As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Iowa Report of Independent Accountants after Audit of Financial Statements

Description

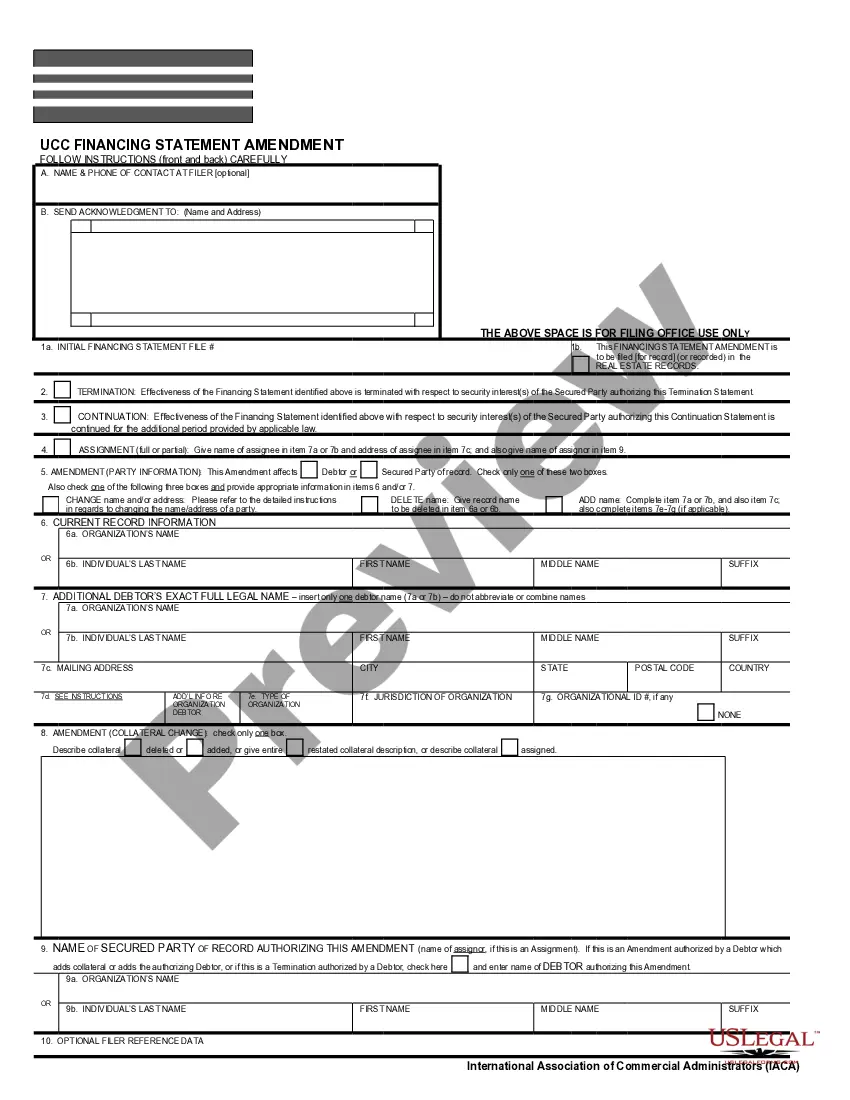

How to fill out Report Of Independent Accountants After Audit Of Financial Statements?

If you require extensive, acquire, or create official document templates, utilize US Legal Forms, the largest collection of official forms available online.

Utilize the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Every official document template you purchase is yours indefinitely.

You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

- Utilize US Legal Forms to find the Iowa Report of Independent Accountants post Audit of Financial Statements in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Iowa Report of Independent Accountants post Audit of Financial Statements.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form’s contents. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other templates of the official form.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your official form and download it onto your device.

- Step 7. Complete, modify, and print or sign the Iowa Report of Independent Accountants after Audit of Financial Statements.

Form popularity

FAQ

An independent auditor assesses an organization's financial statements to ensure accuracy and compliance with accounting standards. During the audit, they examine records, test transactions, and evaluate internal controls, ultimately producing the Iowa Report of Independent Accountants after Audit of Financial Statements. This report serves to provide stakeholders with confidence in the financial health of the organization. Engaging a recognized platform like uslegalforms can simplify the audit process and provide crucial resources.

Not all financial statements require an audit; it often depends on the type of organization and applicable laws. In Iowa, businesses may only need to have an Iowa Report of Independent Accountants after Audit of Financial Statements based on their financial thresholds or legal structure. Smaller businesses and startups might opt for simpler reviews instead. Carefully consider your circumstances to determine the best path for your financial reporting needs.

The need for audited financial statements usually depends on your business structure and industry regulations. If you operate in Iowa, specific entities like larger corporations or organizations accepting certain types of funding often require the Iowa Report of Independent Accountants after Audit of Financial Statements. To make an informed decision, evaluate your business size, growth plans, and stakeholder expectations.

Whether you need to file audited financial statements depends on your business type and financial activities. If you are a public company or meet specific regulatory criteria in Iowa, you will likely need to file an Iowa Report of Independent Accountants after Audit of Financial Statements. If you’re unsure, consulting a financial advisor can provide clarity on your requirements and help assess your situation effectively.

Entities such as public companies, financial institutions, and non-profit organizations typically need to file audited financial statements. If your organization operates in Iowa and meets specific revenue thresholds, you may also be required to submit an Iowa Report of Independent Accountants after Audit of Financial Statements. Additionally, certain lenders or grants may mandate audited statements before providing funds. Hence, review your requirements to ensure compliance.

Small businesses often benefit from audited financial statements, as these documents provide credibility and assurance to stakeholders. Although not all small businesses are required to obtain audits, pursuing an Iowa Report of Independent Accountants after Audit of Financial Statements can strengthen their financial standing. An audit can help attract investors, secure loans, and improve overall financial health. Therefore, consider an audit if you plan on growth or seeking external funding.

An independent CPA is associated with the financial statements when they conduct an audit, review, or compilation of the financial data. Their involvement is crucial to ensure that the statements comply with accounting standards and provide accurate information. The Iowa Report of Independent Accountants after Audit of Financial Statements highlights this association, reaffirming the reliability of the financial information presented.

An independent audit report is generated by external auditors to provide an objective assessment, while a statutory audit report fulfills legal requirements set by government regulations. Both reports serve to ensure financial accuracy, but they differ in their purposes and obligations. An Iowa Report of Independent Accountants after Audit of Financial Statements provides insights for both stakeholders and compliance needs.

An independent accountant's review report is a less detailed assessment than a full audit but still provides valuable insights into financial statements. This report offers a limited level of assurance, identifying any material modifications needed for clarity. By acquiring an Iowa Report of Independent Accountants after Audit of Financial Statements, businesses demonstrate a commitment to transparency and accountability.

An independent audit report is a formal opinion given by an auditor regarding the accuracy of a company's financial statements. This report assesses whether the statements conform to generally accepted accounting principles (GAAP). Receiving an Iowa Report of Independent Accountants after Audit of Financial Statements means you are benefiting from an impartial evaluation of your financial health.