Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children

Description

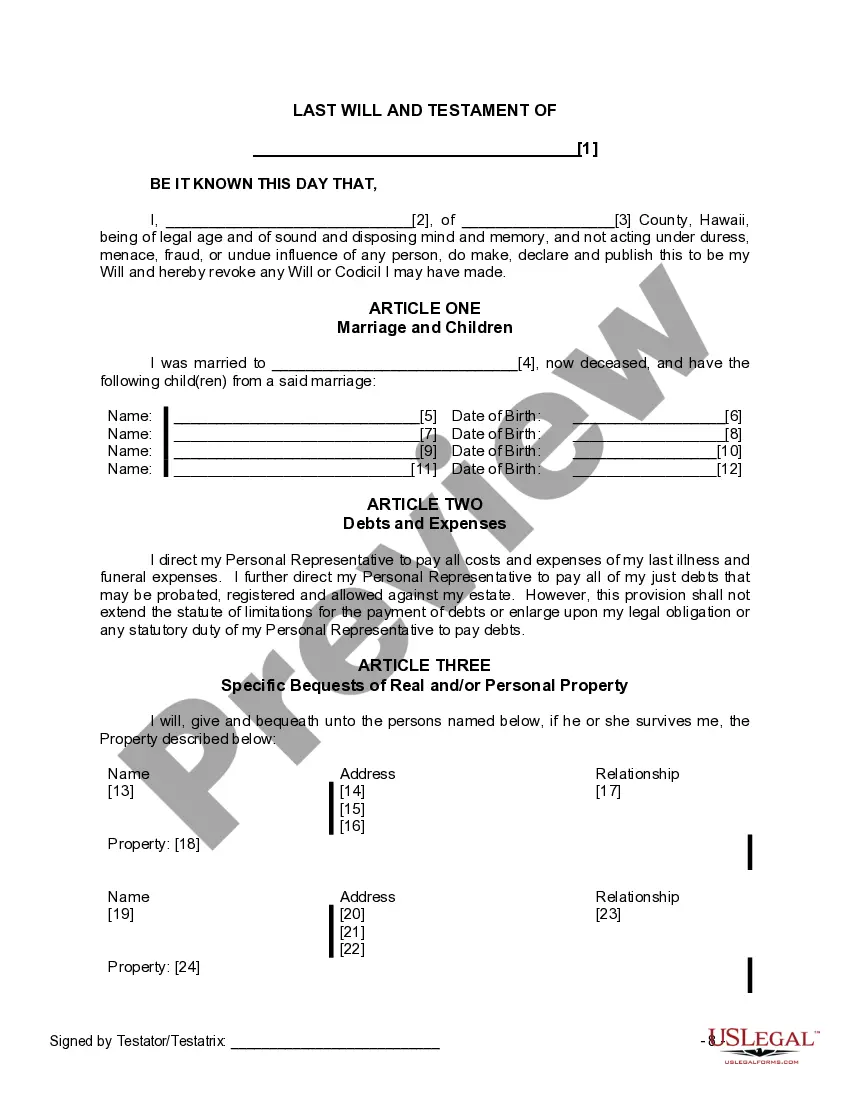

