Iowa Tips and Tricks - October 2017

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Tips And Tricks - October 2017?

Handling official documentation necessitates focus, precision, and utilizing well-crafted templates. US Legal Forms has been assisting individuals nationwide in accomplishing this for 25 years, so when you select your Iowa Tips and Tricks - October 2017 template from our collection, you can be confident it adheres to federal and state laws.

Engaging with our service is simple and efficient. To acquire the necessary document, all you need is an account with an active subscription. Here’s a brief guide for you to secure your Iowa Tips and Tricks - October 2017 in just minutes.

All documents are designed for multiple uses, such as the Iowa Tips and Tricks - October 2017 displayed on this page. If you require them in the future, you can complete them without additional payment - simply access the My documents tab in your profile and fill out your document whenever necessary. Experience US Legal Forms and prepare your business and personal documentation quickly and in full legal compliance!

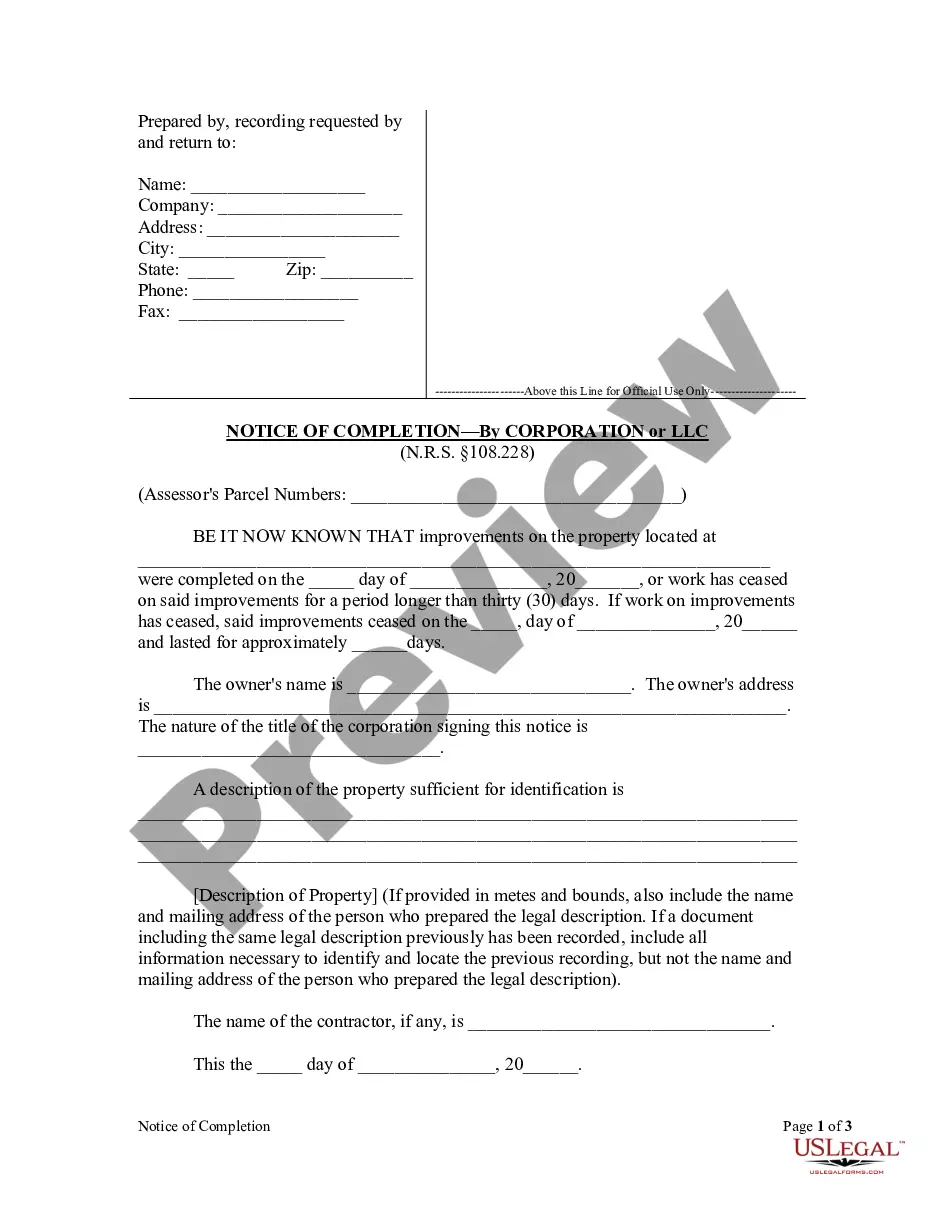

- Ensure to thoroughly review the form's content and its alignment with general and legal criteria by previewing it or examining its description.

- Look for another official template if the current one does not align with your circumstances or state laws (the option for that is located at the top corner of the page).

- Log in to your account and save the Iowa Tips and Tricks - October 2017 in your preferred format. If it’s your initial experience with our service, click Buy now to continue.

- Establish an account, choose your subscription option, and pay using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the blank document or upload it to a professional PDF editor to submit electronically.

Form popularity

FAQ

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents.Step 2: Report Your Income.Step 3: Claim Your Deductions.Step 4: Calculate Your Tax.Step 5: Claim Tax Credits.

How to File Your Taxes This Year: 6 Simple Steps Step 1: Determine if You Need to File. First things first.Step 2: Gather Your Tax Documents.Step 3: Pick a Filing Status.Step 4: Choose Between the Standard Deduction or Itemizing.Step 5: Choose How to File.Step 6: File Your Taxes.

Iowa state law does not require restaurants to tax a voluntary gratuity left by the customer. Whether you leave your voluntary tip via cash, you place your voluntary tip on a credit card, or you place your voluntary tip on a debit card, it is not taxed.

See IRS.gov and IRS.gov/Forms, and for the latest information about developments related to Forms 1040 and 1040-SR and their instructions, such as legislation enacted after they were published, go to IRS.gov/Form1040.

Who needs to file Form 1040? Most people in the U.S. need to file Form 1040 no matter if they are self-employed, work for someone else as an employee, or live off income from investments.

You have a debt with the Iowa Department of Revenue or other agency. For more information regarding this debt, call 515-281-3114.