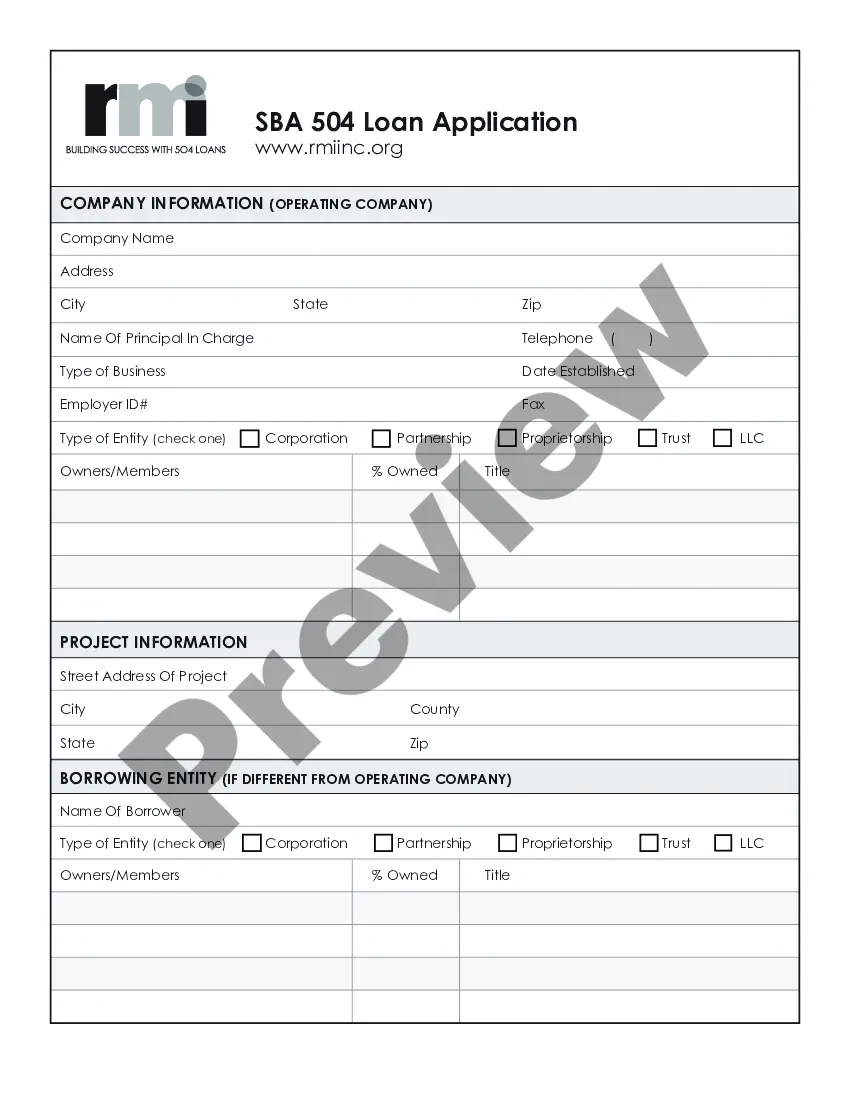

Iowa Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

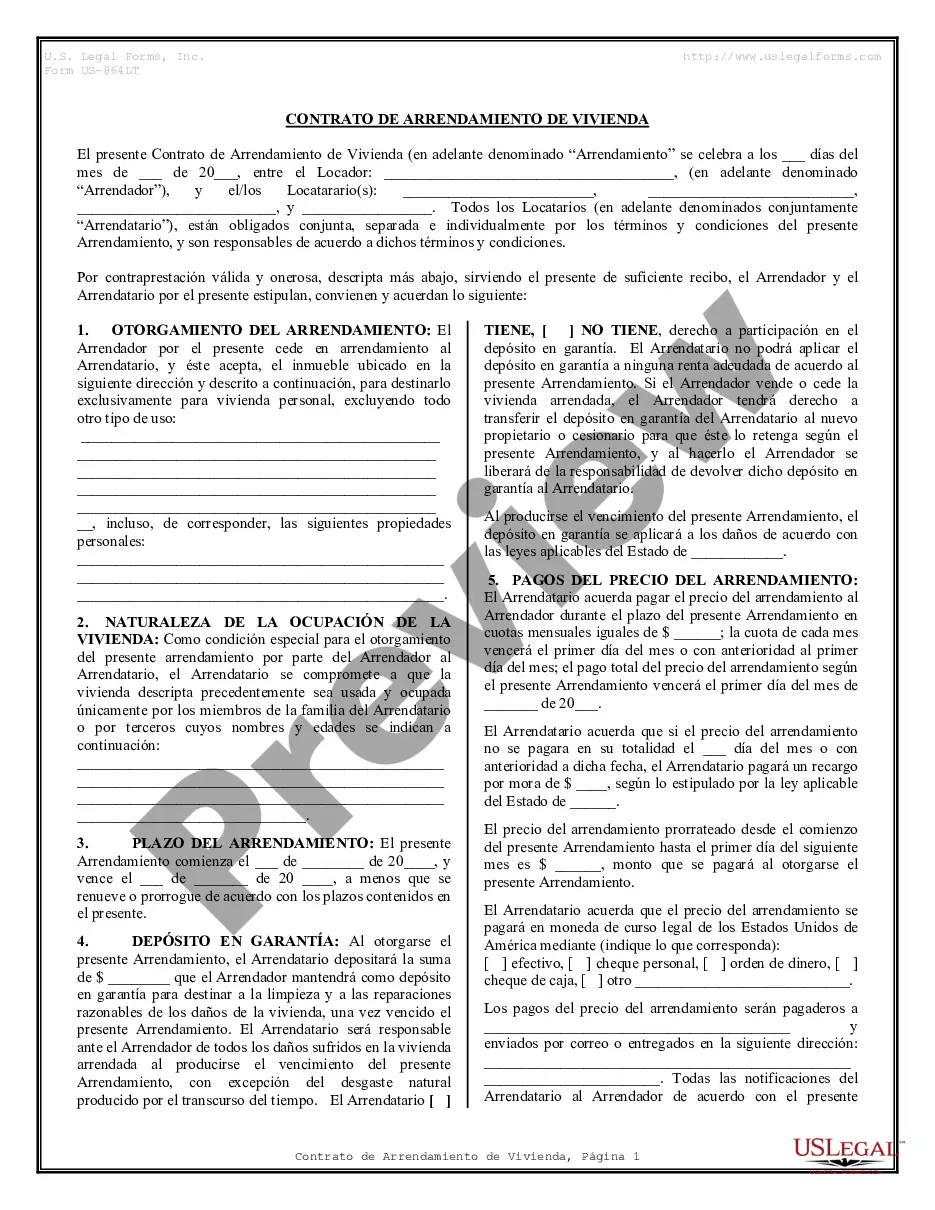

US Legal Forms - one of several most significant libraries of lawful varieties in the States - gives an array of lawful file templates you may acquire or print out. Using the internet site, you can get a huge number of varieties for organization and specific reasons, sorted by groups, states, or keywords and phrases.You will find the newest types of varieties just like the Iowa Small Business Administration Loan Application Form and Checklist within minutes.

If you currently have a registration, log in and acquire Iowa Small Business Administration Loan Application Form and Checklist from the US Legal Forms collection. The Down load option can look on every kind you view. You get access to all formerly saved varieties from the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, listed here are easy directions to help you get started out:

- Be sure to have selected the right kind for the city/area. Go through the Review option to check the form`s content material. Browse the kind information to ensure that you have chosen the appropriate kind.

- If the kind does not fit your needs, utilize the Research industry towards the top of the display to obtain the one that does.

- In case you are satisfied with the shape, affirm your decision by simply clicking the Buy now option. Then, opt for the pricing plan you prefer and provide your qualifications to register on an accounts.

- Approach the transaction. Make use of your Visa or Mastercard or PayPal accounts to complete the transaction.

- Pick the formatting and acquire the shape on your own system.

- Make changes. Complete, edit and print out and indication the saved Iowa Small Business Administration Loan Application Form and Checklist.

Each format you included with your money lacks an expiration particular date and is also the one you have eternally. So, if you wish to acquire or print out an additional version, just go to the My Forms area and click around the kind you require.

Gain access to the Iowa Small Business Administration Loan Application Form and Checklist with US Legal Forms, one of the most extensive collection of lawful file templates. Use a huge number of skilled and status-specific templates that fulfill your small business or specific requirements and needs.

Form popularity

FAQ

Eligible Passive Companies and Operating Companies (EPC/OC) ? SBA allows a loan structure where the Borrower is a passive owner of the assets to be financed with the loan proceeds and leases the assets to an ?Operating Company? (OC). The Borrower in these cases is called an ?Eligible Passive Company? (EPC).

