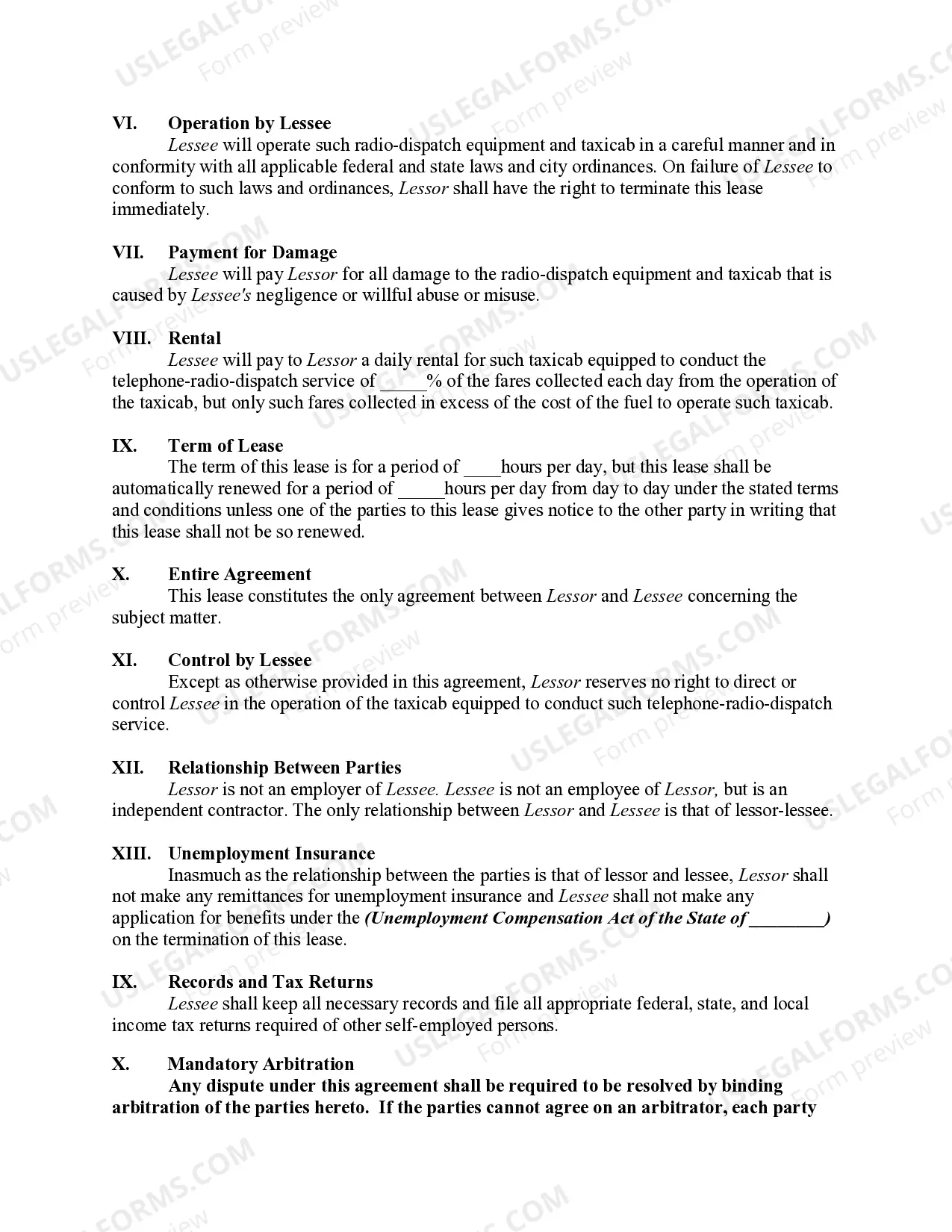

Iowa Lease of Taxicab

Description

How to fill out Lease Of Taxicab?

Locating the appropriate legal document format can be a challenge.

Clearly, there are numerous templates accessible online, but how can you obtain the legal form you need.

Utilize the US Legal Forms site. This service offers a vast array of templates, such as the Iowa Lease of Taxicab, suitable for both business and personal needs.

You can review the form using the Review button and check the form summary to confirm it is suitable for you.

- Each of the forms is reviewed by professionals and meets state and federal standards.

- If you are already registered, sign in to your account and click the Obtain button to retrieve the Iowa Lease of Taxicab.

- Use your account to browse the legal forms you may have purchased previously.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Yes, a bill of sale can be handwritten in Iowa, including for transactions related to an Iowa Lease of Taxicab. Just ensure that all necessary information is clearly written, such as the names of both parties, vehicle details, and the transaction date. A handwritten bill of sale is valid as long as it contains all required information.

Iowa does not require a notarized bill of sale for vehicle transactions, including those involving an Iowa Lease of Taxicab. However, having a notarized document can provide additional security and proof of authenticity for your records. It's wise to keep things organized and straightforward to prevent any potential disputes.

Filling out an Iowa bill of sale requires you to include key details such as the date of sale, a detailed description of the vehicle, and both parties' information. Make sure to mention that the transaction is related to an Iowa Lease of Taxicab to highlight the specific terms of the agreement. This document serves as proof of ownership and must be clear and concise.

To register a leased car in Iowa, you need to submit the Vehicle Registration Application along with the proof of your Iowa Lease of Taxicab. Also, provide the title from the vehicle's manufacturer and any additional forms required by the Iowa Department of Transportation. Completing these steps accurately helps you avoid delays and ensures you can operate your leased car legally.

To fill out an Iowa sales tax exemption certificate, start by entering your details, including your name, address, and sales tax permit number. You must clearly indicate the purpose of the exemption related to your Iowa Lease of Taxicab. Ensure you provide a valid signature and the date for authenticity to prevent any future complications.

The rental tax on vehicles in Iowa typically mirrors the standard sales tax rate of 6%. However, special rates may apply based on specific circumstances or local rules. As a business owner in the Iowa Lease of Taxicab sector, understanding these tax implications can help you maintain compliance and avoid penalties.

The tax on a vehicle in Iowa generally falls under the state sales tax rate of 6%, but additional fees may apply depending on the vehicle type and locality. For a leased vehicle under an Iowa Lease of Taxicab, it's crucial to account for these factors to ensure you meet all tax obligations.

In Iowa, the sales tax on recreational vehicles is typically set at 6%. However, this rate can differ based on local jurisdictions and specific conditions. If you're considering an Iowa Lease of Taxicab, it's advisable to consult current tax regulations to understand your obligations fully.

To obtain a resale certificate in Iowa, you need to fill out the appropriate application form provided by the Iowa Department of Revenue. You must provide information about your business and the types of products you sell. Once approved, use this certificate for purchases related to your Iowa Lease of Taxicab business without paying sales tax upfront.

Yes, rentals are generally taxable in Iowa. This includes rental income derived from leasing vehicles like those included in the Iowa Lease of Taxicab. To ensure compliance, it's crucial to calculate and collect the appropriate sales tax on rental transactions.