An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

Iowa Marital Deduction Trust - Trust A and Bypass Trust B

Description

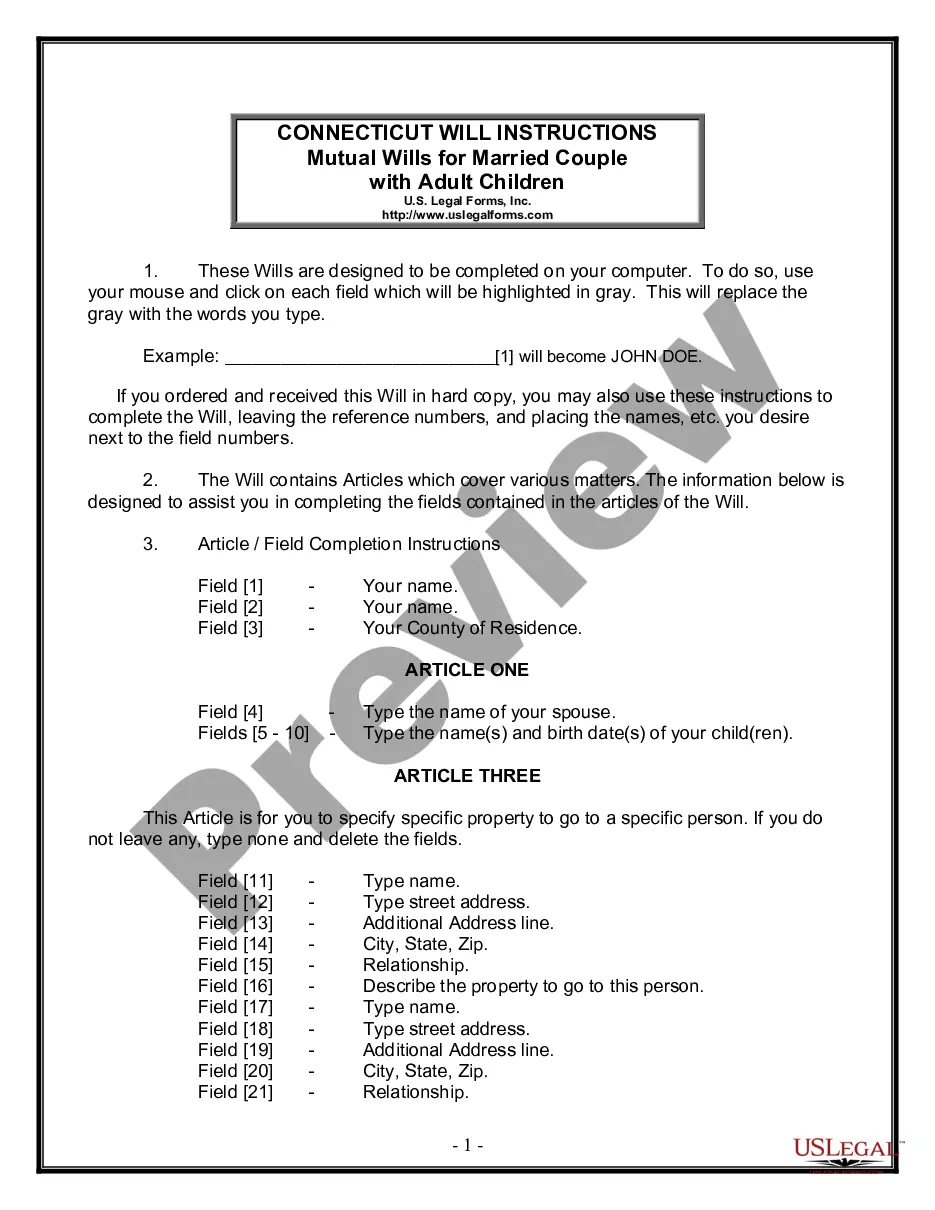

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

If you wish to finish, acquire, or print genuine document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's simple and convenient search to locate the documents you need.

Numerous templates for business and personal use are categorized by various groups, states, or keywords.

Step 5. Complete the transaction. You can use your Мisa or Ьastercard or PayPal account to process the payment.