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

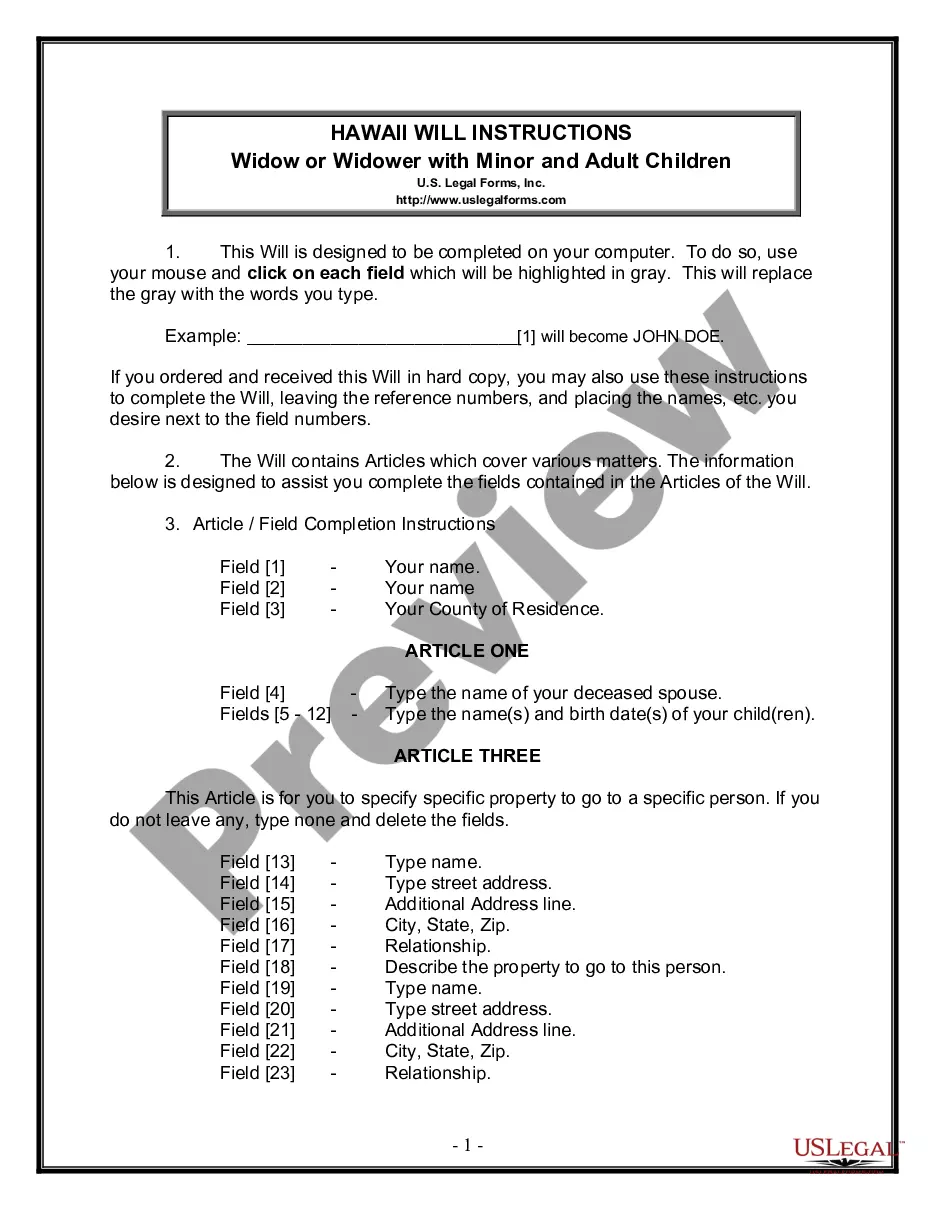

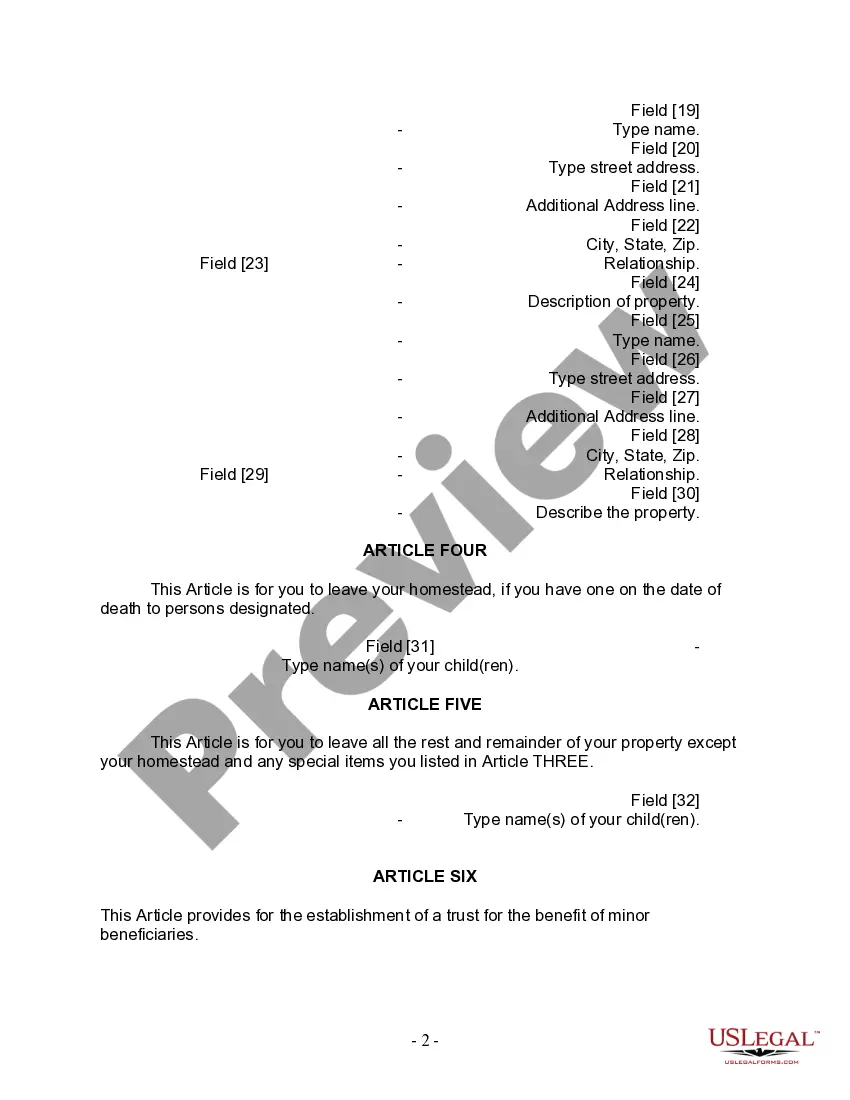

