Iowa Executor's Deed - Executor to Individual

What this document covers

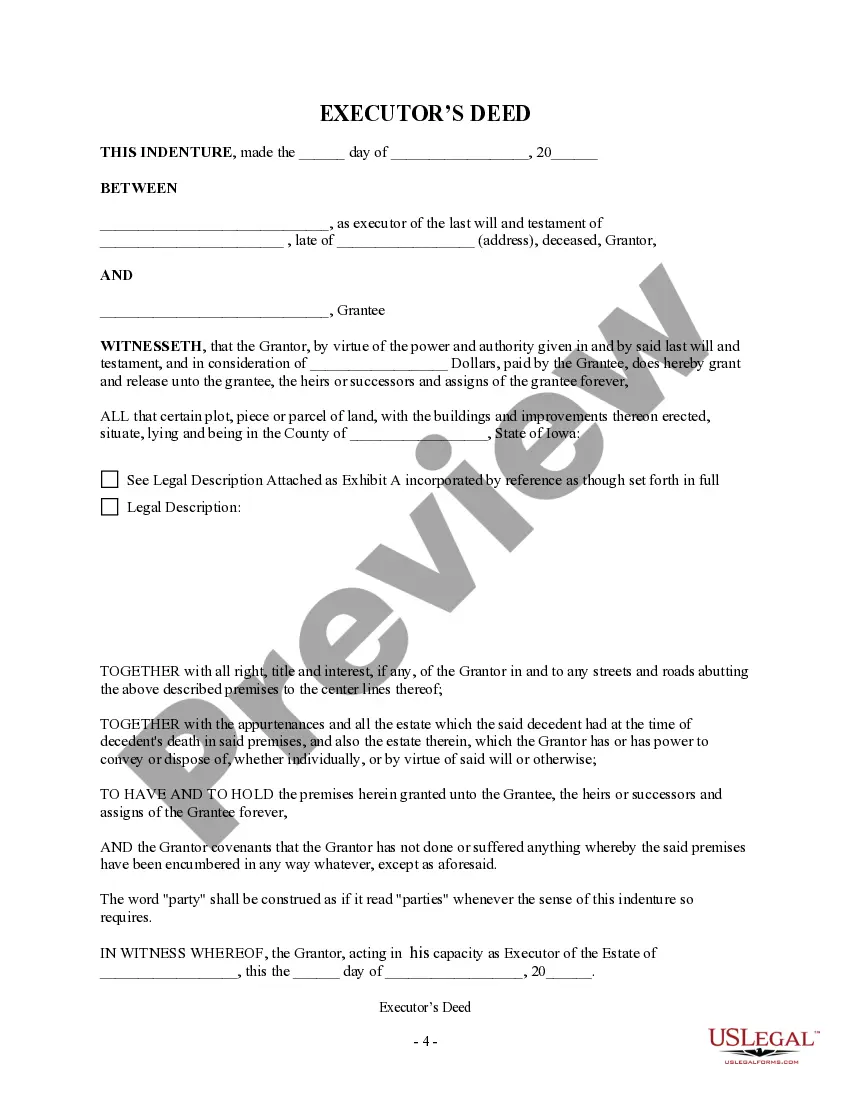

The Executor's Deed - Executor to Individual is a legal document used when an executor of an estate transfers property to an individual. This form serves as proof of the grantor's authority granted under the last will and testament of the deceased and differs from other deeds as it specifically involves the conveyance of property by the executor on behalf of the estate. It is important for ensuring the correct legal transfer of real estate assets in accordance with applicable laws.

