Iowa Quitclaim deed

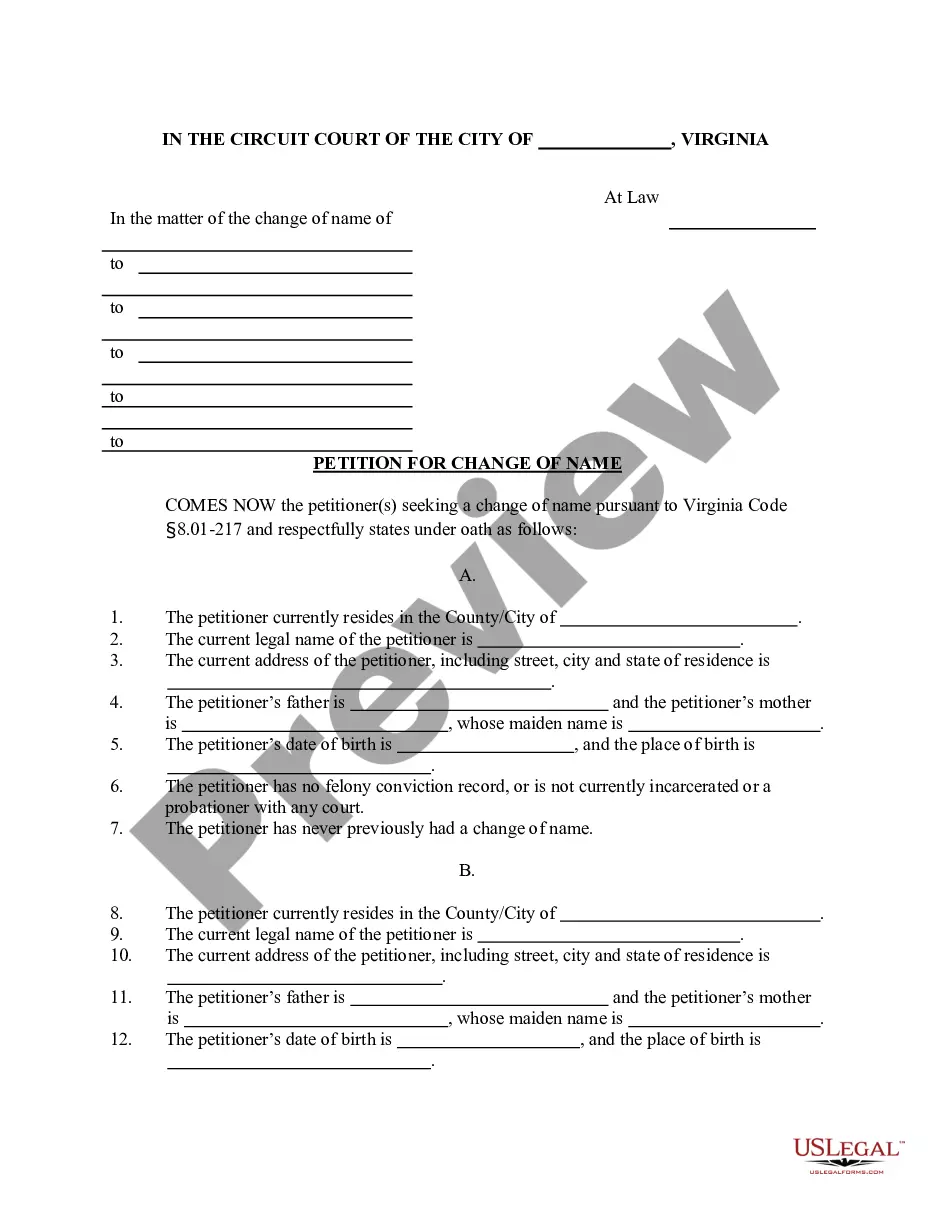

