Hawaii Drafting Agreement - Self-Employed Independent Contractor

Description

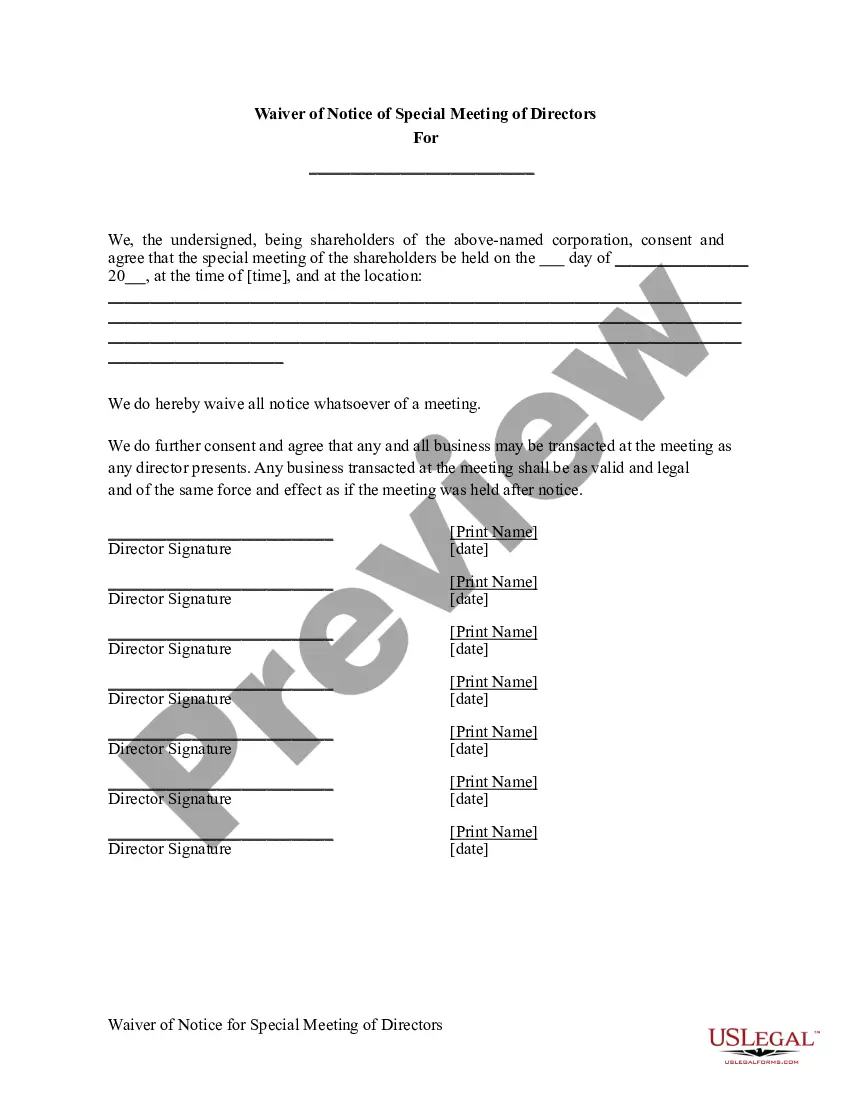

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of valid forms in the USA - offers a broad selection of authentic document templates you can download or print. While utilizing the website, you will encounter thousands of forms for business and personal purposes, categorized by types, suggestions, or keywords. You can find the latest versions of documents such as the Hawaii Drafting Agreement - Self-Employed Independent Contractor in just a few minutes.

If you already have a membership, Log In and obtain the Hawaii Drafting Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are straightforward instructions to help you get started: Make sure you have selected the correct form for your area/county. Click on the Review button to examine the form's content. Read the form summary to confirm you have picked the right document. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Hawaii Drafting Agreement - Self-Employed Independent Contractor. Every document you added to your account does not have an expiration date and is yours indefinitely. Therefore, to download or print another version, simply navigate to the My documents section and click on the form you need.

- Access the Hawaii Drafting Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of valid document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

Form popularity

FAQ

As an independent contractor, you need to complete various forms to keep your business compliant. Essential paperwork includes a contract outlining the scope of work, invoices for payment, and tax forms, particularly the W-9 form. To streamline these tasks, consider leveraging the Hawaii Drafting Agreement - Self-Employed Independent Contractor from USLegalForms, which offers comprehensive templates designed to ensure you meet all legal requirements efficiently. This approach helps you focus more on your projects and less on paperwork.

To fill out a declaration of independent contractor status form, start by gathering your personal information and business details. You will need to specify the nature of the work performed and outline your relationship with the client, emphasizing that you operate as a self-employed person. Ensure you review the requirements specific to Hawaii Drafting Agreement - Self-Employed Independent Contractor, as they may vary by state. Using resources from USLegalForms can simplify this process and provide you the proper templates.

Generally, an independent contractor agreement does not need to be notarized to be legally binding. However, certain situations or specific jurisdictions may require notarization for added security. Always check local regulations or consider using a template for a Hawaii Drafting Agreement - Self-Employed Independent Contractor on US Legal Forms for clarity on your requirements.

Typically, the hiring party drafts the independent contractor agreement, but both parties can contribute to its creation. It is important that the agreement reflects the terms agreed upon by both sides. Using a reliable template for a Hawaii Drafting Agreement - Self-Employed Independent Contractor from US Legal Forms can help ensure that all critical aspects are covered.

When filling out an independent contractor agreement, ensure you clearly state the contractor’s role, the services to be performed, and payment details. Each section should be filled out accurately to prevent misunderstandings. You can find useful templates for a Hawaii Drafting Agreement - Self-Employed Independent Contractor on US Legal Forms to guide you.

To write an independent contractor agreement, start by outlining the scope of work, payment structure, and timeline. You should also include clauses regarding confidentiality and termination. A structured approach using a Hawaii Drafting Agreement - Self-Employed Independent Contractor template from US Legal Forms can simplify this process significantly.

Filling out an independent contractor form involves specifying details such as the services provided, payment terms, and timeframes. It’s crucial to ensure that both parties agree on these conditions. For a comprehensive Hawaii Drafting Agreement - Self-Employed Independent Contractor, consider utilizing templates from US Legal Forms for thorough guidance.

Yes, you can create your own legally binding contract. However, it is essential to include key elements such as clear terms, mutual consent, and the necessary signatures. By using a reliable resource like US Legal Forms, you can access templates for a Hawaii Drafting Agreement - Self-Employed Independent Contractor that meet legal standards.