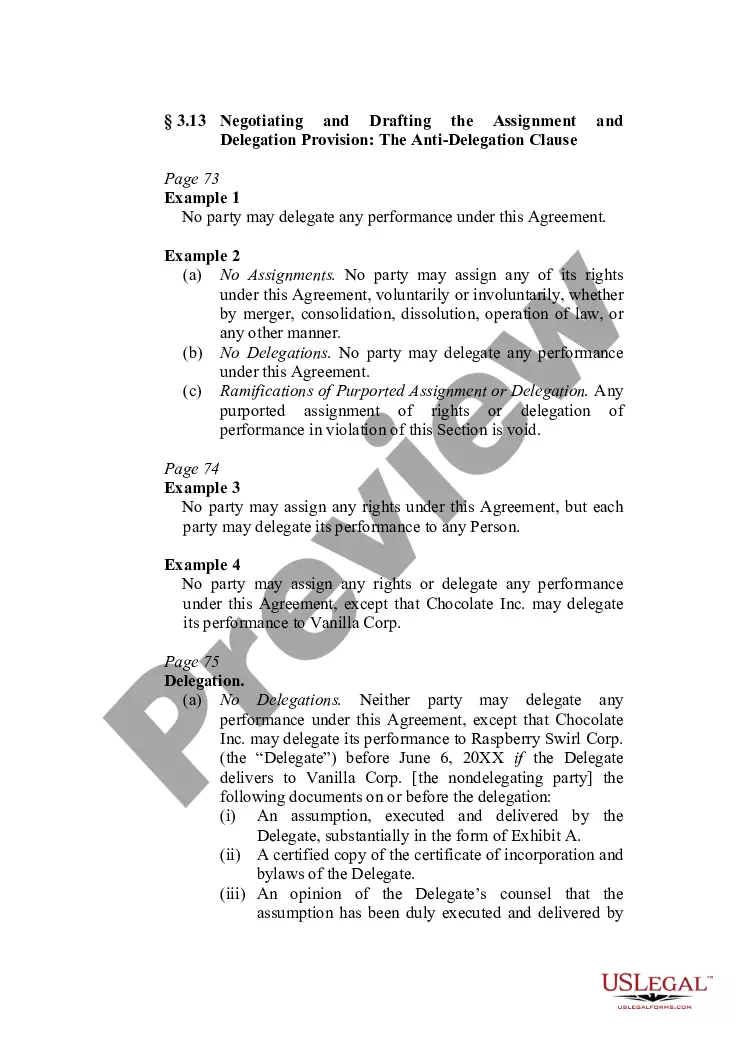

- Utilize the Review button to examine the form.

- Review the details to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Lookup area to find a form that matches your requirements.

Form popularity

FAQ

The main downfall of having a trust is the possibility of losing control over certain assets once they are placed in the trust. For example, with an irrevocable trust, the grantor cannot alter the terms or reclaim the assets. However, an Iowa Revocable Trust for Asset Protection allows for more flexibility and can still provide significant benefits without so much limitation.

The requirements for an asset protection trust can vary based on state laws and individual circumstances. Generally, you will need to identify your assets, appoint a trustee, and outline the terms of the trust. For an effective Iowa Revocable Trust for Asset Protection, working with a qualified attorney ensures all requirements are met and tailored to your needs.

Writing an asset protection trust involves drafting a trust document that clearly outlines the terms, beneficiaries, and assets involved. It's essential to seek legal guidance to ensure compliance with state laws, especially since the requirements for an Iowa Revocable Trust for Asset Protection can vary. Proper drafting safeguards the trust's effectiveness and aligns it with your asset protection goals.

It may benefit your parents to place their assets in a trust, especially if they want to manage how those assets are distributed after their passing. An Iowa Revocable Trust for Asset Protection can help protect their assets from potential creditors and ensure a smoother transition for heirs. Consulting with a legal expert can help clarify the advantages specific to their situation.

The best trust structure for asset protection often includes an irrevocable trust rather than a revocable one. An irrevocable trust generally removes assets from your estate, providing better protection against creditors. However, an Iowa Revocable Trust for Asset Protection can also be a strong option if structured properly, offering flexibility while still shielding your assets.

To set up a protective trust, start by consulting with an attorney who specializes in estate planning. They can help you understand how an Iowa Revocable Trust for Asset Protection can safeguard your assets. Once you have a plan, you will need to draft the trust document, fund the trust with your assets, and follow legal procedures to ensure it is valid.

One disadvantage of a family trust is the potential for increased complexity in managing assets. While family trusts can offer great benefits, they require careful administration and can create confusion among family members. Additionally, misunderstandings may arise regarding the distribution of assets, which can lead to conflict.

Asset protection trusts, including the Iowa Revocable Trust for Asset Protection, can be a valuable tool in your financial planning. They offer flexibility and control over your assets while providing a shield against potential claims from creditors. However, the effectiveness of such trusts can vary based on individual situations. Therefore, reviewing your goals and circumstances with a legal professional can ensure that you implement the best strategy for protecting your assets.

While a revocable trust can help manage your assets during your lifetime, it does not provide absolute protection against creditors. However, an Iowa Revocable Trust for Asset Protection can be structured to offer some level of privacy and facilitate asset distribution without going through probate. To enhance asset protection, consider integrating other strategies such as insurance or irrevocable trusts. It's best to seek guidance to tailor the trust to your specific circumstances.

A common mistake parents make when establishing a trust fund is failing to communicate their intentions to their children. It's essential to ensure that beneficiaries understand the terms and purpose of the Iowa Revocable Trust for Asset Protection. This clarity can prevent misunderstandings and conflicts in the future. Additionally, not regularly reviewing the trust’s provisions can lead to outdated strategies that no longer meet your family's needs.