Iowa Checklist - Key Record Keeping

Description

How to fill out Checklist - Key Record Keeping?

You can spend time online searching for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can obtain or print the Iowa Checklist - Key Record Keeping from the platform.

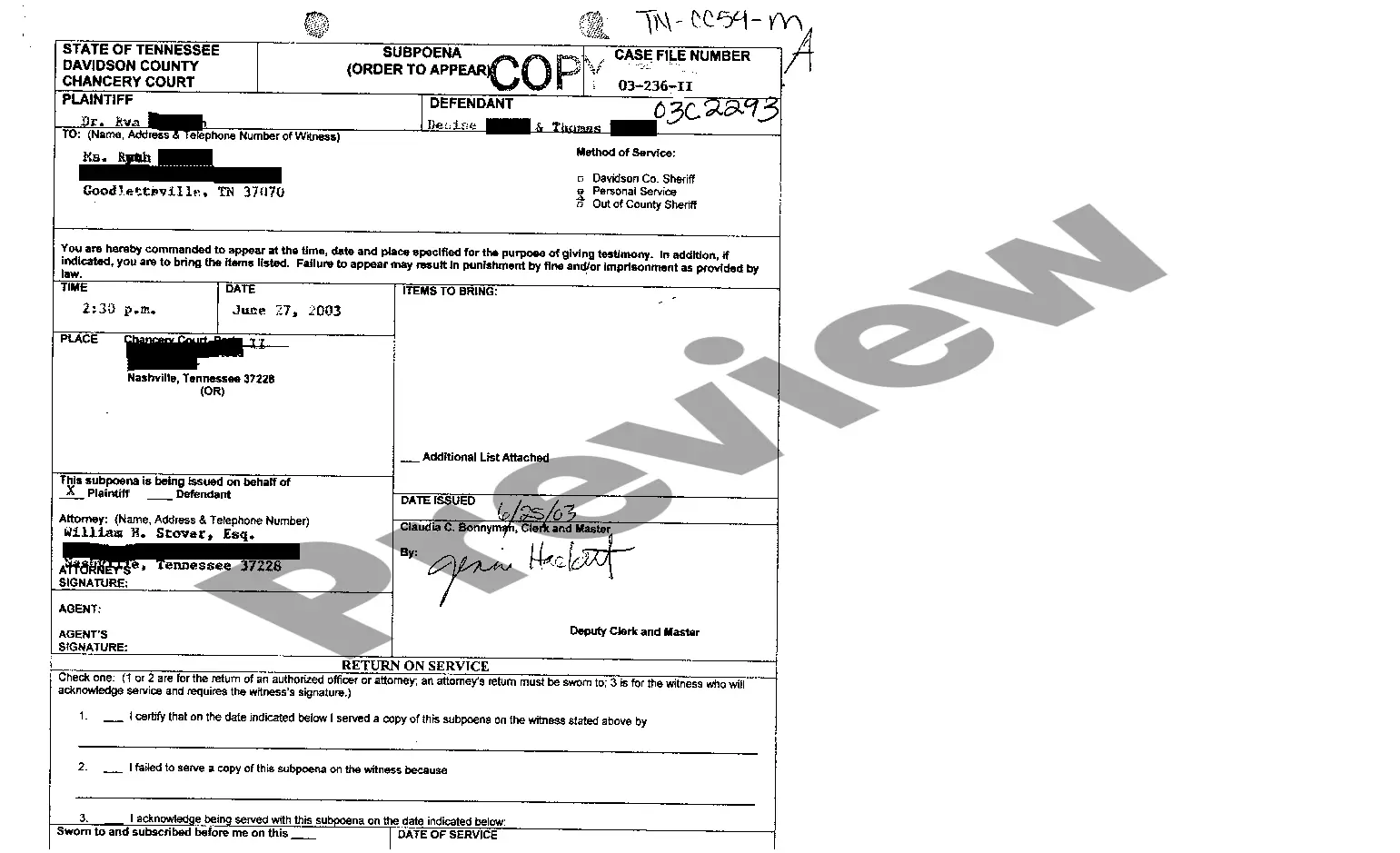

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, edit, print, or sign the Iowa Checklist - Key Record Keeping.

- Every legal document template you purchase is yours permanently.

- To get another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Read the form description to confirm you have chosen the right one.

Form popularity

FAQ

The retention period for business records in Iowa is generally three to seven years, depending on the type of document. Ensuring adherence to this timeframe not only facilitates compliance but also enhances your record-keeping practices. For a clear overview, the Iowa Checklist - Key Record Keeping can serve as your trusted guide. Our user-friendly platform can assist you with templates and expert advice.

Records that typically need to be kept for seven years include tax returns, contracts, and financial statements. Maintaining these records protects you in case of an audit or any legal issues that may arise. Referring to the Iowa Checklist - Key Record Keeping can streamline your process of identifying and organizing these essential documents. Check resources available on our platform for additional support.

You should keep various employee records for at least seven years, including payroll records, performance reviews, and employment contracts. This retention period is essential for addressing any potential legal claims or questions about employment history. The Iowa Checklist - Key Record Keeping offers you more details on managing these records efficiently. Our platform provides tools for proper documentation.

Generally, businesses in Iowa should keep their records for a minimum of three years, but some records must be maintained for up to seven years. This timeline ensures compliance with state regulations and provides a safeguard for audits. The Iowa Checklist - Key Record Keeping is an excellent resource to clarify which documents require longer retention. Explore our platform for comprehensive guides.

In Iowa, the duration you should keep business records can vary based on the type of record. Typically, financial records must be kept for at least three to seven years. Utilizing the Iowa Checklist - Key Record Keeping can help you determine the exact retention periods for your business needs. You can also find templates and organizational tools through our platform.

The records law in Iowa mandates that businesses maintain certain records for specific periods. This law is crucial for compliance and ensures that you have necessary documentation when needed. Understanding this law can assist you in organizing your records effectively, as referenced in the Iowa Checklist - Key Record Keeping. If you need guidance, consider using our platform to get tailored resources.