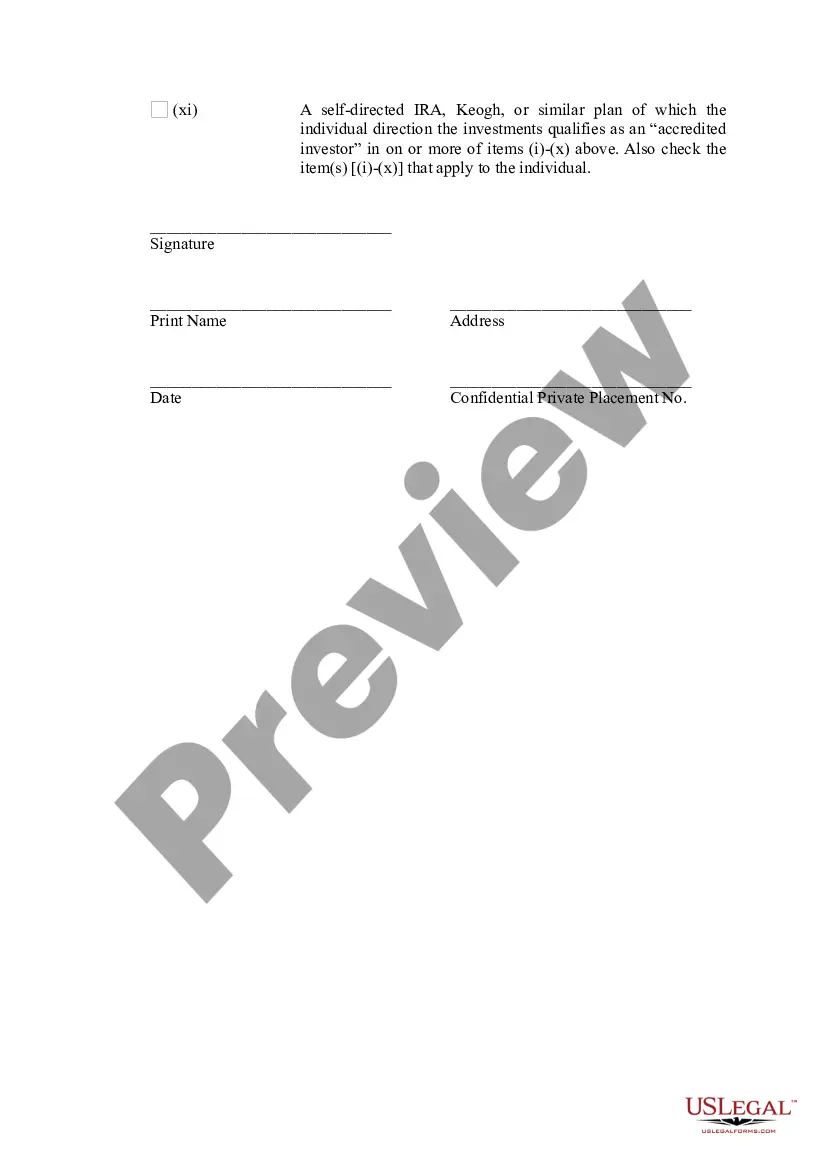

Hawaii Checklist - Certificate of Status as an Accredited Investor

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

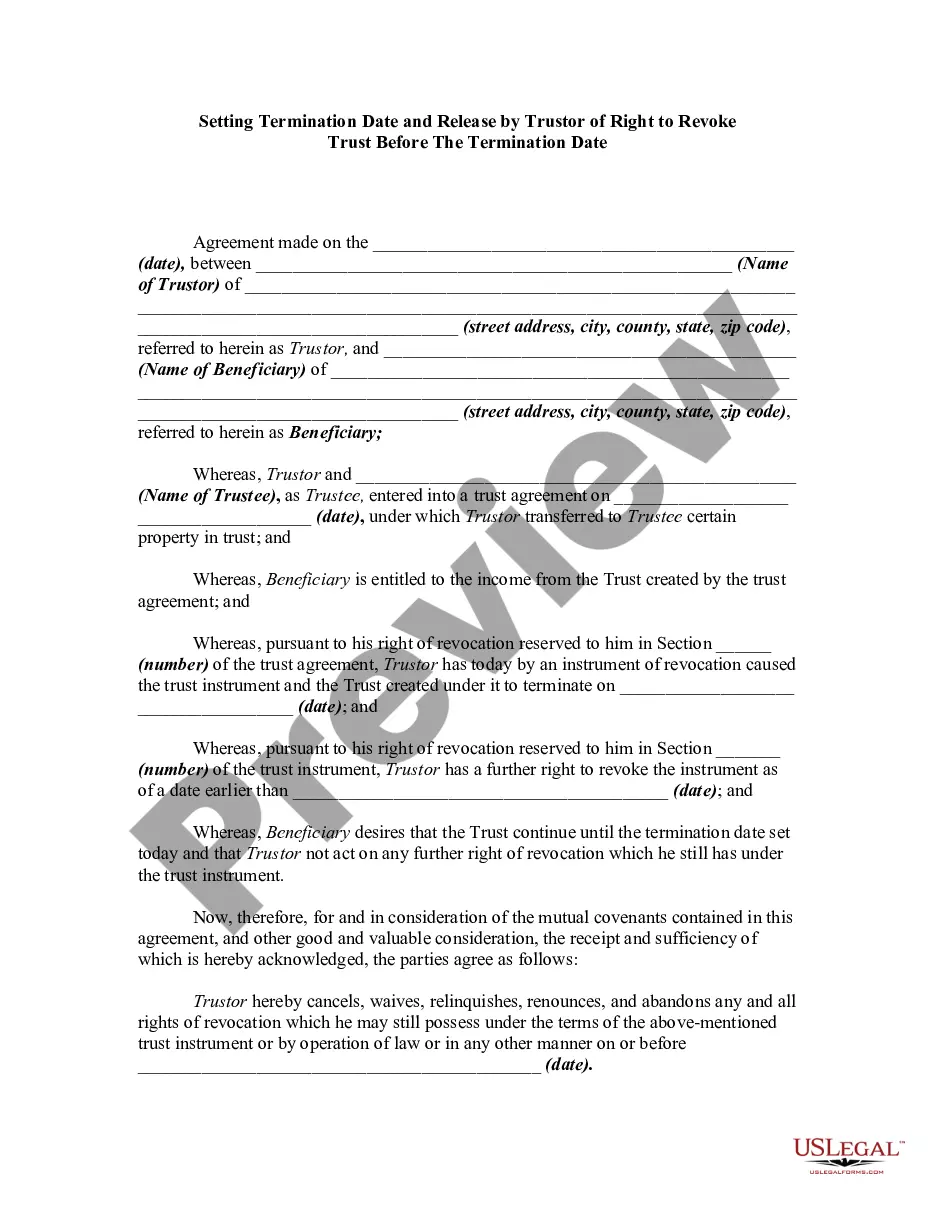

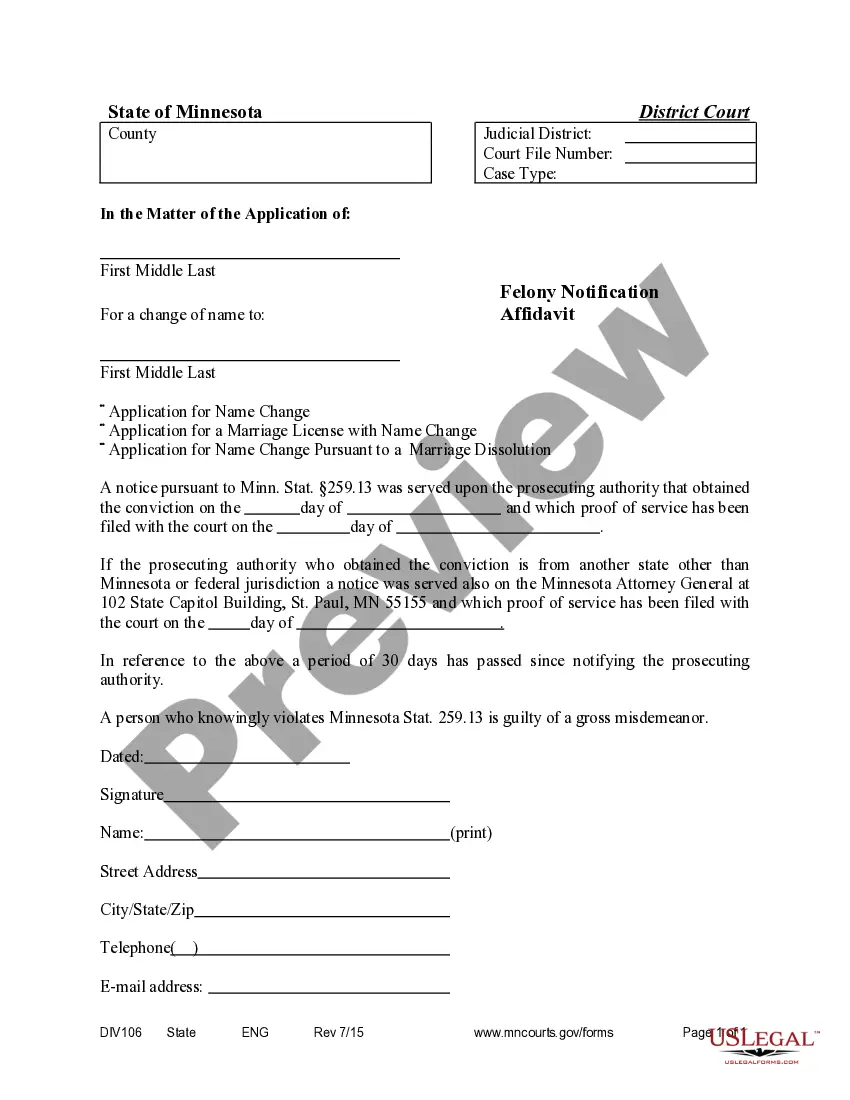

How to fill out Checklist - Certificate Of Status As An Accredited Investor?

Are you presently inside a placement that you need to have paperwork for sometimes business or personal purposes just about every day? There are plenty of lawful document themes available on the net, but locating versions you can trust is not simple. US Legal Forms offers 1000s of form themes, much like the Hawaii Checklist - Certificate of Status as an Accredited Investor, that happen to be published to meet federal and state demands.

When you are currently familiar with US Legal Forms site and possess a free account, basically log in. Afterward, you are able to acquire the Hawaii Checklist - Certificate of Status as an Accredited Investor template.

If you do not provide an profile and wish to start using US Legal Forms, follow these steps:

- Get the form you want and make sure it is for that appropriate town/county.

- Take advantage of the Preview key to examine the form.

