Iowa Tips and Tricks - January 2018

Description

How to fill out Iowa Tips And Tricks - January 2018?

How much time and resources do you generally allocate for producing official documentation.

There’s a greater chance to obtain such forms than employing legal professionals or spending countless hours searching online for an appropriate template.

Another advantage of our library is that you can access previously acquired documents securely stored in your profile under the My documents tab. Retrieve them at any time and re-complete your documents as often as necessary.

Conserve time and effort preparing formal documents with US Legal Forms, one of the most reliable online services. Join us today!

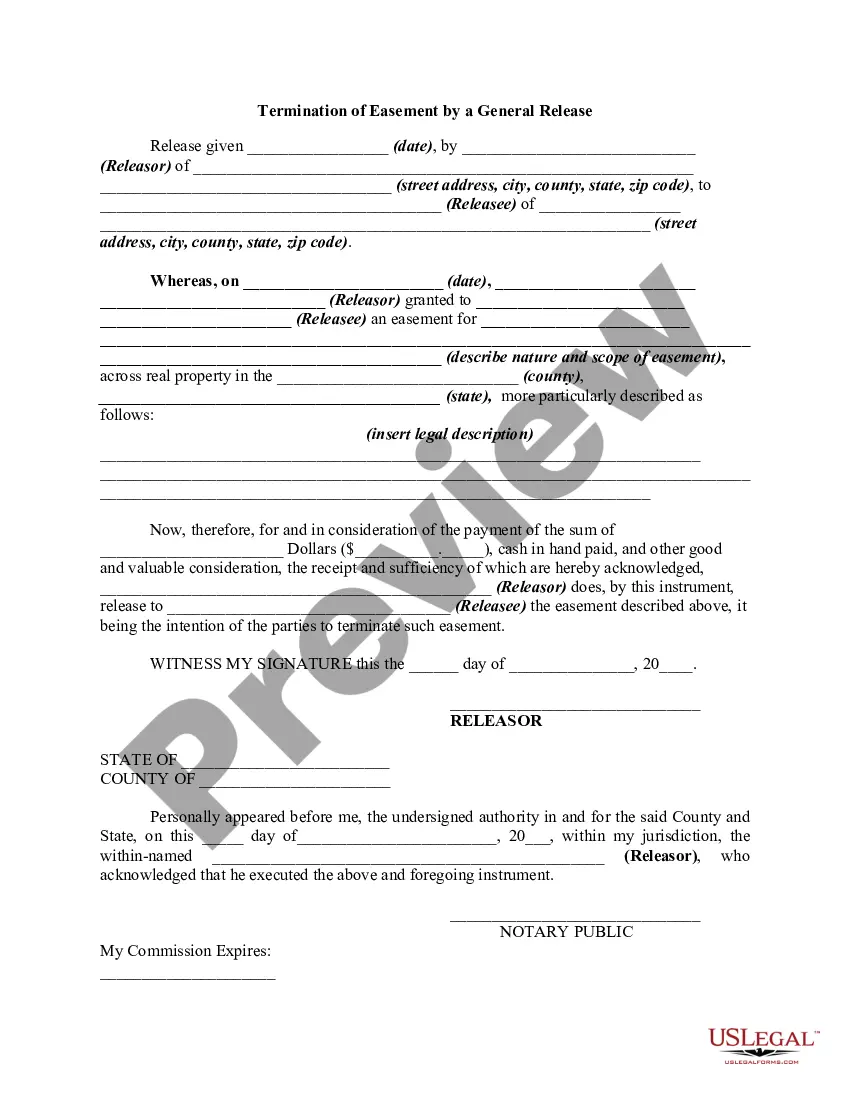

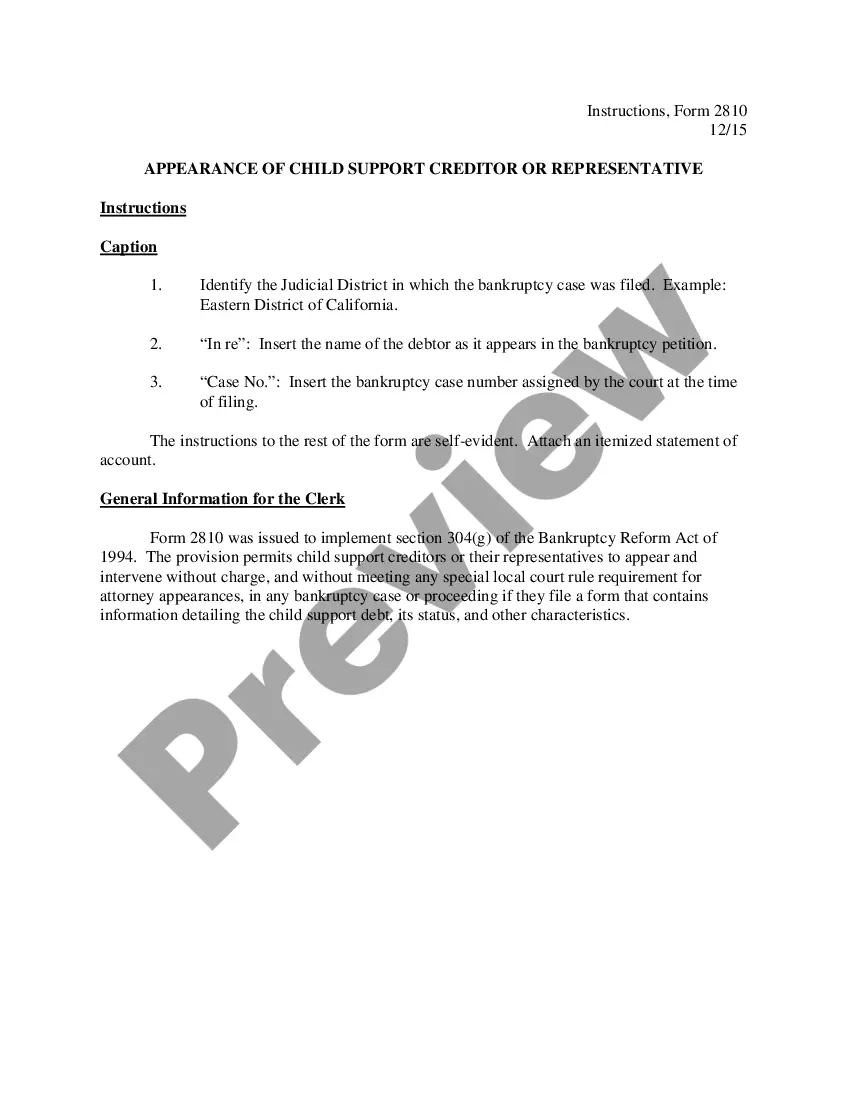

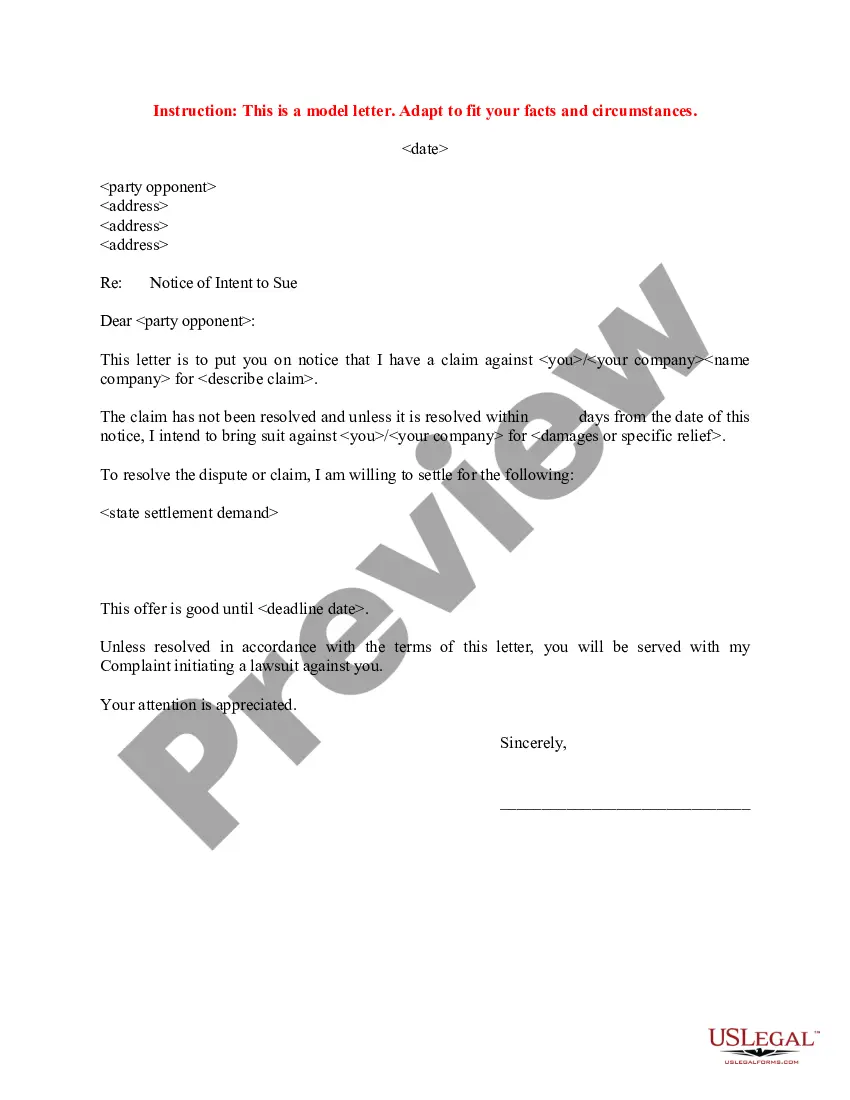

- Browse through the document content to ensure it complies with your state's regulations. You can do this by reviewing the document description or using the Preview option.

- If your legal template does not satisfy your needs, look for another one using the search bar located at the top of the page.

