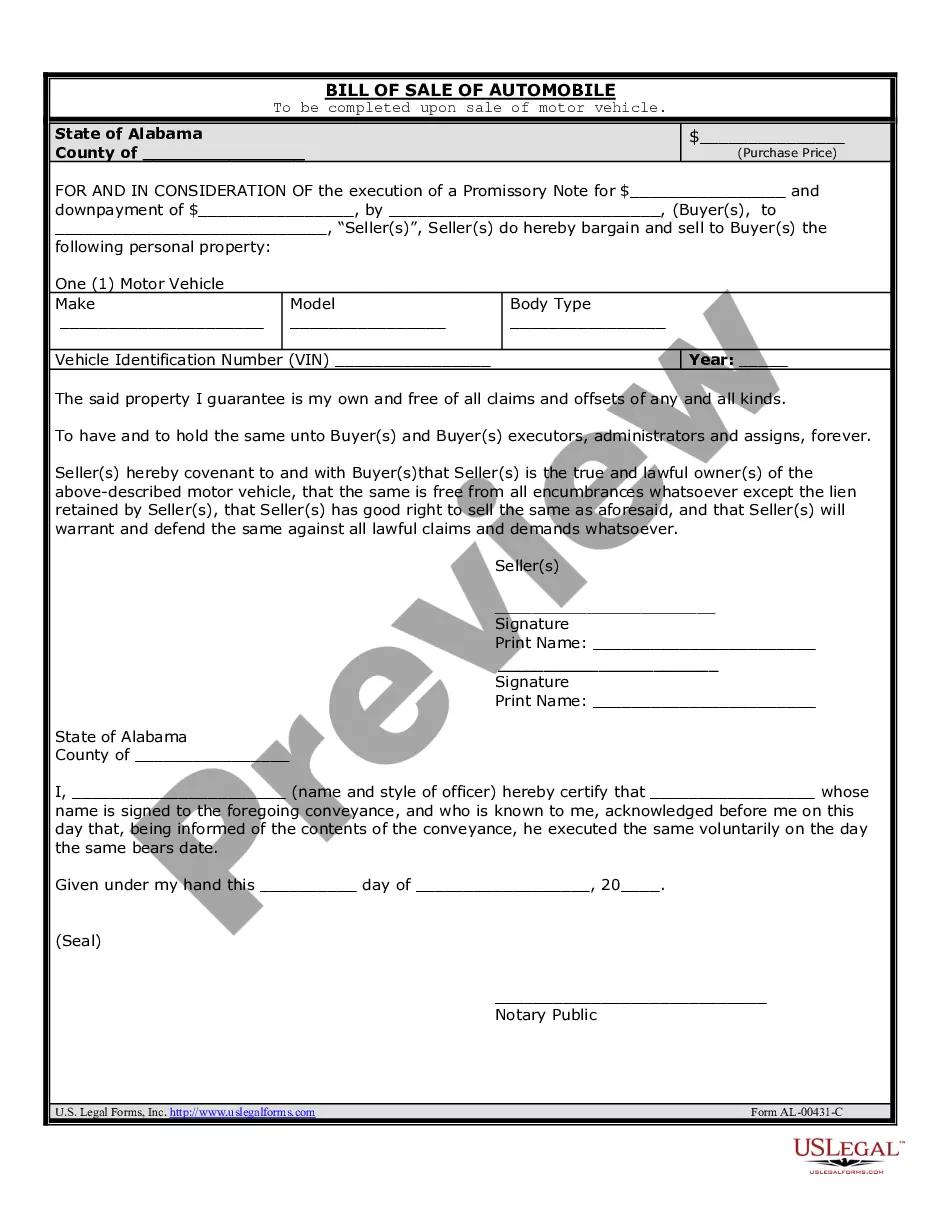

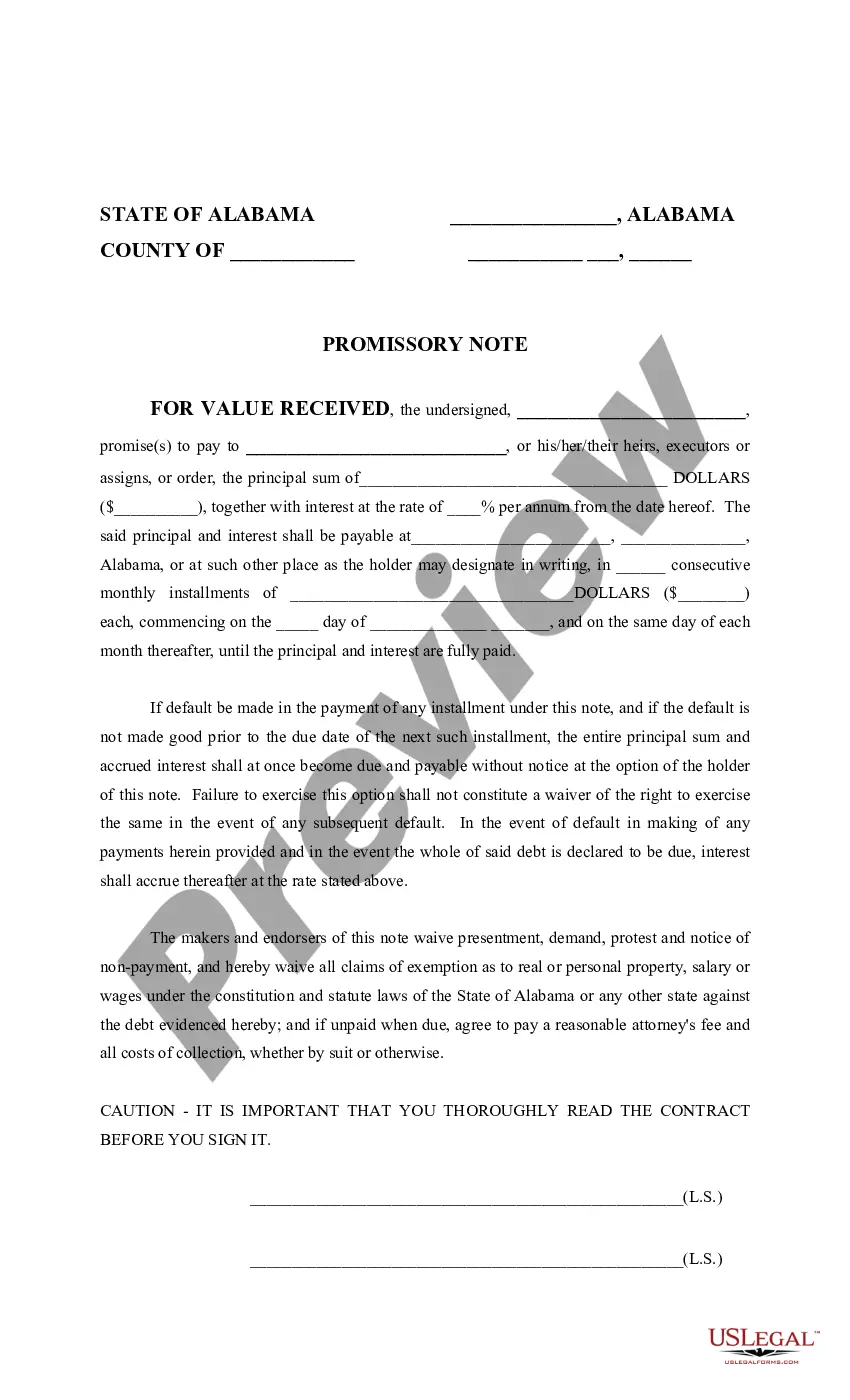

Iowa Receipt for Down Payment for Real Estate

Description

How to fill out Receipt For Down Payment For Real Estate?