Key components of this form

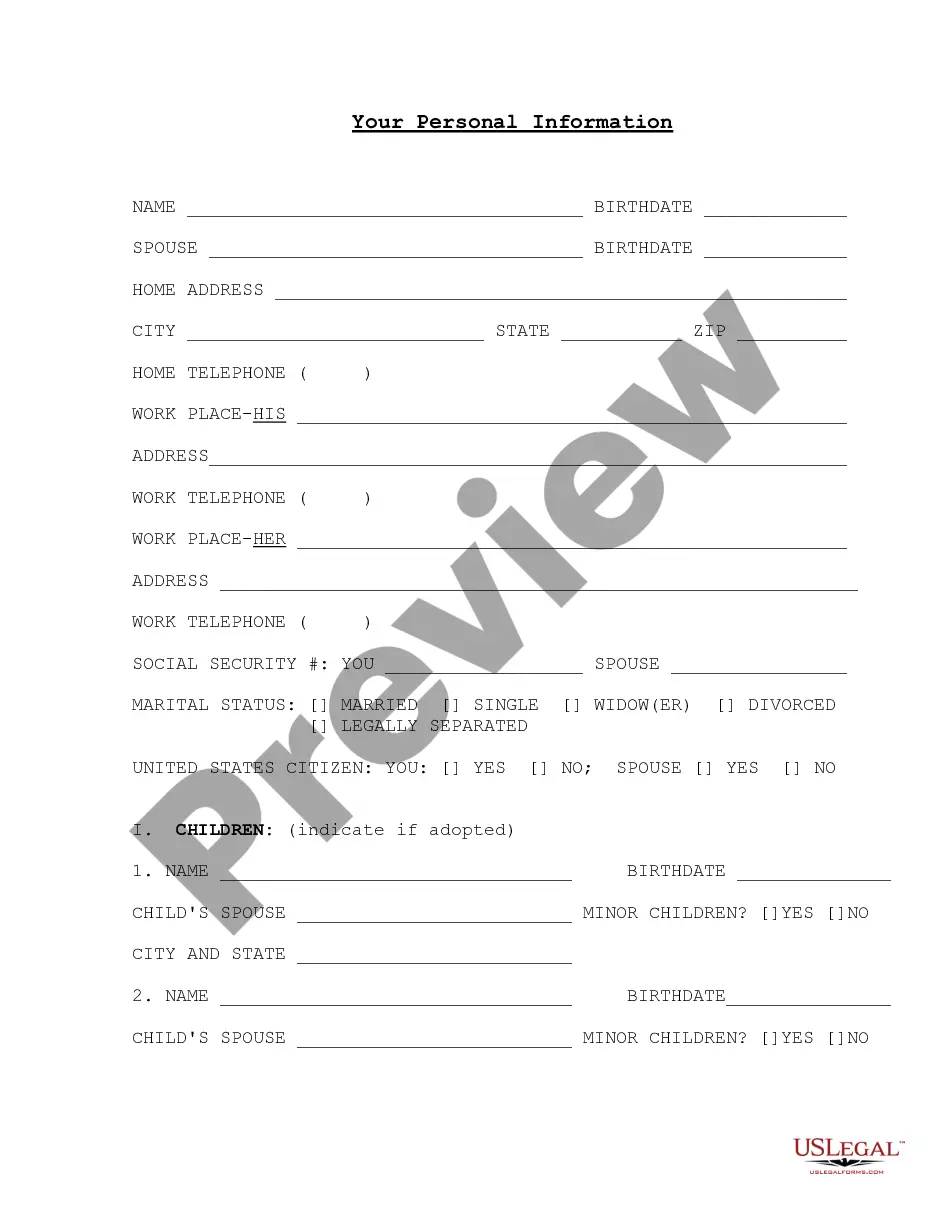

- Parties involved: The grantor (executor) and grantee (individual receiving the property).

- Description of the property: Details of the parcel of land being conveyed, including its legal description.

- Consideration amount: The value paid by the grantee for the property transfer.

