Iowa Self-Employed Part Time Employee Contract

Description

How to fill out Self-Employed Part Time Employee Contract?

You can spend countless hours on the internet searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that have been reviewed by experts.

You can easily obtain or print the Iowa Self-Employed Part Time Employee Agreement from their service.

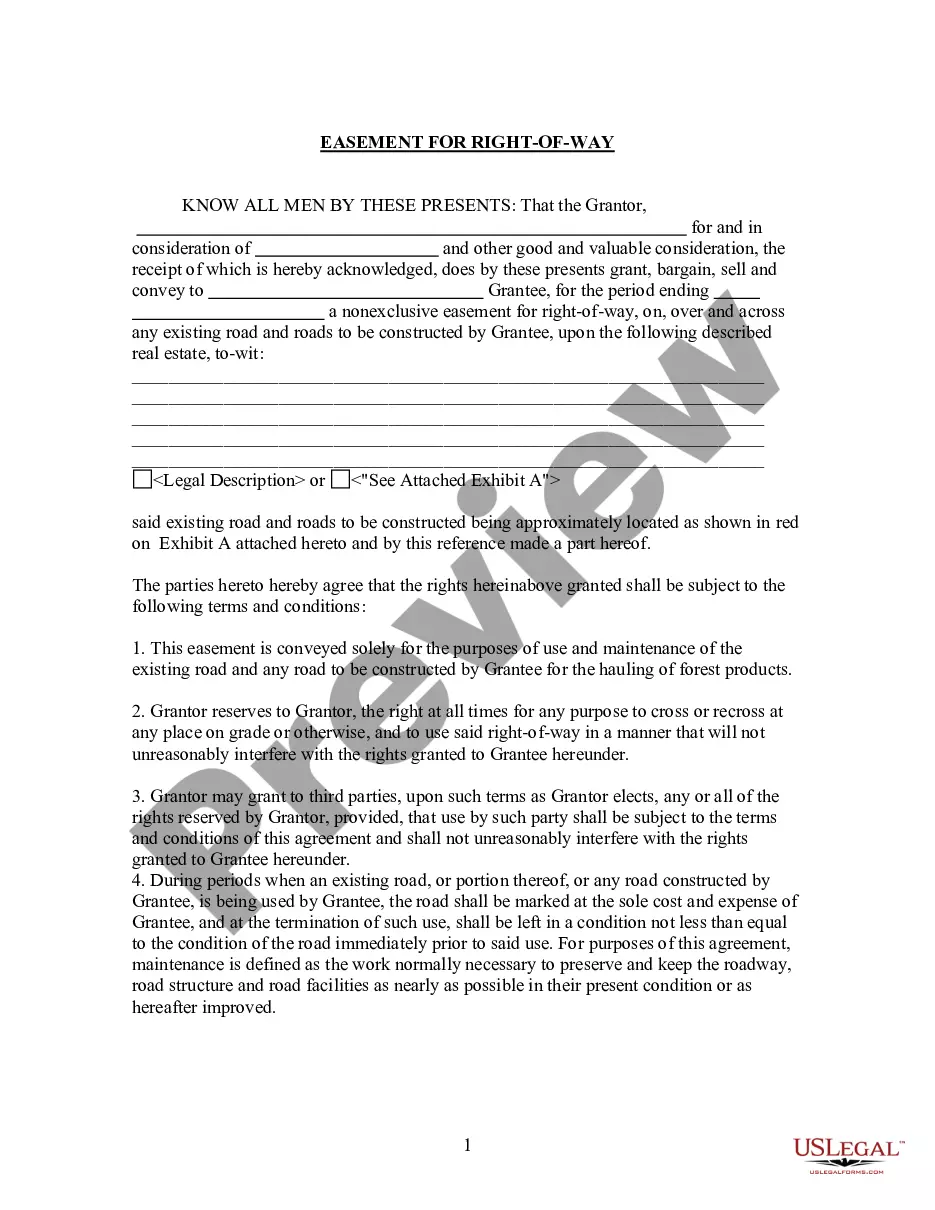

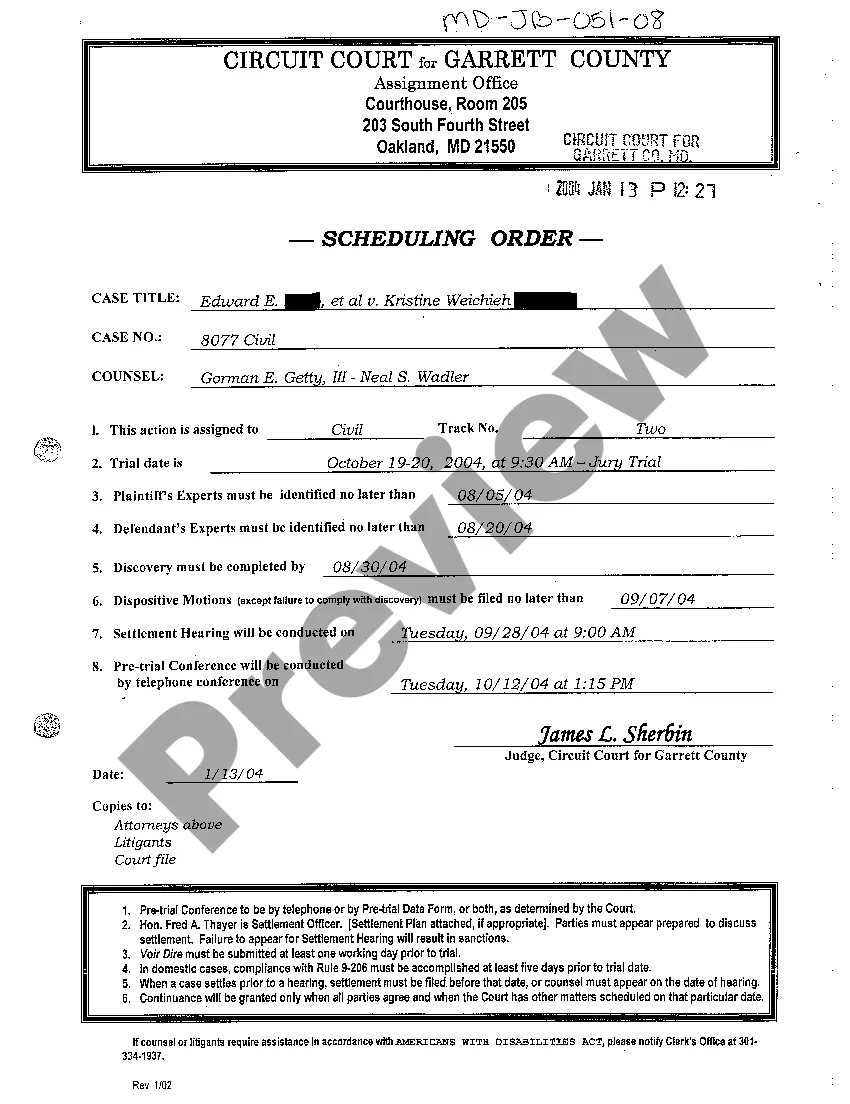

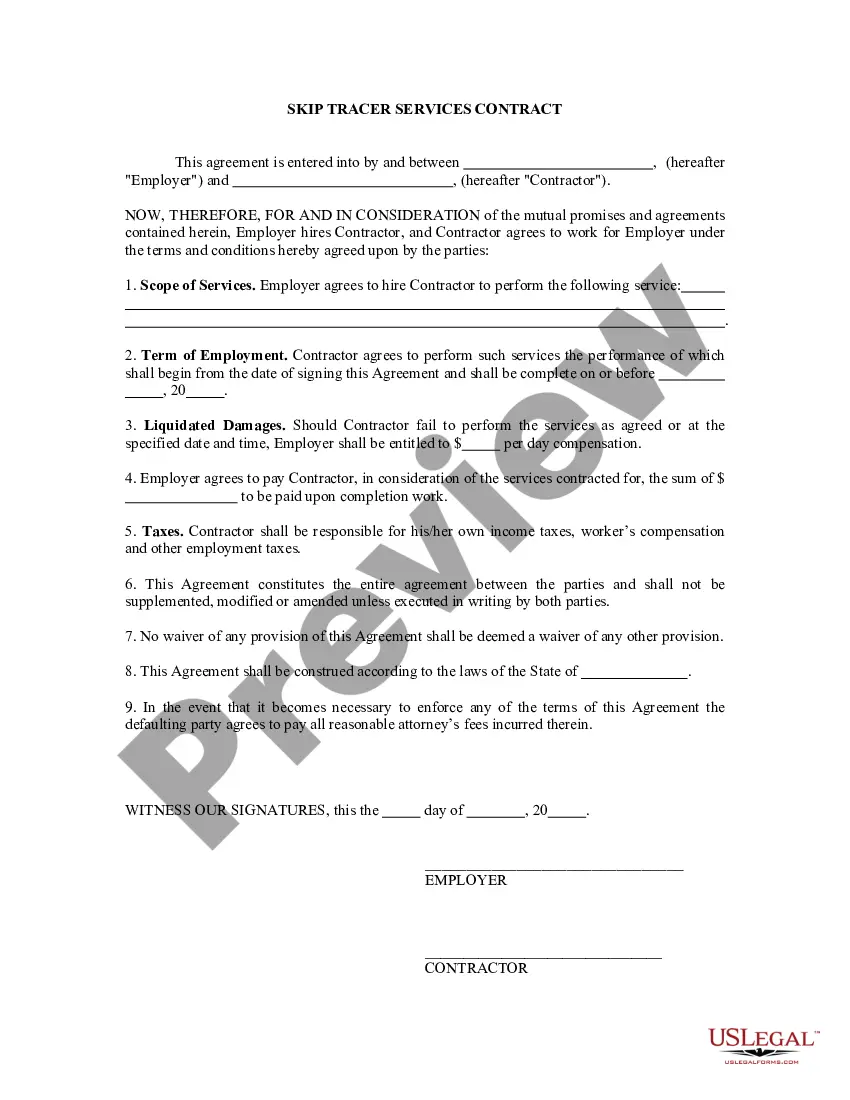

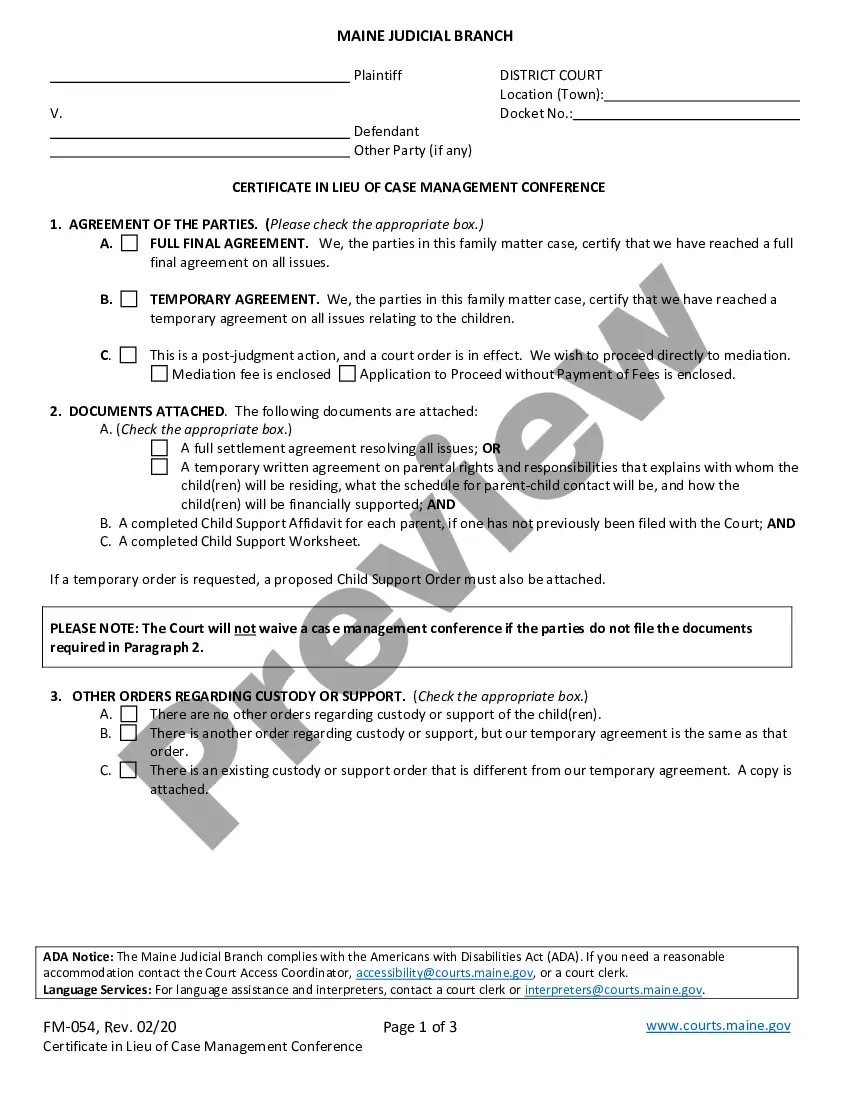

If available, use the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and select the Download option.

- Then, you can complete, modify, print, or sign the Iowa Self-Employed Part Time Employee Agreement.

- Every legal document template you obtain is yours forever.

- To get an extra copy of any purchased form, go to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Yes. You can be employed and self-employed at the same time. This would usually be the case if you were doing two jobs. For example, if you work for yourself as a hairdresser during the day but in the evenings you work as a receptionist in a hotel, you will be both self-employed and employed.

When you're self-employed, you pay income tax on your trading profits not your total income. To work out your trading profits, simply deduct your business expenses from your total income. This is the amount you'll pay Income Tax on.

You can be employed for your day job and self-employed as a freelance in your spare time, it's perfectly legal. When you start working for yourself, you need to inform HM Revenue & Customs (HMRC the UK tax authority) by registering for Self Assessment, which is the system HMRC uses to collect Income Tax.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

In short, Yes! You absolutely can be employed and freelance on the side. Actually, you will find that there are many freelancers holding onto full time or part-time jobs while they grow their own freelance client base and their freelancing pays them the salary they need.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Yes definitely you can be employed and self-employed at the same time, it just means some of your income is taxed at source through PAYE and some will need to be declared on a Self Assessment Tax Return by you.