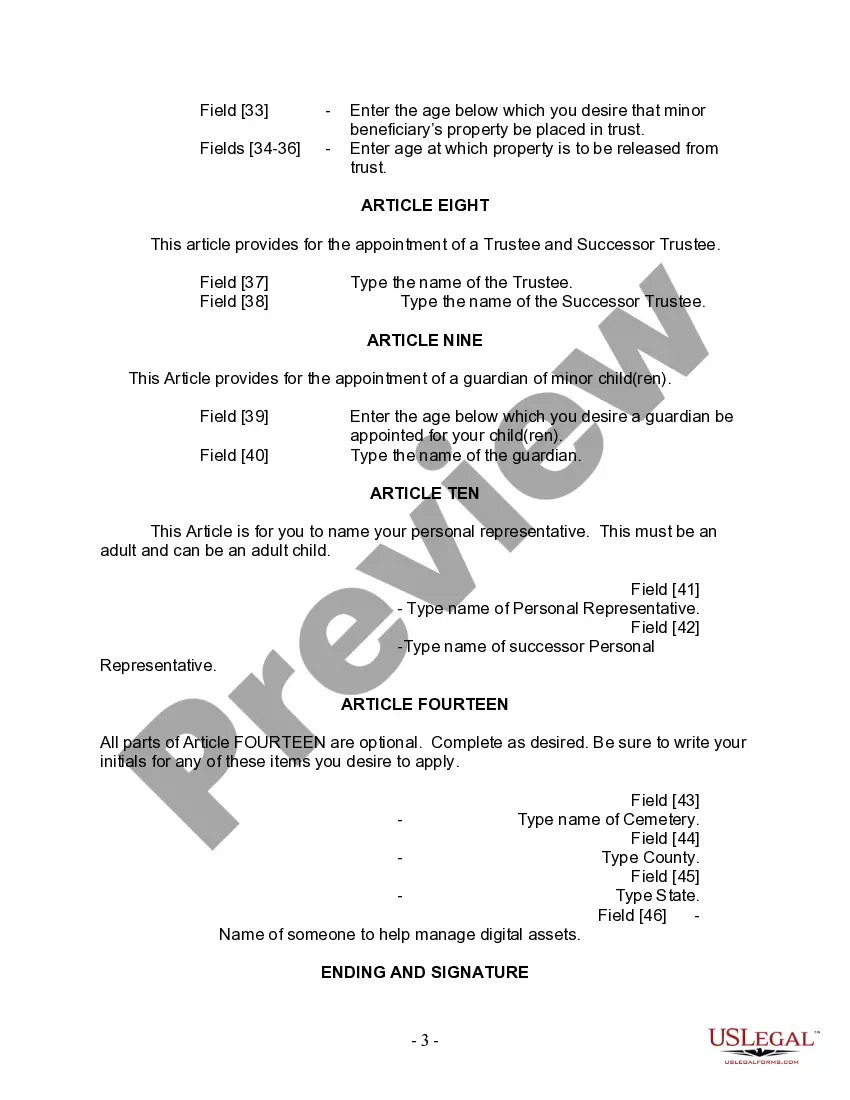

How to fill out Hawaii Last Will And Testament For A Widow Or Widower With Adult And Minor Children?

