Iowa Aging Accounts Payable

Description

How to fill out Aging Accounts Payable?

If you aim to be thorough, acquire, or generate authentic document templates, utilize US Legal Forms, the largest repository of legal forms, accessible on the web.

Employ the site's straightforward and user-friendly search functionality to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords. Use US Legal Forms to obtain the Iowa Aging Accounts Payable with just a few clicks.

Every legal document template you purchase belongs to you indefinitely. You have access to every form you saved in your account. Check the My documents section and select a form to print or download again.

Acquire and print the Iowa Aging Accounts Payable with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms subscriber, sign in to your account and select the Purchase option to acquire the Iowa Aging Accounts Payable.

- You can also access forms you have previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

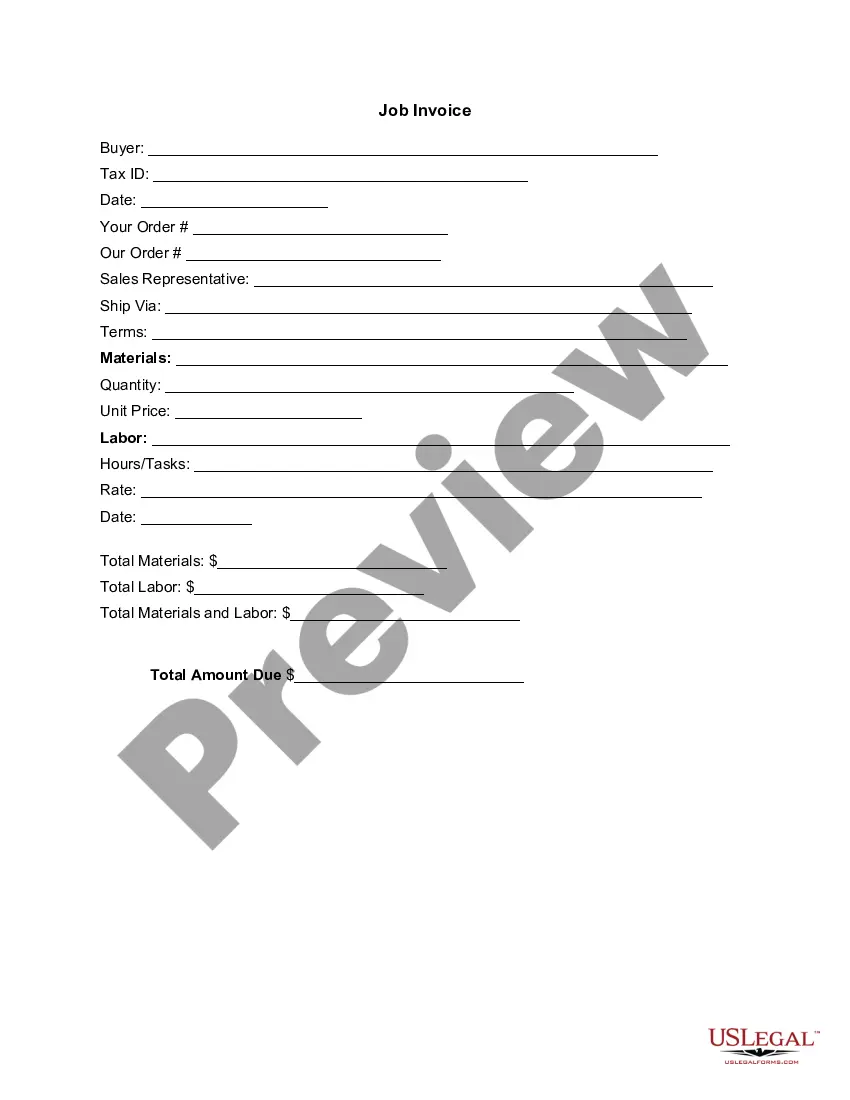

- Step 2. Utilize the Preview option to review the form's content. Don’t forget to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose your preferred pricing plan and provide your details to register for the account.

- Step 5. Complete the payment. You can use your credit card or PayPal account for the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Iowa Aging Accounts Payable.

Form popularity

FAQ

The AP Aging format is a structured layout that lists your accounts payable along with their respective due dates. This format often includes columns for vendor names, invoice amounts, and aging buckets. Utilizing the AP Aging format for Iowa Aging Accounts Payable can streamline your payment process and enhance your ability to track overdue invoices effectively.

Are accounts payable an expense? Accounts payable is a liability account, not an expense account. However, under accrual accounting, the expense associated with an account payable is recorded at the same time that the account payable is recorded.

When recording an account payable, debit the asset or expense account to which a purchase relates and credit the accounts payable account. When an account payable is paid, debit accounts payable and credit cash.

When an account payable is paid, Accounts Payable will be debited and Cash will be credited. Therefore, the credit balance in Accounts Payable should be equal to the amount of vendor invoices that have been recorded but have not yet been paid.

How the accounts payable process worksStep 1: Create your chart of accounts.Step 2: Setting up vendor details.Step 3: Examining and entering bill details.Step 4: Review and process payment for any invoices due.Step 5: Repeat the process weekly.

Accounts payable have payment terms associated with them. For example, the terms could stipulate that payment is due to the supplier in 30 days or 90 days. The payable is in default if the company does not pay the payable within the terms outlined by the supplier or creditor.

To make sure a company's cash and assets are safe, the accounts payable process should have internal controls to: prevent paying a fraudulent invoice. prevent paying an inaccurate invoice. prevent paying a vendor invoice twice. be certain that all vendor invoices are accounted for.

The full cycle of the accounts payable process includes invoice data capture, coding invoices with correct account and cost center, approving invoices, matching invoices to purchase orders, and posting for payments. The accounts payable process is only one part of what is known as P2P (procure-to-pay).

Accounts payable are usually due within 30 days, and are recorded as a short-term liability on your company's balance sheet.

Accounts payable are debts that must be paid off within a given period to avoid default. At the corporate level, AP refers to short-term debt payments due to suppliers. The payable is essentially a short-term IOU from one business to another business or entity.