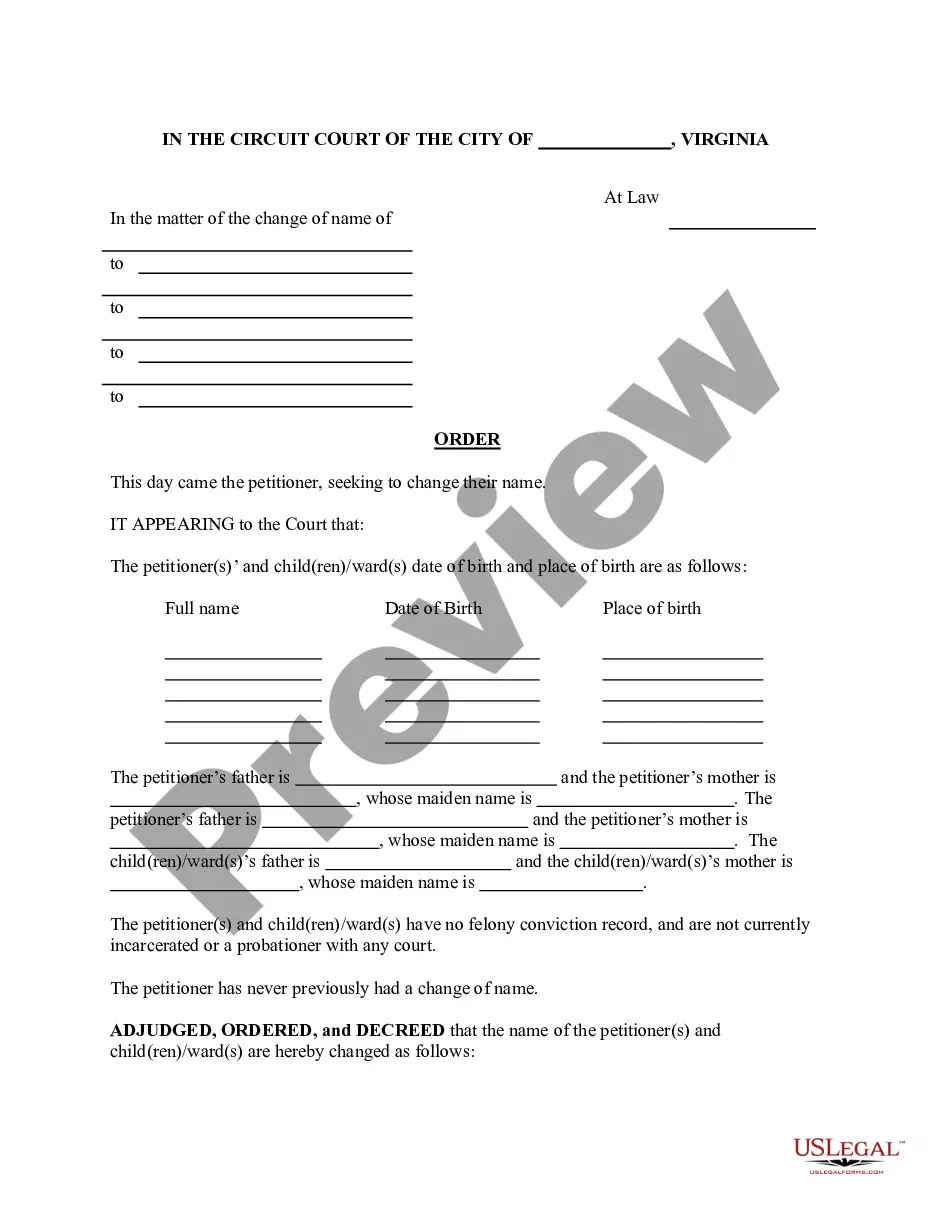

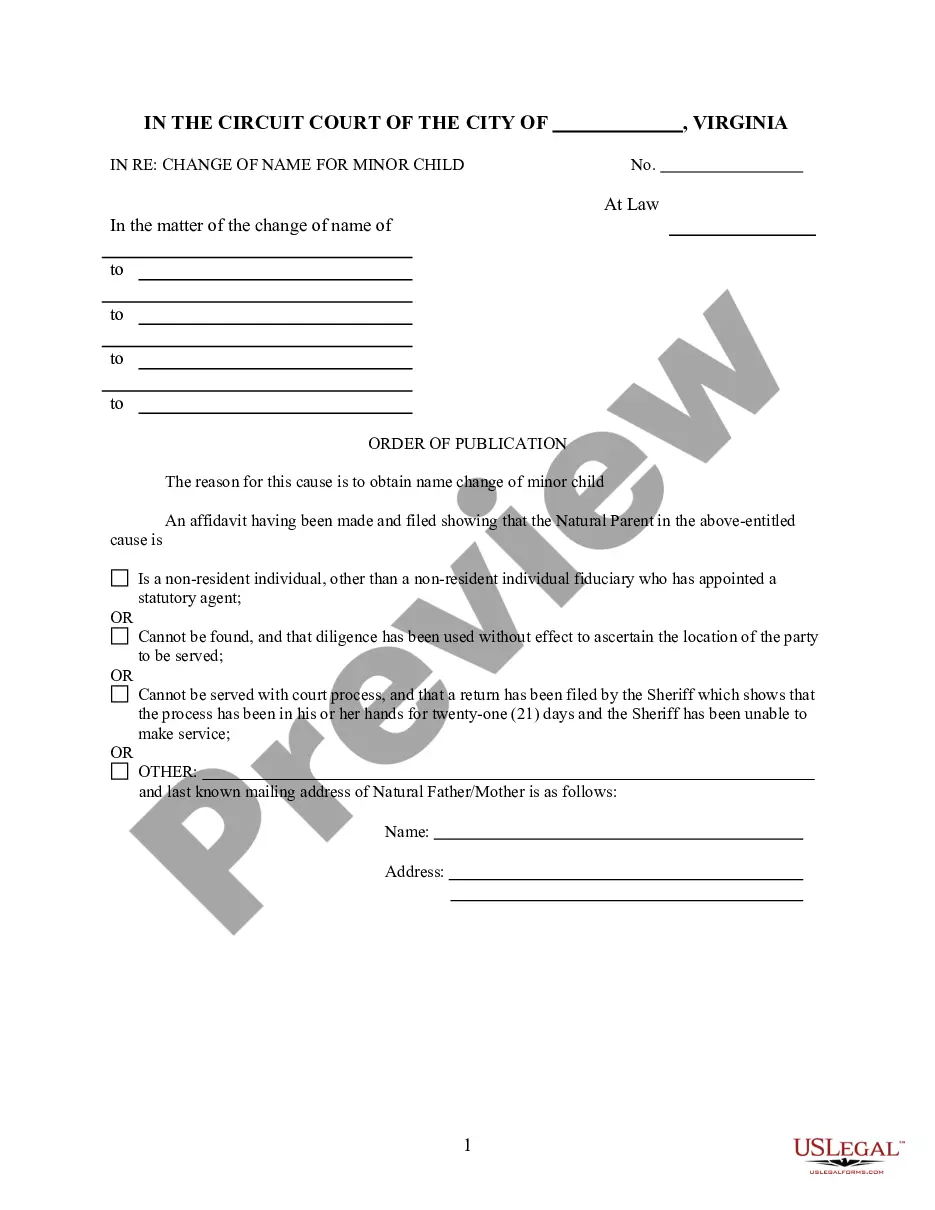

