Iowa Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

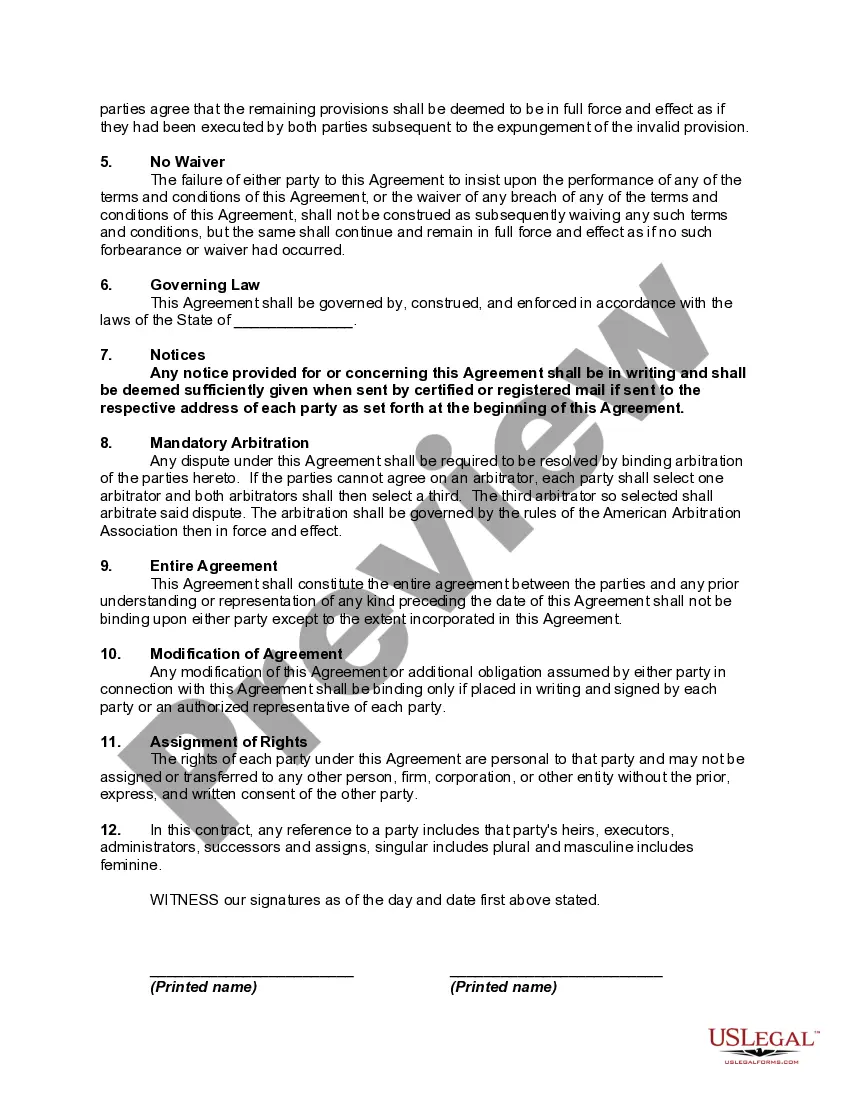

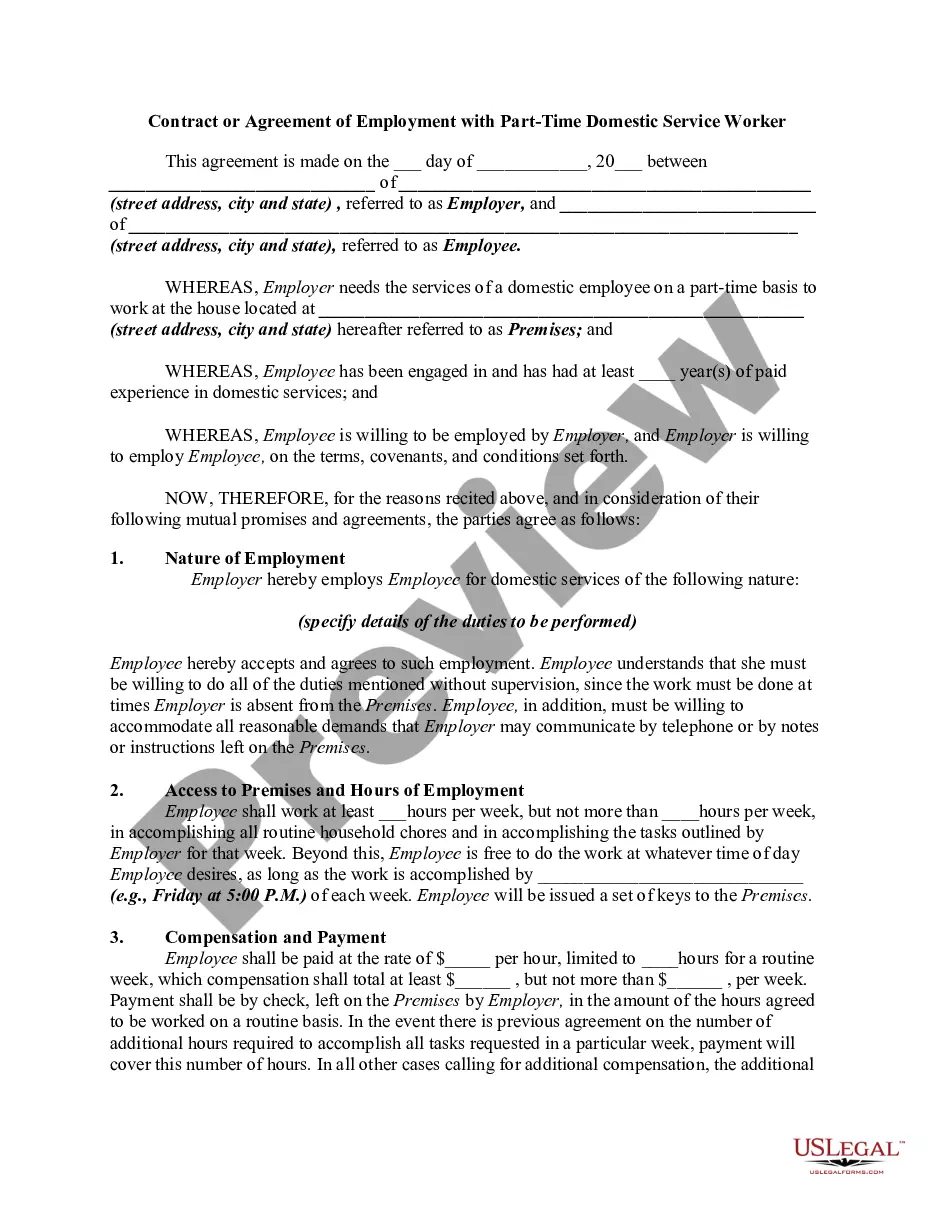

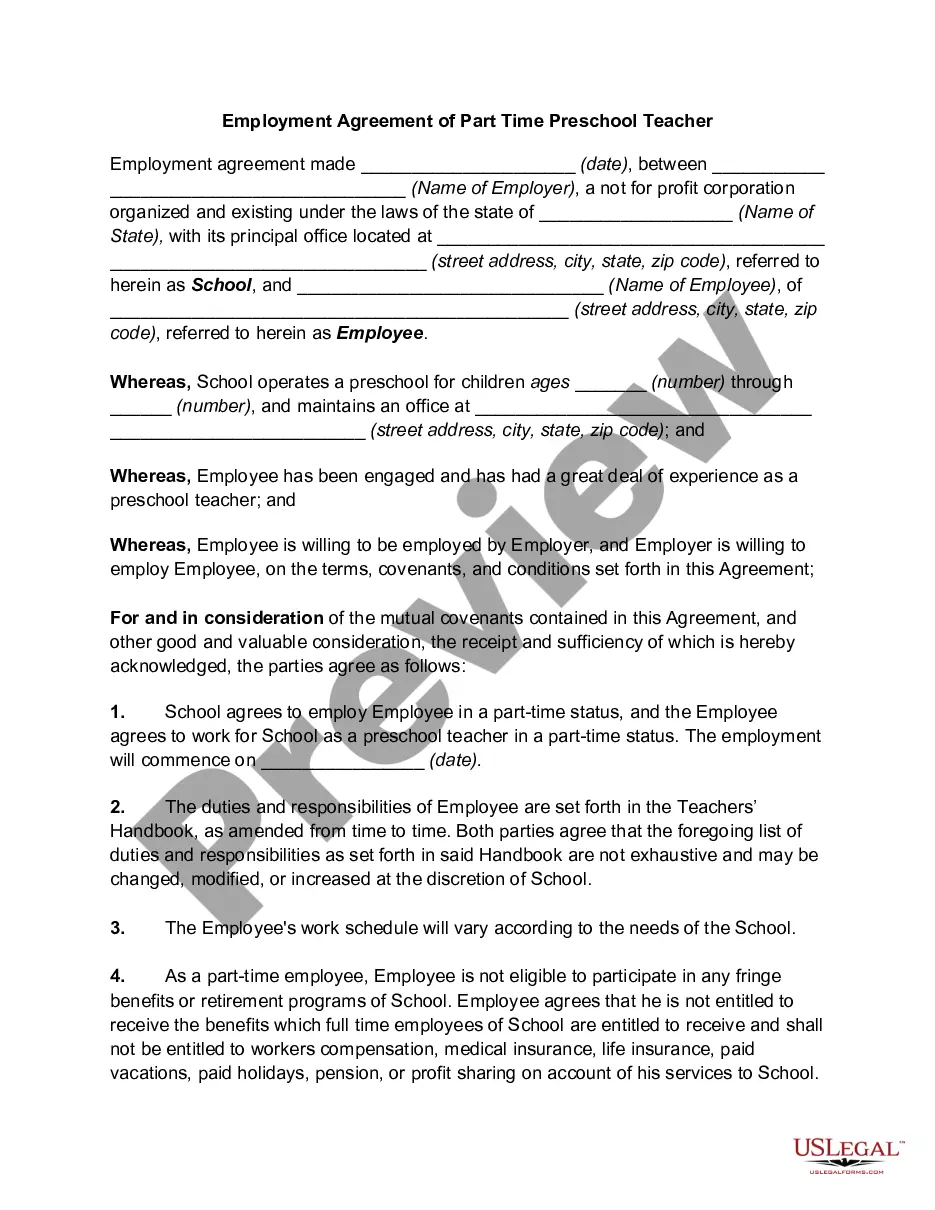

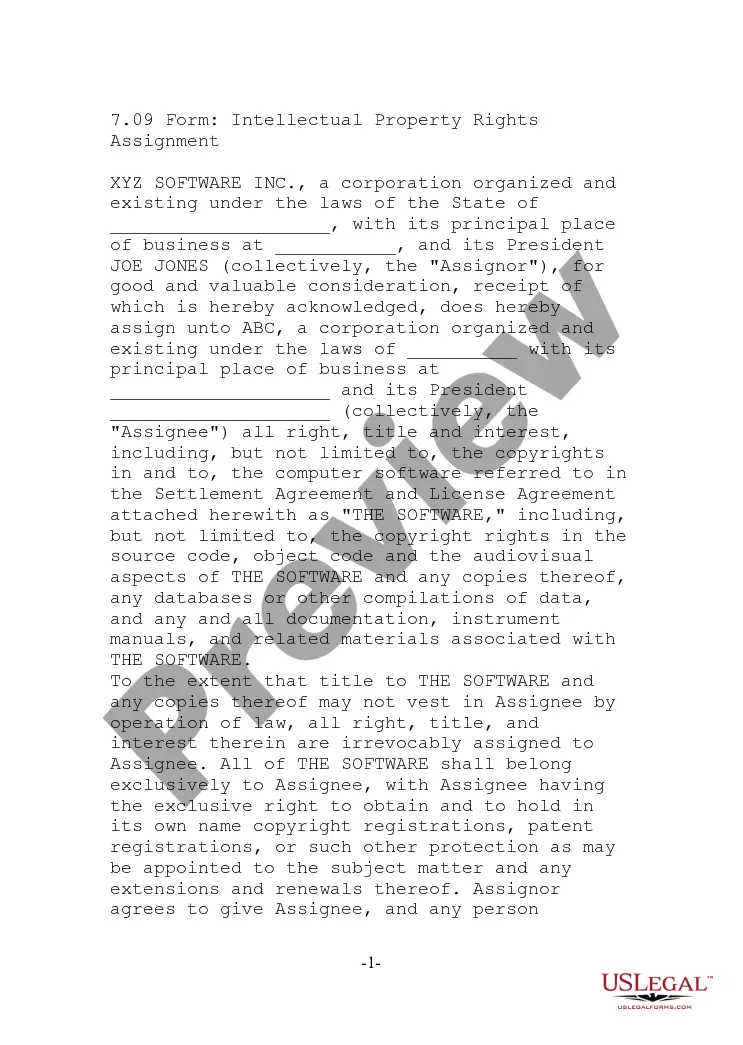

Are you currently in a circumstance where you require documents for both business and personal activities almost every day? There are numerous legal document templates available online, but locating reliable ones can be challenging. US Legal Forms provides thousands of form templates, including the Iowa Contract for Part-Time Assistance from Independent Contractor, designed to meet both federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, just Log In. After that, you can download the Iowa Contract for Part-Time Assistance from Independent Contractor template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Access all the document templates you have purchased in the My documents section. You can retrieve another copy of Iowa Contract for Part-Time Assistance from Independent Contractor at any time if needed. Simply select the required form to download or print the template.

Utilize US Legal Forms, one of the most extensive collections of legal documents, to save time and prevent errors. The service offers well-crafted legal document templates suitable for diverse purposes. Create an account on US Legal Forms and start simplifying your life.

