Iowa Personal Monthly Budget Worksheet

Description

How to fill out Personal Monthly Budget Worksheet?

Have you ever found yourself needing documents for potential business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but locating reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Iowa Personal Monthly Budget Worksheet, designed to meet federal and state requirements.

When you find the appropriate form, simply click Acquire now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Iowa Personal Monthly Budget Worksheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and confirm that it is for the correct city/county.

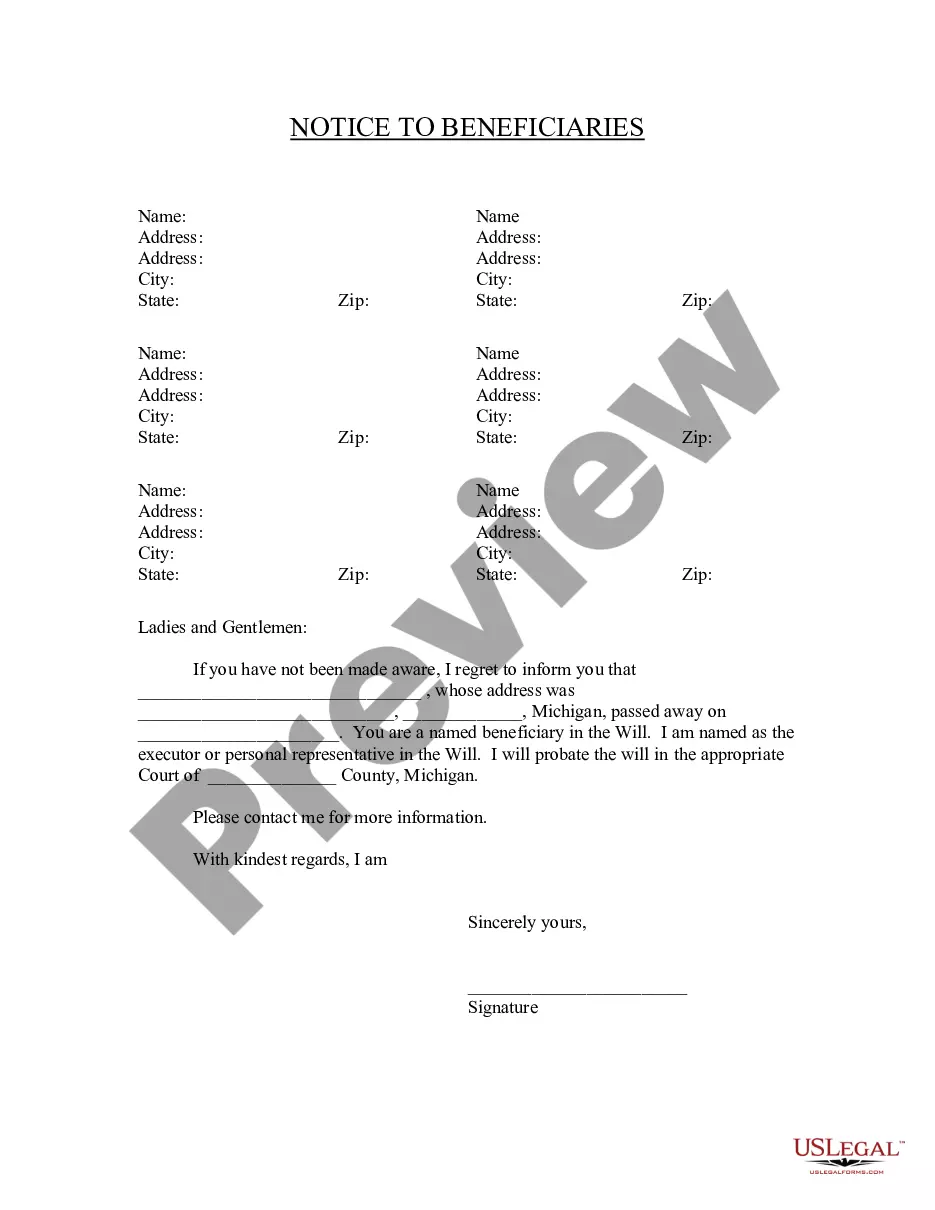

- Utilize the Review option to evaluate the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

Individuals who receive additional income or have adjustments to their taxable income typically complete Schedule 1. This includes freelancers, independent contractors, and those receiving miscellaneous income. Accurately filling out Schedule 1 ensures compliance with tax regulations and may affect your refund or tax due. The Iowa Personal Monthly Budget Worksheet can help you compile necessary information for this form efficiently.

In Iowa, you can deduct certain vehicle registration fees, particularly if they are assessed based on the value of your vehicle. These fees can qualify as an itemized deduction on your tax return. Knowing how these fees work helps you make informed decisions about vehicle purchases and budgeting. Using the Iowa Personal Monthly Budget Worksheet can help you monitor these costs effectively.

Taxable refunds on Schedule 1 refer to amounts that you received that may affect your taxable income. This includes refunds related to state taxes that you previously claimed. Understanding these refunds is crucial to ensure you report them correctly on your tax return to avoid any penalties. Utilizing the Iowa Personal Monthly Budget Worksheet can help you categorize and recall such refunds easily.

The purpose of a Schedule 1 form is to provide a detailed account of income that may not be captured in your primary tax forms. This includes items such as rental income, unemployment compensation, and other miscellaneous incomes. Accurately completing Schedule 1 ensures you comply with tax laws while potentially reducing your overall tax liability. Incorporating data from your Iowa Personal Monthly Budget Worksheet can streamline this process.

A Schedule I form is used to report additional income and adjustments to income for your tax return. It captures various types of income that might not be included in your standard tax forms. Completing this form allows you to accurately report your income and may help you determine taxes owed or refunds due. Using a comprehensive tool like the Iowa Personal Monthly Budget Worksheet can assist you in managing your finances and understanding your tax obligations.

The 50 20 30 budget rule is a straightforward budgeting method that suggests you allocate 50% of your income to necessities, 20% to savings, and 30% to discretionary spending. This flexible framework allows for a balanced financial approach. Using an Iowa Personal Monthly Budget Worksheet, you can easily apply this rule to achieve financial health and stability.

Creating a monthly budget for yourself involves assessing your income against your expenses. Identify your fixed and variable costs, and then determine how much you want to save. Utilize an Iowa Personal Monthly Budget Worksheet to organize your financial data and make informed decisions about your spending and savings habits.

To create a monthly budget for beginners, start by listing your monthly income and fixed expenses. Next, estimate your variable expenses and savings goals. An Iowa Personal Monthly Budget Worksheet can guide you through this process, ensuring you account for all aspects of your financial life so you can work toward your goals confidently.

A good monthly personal budget varies based on individual circumstances, but it generally aligns your income with your expenses. Aim to cover your essential needs first, set aside savings, and allow for discretionary spending. Using an Iowa Personal Monthly Budget Worksheet can help you tailor your budget to fit your lifestyle and financial objectives.

The 50 30 20 budget rule template is a simple method for managing your finances. It suggests you allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. This approach helps you create an effective Iowa Personal Monthly Budget Worksheet that balances your essential expenses with your financial goals.