Step 6. Choose the format of the legal form and download it onto your device. Step 7. Complete, edit, print, or sign the Iowa Marital Deduction Trust - Trust A and Bypass Trust B.

- Utilize US Legal Forms to discover the Iowa Marital Deduction Trust - Trust A and Bypass Trust B with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Obtain button to get the Iowa Marital Deduction Trust - Trust A and Bypass Trust B.

- You can also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's contents. Remember to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other versions in the legal document template.

- Step 4. After finding the form you want, click the Acquire now button. Choose the subscription plan you prefer and enter your details to register for an account.

Form popularity

FAQ

To fund a bypass trust, first identify the assets you want to transfer from the deceased spouse's estate. This may include real estate, bank accounts, or business interests, all contributing to the intended tax advantages. It is essential to ensure that these assets align with the objectives of the Iowa Marital Deduction Trust - Trust A and Bypass Trust B. Utilizing resources like US Legal Forms can simplify the documentation and process.

A marital deduction trust allows the surviving spouse to receive income from the trust during their lifetime, with the principal passing to other beneficiaries after their death. For example, consider a trust set up under the Iowa Marital Deduction Trust - Trust A and Bypass Trust B framework. In this scenario, the surviving spouse could receive trust income, enabling them to maintain financial stability while preserving assets for family. Such trusts are beneficial for ensuring both immediate support and long-term benefits.

If a bypass trust is never funded, it cannot fulfill its intended purpose. Typically, a bypass trust should receive assets from the estate of the deceased spouse, ensuring that those assets are excluded from the surviving spouse's estate. Without funding, the Iowa Marital Deduction Trust - Trust A and Bypass Trust B cannot provide the expected tax benefits or protect assets from taxes upon the death of the surviving spouse. You may want to consult a professional to ensure your trust is properly funded.

Yes, trusts that earn income are generally required to file tax returns. This includes both the Iowa Marital Deduction Trust - Trust A and Bypass Trust B. By filing Form 1041, the trust can ensure compliance with IRS regulations and properly report any income generated, ultimately benefiting the estate and its beneficiaries.

Yes, a marital trust can qualify for the marital deduction, allowing assets to pass to the surviving spouse without incurring immediate estate taxes. However, it's important to distinguish between the marital trust and the Bypass Trust B within the Iowa Marital Deduction Trust. Each serves different purposes and has unique tax implications.

Yes, the income generated from a bypass trust is taxable to the beneficiaries. When you receive distributions from the Bypass Trust B of the Iowa Marital Deduction Trust, you must include that income on your tax return. It is essential to plan accordingly to avoid unexpected tax liabilities.

Yes, a bypass trust typically must file a tax return. The Internal Revenue Service requires trusts that generate income above a certain threshold to file Form 1041. This ensures that any income generated from the Iowa Marital Deduction Trust - Trust A and Bypass Trust B is appropriately reported and taxed.

A trust generally refers to a legal arrangement where one party holds assets for the benefit of another. Specific to the context of the Iowa Marital Deduction Trust - Trust A and Bypass Trust B, a B trust refers specifically to the bypass trust designed to avoid taxation on the surviving spouse's estate. Essentially, while all B trusts are types of trusts, not all trusts serve the same purpose or function as a B trust. This distinction is important for those engaged in estate planning.

The primary disadvantages of a bypass trust include increased upfront costs and the need for ongoing maintenance. While it can successfully reduce estate taxes, the complexity may require the involvement of legal and financial professionals, adding to the overall expense. Furthermore, if trust assets grow significantly, managing these assets could become an added burden. Understanding these aspects is essential when considering an Iowa Marital Deduction Trust - Trust A and Bypass Trust B.

One downside of an AB trust is the complexity and potential confusion it can create for beneficiaries and trustees. The split of assets into Trust A and Trust B may lead to misunderstandings about the distribution of wealth, especially when the surviving spouse remarries. Additionally, the administrative responsibilities may require more time and effort to manage compared to a single trust. When using an Iowa Marital Deduction Trust - Trust A and Bypass Trust B, clear communication is vital to alleviate concerns.