Iowa Tips and Tricks - July 2017

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Tips And Tricks - July 2017?

If you're seeking a method to adequately prepare the Iowa Tips and Tricks - July 2017 without employing a legal expert, you are in the perfect place.

US Legal Forms has established itself as the most comprehensive and trustworthy collection of official templates for every personal and business circumstance. Each document you find on our online platform is crafted in accordance with federal and state regulations, ensuring that your documents are properly organized.

Another significant benefit of US Legal Forms is that you will never misplace the documents you acquired - you can access any of your downloaded forms in the My documents tab of your profile whenever you need them.

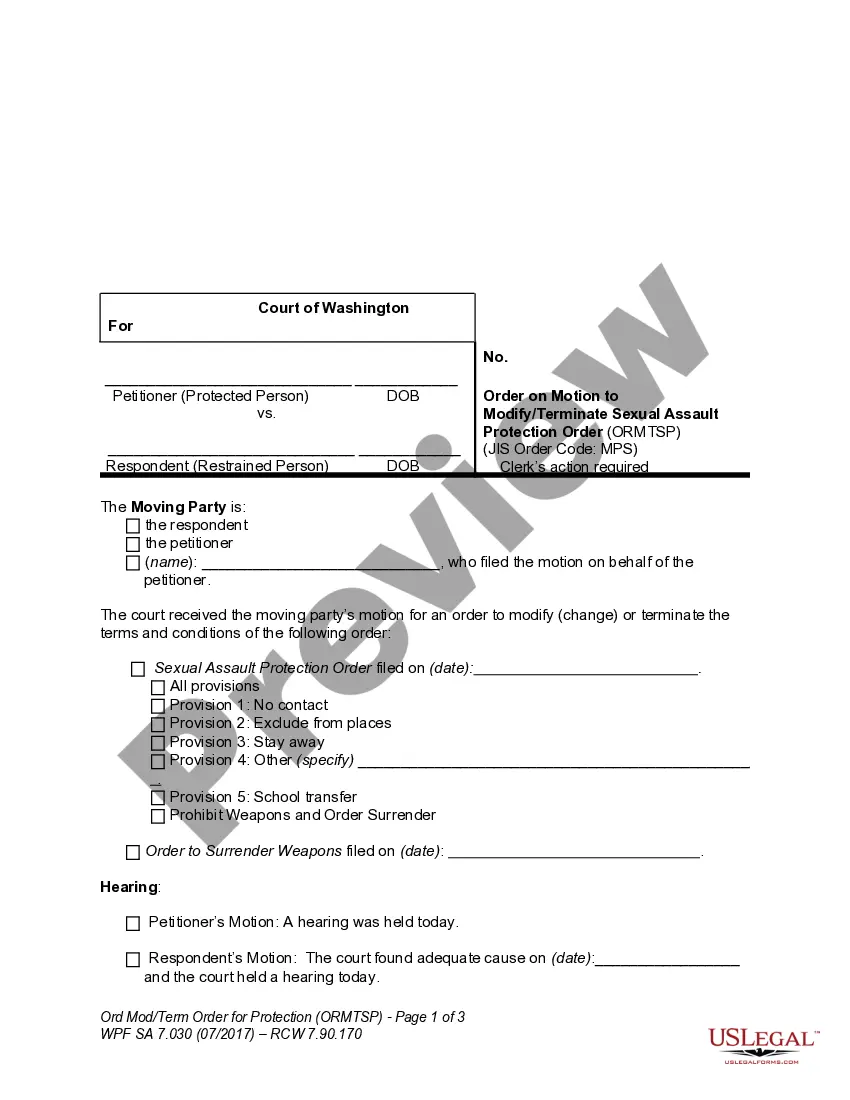

- Verify that the document displayed on the page aligns with your legal situation and state laws by reviewing its text description or browsing through the Preview mode.

- Enter the document title in the Search tab located at the top of the page and select your state from the dropdown list to find an alternate template if there are any discrepancies.

- Conduct a content review and click Buy now when you are sure that the paperwork meets all requirements.

- Log in to your account and press Download. If you don’t have an account, create one and choose a subscription plan.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be ready for download immediately after.

- Choose the format in which you want to save your Iowa Tips and Tricks - July 2017 and download it by clicking the corresponding button.

- Upload your template to an online editor for quick completion and signing, or print it out to fill in a hard copy manually.

Form popularity

FAQ

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents.Step 2: Report Your Income.Step 3: Claim Your Deductions.Step 4: Calculate Your Tax.Step 5: Claim Tax Credits.

You have two options when it comes to filing sales tax in Iowa: File online ? File online at the Iowa Department of Revenue. You can remit your Iowa tax payment through their online system. AutoFile ? AutoFile ? Let TaxJar file your sales tax for you. We take care of the payments, too.

The Iowa (IA) state sales tax rate is currently 6%. Depending on local municipalities, the total tax rate can be as high as 8%. Food and prescription drugs are exempt from sales tax. All businesses selling tangible personal property or engaging in retail sales must register with the state.

All monthly filers are required to file and pay electronically. If you collect and remit most excise taxes, you must file a return and pay those taxes each month.

You have two options when it comes to filing sales tax in Iowa: File online ? File online at the Iowa Department of Revenue. You can remit your Iowa tax payment through their online system. AutoFile ? AutoFile ? Let TaxJar file your sales tax for you. We take care of the payments, too.

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR.

The gain on the sale of a personal item is taxable. You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.