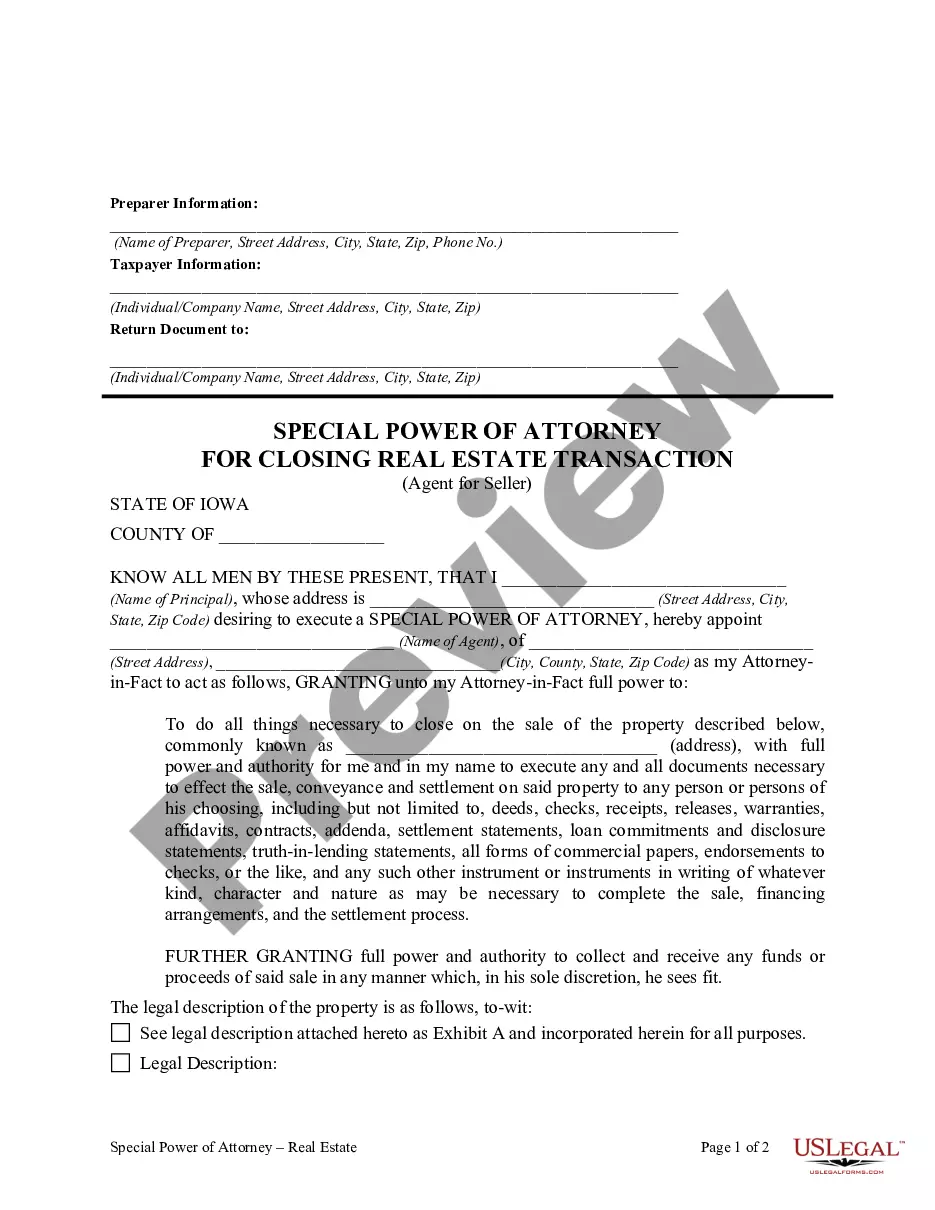

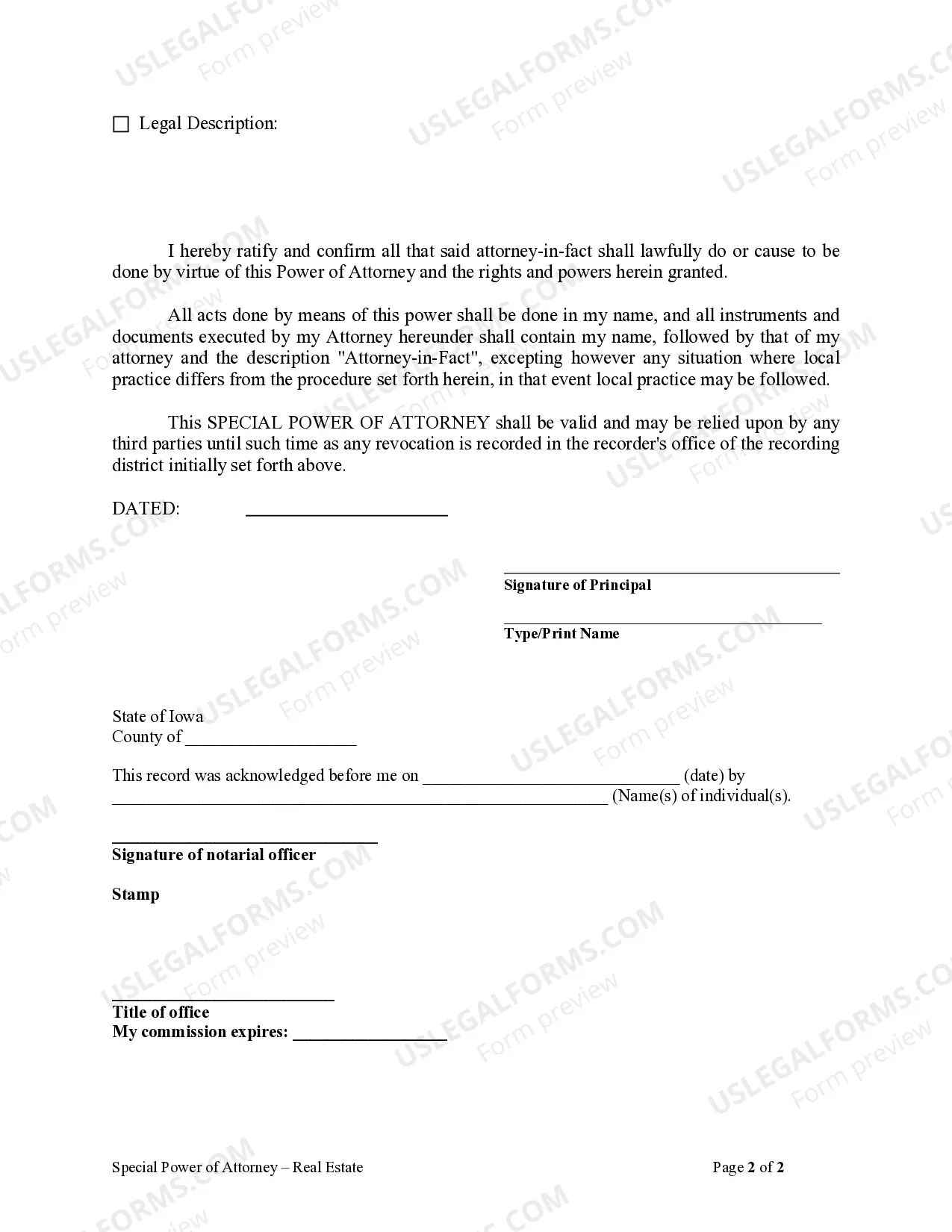

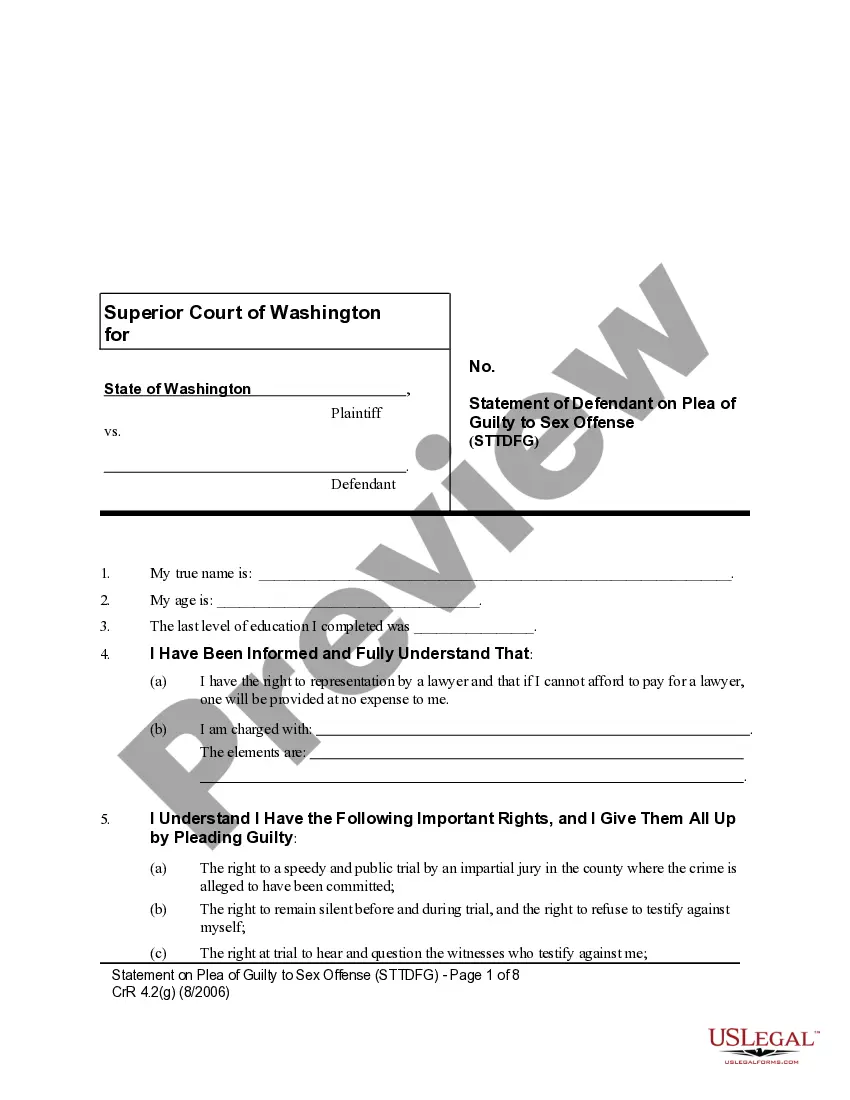

This Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller form is for a Seller to authorize an attorney-in-fact to execute all documents and do all things necessary to convey a particular parcel of real estate for Seller.

Iowa Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller

Description

How to fill out Iowa Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

Gain entry to the most comprehensive collection of approved documents.

US Legal Forms is essentially a platform where you can discover any state-specific paperwork in just a few clicks, such as Iowa Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller examples.

No need to squander your time searching for a court-recognized template.

After confirming everything is accurate, click on the Buy Now button. Following the selection of a pricing plan, create an account. Make payment by card or PayPal. Download the document to your device by clicking on Download. That's it! You need to complete the Iowa Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller form and verify it. To ensure everything is correct, consult your local legal advisor for assistance. Sign up and effortlessly explore over 85,000 useful templates.

- To utilize the forms library, choose a subscription and create an account.

- If you have already registered, simply Log In and select Download.

- The Iowa Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller model will be automatically stored in the My documents section (a section for each document you download on US Legal Forms).

- To establish a new account, follow the straightforward instructions listed below.

- If you are going to use state-specific documents, be sure to specify the correct state.

- If possible, review the description to understand all the particulars of the document.

- Utilize the Preview feature if it's available to examine the details of the document.

Form popularity

FAQ

The responsibilities of a financial POA include managing assets, paying bills, and making investment decisions on behalf of the principal. With an Iowa Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller, the agent specifically handles tasks related to selling property, ensuring all actions align with the best interests of the seller. It's crucial for the agent to maintain transparency and act diligently in these roles.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