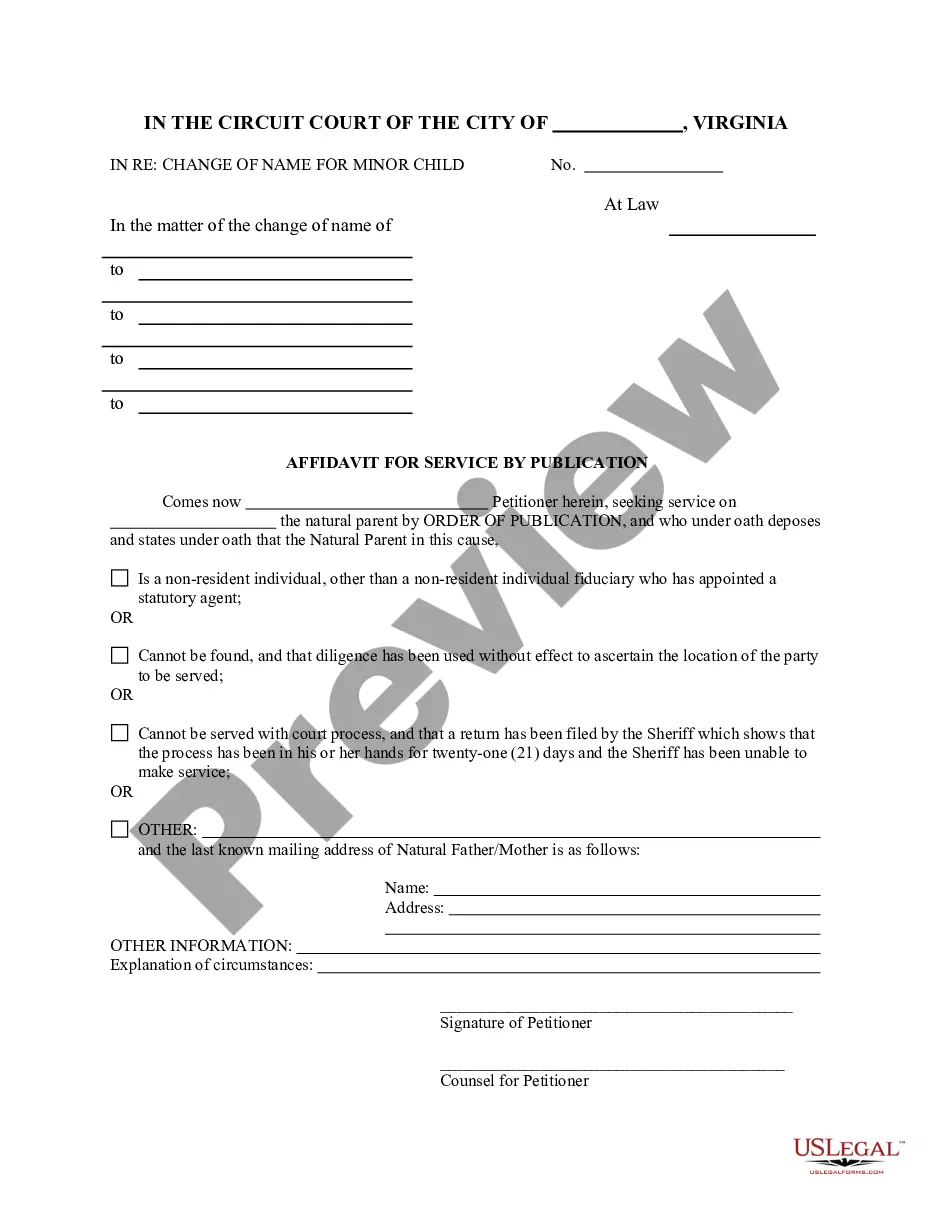

What is this form?

