Iowa Notification of Release from Active Duty (IANB0807) is a form issued to Iowa veterans by the Iowa Department of Veterans Affairs (IDEA). It is used to verify a veteran's honorable discharge from active military service. The form is issued to veterans who have served in any branch of the United States armed forces and meet the requirements for Iowa residency, which include having lived in the state for a minimum of one year prior to filing for benefits. The form includes the veteran's name, service branch, dates of service, discharge date, and other information related to the veteran's service. It is important for veterans to keep this form as it is required for many veterans' benefits, including health care, education, and housing benefits. There are two types of Iowa Notification of Release from Active Duty (IANB0807): DD-214 and DD-215. The DD-214 form is the most common form used to document a veteran's honorable discharge from active military service, while the DD-215 form is used to document an administrative or other type of discharge.

Iowa Notification of Release from Active Duty (IANB0807)

Description

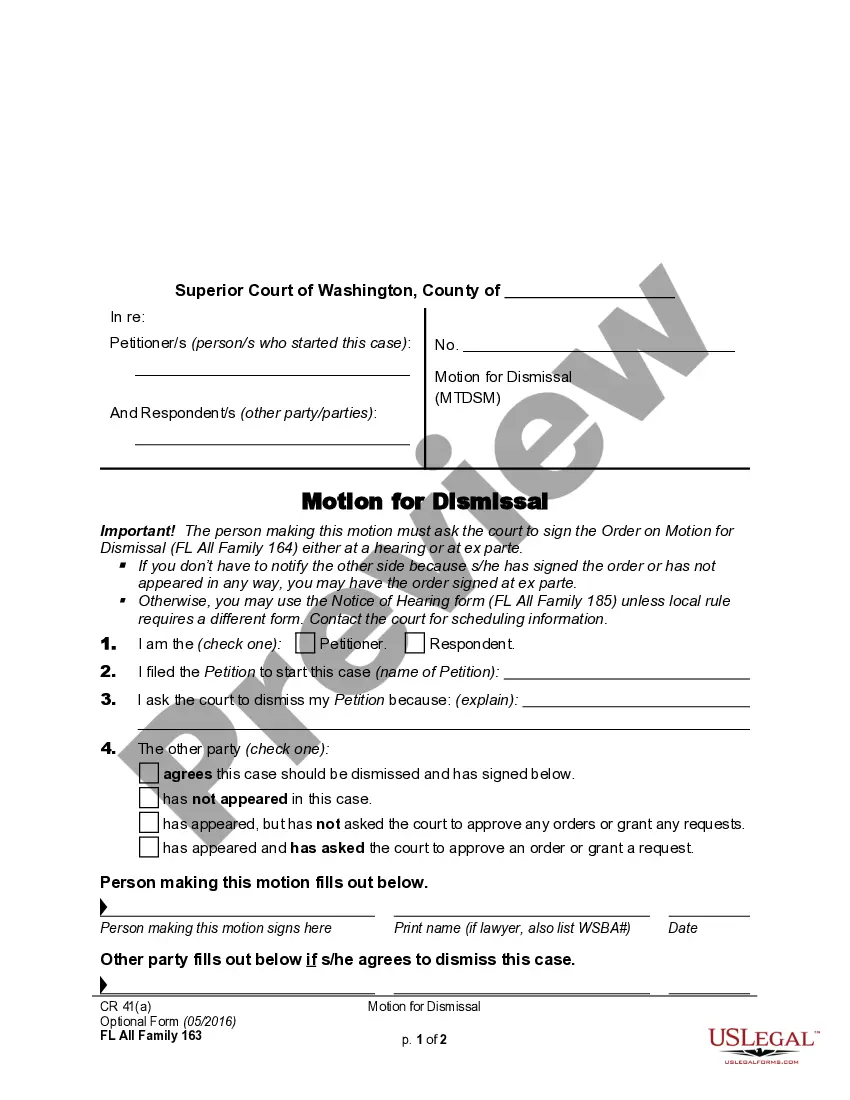

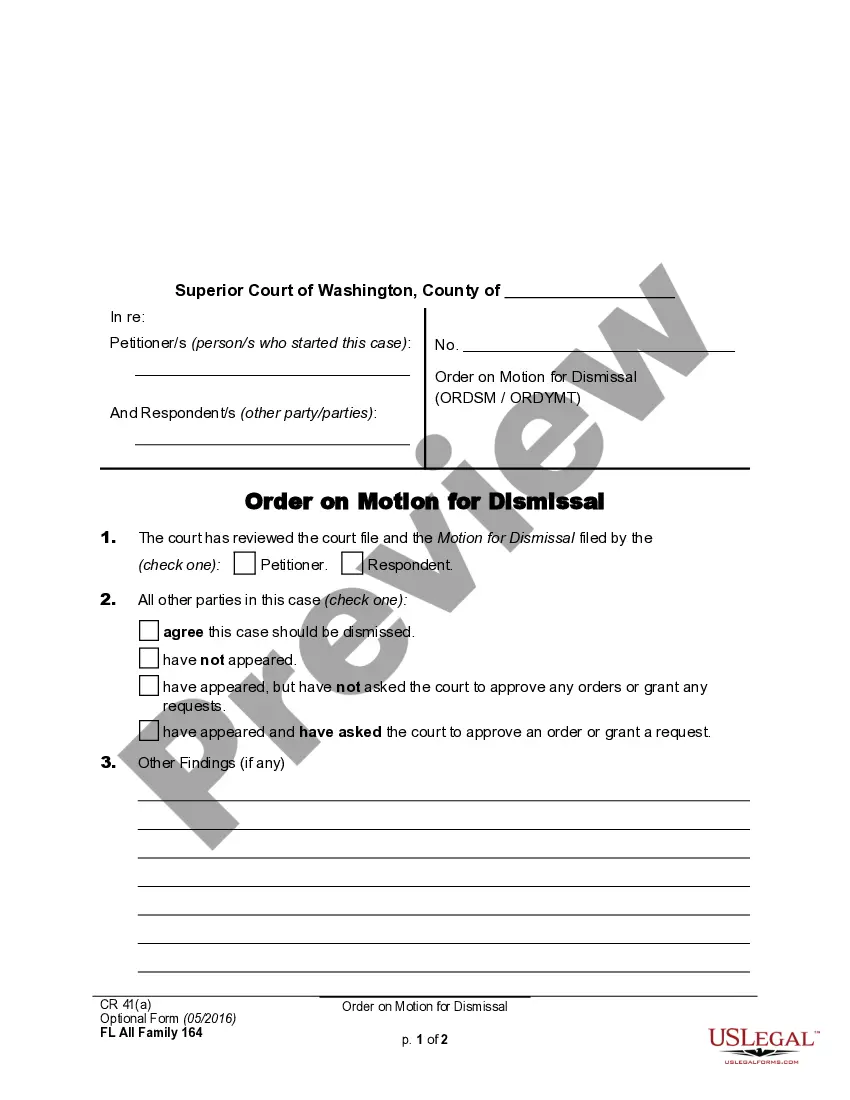

How to fill out Iowa Notification Of Release From Active Duty (IANB0807)?

How much duration and resources do you typically invest in creating formal documentation.

There’s a greater possibility to acquire such forms than employing legal professionals or spending countless hours browsing the internet for an appropriate template.

Create an account and pay for your subscription. You can complete a transaction using your credit card or via PayPal - our service is entirely secure for that.

Download your Iowa Notification of Release from Active Duty (IANB0807) onto your device and fill it out on a printed hard copy or digitally.

- US Legal Forms is the premier online repository that offers expertly crafted and verified state-specific legal documents for any purpose, such as the Iowa Notification of Release from Active Duty (IANB0807).

- To obtain and fill in a suitable Iowa Notification of Release from Active Duty (IANB0807) template, adhere to these straightforward instructions.

- Review the form content to ensure it aligns with your state regulations. To do so, examine the form description or utilize the Preview option.

