Iowa Revocable Trust for Estate Planning

Description

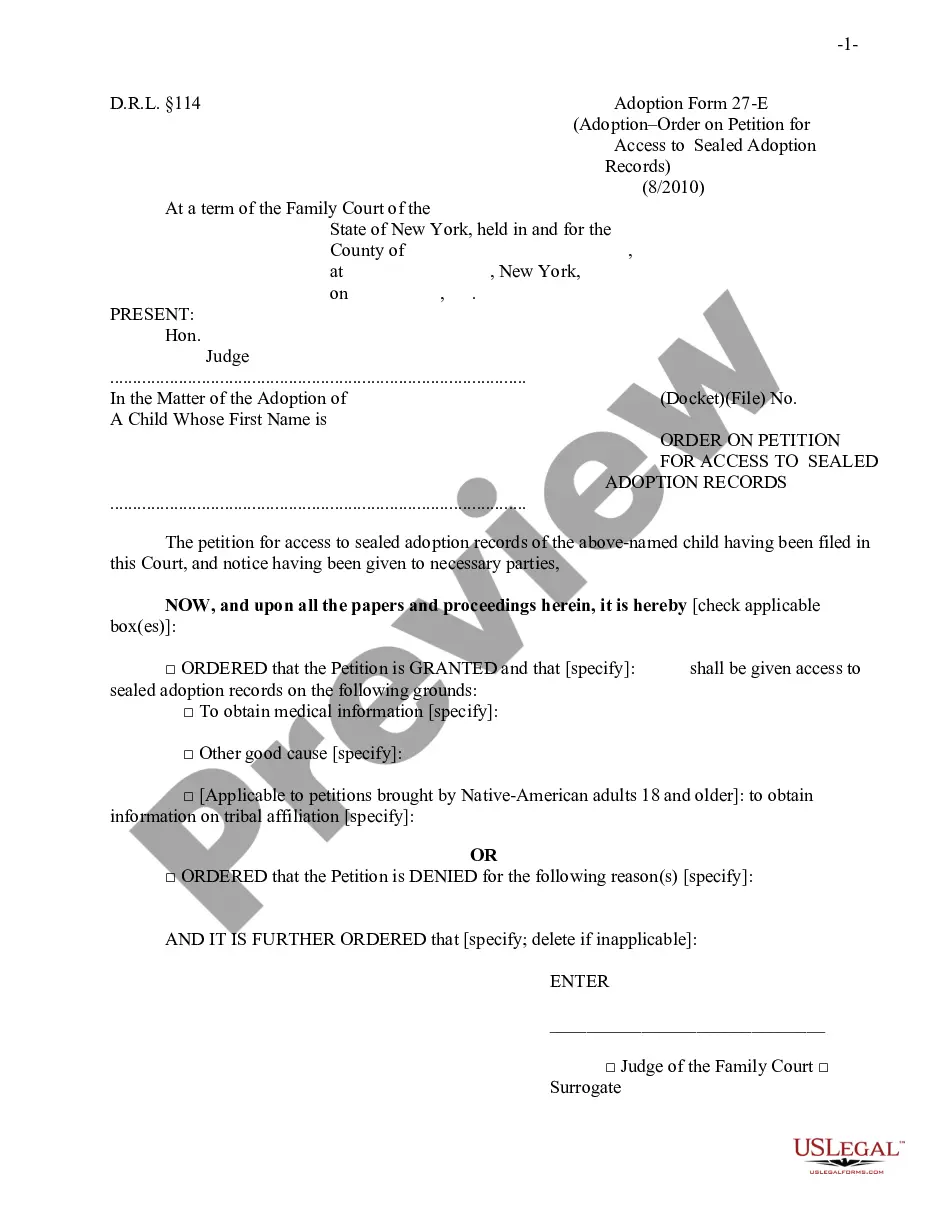

How to fill out Revocable Trust For Estate Planning?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by type, state, or keywords.

You can find the latest versions of forms such as the Iowa Revocable Trust for Estate Planning in just a few minutes.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose your preferred payment plan and provide your details to register for an account.

- If you hold a membership, Log In and download the Iowa Revocable Trust for Estate Planning from the US Legal Forms collection.

- The Download button will appear on every document you view.

- You can find all previously downloaded forms under the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are simple steps to begin.

- Make sure you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

In Iowa, a trust does not need to be notarized to be valid. However, having it notarized can provide an additional layer of security and may be helpful in verifying its contents. As you consider your options for estate planning, an Iowa Revocable Trust for Estate Planning is a beneficial choice that allows for changes over time. Ensuring proper documentation can simplify future processes for your heirs.

The primary difference between a will and a trust in Iowa lies in their functions and timelines. A will goes into effect after your death, while an Iowa Revocable Trust for Estate Planning takes effect as soon as you create it, allowing for immediate management of your assets. Trusts also generally avoid the probate process, providing a more efficient distribution of your estate. Understanding this distinction can help you choose the right planning tool for your needs.

Iowa has specific laws regulating trusts, designed to protect both the grantor and the beneficiaries. Trusts must be created in writing, and an Iowa Revocable Trust for Estate Planning allows for flexibility since you can alter or revoke it during your lifetime. Understanding these laws helps ensure that your estate is managed according to your wishes. It's advisable to consult with a legal expert to navigate these laws effectively.

In Iowa, a will does not require notarization to be valid. However, having a notary can help verify its authenticity, especially if you encounter disputes later. An Iowa Revocable Trust for Estate Planning offers a way to manage your assets without the complexities of a will. By including a revocable trust, you can streamline the estate planning process.

To set up a trust account for an estate, you typically need to begin with a formal trust agreement outlining the terms. An Iowa Revocable Trust for Estate Planning allows the trustee to manage the assets for the beneficiaries efficiently. You will need to provide necessary documentation, including the trust agreement and identification, to the financial institution. Seeking guidance from a legal expert can help navigate this process smoothly.

To create a revocable living trust in Iowa, start by drafting the trust document, outlining its terms and naming the beneficiaries. The Iowa Revocable Trust for Estate Planning can be customized to fit your financial situation and family needs. You will need to fund the trust by transferring assets into it, ensuring it is properly executed in accordance with state laws. Utilizing services like US Legal Forms can simplify this process.

Yes, a revocable trust generally becomes irrevocable upon the death of the grantor. After that point, the terms of the Iowa Revocable Trust for Estate Planning cannot be altered. This change ensures that your wishes are honored and that the trust is administered according to your original intentions. It's crucial to have a well-drafted trust to avoid complications for your beneficiaries.

The downside of a revocable trust is that it does not provide creditor protection or tax benefits during your lifetime. While an Iowa Revocable Trust for Estate Planning facilitates asset management and distribution, it does not shield your assets from potential claims by creditors. Additionally, you may incur fees for establishing and maintaining the trust, which is something to consider in your overall estate planning strategy.

One of the biggest mistakes parents make when setting up a trust fund is not clearly specifying the terms and conditions. This can lead to confusion about how funds should be distributed, especially with an Iowa Revocable Trust for Estate Planning. It's essential to communicate your intentions clearly and include specific guidelines on how and when beneficiaries can access the funds. Working with a legal professional can help clarify these details.

The greatest advantage of a revocable trust lies in its flexibility. With an Iowa Revocable Trust for Estate Planning, you can modify or revoke the trust at any time during your lifetime. This adaptability means you can respond to changes in your financial situation or family dynamics. Additionally, it provides privacy and helps your estate avoid probate, simplifying the transfer of assets.