Iowa New State Resident Package

About this form package

The Iowa New State Resident Package is designed to help individuals organize their legal affairs after relocating to Iowa. This package includes essential legal documents tailored to meet the state-specific needs of new residents. Unlike generic form packages, the Iowa New State Resident Package addresses unique legal requirements that may arise during your relocation process, ensuring you have everything you need to settle in smoothly.

Forms you’ll find in this package

Situations where these forms applies

Use this package when you have recently moved to Iowa and need to address various legal and non-legal aspects of your new residency. This includes situations such as:

- Establishing or updating legal wills

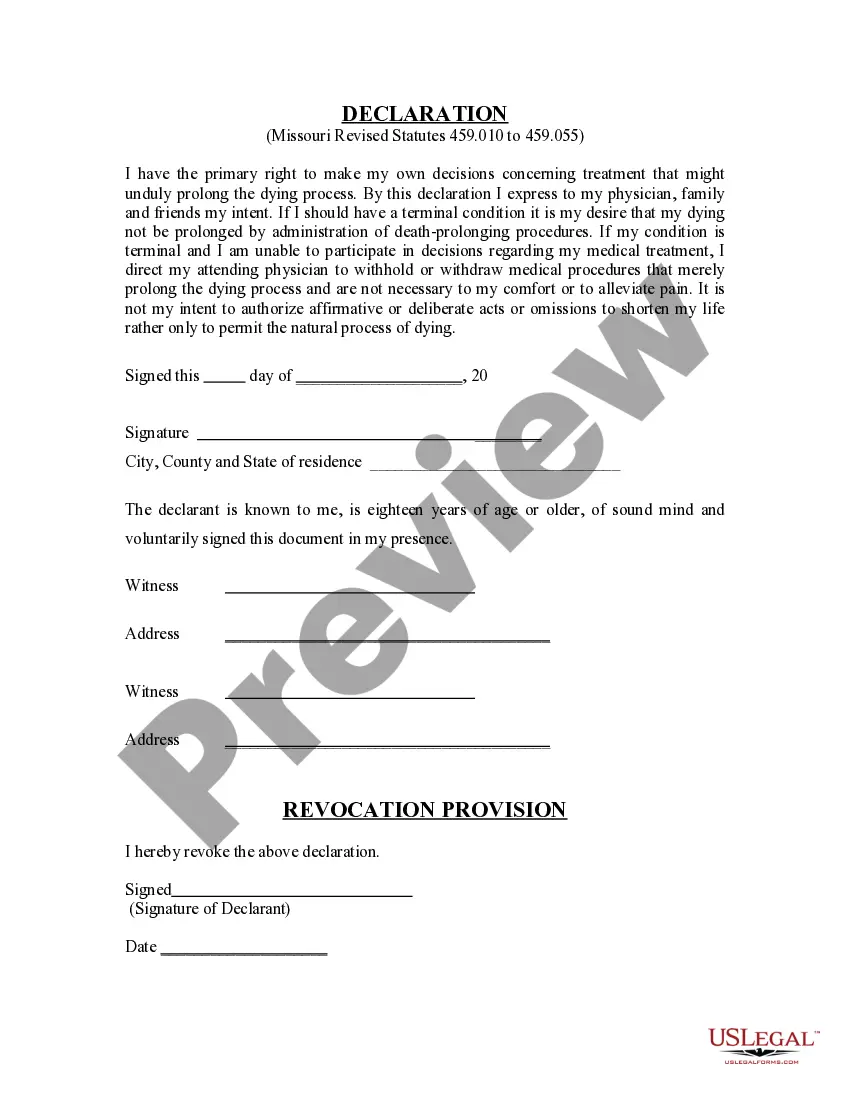

- Setting up healthcare directives in accordance with Iowa law

- Granting a trusted individual power of attorney for financial matters

- Understanding state-specific requirements for residents, such as voter registration and vehicle title

Who this form package is for

- Individuals or families relocating to Iowa

- New residents looking to establish their legal documents

- People seeking to ensure their healthcare and financial decisions are legally documented

- Anyone needing to understand the legal obligations of living in Iowa

How to prepare this document

- Review the included forms carefully to understand their purpose and requirements.

- Fill out each form by entering the required information clearly and accurately.

- Ensure signatures are included where necessary, especially for the Last Will and Testament and Power of Attorney.

- Keep a copy of all completed forms for your records.

- Store the original legal documents in a secure location, such as a safe deposit box or home safe.

Notarization details for included forms

Certain documents in this package must be notarized for legal effectiveness. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to sign the forms where required.

- Not updating the Last Will and Testament regularly after major life changes.

- Overlooking state-specific requirements outlined in the New Resident Guide.

- Not keeping copies of completed documents for personal records.

Why complete this package online

- Convenience of downloading legal forms at any time from the comfort of your home.

- Editability allows you to customize the forms easily to suit your needs.

- Access to state-specific guidance ensures you comply with local laws.

- Cost savings of up to 40% when purchasing the package compared to buying forms individually.

Looking for another form?

Form popularity

FAQ

Generally, you need to establish a physical presence in the state, an intent to stay there and financial independence. Then you need to prove those things to your college or university. Physical presence: Most states require you to live in the state for at least a full year before establishing residency.

To qualify as a resident for the purposes of acquiring resident licenses and privileges issued by the Iowa Department of Natural Resources, you must physically reside in Iowa as your primary domicile for at least 90 consecutive days immediately before purchasing a resident privilege.

An individual can at any one time have but one domicile. If an individual has acquired a domicile at one place (i.e. California), he retains that domicile until he acquires another elsewhere.

For Iowa individual income tax purposes, an individual is a resident if: (1) the individual maintains a permanent place of abode within the state, or (2) the individual is domiciled in the state.

To qualify as a resident for the purposes of acquiring resident licenses and privileges issued by the Iowa Department of Natural Resources, you must physically reside in Iowa as your primary domicile for at least 90 consecutive days immediately before purchasing a resident privilege.

Present acceptable proof of identity, residence and Social Security number. Not be canceled, suspended or revoked in any state. Pass a vision test, all applicable written test(s) and driving test. Pay applicable fees.

You can have multiple residences, reside in multiple states but can have only one domicile. domicile is important for income tax purposes and estate tax purposes and possibly other purposes. Many states look to a person's domicile to determine residency.

Keep a log that shows how many days you spend in the old and new locations. Change your mailing address. Get a driver's license in the new state and register your car there. Register to vote in the new state. Open and use bank accounts in the new state.

Many states require that residents spend at least 183 days or more in a state to claim they live there for income tax purposes. In other words, simply changing your driver's license and opening a bank account in another state isn't enough. You'll need to actually live there to claim residency come tax season.