- If your legal template doesn’t fulfill your requirements, locate another one using the search field at the top of the page.

- If you are already subscribed to our service, Log In and download the Iowa Notification of Release from Active Duty (IANB0807). If not, proceed to the next steps.

- Click Buy now once you locate the appropriate document. Choose the subscription plan that best fits your needs to access our library’s complete service.

Form popularity

FAQ

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $1,7430.33%Over $1,743 but not over $3,486$5.75 plus 0.67% of excess over $1,743Over $3,486 but not over $6,972$17.43 plus 2.25% of excess over $3,4866 more rows ?

How to file: File this report online through eFile & Pay at tax.iowa.gov, by telephone at 800-514-8296, or by mail to: Verified Summary of Payments Report, Iowa Department of Revenue, PO Box 10411, Des Moines IA 50306-0411.

Starting with tax year 2022, the Verified Summary of Payments (VSP) is no longer required.

Nonwage Withholding Requirements "Nonwage income" includes pensions, annuities, supplemental unemployment benefits, sick pay benefits, and other nonwage income payments to Iowa residents. Iowa income tax is generally required to be withheld in cases where federal income tax is withheld.

Ing to the Iowa Department of Revenue, Active Duty Military pay is not taxable on the Iowa return. However, the income does need to be reported on the return. If you are a resident of Iowa, you can deduct the active duty military pay from the return by performing the following steps in the program: State Section.

Iowa income tax is generally required to be withheld in cases where federal income tax is withheld. In situations where no federal income tax is withheld, the receiver of the payment may choose to have Iowa withholding taken out. Withholding on nonwage income may be made at a rate of 5 percent.

Iowa Military Property Tax Exemption: Reduces a Veteran's assessed home value for the property by $1,852. Must have served on active duty during a period of war or for a minimum of 18 months during peacetime to be eligible.

Access the digital replica of USA TODAY and more than 200 local newspapers with your subscription. Here's how the rates will change: 2023: The top rate will lower to 6%, giving a tax cut to Iowans making $75,000 or more. 2024: The top rate will lower to 5.7%, giving a tax cut to Iowans making $30,000 or more.