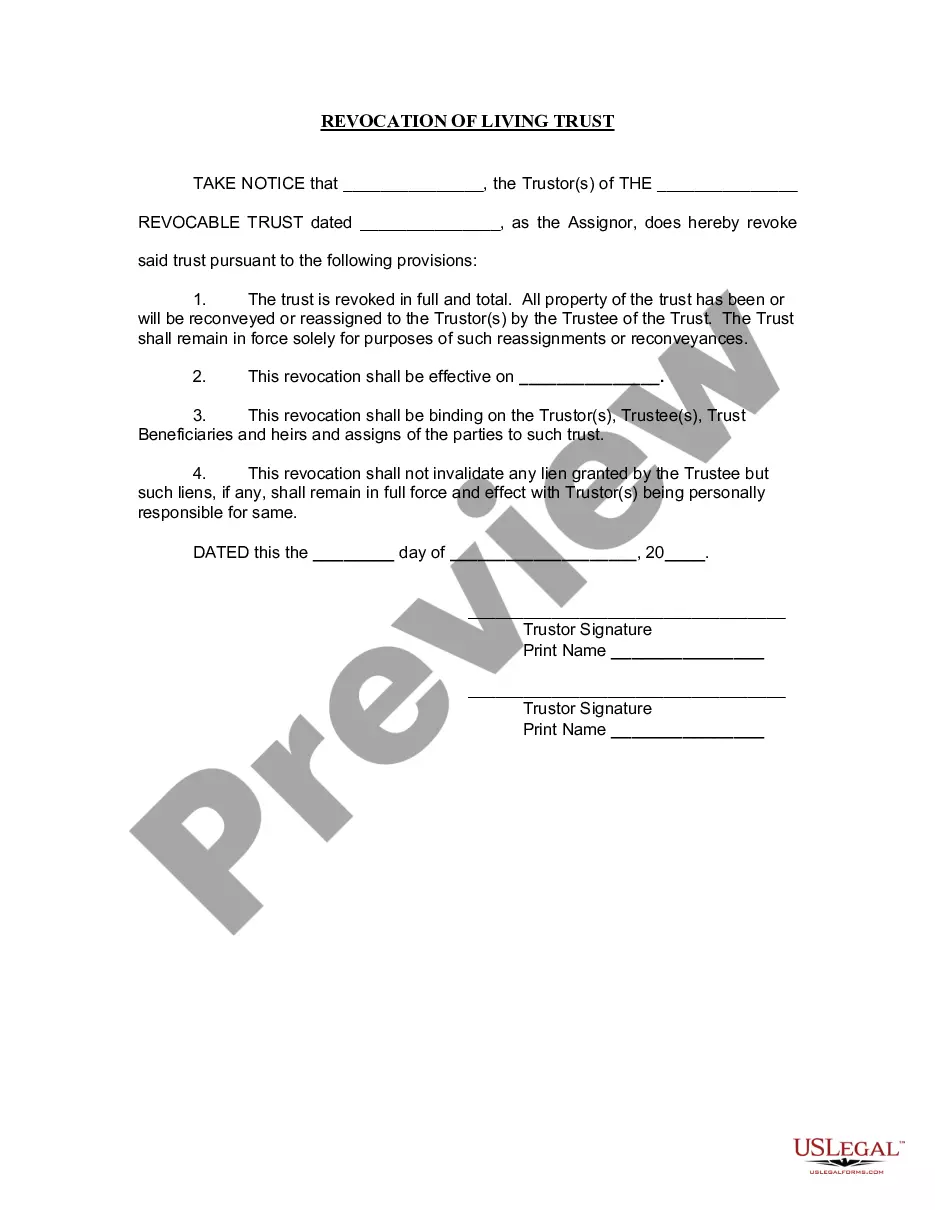

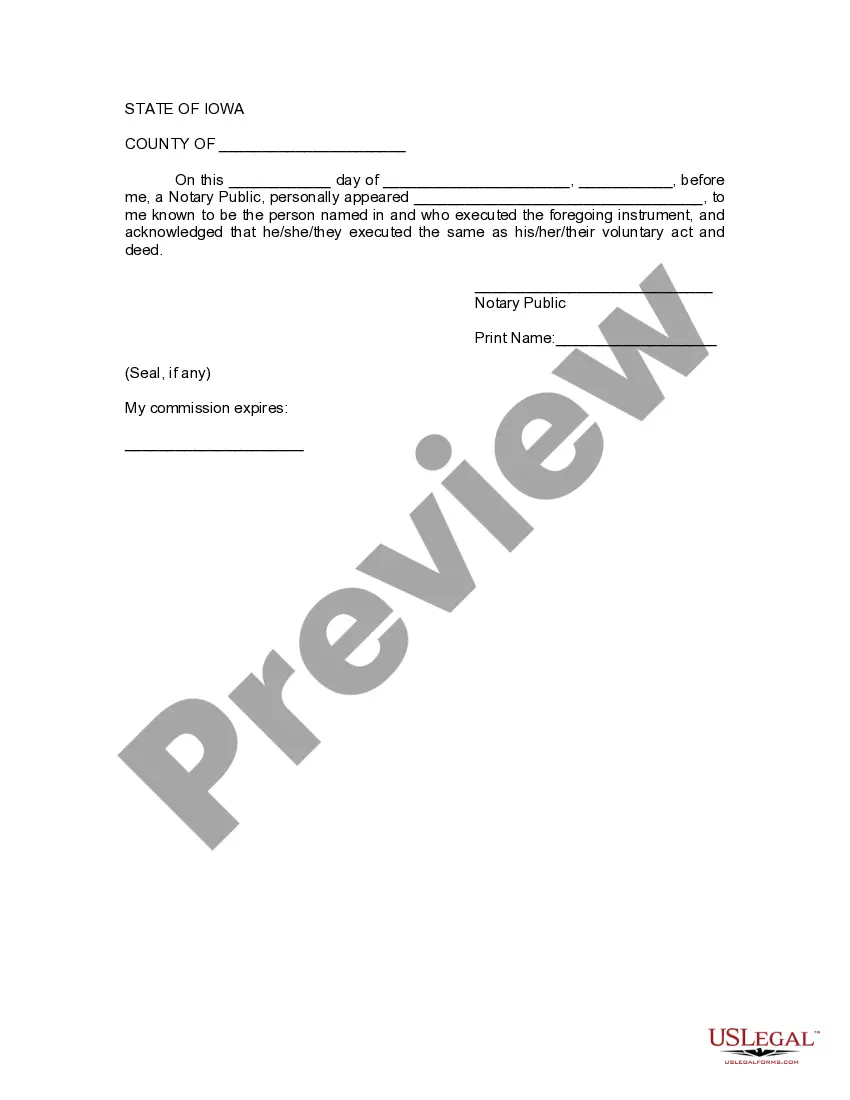

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Iowa Revocation of Living Trust

Description

How to fill out Iowa Revocation Of Living Trust?

Obtain one of the most comprehensive collections of sanctioned documents.

US Legal Forms is a service where you can locate any state-specific document in a matter of clicks, including examples of Iowa Revocation of Living Trust.

No need to squander hours of your time hunting for a court-acceptable template. Our accredited experts ensure that you receive current samples each time.

After selecting a pricing plan, create an account. Pay via card or PayPal. Download the document to your computer by clicking Download. That's it! You should fill out the Iowa Revocation of Living Trust form and verify it. To ensure everything is precise, consult your local legal advisor for assistance. Register and effortlessly access over 85,000 useful forms.

- To use the document library, select a subscription and register an account.

- If you have already completed this, simply Log In and click on the Download button.

- The Iowa Revocation of Living Trust file will automatically be saved in the My documents tab (a section for all documents you download from US Legal Forms).

- To create a new account, follow the straightforward instructions below.

- If you intend to utilize a state-specific document, ensure to specify the correct state.

- If possible, review the details to understand all aspects of the form.

- Utilize the Preview option if available to examine the document's content.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

Revoking a revocable trust, particularly in Iowa, is a straightforward process. You typically just need to create a formal revocation document that states your intention to revoke the trust. Ultimately, the Iowa Revocation of Living Trust allows you to easily regain control over your assets, and USLegalForms can provide you with the necessary templates to simplify this process. Don't hesitate to reach out to ensure that you follow the appropriate legal steps.

