Iowa Aging of Accounts Receivable

Description

How to fill out Aging Of Accounts Receivable?

Are you in the situation where you require documentation for either business or personal activities almost every day.

There are numerous legal form templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast selection of template forms, including the Iowa Aging of Accounts Receivable, designed to comply with federal and state regulations.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using your PayPal or credit card.

Select a convenient file format and download your copy. You can find all the form templates you have purchased in the My documents menu. You can download an additional copy of Iowa Aging of Accounts Receivable at any time if needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Iowa Aging of Accounts Receivable template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific state/region.

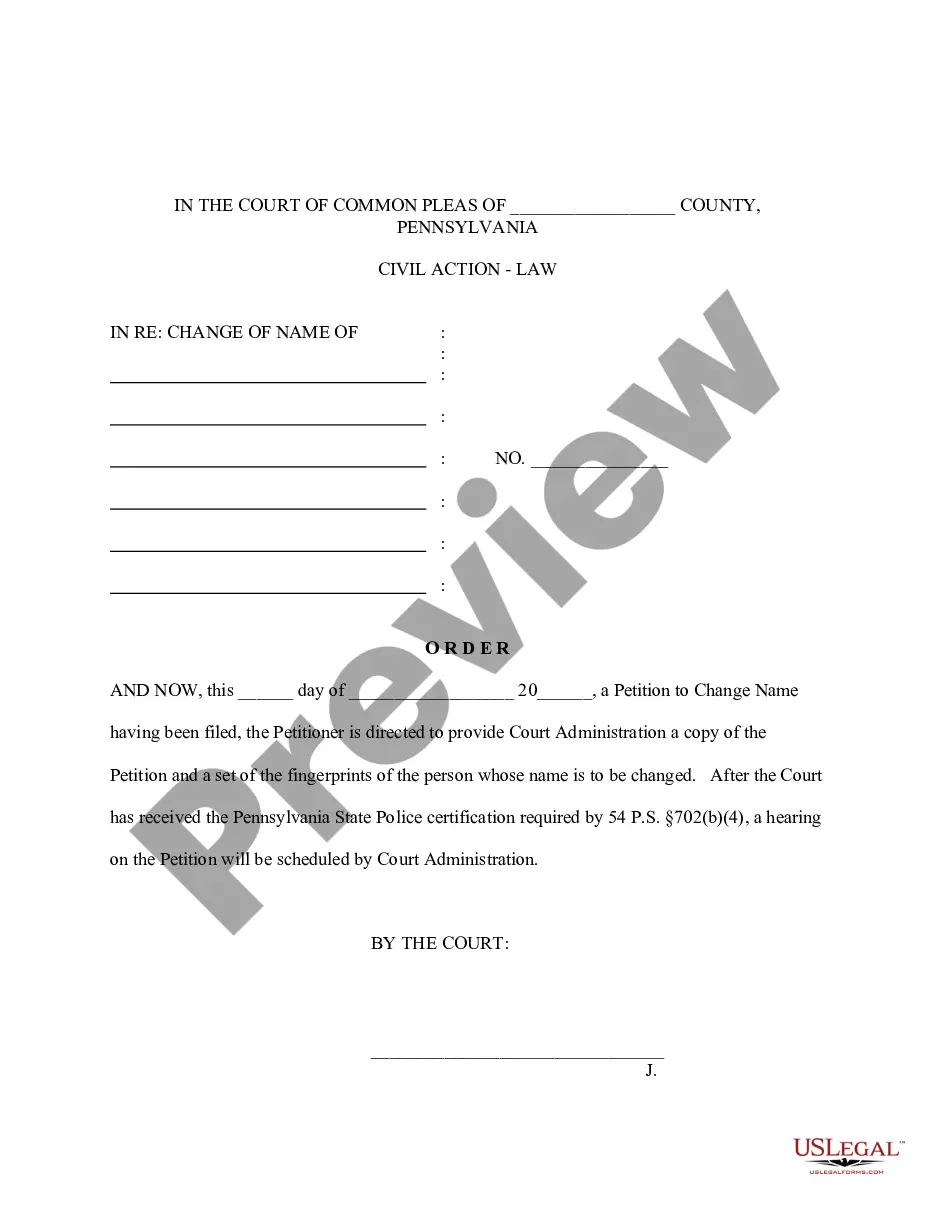

- Utilize the Review option to evaluate the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and preferences.

- If you acquire the correct form, click on Buy now.

Form popularity

FAQ

Calculating the age of accounts receivable involves a straightforward process. First, list all outstanding invoices and their corresponding due dates. By counting the days until the current date, you can classify these invoices into different aging categories. This procedure is essential for managing Iowa aging of accounts receivable, allowing you to focus on collections and improve your financial stability.

To write off old accounts receivable, review your aged accounts and determine which invoices are uncollectible. Once you confirm that efforts to collect have been exhausted, record the write-off in your financial statements. This step is an important part of managing your Iowa Aging of Accounts Receivable, allowing you to maintain accurate records and improve financial health.

To record aging accounts receivable, accurately track the date of each invoice and the payment due date. Regularly update this information in your accounting system to keep an eye on aging debts. This proactive approach can significantly enhance your Iowa Aging of Accounts Receivable practices.

Creating a schedule for accounts receivable begins with compiling all outstanding invoices into a spreadsheet or accounting software. Make sure to categorize the invoices based on the age of the debt. An organized Iowa Aging of Accounts Receivable schedule will help you visualize payment timelines and prioritize follow-ups.

To calculate accounts receivable aging, take the date the invoice was issued and subtract it from the current date. Next, categorize these amounts into specific aging periods. By implementing an Iowa Aging of Accounts Receivable calculation method, you can determine the effectiveness of your credit policies and identify problem accounts.

Preparing an accounts receivable aging report involves compiling data from your accounting software. First, select all the unpaid invoices, then organize them by age. The report will serve as a crucial element in your Iowa Aging of Accounts Receivable strategy, helping you track overdue accounts and improve your collection processes.

To prepare an accounts receivable aging schedule, start by listing all outstanding invoices. Then, categorize them into time frames, such as 0-30 days, 31-60 days, and beyond. This Iowa Aging of Accounts Receivable schedule allows you to visualize debts and prioritize collections effectively.

Industry standards for accounts receivable aging can differ widely across sectors, but many businesses aim to collect payments within 30 to 60 days. Knowing these benchmarks can help Iowa companies evaluate their performance against similar businesses. By leveraging tools from platforms like uslegalforms, firms can streamline their invoicing and collection efforts to align with industry expectations.

Calculating accounts receivable aging involves categorizing outstanding invoices based on how long they have been unpaid. You can create an aging report showing receivables grouped into intervals, like 0-30 days, 31-60 days, and beyond. Companies in Iowa can benefit from an effective aging of accounts receivable system to pinpoint overdue accounts and improve collection processes.

Health insurance is generally tax deductible in Iowa if you itemize your deductions. This can significantly lower your taxable income, thereby offering some financial relief. It's essential to track all premiums and related expenses diligently. For assistance in managing these details and maximizing your tax benefits, Iowa Aging of Accounts Receivable could provide valuable insights.