Locating the correct authorized document template can be a challenge.

Certainly, there is a wide range of templates accessible on the web, but how can you acquire the authorized format you need.

Utilize the US Legal Forms website. The service provides an extensive selection of templates, such as the Iowa Receipt for Down Payment for Real Estate, that you can utilize for both commercial and personal purposes. All of the documents are reviewed by experts and meet federal and state standards.

Once you are confident that the document is correct, click the Acquire now button to obtain the form. Choose the pricing option you want and enter the necessary details. Create your account and process the payment using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Complete, edit, and print and sign the obtained Iowa Receipt for Down Payment for Real Estate. US Legal Forms is indeed the largest repository of authorized documents where you can find various file templates. Use the service to download professionally crafted documents that adhere to state regulations.

- If you are currently logged in, sign in to your account and click the Obtain button to receive the Iowa Receipt for Down Payment for Real Estate.

- Use your account to search through the authorized documents you may have previously purchased.

- Visit the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your county/region. You can review the file with the Preview button and read the document description to confirm this is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate document.

Form popularity

FAQ

To obtain your property tax statement in Iowa, you can visit your local county treasurer's office. Many counties also offer online access to property tax records, making it easy to find your statement. If you need further assistance, consider using platforms like USLegalForms to streamline your process. Keeping your Iowa Receipt for Down Payment for Real Estate organized can help when addressing any property tax concerns.

In Iowa, you may qualify for property tax relief if you are 65 years or older. Additionally, certain programs, like the Homestead Tax Credit, can provide exemptions for eligible seniors. However, it is essential to understand that even if you qualify for tax relief, you may still receive a property tax statement. Always keep your Iowa Receipt for Down Payment for Real Estate handy to establish total expenses related to your property.

In Iowa, seniors may qualify for a property tax exemption starting at age 65. This exemption can significantly reduce property tax liability for eligible homeowners. However, they should still maintain their financial records and keep the Iowa Receipt for Down Payment for Real Estate handy, as it may be required to verify ownership and eligibility when applying for this benefit.

While it is not mandatory to hire an attorney to buy a house in Iowa, having legal support can be beneficial. An attorney can help you navigate the complexities of real estate transactions and ensure that your Iowa Receipt for Down Payment for Real Estate is properly executed. With expert guidance, you can avoid potential pitfalls and have peace of mind throughout the process.

Section 558.44 of Iowa law pertains to the receipt of down payments in real estate transactions. This section mandates that sellers provide buyers with an Iowa Receipt for Down Payment for Real Estate, ensuring transparency and record-keeping in financial exchanges. Understanding this section is crucial for both parties, as it safeguards their interests and promotes honest dealings. You can find template forms and legal guidance on platforms like USLegalForms to stay compliant with Iowa laws.

In Iowa, the buyer's agreement law outlines the rights and obligations of both buyers and sellers involved in real estate transactions. This law emphasizes the importance of clear agreements that detail the terms of the sale, including the Iowa Receipt for Down Payment for Real Estate. It protects buyers by ensuring they receive proper documentation and recourse in case of disputes. Utilizing legal resources, like USLegalForms, can help you navigate these agreements effectively.

Writing an invoice for a down payment requires you to list the date, the payment amount, and a description of the services or property involved. Include the names and contact information of both parties for clarity. Clearly indicate that this invoice serves specifically for the down payment on real estate, reinforcing its importance in the transaction. Utilizing platforms like US Legal Forms can simplify this process, ensuring that your Iowa Receipt for Down Payment for Real Estate meets all necessary legal standards.

Creating a receipt for payment involves detailing the date, the parties involved, and the payment amount. Include the purpose of the payment—whether it’s a down payment on real estate or a different transaction. Be sure to note any relevant transaction references or identification numbers. This documentation serves as a crucial element of an Iowa Receipt for Down Payment for Real Estate, offering proof for both the payer and the recipient.