New York Notice from Employer to Employee Regarding Early Termination of Continuation Coverage

Description

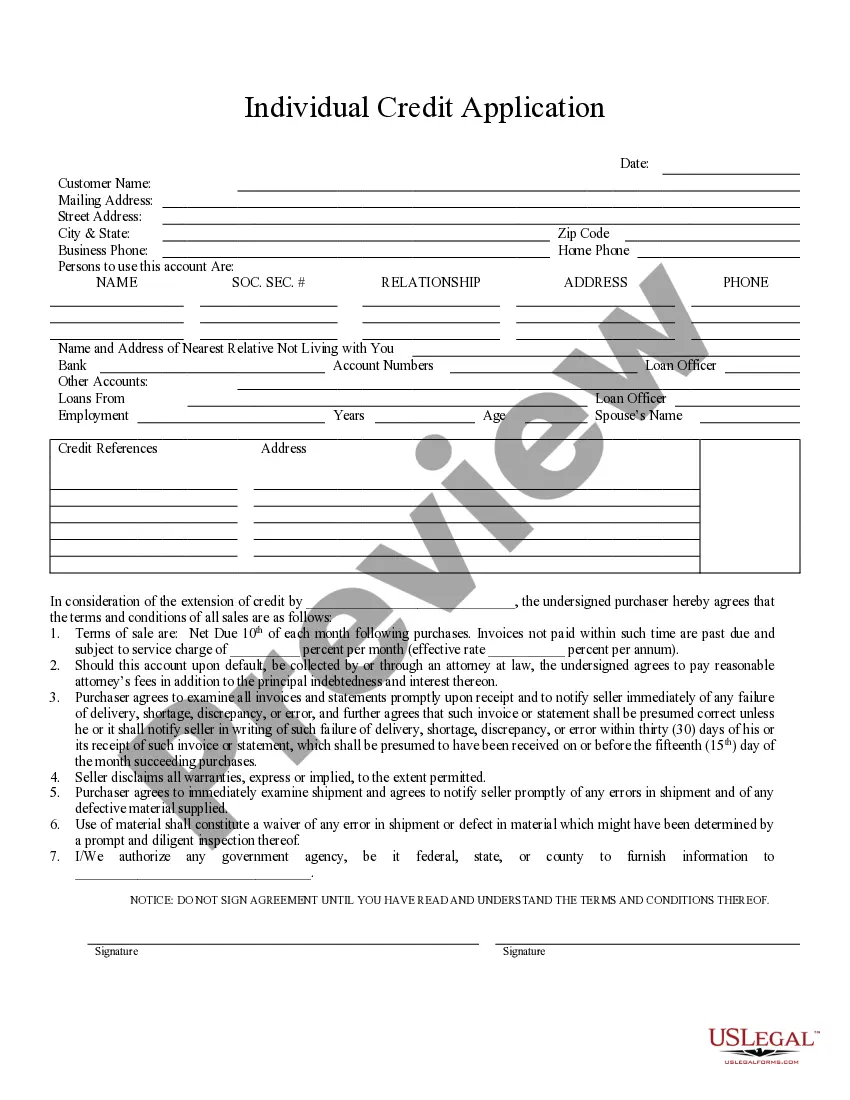

How to fill out Notice From Employer To Employee Regarding Early Termination Of Continuation Coverage?

Are you in a circumstance where you require documents for potentially business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of template documents, including the New York Notice from Employer to Employee Concerning Early Termination of Continuation Coverage, which can be filled out to comply with federal and state regulations.

After you secure the appropriate form, click Acquire now.

Choose the pricing plan you want, fill in the required details to create your account, and complete the payment with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Notice from Employer to Employee Concerning Early Termination of Continuation Coverage template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Utilize the Review option to examine the form.

- Read the details to confirm that you have selected the right document.

- If the form is not what you are looking for, use the Lookup field to find the document that meets your needs and requirements.

Form popularity

FAQ

Meet the Deadlines You should get a notice in the mail about your COBRA and Cal-COBRA rights. You have 60 days after being notified to sign up. If you are eligible for Federal COBRA and did not get a notice, contact your employer. If you are eligible for Cal-COBRA and did not get a notice, contact your health plan.

New York State law requires small employers (less than 20 employees) to provide the equivalent of COBRA benefits. You are entitled to 36 months of continued health coverage at a monthly cost to you of 102% of the actual cost to the employer which may be different from the amount deducted from your paychecks.

Yes you can collect both NYS Unemployment Insurance benefits and Workers' Compensation benefits at the same time.

In addition, employers can provide COBRA notices electronically (via email, text message, or through a website) during the Outbreak Period, if they reasonably believe that plan participants and beneficiaries have access to these electronic mediums.

New York employers are not required to provide health insurance to employees or their families, nor do they need to provide retirement benefits. However, a new federal law could make it more appealing for employers to do so.

Does my employer have to pay my regular health insurance premiums while I am out on workers' compensation? There is nothing in the workers' compensation law that requires the employer to do so. However, many employers offer an employment benefit by making such payments at least for a short period of time.

If you have a work-related injury your employer is not allowed to dismiss you within 6 months of being deemed unfit for work. This right is protected under the NSW Workers Compensation Act.

COBRA Notice of Early Termination of Continuation Coverage Continuation coverage must generally be made available for a maximum period (18, 29, or 36 months).

If your employer terminates your health insurance when you are receiving workers compensation benefits, he or she must give you notice in advance and an opportunity to continue to pay the premium yourself under the Federal Continuation of Health Coverage (COBRA) program.

New York requires employers to provide a written termination letter to employees, regardless of whether the employee's termination was voluntary or involuntary. The letter must state the date of termination of employment, and the date of termination of benefits.