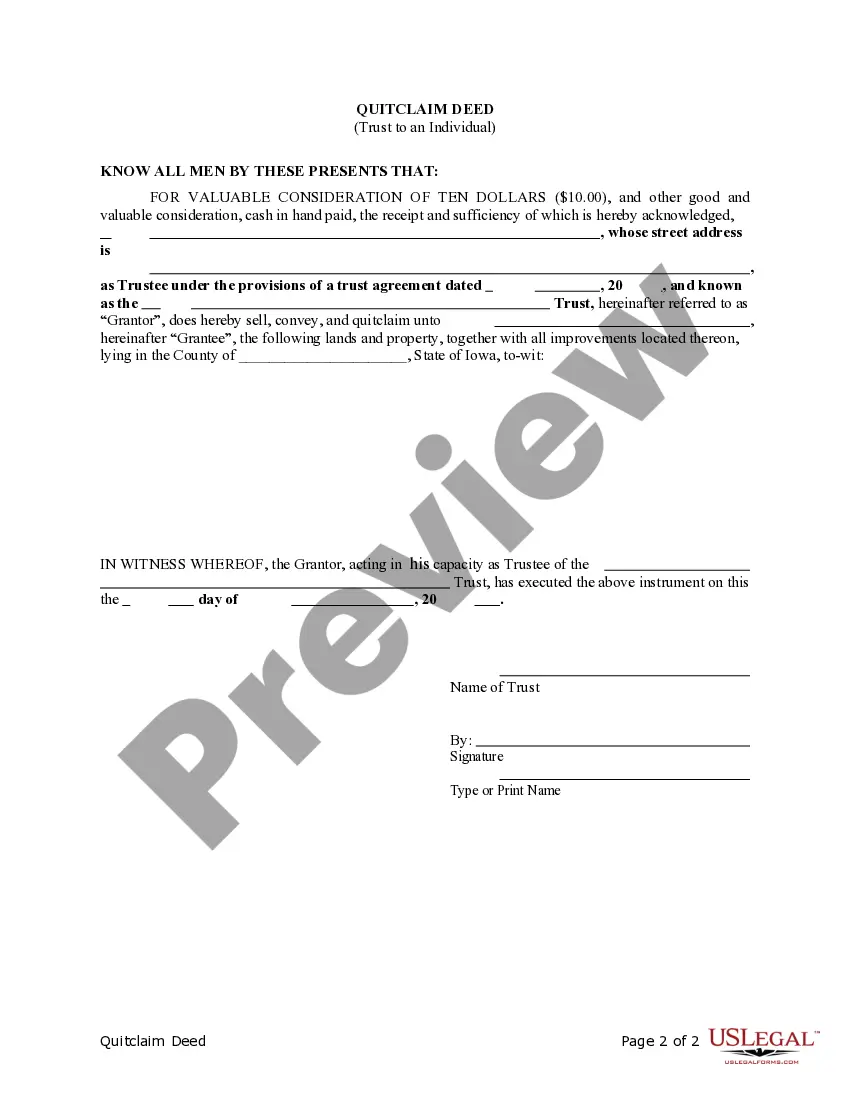

A quitclaim deed is a legal document used to transfer ownership of real property from one party to another without any warranties or guarantees. In this specific quitclaim deed, the Grantor is a Trust, and the Grantee is an Individual, effectively conveying ownership of the specified property. This form is distinct from other types of deeds, such as warranty deeds, which offer additional assurances regarding title and ownership.