- Identify the form you require and ensure it is applicable to the correct area/state.

- Utilize the Preview button to inspect the document.

- Review the description to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search box to find the form that aligns with your requirements.

- Once you find the appropriate form, click Buy now.

- Choose the pricing plan you prefer, fill in the necessary details to create your account, and complete the purchase using PayPal or Visa or Mastercard.

- Select a convenient paper format and download your copy.

Form popularity

FAQ

The 2 year contractor rule refers to a guideline that limits certain practices regarding the hire of independent contractors. This rule often comes into play when determining if a contractor has been treated like an employee. When drafting your Iowa Contract for Part-Time Assistance from Independent Contractor, be mindful of this guideline to ensure compliance with regulations.

While 1099 employees typically do not receive benefits similar to W-2 employees, a company can choose to offer them. Offering benefits may help enhance relationships and ensure project completion. If this applies to your agreement, consider detailing any benefits in your Iowa Contract for Part-Time Assistance from Independent Contractor.

Yes, you can give bonuses to independent contractors as a way to incentivize performance. Bonuses can enhance motivation and establish goodwill if well-defined in an Iowa Contract for Part-Time Assistance from Independent Contractor. Be sure to clarify any bonus criteria or amounts in your contract.

Offering benefits to independent contractors is not standard practice, but it is possible. Some companies choose to provide limited benefits to attract and retain quality contractors. If you decide to include benefits within your Iowa Contract for Part-Time Assistance from Independent Contractor, clearly outline these provisions to avoid confusion.

Typically, independent contractors do not receive benefits like full-time employees. Their compensation is often higher to account for this absence of benefits. When using an Iowa Contract for Part-Time Assistance from Independent Contractor, you can specify any additional compensation or incentives to attract skilled contractors.

Yes, you can choose to offer benefits to one employee while not offering them to another. This decision often depends on each employee's role, hours worked, and contract terms. When creating an Iowa Contract for Part-Time Assistance from Independent Contractor, ensure you outline any specific agreements regarding benefits clearly.

Several key rules govern 1099 employees. They must operate under the terms set out in any contract, like the Iowa Contract for Part-Time Assistance from Independent Contractor, and are considered independent contractors responsible for their taxes. Additionally, they should control how they complete their work, offering flexibility outside traditional employer oversight.

While it may not be legally required, having a contract for a 1099 employee is highly recommended. Using the Iowa Contract for Part-Time Assistance from Independent Contractor provides clarity on duties, payment terms, and expectations. A well-drafted contract can reduce misunderstandings and protect both parties involved.

Yes, a 1099 employee is indeed classified as contract labor. This categorization applies when they work based on a contract, such as the Iowa Contract for Part-Time Assistance from Independent Contractor. This means they operate independently and are responsible for their own taxes, unlike traditional employees.

When you hire a 1099 employee under the Iowa Contract for Part-Time Assistance from Independent Contractor, you need essential paperwork. First, collect their W-9 form to obtain their Taxpayer Identification Number. Additionally, keep a copy of any contracts outlining the terms of your agreement to ensure clarity and legal compliance.