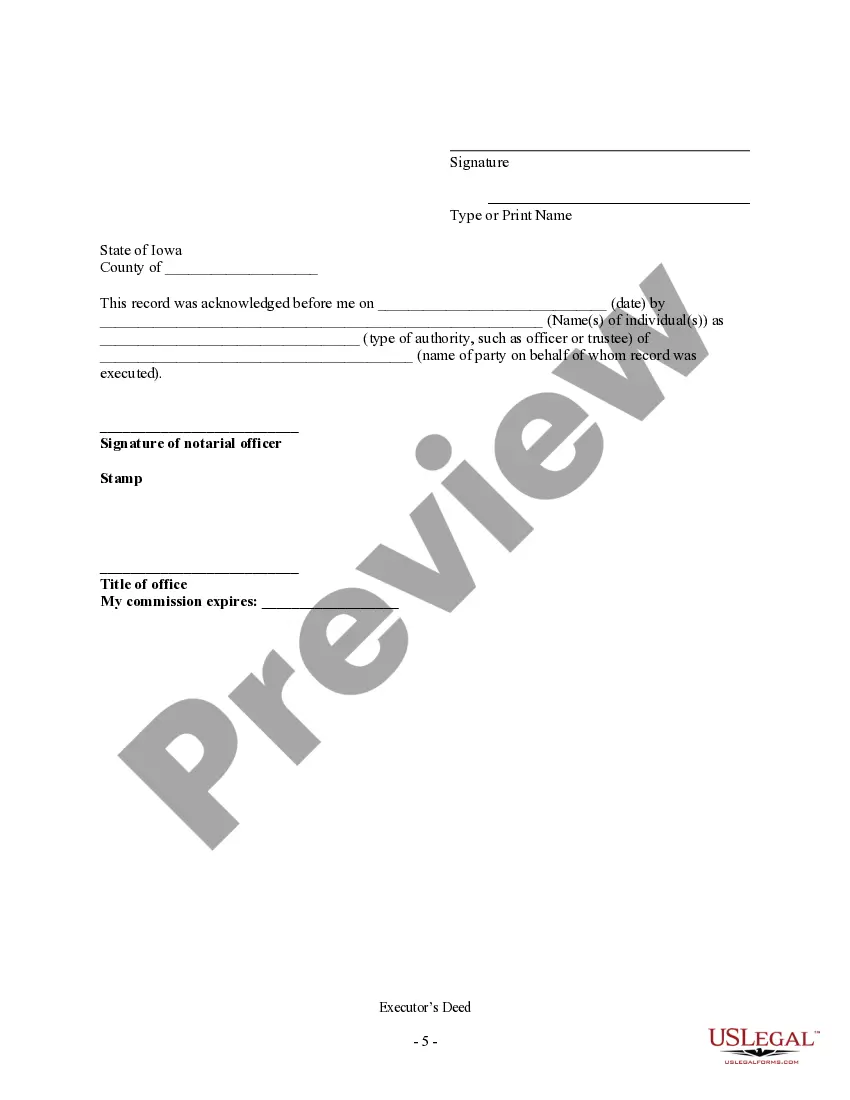

- Signature section: The executor's signature, affirming their authority to act on behalf of the estate.

- Date of execution: The date when the deed is signed and becomes effective.

Common use cases

This form should be used when real estate owned by a deceased person needs to be transferred to an individual as directed by the will. Common scenarios include post-mortem property transfers where the executor manages the estate and fulfills the deceased's last wishes regarding asset distribution.

Who should use this form

This form is intended for:

- Executors of estates who are responsible for distributing assets according to a will.

- Individuals designated as grantees in a will who are to receive real estate property.

- Legal representatives assisting in the administration of an estate with real property components.

How to prepare this document

- Identify the parties: Enter the names of the grantor (executor) and grantee.

- Specify the property: Include a detailed legal description of the property being transferred.

- Enter the consideration amount: Fill in the amount the grantee is paying for the property.

- Fill in the dates: Provide the relevant dates for the execution of the deed.

- Obtain signatures: The executor must sign the deed to validate the transfer.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide a complete legal description of the property.

- Not properly identifying the parties involved in the transfer.

- Omitting the executor's signature, which is essential for the deed's validity.

- Not filling in the consideration amount or providing an incorrect amount.

- Leaving out execution dates, which can lead to confusion about the timing of the transfer.

Advantages of online completion

- Convenience: Fill out the form easily from your computer without needing to visit a legal office.

- Editability: Make adjustments to the form as needed before finalizing your entries.

- Reliability: Ensure you are using a form compliant with state laws designed by licensed attorneys.

Looking for another form?

Form popularity

FAQ

In order to qualify for the simplified probate process, the gross value of the estate must be $100,000 or less. In order to use the procedure, the executor files a written request with the local probate court asking to use the simplified process.

Given the amount of work and risk involved in being an executor, it's no wonder that an executor is entitled to compensation for her work.An executor is entitled to a 6% commission on any income that the estate earns. So, for instance, assume that the entire estate is worth $400,000.

Iowa law says that attorneys and Executors can each receive $220 for estates less than $5000. For estates over $5,000, they can each receive $220 plus 2% of the amount over $5000. If the estate is complicated, a judge can order higher fees. You can also negotiate the fees to pay an attorney.

Iowa does not allow real estate to be transferred with transfer-on-death deeds.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

When someone who owns real property dies, the property goes into probate or it automatically passes, by operation of law, to surviving co-owners. Often, surviving co-owners do nothing with the title for as long as they own the property. Yet the best practice is to remove the deceased owner's name from the title.

Executor's remuneration: 3.5% calculated on the gross value of assets as at death. income collection fee: 6% calculated on all post-death revenue.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

The guidelines set out four categories of executor fees: Fees charged on the gross capital value of the estate. 3% to 5% is charged on the first $250,000; 2% to 4% on the next $250,000; and 0.5% to 3% on the balance. According to the Fee Guidelines, compensation on revenue receipts is 4% to 6%.