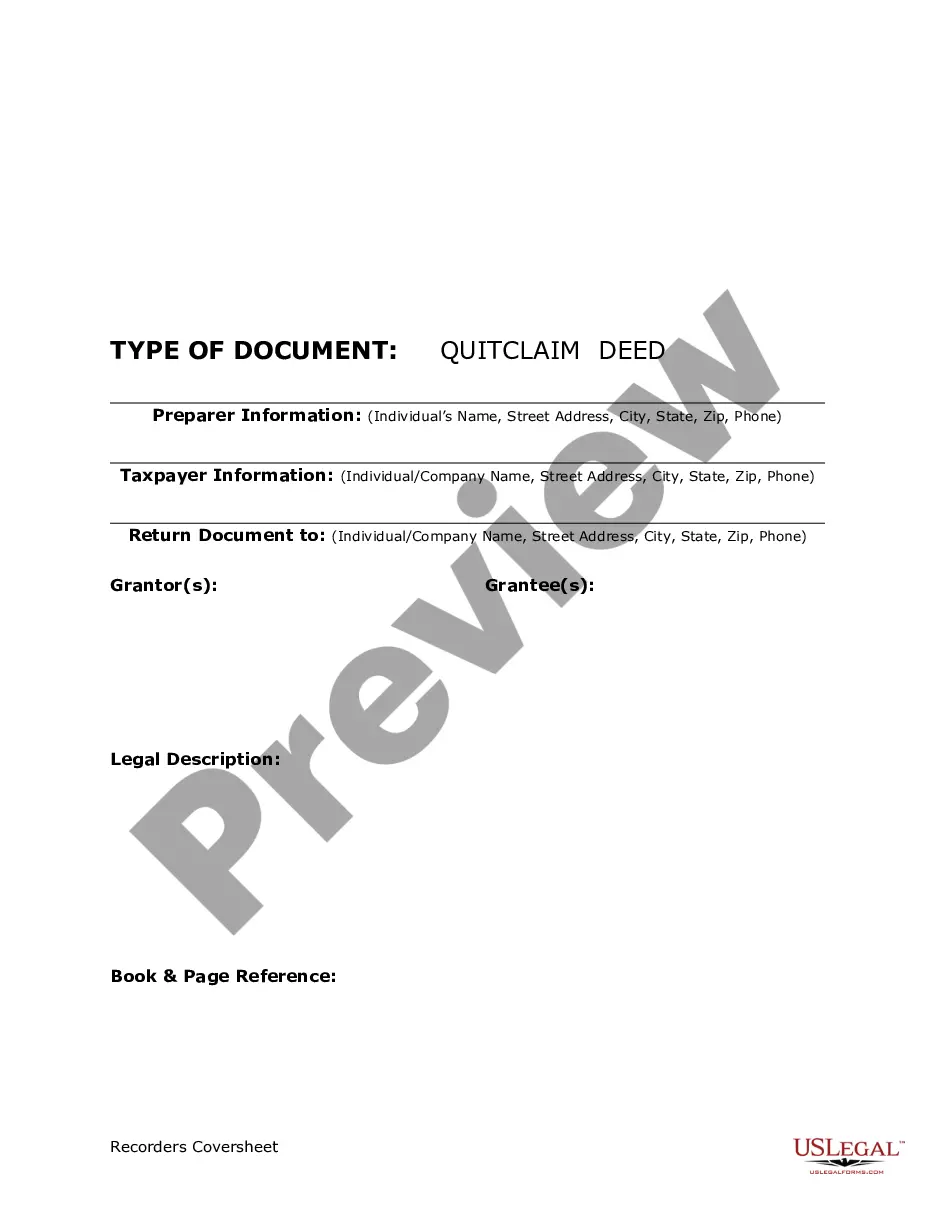

Form components explained

- Grantor Information: Identifies the Trust transferring property ownership.

- Grantee Information: Details the Individual receiving the property.

- Property Description: Provides a legal description of the property being transferred.

- Signatures: Requires signatures of the Grantor and other involved parties for legal validity.

- Date of Transfer: Specifies the date on which the transfer of ownership occurs.

Situations where this form applies

This form is typically used when a property owner wishes to transfer their interest in the property without the assurances typically included in a warranty deed. Scenarios may include transferring property between family members, placing property into a trust, or removing an individual's name from the property title.

Who needs this form

- Property owners wanting to transfer their property to another party.

- Individuals involved in estate planning, such as placing property into a trust.

- Family members wishing to facilitate a property transfer without a sale.

- Trustees looking to transfer trust property to beneficiaries.

Instructions for completing this form

- Identify the parties involved: the Grantor (Trust) and the Grantee (Individual).

- Specify the property: Include a detailed legal description of the property being conveyed.

- Enter the date of the transfer.

- Obtain signatures: Ensure the Grantor signs the deed, along with any required witnesses.

- File the deed with the appropriate county office to complete the property transfer process.