- Read the explanation to actually have selected the right form.

- In the event the form is not what you are looking for, take advantage of the Lookup industry to discover the form that suits you and demands.

- If you find the appropriate form, click Acquire now.

- Pick the rates strategy you need, fill in the necessary info to make your account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free file structure and acquire your duplicate.

Locate every one of the document themes you possess purchased in the My Forms food selection. You can obtain a additional duplicate of Hawaii Checklist - Certificate of Status as an Accredited Investor any time, if possible. Just go through the necessary form to acquire or printing the document template.

Use US Legal Forms, probably the most substantial assortment of lawful varieties, to save lots of time and prevent errors. The support offers expertly manufactured lawful document themes which you can use for a selection of purposes. Create a free account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

Accredited Investor Verification In a Rule 506(b) offering, the issuer may take the investor's word that he, she, or it is accredited, unless the issuer has reason to believe the investor is lying. In a Rule 506(c) offering, the issuer must take reasonable steps to verify that every investor is accredited.

The SEC's Rule 506 allows self-certification of investors in order for them to become accredited.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

After all, qualified purchasers must be capable of investing $5 million or more on their own, which means they will likely meet the $1 million net worth requirement to be considered an accredited investor. Granted, the two don't always go hand in hand, but they do align more often than not.

? Self-certified investors are treated in a ?generally similar manner? to accredited investors. and are able to invest alongside them. ? May also be of interest to listed issuers. ? Further facilitating their capital raising efforts by private placement.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Among other categories, the SEC now defines accredited investors to include the following: Individuals who have certain professional certifications, designations, or credentials. Individuals who are ?knowledgeable employees? of a private fund. SEC- and state-registered investment advisers5.