Hawaii Grant Agreement from 501(c)(3) to 501(c)(4)

Description

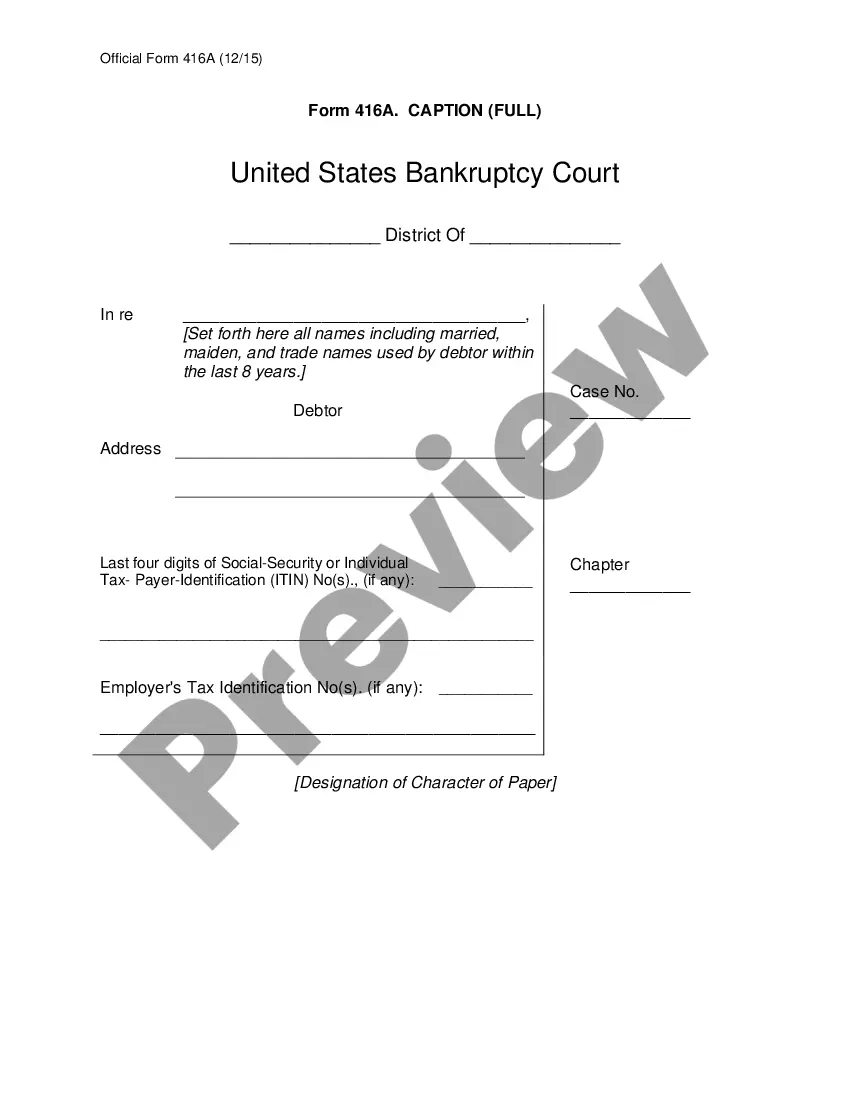

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

If you need to complete, acquire, or printing lawful file web templates, use US Legal Forms, the biggest variety of lawful forms, which can be found online. Make use of the site`s simple and convenient lookup to get the files you want. A variety of web templates for company and individual uses are categorized by types and claims, or keywords. Use US Legal Forms to get the Hawaii Grant Agreement from 501(c)(3) to 501(c)(4) with a number of mouse clicks.

Should you be presently a US Legal Forms buyer, log in to the account and click the Obtain key to find the Hawaii Grant Agreement from 501(c)(3) to 501(c)(4). You can even gain access to forms you earlier saved inside the My Forms tab of the account.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the form for your proper area/land.

- Step 2. Use the Review choice to look over the form`s articles. Never overlook to learn the outline.

- Step 3. Should you be unhappy together with the form, take advantage of the Search area towards the top of the display to locate other versions of the lawful form web template.

- Step 4. When you have found the form you want, click on the Get now key. Select the prices prepare you prefer and add your credentials to sign up to have an account.

- Step 5. Procedure the financial transaction. You can use your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Choose the format of the lawful form and acquire it on the device.

- Step 7. Full, change and printing or indication the Hawaii Grant Agreement from 501(c)(3) to 501(c)(4).

Every single lawful file web template you buy is yours permanently. You have acces to each form you saved within your acccount. Click the My Forms section and pick a form to printing or acquire once more.

Contend and acquire, and printing the Hawaii Grant Agreement from 501(c)(3) to 501(c)(4) with US Legal Forms. There are many skilled and state-certain forms you can utilize to your company or individual requires.

Form popularity

FAQ

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.

How Many Nonprofits Are in Hawaii? More than 10,000 nonprofit corporations are registered in Hawaii (State of Hawaii Department of Commerce and Consumer Affairs). Of the more than 10,000 nonprofit corporations in Hawaii, 7,508 are tax exempt at the federal level (2013, IRS, SOI Tax Stats -- Exempt Organizations).

HCF is a steward of more than 1,100 funds, including over 300 scholarship funds, created by donors who desire to transform lives and improve communities.

Hawaii Community Foundation, fiscal year ending Dec. 2021 Organization zip code96813-4317Organization cityHonoluluTax code designation501(c)(3)Ruling date of organization's tax exempt status1996-07-0124 more rows

Yes, Hawai'i Community Foundation is a nonprofit, tax-exempt, 501(c)(3) organization. Contributions are tax deductible as allowable by the law and your tax situation.

Nonprofit corporations are not automatically tax exempt. Once a nonprofit corporation is established in Hawaii, exemption from federal income taxes may be sought from the Internal Revenue Service. Some, but not all, nonprofit corporations apply for and receive some form of tax exemption.

Hawaii charges all filers at least $26 in combined fees to file nonprofit Articles of Incorporation, which includes the $25 filing fee and a $1 State Archive fee. Online filing costs an additional $2.50, and you also have the option to pay a $25 expedite fee to speed up the application process.

We are a 501(c)(3), so all gifts to Hawai'i Community Foundation are eligible for the full charitable deduction.