Hawaii Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

Have you been inside a placement that you require papers for possibly enterprise or person purposes virtually every working day? There are a lot of legal file themes available online, but finding types you can rely on isn`t straightforward. US Legal Forms provides a huge number of type themes, such as the Hawaii Summary of Terms of Proposed Private Placement Offering, that happen to be created in order to meet federal and state requirements.

When you are already informed about US Legal Forms site and possess a free account, merely log in. After that, you are able to down load the Hawaii Summary of Terms of Proposed Private Placement Offering design.

Unless you come with an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the type you require and ensure it is for that right town/area.

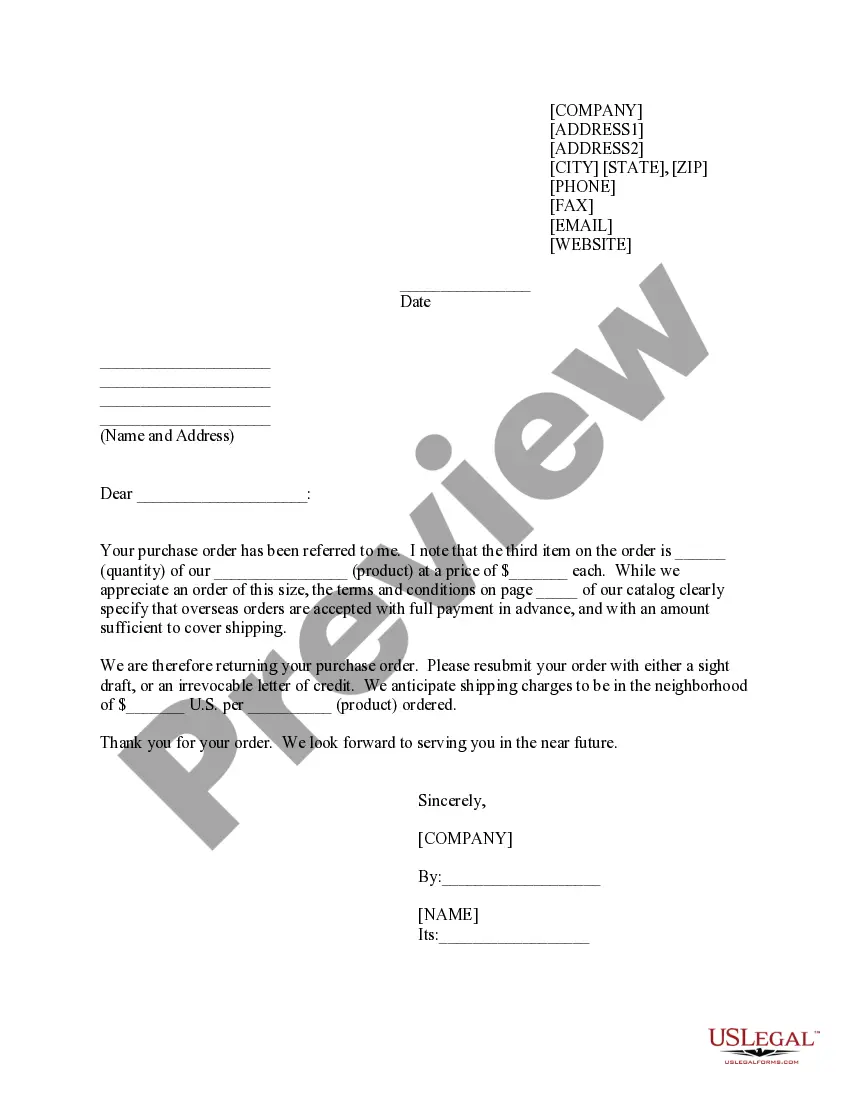

- Utilize the Review key to review the shape.

- Browse the outline to actually have chosen the proper type.

- In case the type isn`t what you are looking for, take advantage of the Research field to get the type that suits you and requirements.

- If you find the right type, click Purchase now.

- Select the rates plan you need, submit the required info to generate your account, and purchase your order utilizing your PayPal or bank card.

- Choose a convenient document file format and down load your copy.

Locate all the file themes you possess bought in the My Forms menus. You may get a further copy of Hawaii Summary of Terms of Proposed Private Placement Offering any time, if needed. Just go through the required type to down load or printing the file design.

Use US Legal Forms, one of the most extensive selection of legal forms, to conserve efforts and prevent faults. The support provides professionally created legal file themes that can be used for a selection of purposes. Produce a free account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

Private Placement Programs, also called ?High Yield Investment Programs?, are private (non-public) investment programs which are based on the purchase or sale of bank financial instruments. In most cases MTNs are mainly used.

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

Private placements involve the non-public sale of securities to a relatively small number of investors.

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.

An offering memorandum is a document issued to potential investors in a private placement deal. The offering memorandum spells out the private placement's objectives, risks, financials, and deal terms.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

As the name suggests, a ?private placement? is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.