Hawaii Partial Release of Judgment Lien

Description

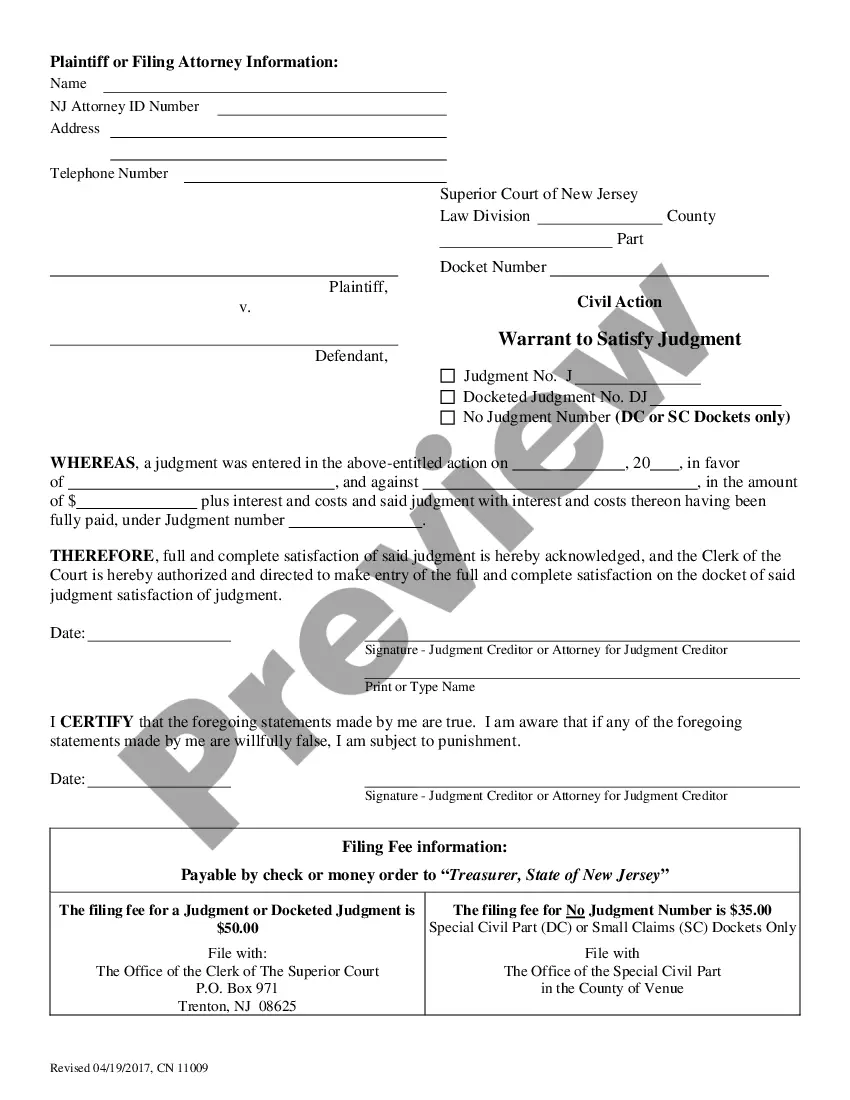

How to fill out Partial Release Of Judgment Lien?

Are you currently in a placement in which you need documents for both enterprise or person reasons nearly every time? There are plenty of lawful document templates available on the Internet, but getting types you can depend on is not easy. US Legal Forms gives 1000s of type templates, like the Hawaii Partial Release of Judgment Lien, which are published to satisfy federal and state requirements.

Should you be currently informed about US Legal Forms internet site and have a merchant account, merely log in. Next, it is possible to obtain the Hawaii Partial Release of Judgment Lien design.

Should you not have an profile and wish to begin using US Legal Forms, follow these steps:

- Find the type you want and make sure it is for that correct metropolis/area.

- Take advantage of the Review button to analyze the shape.

- Look at the information to ensure that you have selected the appropriate type.

- In the event the type is not what you`re seeking, use the Lookup industry to get the type that meets your requirements and requirements.

- If you get the correct type, simply click Purchase now.

- Opt for the rates strategy you desire, fill out the desired info to create your bank account, and purchase the transaction with your PayPal or credit card.

- Pick a handy document formatting and obtain your backup.

Discover every one of the document templates you might have bought in the My Forms food list. You can aquire a additional backup of Hawaii Partial Release of Judgment Lien anytime, if possible. Just click the essential type to obtain or produce the document design.

Use US Legal Forms, one of the most considerable collection of lawful forms, to conserve time and prevent faults. The services gives skillfully made lawful document templates which can be used for an array of reasons. Make a merchant account on US Legal Forms and commence generating your life a little easier.

Form popularity

FAQ

Hear this out loud PauseWithin 28 days after payment in full of the amount due on a judgment that is the basis for a judgment lien, the judgment creditor or the judgment creditor's attorney shall record a discharge of judgment lien with the office of the register of deeds where the judgment lien is recorded.

Hear this out loud PauseHow does a creditor go about getting a judgment lien in Oklahoma? To attach the lien, the creditor files the Statement of Judgment with the county clerk in any Oklahoma county where the debtor has property now or may have property in the future.

CALIFORNIA. A judgment and any lien created by an execution on the judgment expires ten years after the date of the entry of the judgment.

Hear this out loud PauseHow long does a judgment lien last in Hawaii? A judgment lien in Hawaii will remain attached to the debtor's property (even if the property changes hands) for as long as the underlying judgment is valid.

Contact the filing entity directly for detailed information regarding the lien. (For example, contact the Internal Revenue Service and/or Hawaii Department of Taxation for unpaid tax liens.)

Hear this out loud PauseA lien is a legal document that is attached to real estate. A court judgment must be recorded with the Recorder of Deeds in the county where the property is located in Illinois before it can be enforced. Even if the property is situated in the same county as the judgment, the creditor must record the judgment.

The lien shall expire three months after the entry of the Order Directing Lien to Attach unless proceedings are commenced within that time to collect the amount due thereon by enforcing the same.

Hawaii Civil Statute of Limitations Laws: At a Glance Injury to PersonTwo years (H.R.S. § 657-7)JudgmentsTen years from the court of record, if within the state, and six years if a judgment outside Hawaii (H.R.S. § 657-5) Six years if the judgment is not from a court of record (H.R.S. § 657-1)8 more rows