Obtain one of the most comprehensive collections of legal documents. US Legal Forms serves as a resource to locate any state-specific paperwork in just a few clicks, including the Hawaii Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children samples.

No need to waste hours of your time searching for a court-acceptable template. Our certified professionals guarantee that you receive the latest templates every time.

To utilize the forms library, choose a subscription and set up your account. If you have done this, just Log In and then click Download. The Hawaii Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children document will be promptly saved in the My documents tab (the tab for all documents stored on US Legal Forms).

That's it! You should fill out the Hawaii Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children template and review it. To ensure all is correct, reach out to your local legal advisor for assistance. Register and easily access over 85,000 valuable forms.

- If you're planning to use a state-specific sample, be sure to select the correct state.

- If possible, review the description to comprehend all aspects of the document.

- Make use of the Preview feature if it’s available to examine the document's details.

- If everything appears to be accurate, click Buy Now.

- After selecting a payment plan, create an account.

- Pay using either a credit card or PayPal.

- Download the template to your device by clicking Download.

Form popularity

FAQ

Yes, Hawaii does allow handwritten wills, known as holographic wills, provided they meet legal requirements. These wills must be in your handwriting, signed by you, and detail your wishes regarding asset distribution. When creating a Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children, ensure you include precise instructions to prevent potential disputes among heirs and to honor your intentions.

Writing a will in Hawaii involves several steps to ensure it reflects your intentions and is legally enforceable. First, you should determine how you want to distribute your assets, considering both adult and minor children. Then, creating a clear, written document is crucial, and using online resources like US Legal Forms can simplify the process, making it easier to draft a comprehensive Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children.

A handwritten will can be valid in Hawaii, but it must meet specific requirements to ensure it legally represents your wishes. The document, often called a holographic will, should be signed by you and include clear instructions regarding your assets and beneficiaries. For a Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children, clarity is essential, particularly when addressing the distribution of assets to your loved ones.

Yes, a spouse can change a will at any time before their death, including a Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children. These changes can reflect new circumstances or preferences that may arise. It’s important to execute these changes properly to ensure they are legally binding. Using online platforms like USLegalForms can provide guidance and resources to make this process straightforward and compliant.

Yes, a handwritten will, also known as a holographic will, is legal in Hawaii, provided it meets certain requirements. To ensure that your Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children is valid, it should be signed and dated by you. Additionally, the material provisions must be clear to support your intentions. However, using a professionally prepared will is often recommended for clarity and ease in executing your wishes.

No, you do not have to register a will in Hawaii for it to be valid. However, it is essential to ensure that your will complies with state requirements and is accessible after your death. Creating a comprehensive Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children using uslegalforms can simplify the process and ensure your wishes are clear and enforceable.

The three basic requirements of a valid will in Hawaii include having a written document, a signature from the testator, and the presence of two witnesses who can attest to the signing. By following these fundamental guidelines, your Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children can clearly outline your desires and ensure they are respected after your passing. Utilizing uslegalforms can help you navigate this process smoothly.

For a will to be valid in Hawaii, it must meet several requirements. It should be in writing, signed by the testator, and acknowledged by at least two witnesses. Incorporating guidelines from uslegalforms can assist you in crafting a Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children that adheres to these legal standards.

Writing a will on a piece of paper is possible, but it must follow specific legal guidelines to be valid in Hawaii. Ensure that it is signed, dated, and includes the necessary declarations regarding your estate. For a Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children, using proper forms provided by uslegalforms helps guarantee all legal requirements are met.

In Hawaii, a will becomes legal when it meets certain criteria. It must be in writing, signed by the testator, and witnessed by at least two people who are present during the signing. By creating a Hawaii Last Will and Testament for a Widow or Widower with Adult and Minor Children, you ensure that your wishes are clearly documented and enforceable after your passing.