- If you are already a member with us, sign in and download the Iowa Tips and Tricks - January 2018. Otherwise, follow the next steps.

- Click Buy now once you locate the appropriate document. Choose the subscription plan that works best for you to gain access to our full library service.

- Register for an account and complete the payment for your subscription. Payments can be made via credit card or PayPal—our service is entirely dependable for this.

- Download your Iowa Tips and Tricks - January 2018 onto your device and fill it out on a printed hard copy or digitally.

Form popularity

FAQ

Iowa state law does not require restaurants to tax a voluntary gratuity left by the customer. Whether you leave your voluntary tip via cash, you place your voluntary tip on a credit card, or you place your voluntary tip on a debit card, it is not taxed.

Casual sales are exempt from the Iowa sales and use tax except for the casual sale of vehicles subject to registration, ATVs, off-road motorcycles, off-road utility vehicles, aircraft, or watercraft.

Sales of services are exempt from Iowa sales tax unless taxed by state law. The retailer must add the tax to the price and collect the tax from the purchaser. The retailer cannot indicate that the sales tax is being ?absorbed.?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

Iowa requires tax to be collected on the sale of all "tangible goods". The sale of personal property is also taxable in Iowa. Furthermore, automobile rentals and leases as well as hotel and motel rooms are also taxable. Counties in Iowa have the option to impose a local tax.

The Iowa (IA) state sales tax rate is currently 6%. Depending on local municipalities, the total tax rate can be as high as 8%. Food and prescription drugs are exempt from sales tax. All businesses selling tangible personal property or engaging in retail sales must register with the state.

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents.Step 2: Report Your Income.Step 3: Claim Your Deductions.Step 4: Calculate Your Tax.Step 5: Claim Tax Credits.

Registering as an Iowa Withholding Agent Register with the Internal Revenue Service first to obtain a Federal Identification Number (FEIN) or call the IRS at 1-800-829-4933. There is no fee for registering.