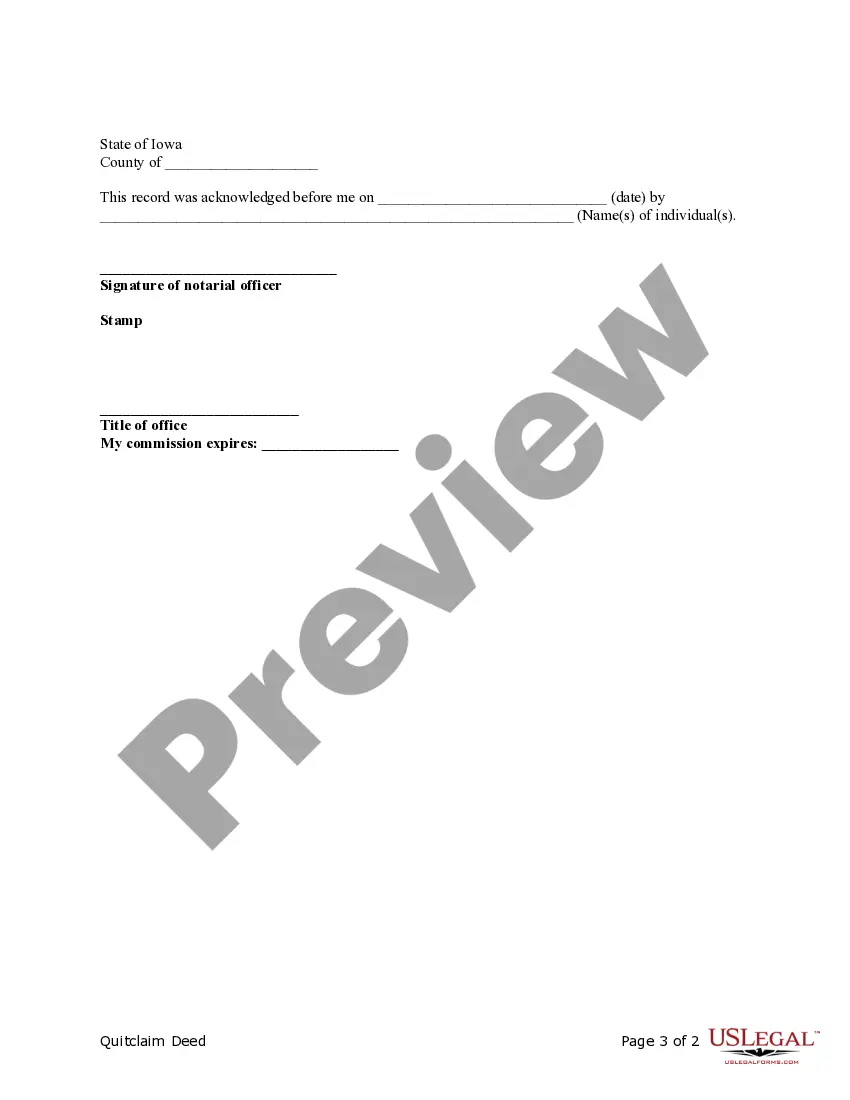

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include a complete property description.

- Not having the deed signed by the Grantor and witnesses, if applicable.

- Neglecting to file the quitclaim deed with the local government office.

Advantages of online completion

- Convenience: Easily access and download the form at any time.

- Editability: Customize the form to fit specific needs before printing.

- Reliability: Ensure accuracy with forms drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

You can obtain a copy of a quitclaim deed from the county clerk or recorder's office where the property is located. Many counties provide online access to these records, making it easier than ever to find the documentation you need. If you are specifically looking for an Iowa Quitclaim deed, check the Iowa Secretary of State's website or use US Legal Forms for a streamlined experience. This platform ensures you get the right forms and instructions quickly.

You can obtain a copy of your quitclaim deed by contacting the county recorder's office that holds the original document. They may allow you to request a copy online, by mail, or in person. It's essential to have relevant details like the property address and deed number handy, especially if it’s an Iowa Quitclaim deed. Alternatively, you can use US Legal Forms to simplify the process of acquiring your document.

To look up a deed in Ohio, you can visit the county recorder's office where the property is located. Most counties offer online databases for you to search for deeds by name, address, or parcel number. This process allows you to view property records, including any Iowa Quitclaim deeds associated with the property. If you need assistance, consider using US Legal Forms to guide you through the process.

The pros of an Iowa Quitclaim deed include the ease of use and speed of transferring property without extensive legal processes. They are particularly advantageous for informal transactions among acquaintances or family members. However, the cons involve the lack of warranties and potential for unresolved ownership issues, which could lead to disputes later. Carefully evaluate both sides before proceeding with a quit claim deed.

