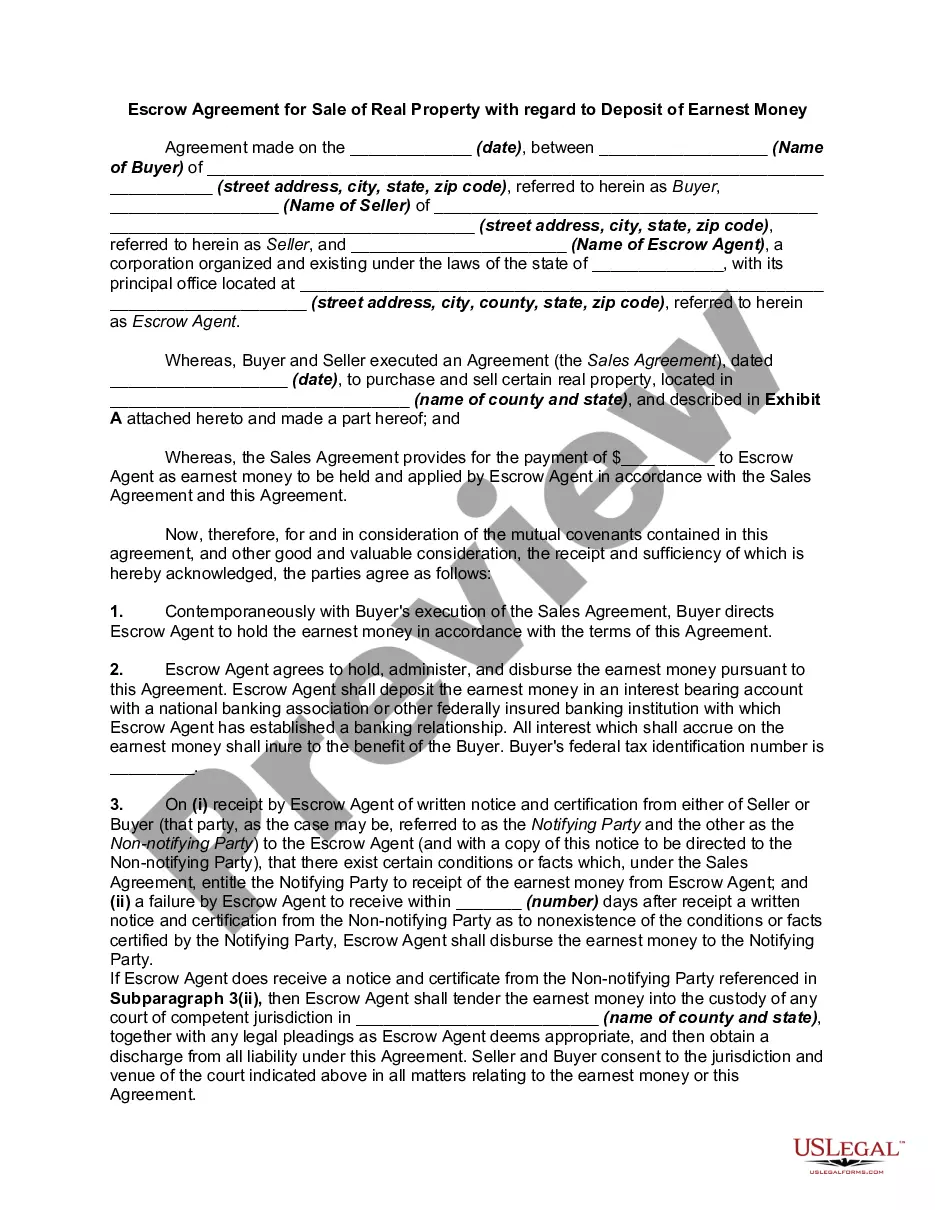

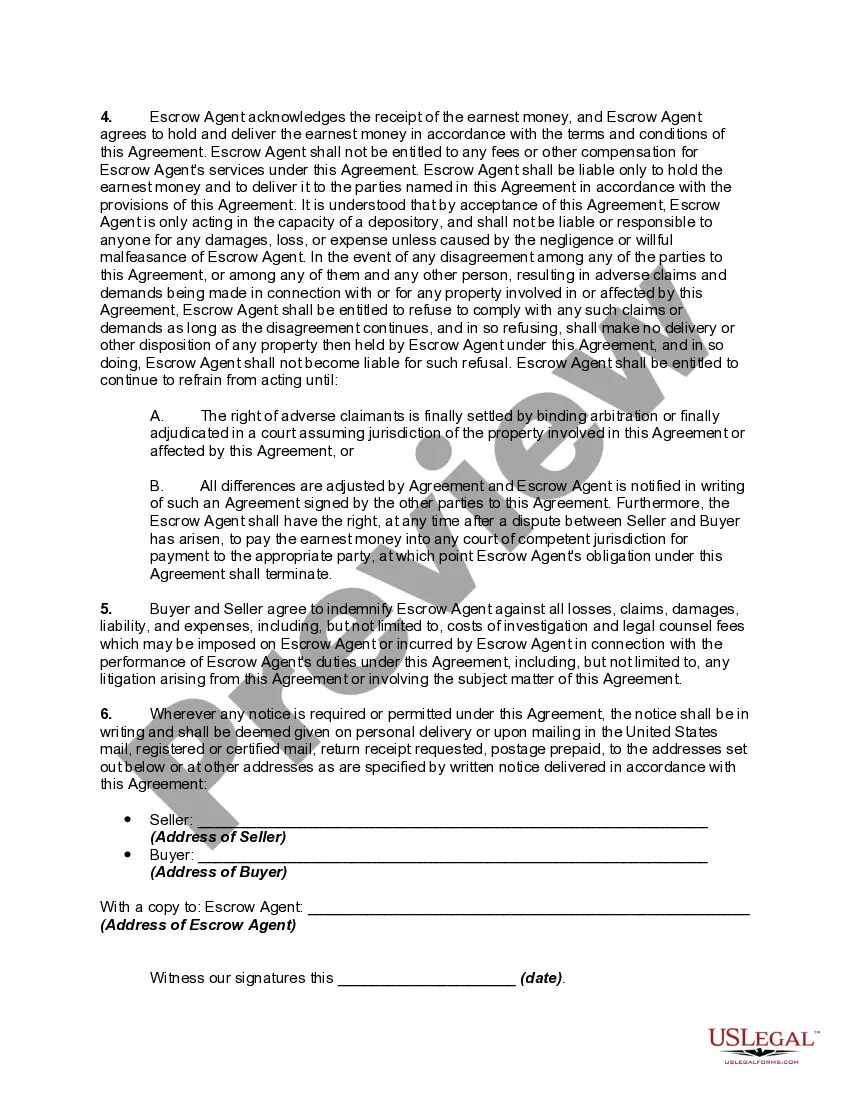

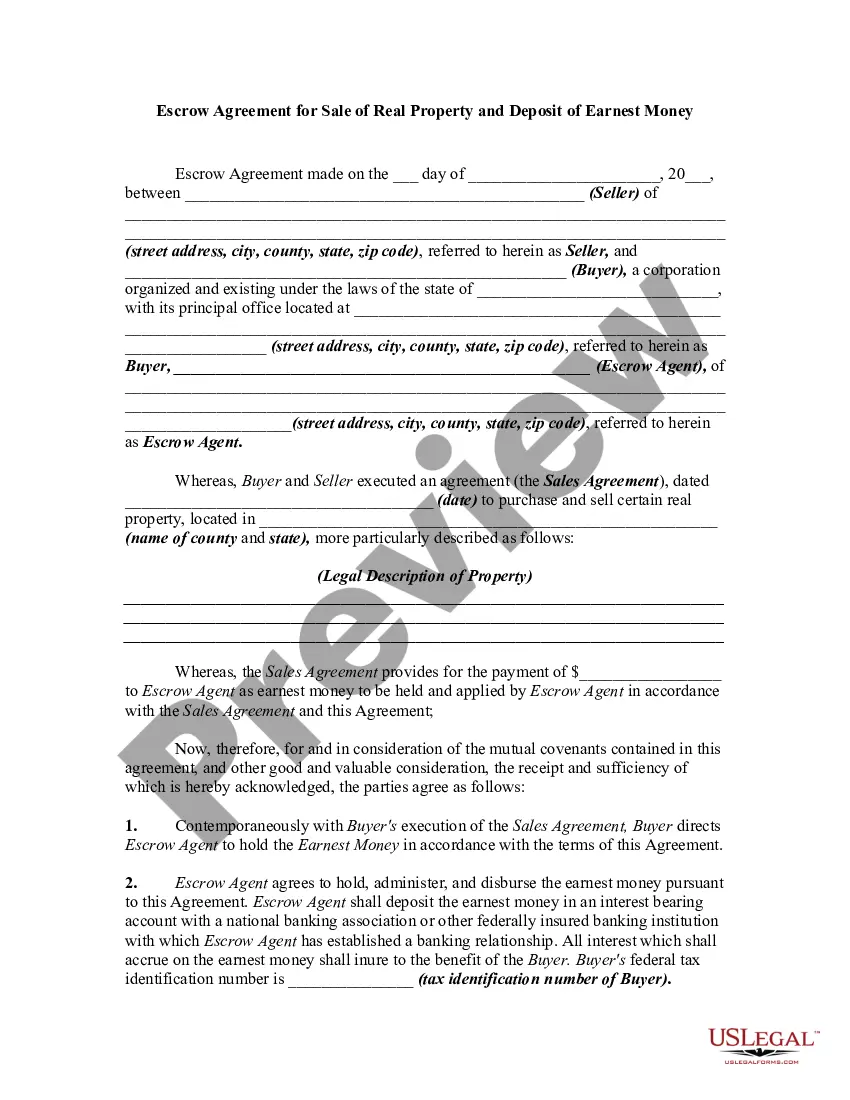

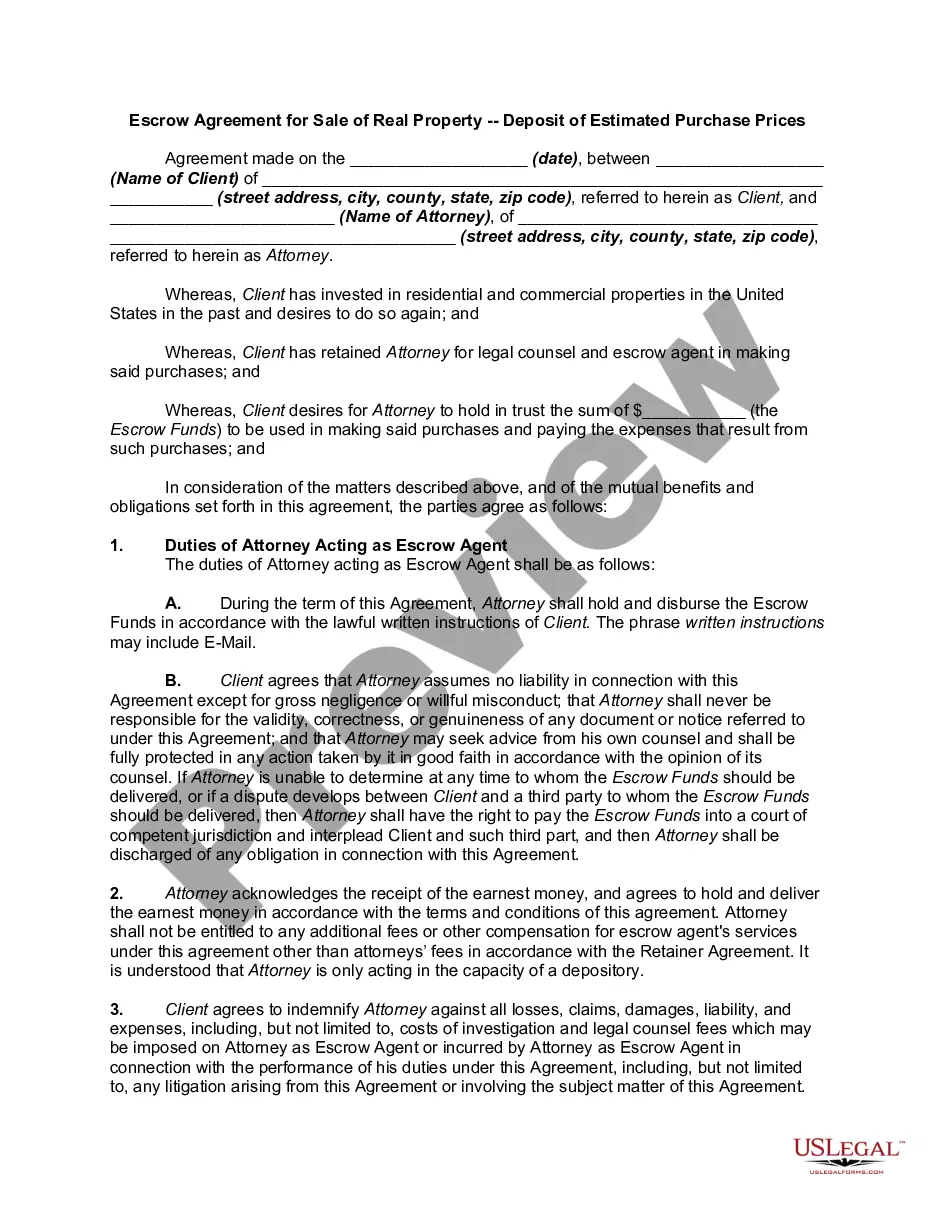

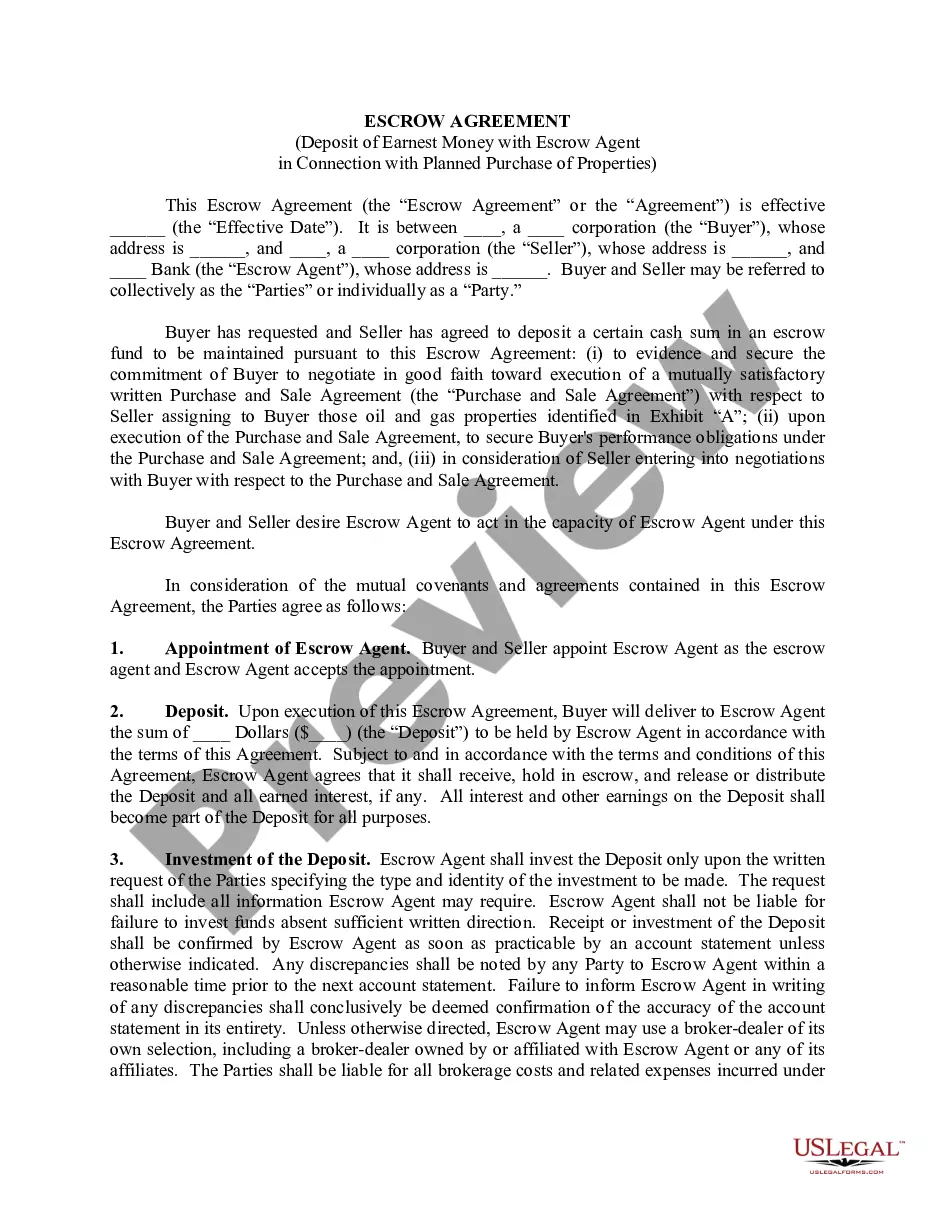

Iowa Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money

Description

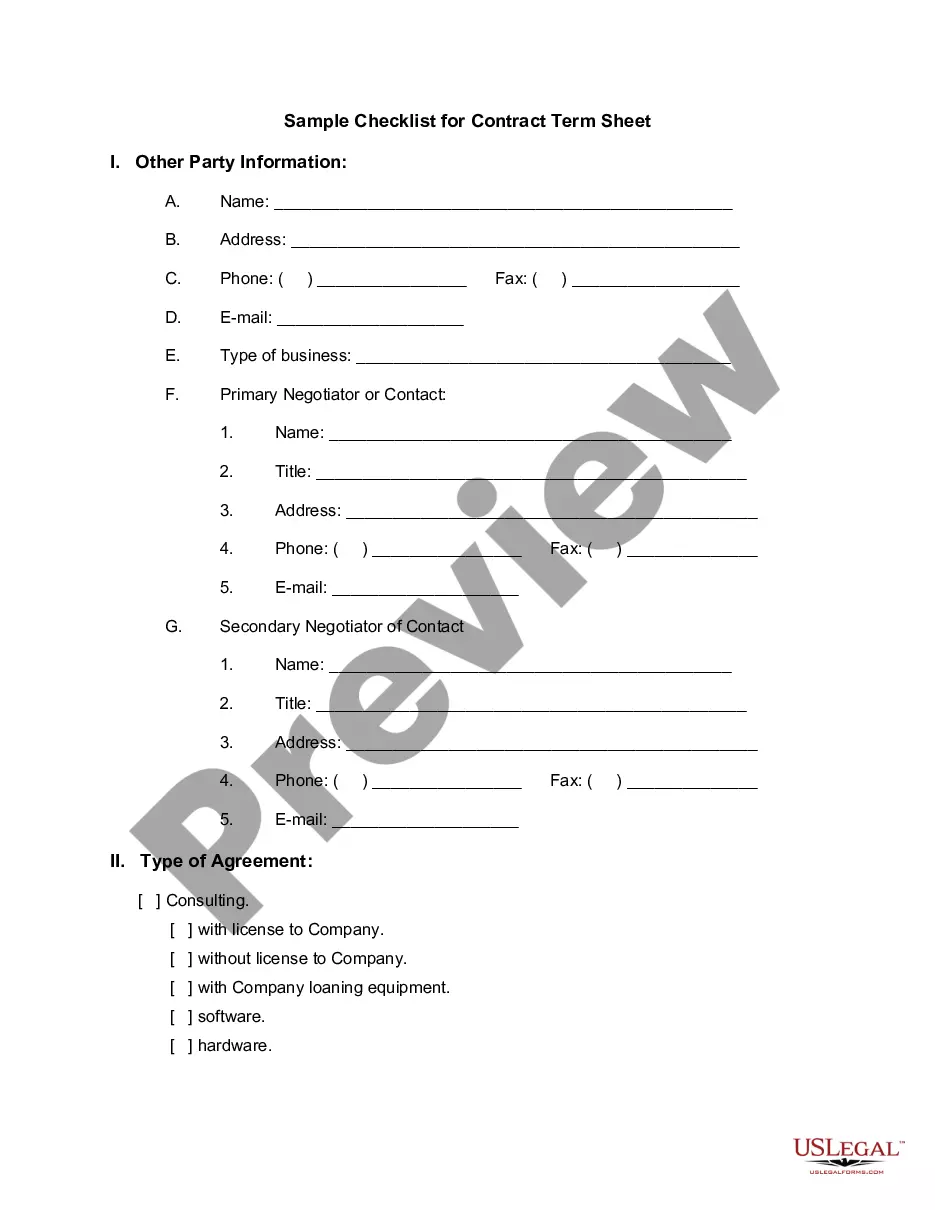

How to fill out Escrow Agreement For Sale Of Real Property With Regard To Deposit Of Earnest Money?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the premier source of legal documents accessible online.

Take advantage of the site's simple and convenient search feature to find the documents you require.

