Utah Accredited Investor Representation Letter

Description

How to fill out Accredited Investor Representation Letter?

You might spend numerous hours online searching for the valid document template that fits the state and federal requirements you need.

US Legal Forms offers a plethora of valid forms that are reviewed by experts.

You can easily download or print the Utah Accredited Investor Representation Letter from our services.

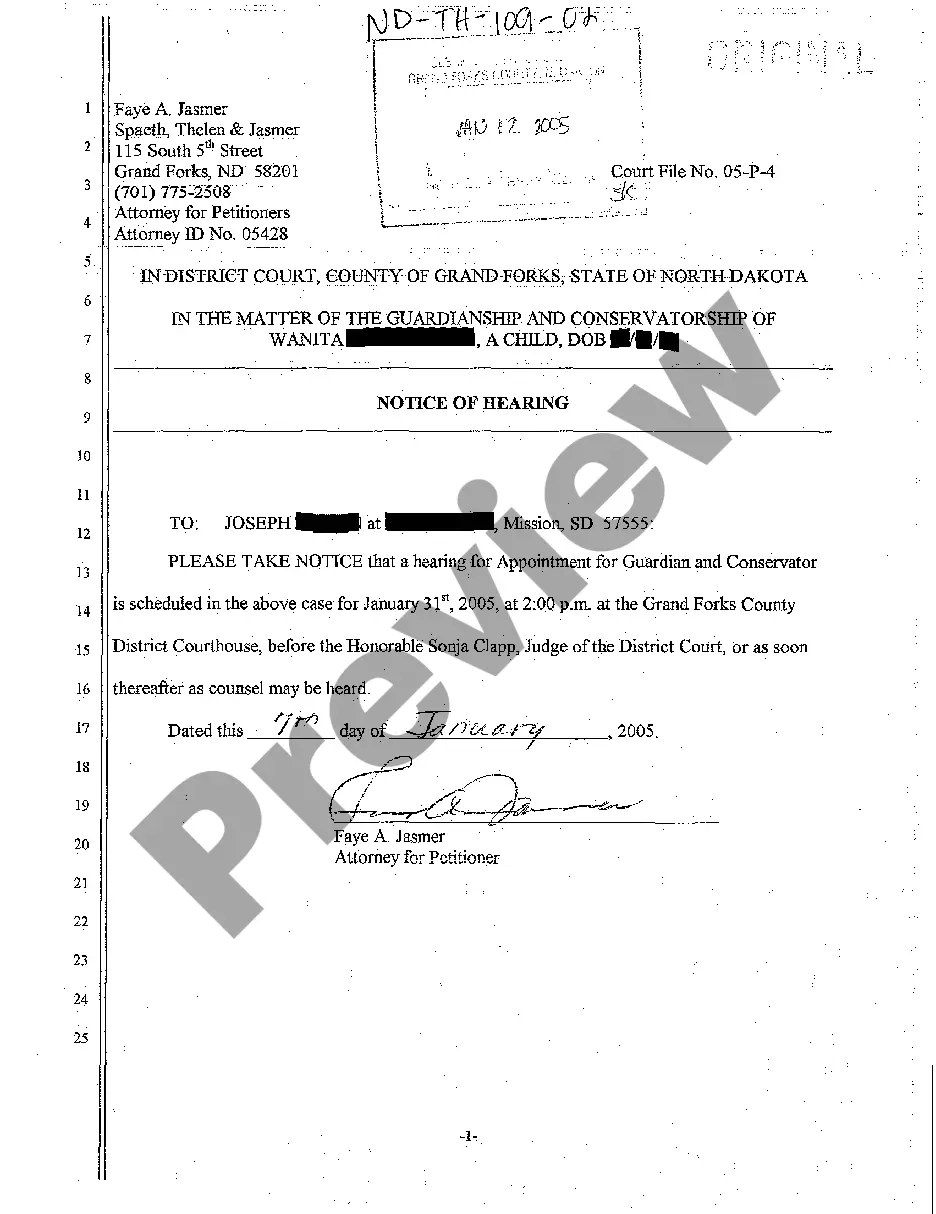

If available, use the Preview option to browse through the document template as well.

- If you already have a US Legal Forms account, you may Log In and select the Obtain option.

- Afterward, you can complete, edit, print, or sign the Utah Accredited Investor Representation Letter.

- Each valid document template you acquire is yours indefinitely.

- To obtain another copy of the acquired form, visit the My documents tab and click the corresponding option.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, make sure you have chosen the correct document template for your area/city of choice.

- Check the form description to ensure you have selected the right form.

Form popularity

FAQ

In a Rule 506(b) offering, investors can self-certify, so this is where the opportunity for an investor to falsify their qualifications comes in. In a Rule 506(c) offering, investors must provide reasonable assurance to the Syndicator that they are accredited, which must be dated within 90 days of the investment.

Accredited Investor Definition Income: Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year. Professional: Is a knowledgeable employee of certain investment funds or holds a valid Series 7, 65 or 82 license.

Some documents that can prove an investor's accredited status include:Tax filings or pay stubs;A letter from an accountant or employer confirming their actual and expected annual income; or.IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

An accredited investor is a person or entity that is allowed to invest in securities that are not registered with the Securities and Exchange Commission (SEC). To be an accredited investor, an individual or entity must meet certain income and net worth guidelines.

Syndication offering documents may require the investor to indemnify the Syndicator if they lie about their qualifications and it causes liability for the Syndicator later (ours do), so there could be repercussions against investors in those cases.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

Investor Representation Letter means a letter from initial investors of a Bond offering that includes but is not limited to a certification that they reasonably meet the standards of a Sophisticated Investor or Qualified Institutional Buyer, that they are purchasing Bonds for their own account, that they have the

A qualified institutional buyer (QIB) representation letter for an unlegended Rule 144A offering of securities by a Canadian issuer. The QIB representation letter relates to a concurrent public offering in Canada and an offering in the United States conducted in reliance on Rule 144A under the Securities Act.