Individuals who benefit most from an Iowa Quitclaim deed typically include family members engaged in informal property transfers, such as parents gifting property to their children. Also, those who need a quick resolution for transferring a property without the costs associated with traditional methods can find this option appealing. It's an efficient way to facilitate ownership changes, especially in close relationships.

The dangers of using an Iowa Quitclaim deed mainly lie in their lack of guarantees. Since these deeds do not confirm the grantor's ownership, the grantee may inadvertently assume risks related to undisclosed liens or property disputes. Furthermore, once the deed is executed, it becomes challenging to reverse the transfer if complications arise. Always consider these risks when opting for a quit claim deed.

Iowa Quitclaim deeds come with notable disadvantages. First, they do not guarantee that the grantor actually holds clear title to the property, leaving the grantee vulnerable to ownership disputes. Additionally, these deeds do not provide any warranties, meaning that if issues arise after the transfer, the grantee has limited recourse. It's crucial to weigh these factors before proceeding with a quit claim deed.

To file an Iowa Quitclaim deed, first complete the deed form with the necessary information, including the names of the grantor and grantee, and a legal description of the property. Next, sign the document in the presence of a notary public. Finally, submit the signed deed to the county recorder’s office in the county where the property is located. Utilizing USLegalForms can simplify this process, as they provide step-by-step guidance to ensure your deed is filled out correctly.

An Iowa quitclaim deed does not override a will, as the deed transfers ownership regardless of any existing wills. If you transfer a property via a quitclaim deed, that property's title will be held by the new owner, regardless of what the will states. Therefore, it's crucial to review both your deeds and your estate plan to ensure your intentions are clear.

Yes, you can create an Iowa quitclaim deed yourself, as it is a straightforward document. Many people use templates available online which simplify the drafting process. However, to ensure that all legal requirements are met, consider utilizing a platform like US Legal Forms, which provides forms and guidance tailored to your state's regulations.