15. OPERATING COMPANY (OC) Definition: A business actively involved in conducting business operations now, or about to be located on, real property owned by an eligible passive company (EPC).

In general, SBA loans are not as difficult to get as business bank loans. Because they're backed by the U.S. government, they're less risky for banks than issuing their own loans.

SBA only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. SBA partners with lenders to help increase small business access to loans.

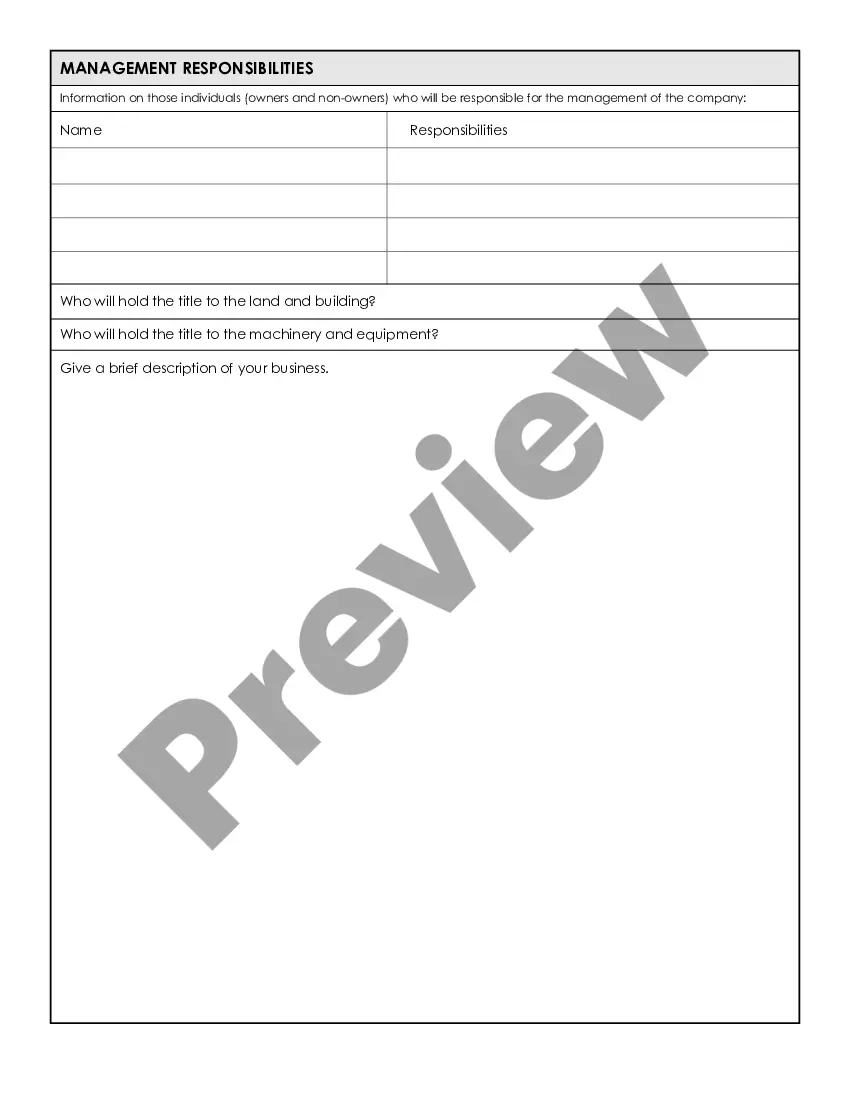

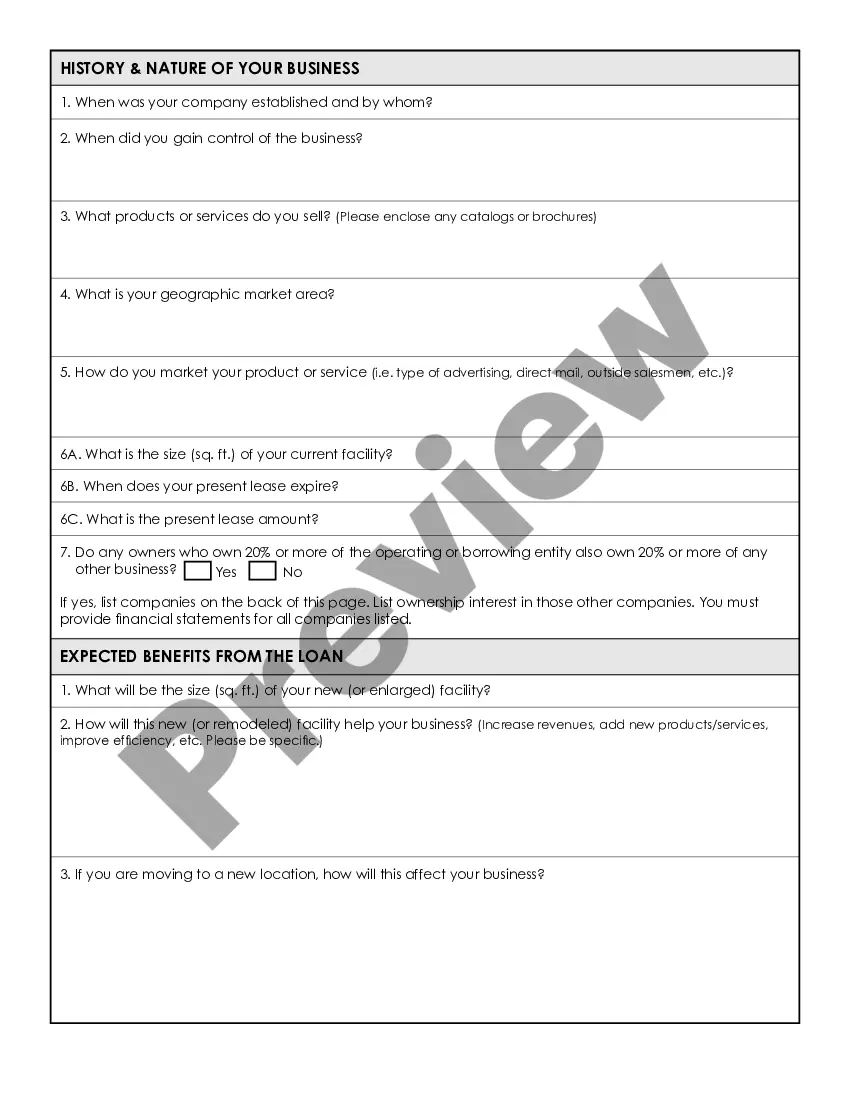

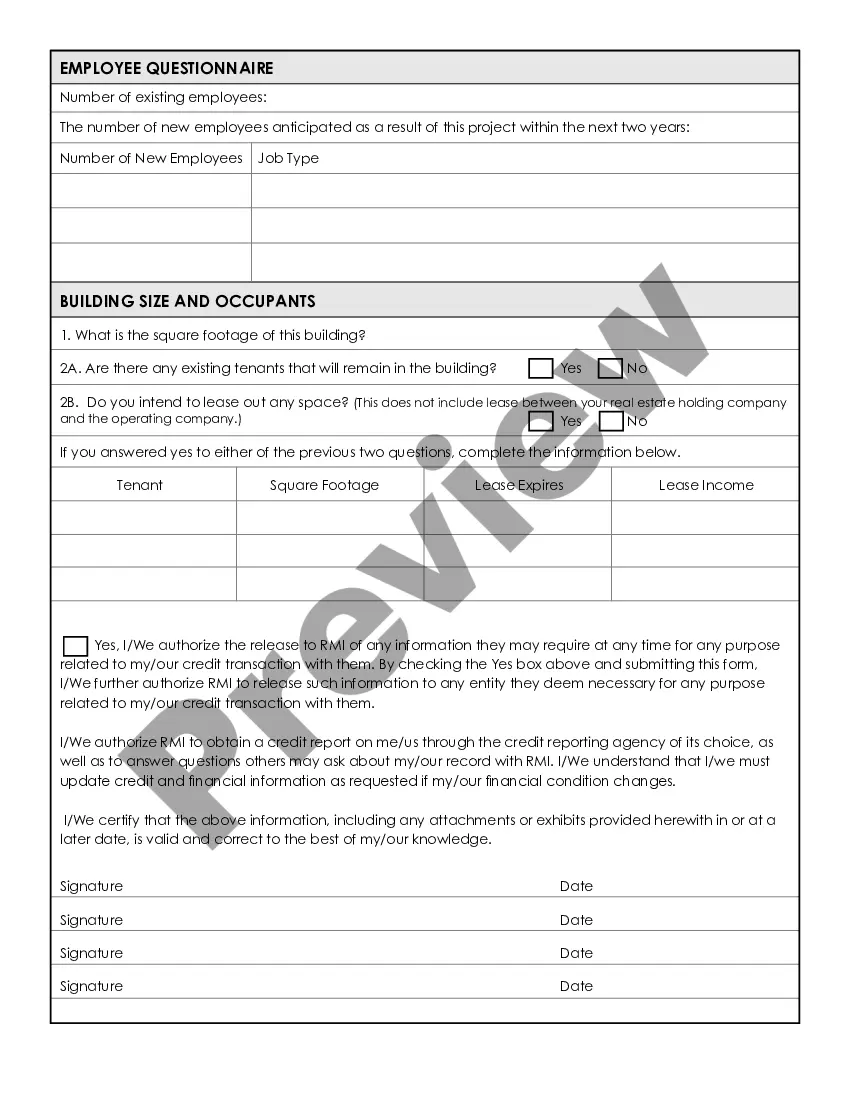

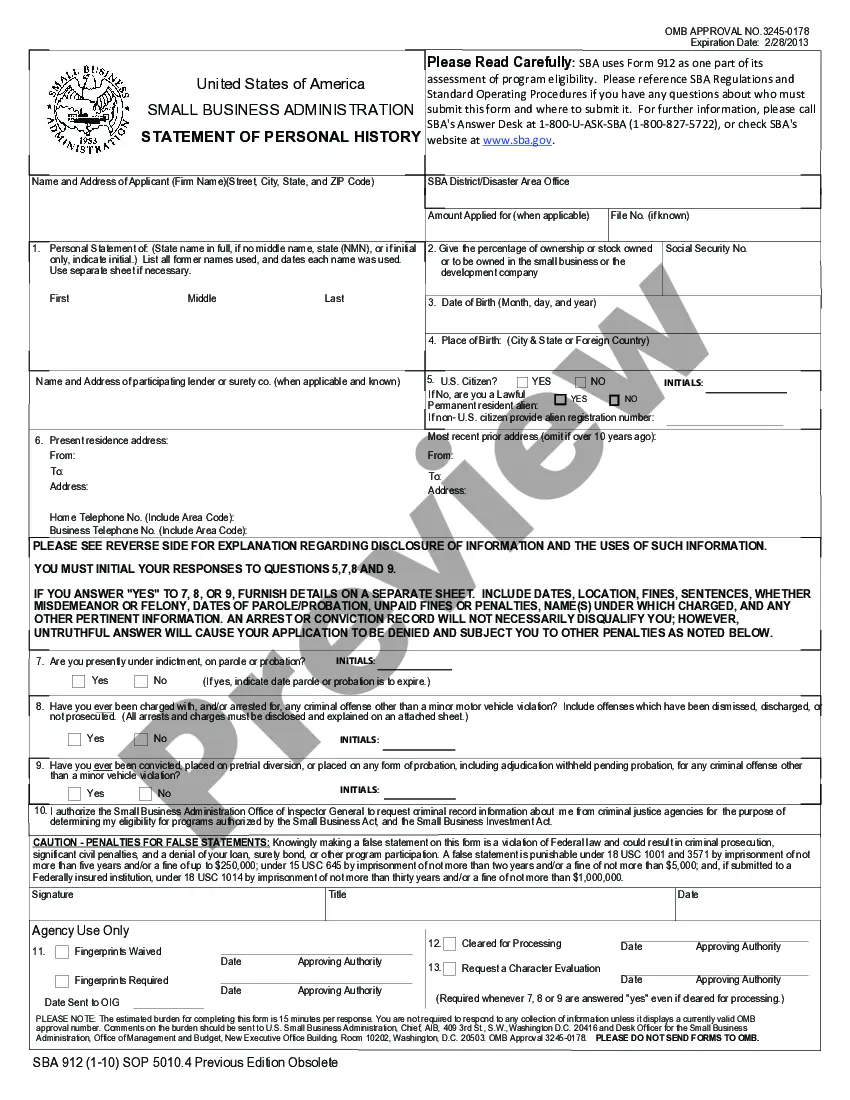

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.

Although the SBA Form 912 is no longer required, if an individual owner answers ?yes? to question 18 or 19, the individual must provide the details to Page 3 PAGE 3 of 6 EXPIRES: 9-1-21 SBA Form 1353.3 (4-93) MS Word Edition; previous editions obsolete Must be accompanied by SBA Form 58 Federal Recycling Program ...