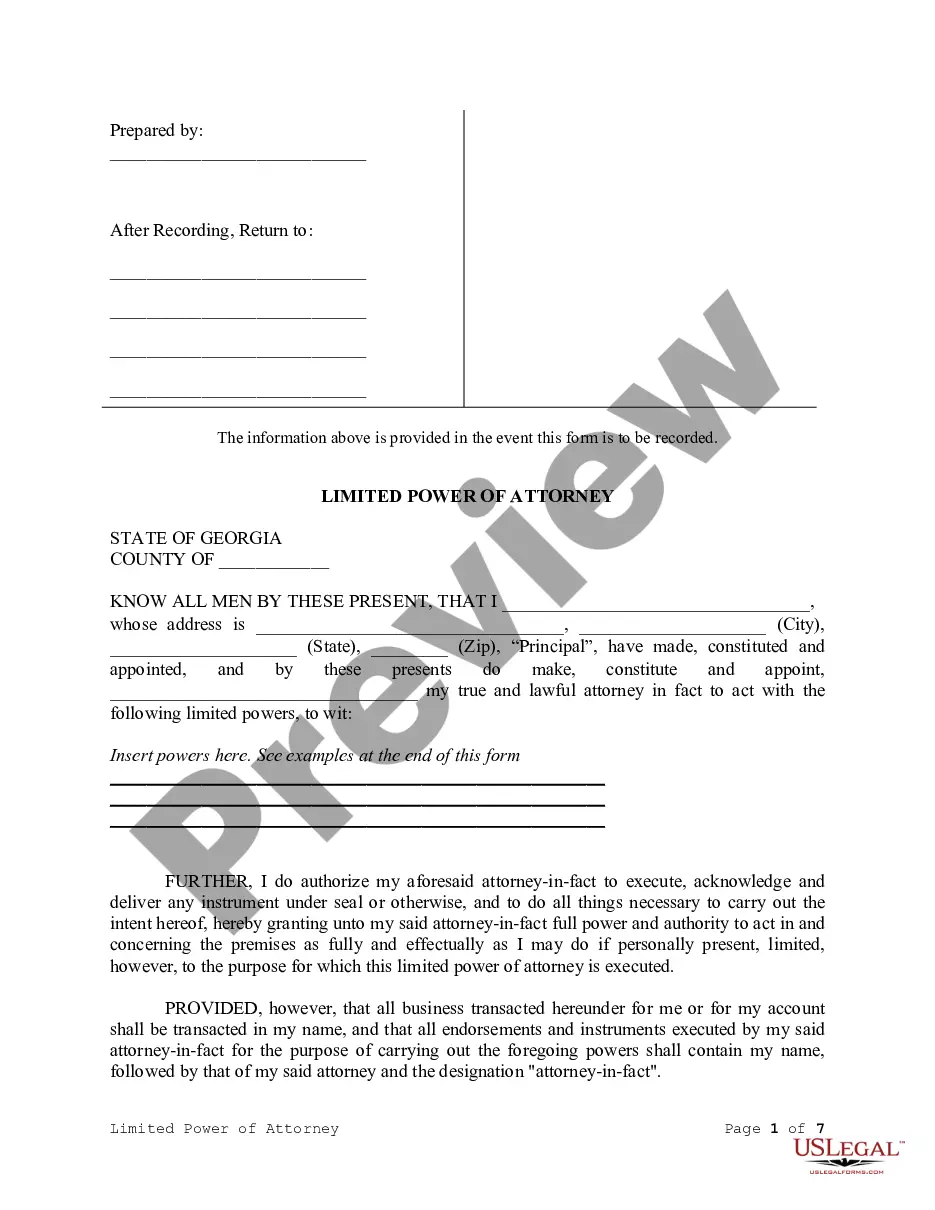

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

The durable power of attorney is almost always required. This instrument gives another person specific powers to sign for an individual in a real estate transaction where the exact name and description of the property is stated in the document.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

A financial power of attorney requires an acknowledged signature by a notary public. Signing a health care power of attorney can be done in one of two ways: It can be signed and dated in the presence of two witnesses; or. It can be signed and dated before a notary public.

The non-durable power of attorney is used only for a set period of time and usually for a particular transaction in which you grant your agent authority to act on your behalf. Once the transaction is completed, or should the principal become incapacitated during this time, the non-durable power of attorney ceases.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

Remember that all of the authorized agents under the power of attorney or representatives in an estate must sign the listing agreement, disclosure documents, etc. For example, when there are two executors in an estate, then they both must sign the Listing Contract.