Iowa Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

Locating the appropriate sanctioned document template can be a challenge.

Clearly, there are numerous designs accessible on the internet, but how can you discover the sanctioned format you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Iowa Receipt and Withdrawal from Partnership, which you can utilize for business and personal requirements.

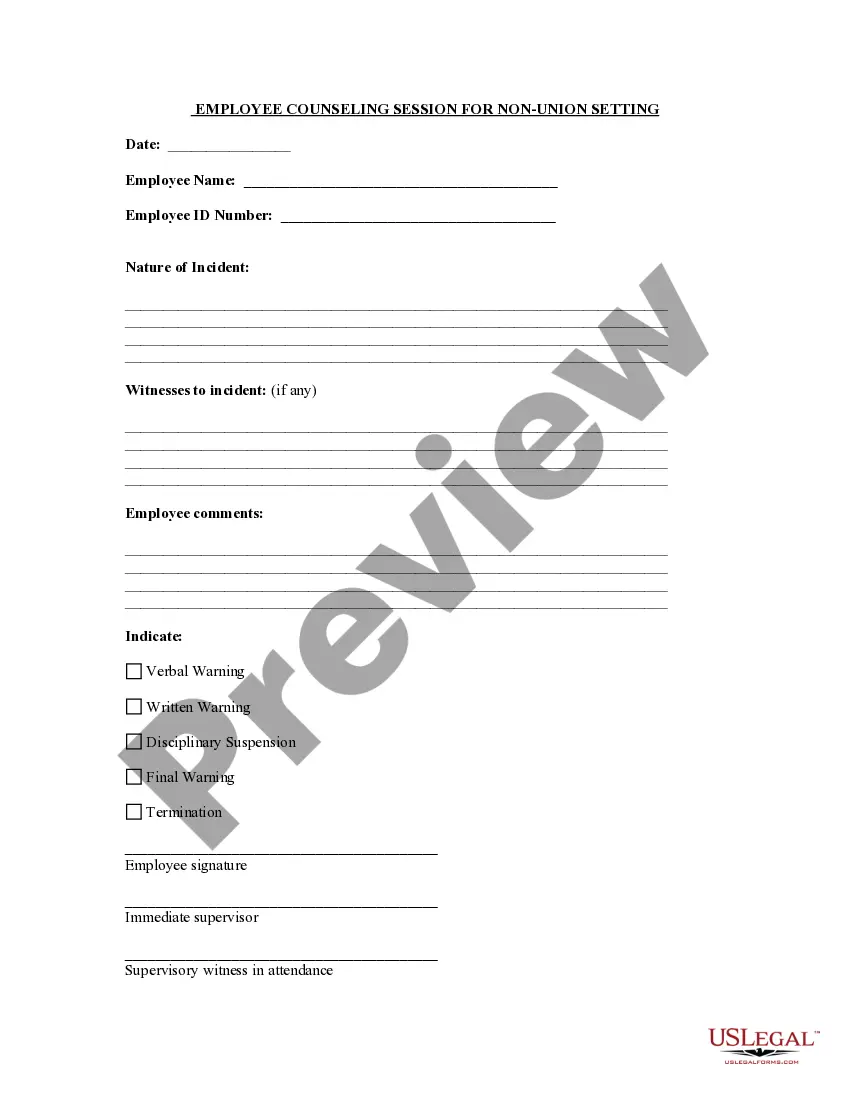

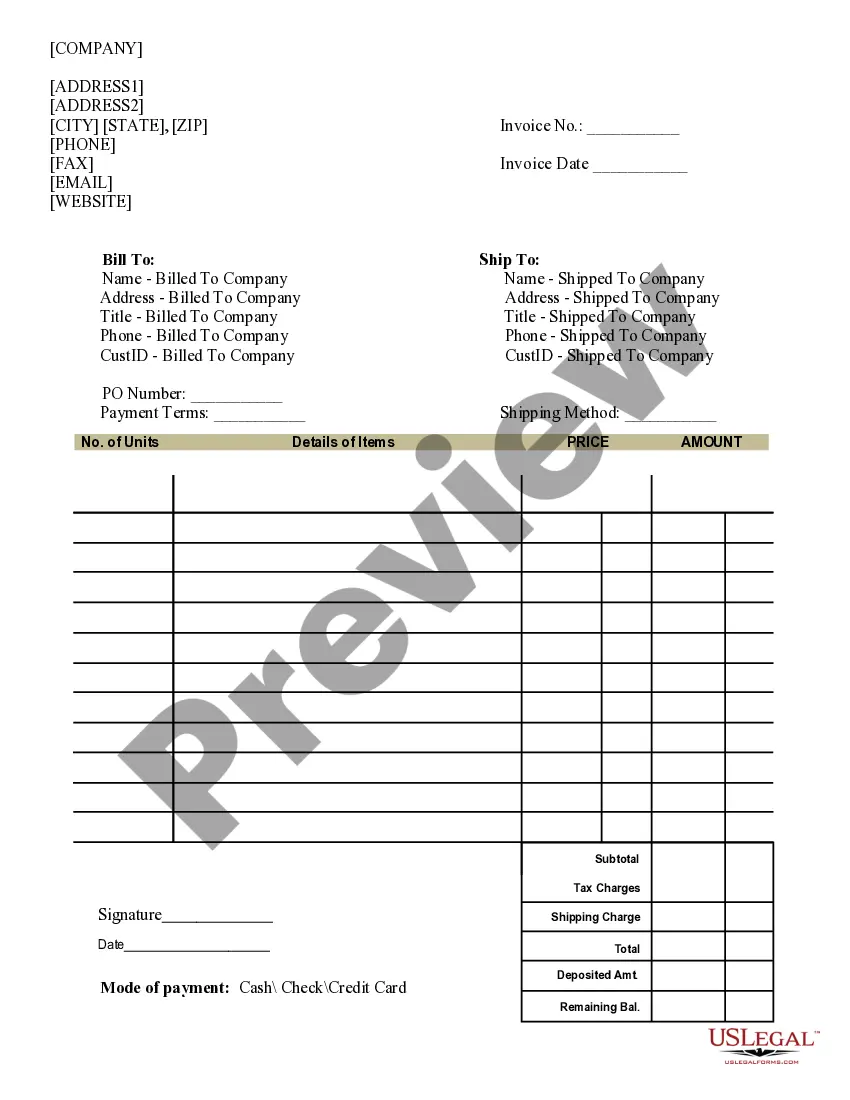

You can review the form using the Preview button and read the form summary to confirm it is appropriate for you.

- All the documents are reviewed by experts and meet state and federal specifications.

- If you are currently registered, Log In to your account and click on the Download button to locate the Iowa Receipt and Withdrawal from Partnership.

- Use your account to browse through the sanctioned documents you've purchased previously.

- Go to the My documents section of your account and obtain an additional copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure that you have selected the correct form for your city/state.

Form popularity

FAQ

Withdrawal from a partnership is achieved by serving a written notice ending the involvement of a particular partner in the partnership for one reason or another. There are two kinds of withdrawals: Voluntary withdrawal is when a partner chooses to leave the partnership and is serving notice on the other partner(s).

Voluntary withdrawal refers to a situation where a partner decides to exit or step out of the partnership of his own free will or his own accord. The reason behind the same may be personal, such as his desire to go into retirement or if he simply does not wish to be part of the firm anymore.

In a normal partnership, when one partner withdraws, or leaves the company, the partnership dissolves.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

Withdrawal from a partnership is achieved by serving a written notice ending the involvement of a particular partner in the partnership for one reason or another. There are two kinds of withdrawals: Voluntary withdrawal is when a partner chooses to leave the partnership and is serving notice on the other partner(s).

Withdrawal of general partner and assignment of general partner's partnership interest. (a) A general partner may withdraw from a limited partnership at the time or upon the happening of events specified in the partnership agreement and in accordance with the partnership agreement.

Withdrawal from a partnership is achieved by serving a written notice ending the involvement of a particular partner in the partnership for one reason or another. There are two kinds of withdrawals: Voluntary withdrawal is when a partner chooses to leave the partnership and is serving notice on the other partner(s).

A distribution is a transfer of cash or property by a partnership to a partner with respect to the partner's interest in partnership capital or income. Distributions do not include loans to partners or amounts paid to partners for services or the use of property, such as rent, or guaranteed payments.

Limited partners may withdraw from a partnership in the manner allowed by the partnership agreement, or state law if there is no agreement. In states that follow the Revised Uniform Limited Partnership Act (RULPA), a limited partner has the right to withdraw after six months' notice to all the general partners.