To revoke a revocable living trust, you must follow the terms outlined in the trust agreement, often requiring a written notice of revocation. You should also properly notify any beneficiaries involved. An Iowa Revocation of Living Trust offers clarity and ease throughout this process. For additional assistance, consider using platforms like USLegalForms, which can provide the necessary resources and guidance.

A trust can be terminated through expiration, revocation, or by order of the court. Expiration occurs when the trust fulfills its intended purpose. Revocation happens when the grantor decides to cancel the trust, which is a common scenario with an Iowa Revocation of Living Trust. Lastly, a court may terminate a trust if it determines that the trust is no longer viable.

A trust can become null and void under specific circumstances, such as if the trust lacks proper legal formalities. For instance, if it does not meet state requirements or lacks the required signatures, it may not be recognized. Additionally, if the trust's purpose is illegal or against public policy, it can also be deemed void. Understanding the Iowa Revocation of Living Trust process can clarify these factors.

However, trust beneficiaries typically have certain rights in relation to the trust.If the trust is a revocable trustmeaning the person who set up the trust can change it or revoke it at any timethe trust beneficiaries other than the settlor have very few (if any) rights.

Once a California Trust becomes irrevocable, the Trust beneficiaries generally cannot be changed. That's the good news.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

Right to Communication You have the right to be kept informed of any changes of the Trust. Right to Accounting You have the right to an accounting, such as assets the Trust holds, interest earned by the Trust, expenses paid out by the Trust.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.