A variety of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finish the purchase. Step 6. Select the format of the legal document and download it to your computer. Step 7. Complete, modify, and print or sign the Iowa Escrow Agreement for Sale of Real Property concerning Deposit of Earnest Money.

- Utilize US Legal Forms to download the Iowa Escrow Agreement for Sale of Real Property concerning Deposit of Earnest Money with just a couple of clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Iowa Escrow Agreement for Sale of Real Property regarding Deposit of Earnest Money.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Earnest money protects the seller if the buyer backs out. It's typically around 1 3% of the sale price and is held in an escrow account until the deal is complete. The exact amount depends on what's customary in your market.

Will my earnest money earn interest between contract and closing? PROBABLY NOT. Most earnest money is held by real estate brokers in non-interest-bearing trust or escrow accounts. In order for the money to earn interest, the buyer and seller must agree, and they also must determine who will earn the interest.

Earnest money refers to the deposit paid by a buyer to a seller, reflecting the good faith of a buyer in purchasing a home. The money buys more time to the buyer before closing the deal to arrange for funding and perform the hunt for names, property valuation, and inspections.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

Earnest money is a deposit made to a seller that represents a buyer's good faith to buy a home. The money gives the buyer extra time to get financing and conduct the title search, property appraisal, and inspections before closing.

Typically, you pay earnest money to an escrow account or trust under a third-party like a legal firm, real estate broker or title company. Acceptable payment methods include personal check, certified check and wire transfer. The funds remain in the trust or escrow account until closing.

Earnest money refers to the deposit paid by a buyer to a seller, reflecting the good faith of a buyer in purchasing a home. The money buys more time to the buyer before closing the deal to arrange for funding and perform the hunt for names, property valuation, and inspections.

If a Buyer backs out of the deal without valid cause, it would result in forfeiture of the Buyer's earnest money. Can I get my earnest money returned to me? A Buyer is only qualified to receive refunded earnest money if he had, according to the terms of the contract, valid cause to do so.

Interest shall be disbursed to the owner or owners of the funds at the time of settlement of the transaction or as agreed to in the management contract and shall be properly accounted for on closing statements. A broker shall not disburse interest on trust funds except as provided in 13.1(3) and 13.1(7).